Report Overview

Global Collaborative Robots Market Highlights

Global Collaborative Robots Market Size:

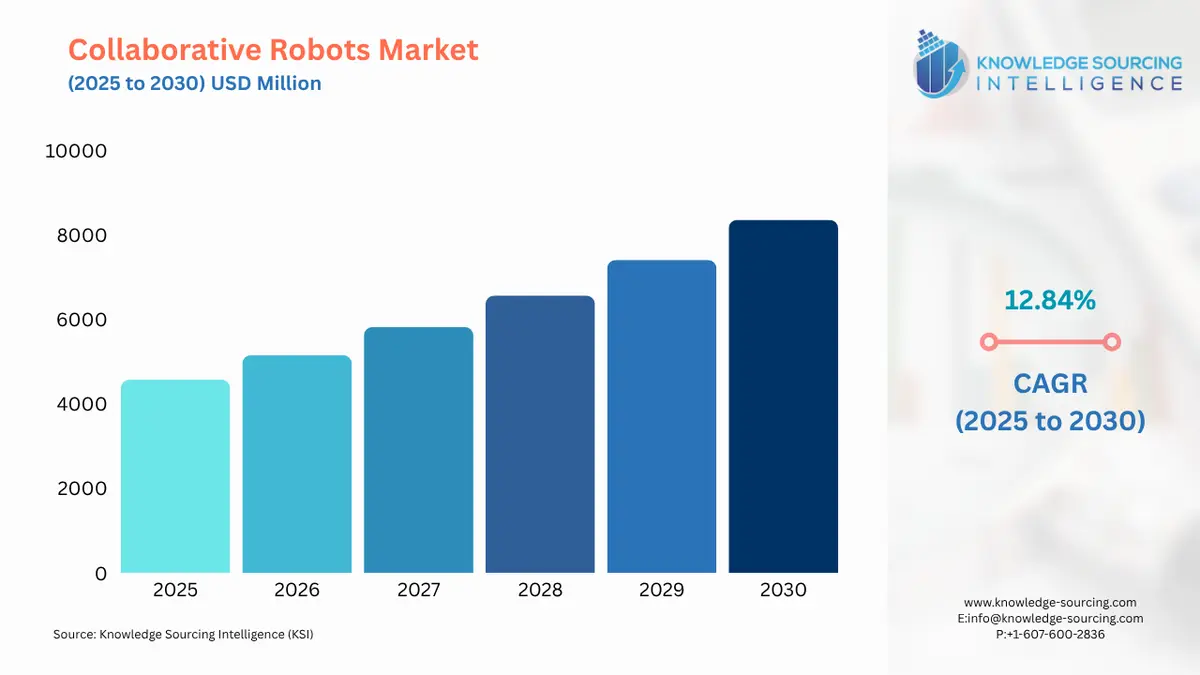

The Global Collaborative Robots Market is expected to grow at a CAGR of 12.84% over the forecast period, reaching a market size of USD 8,362.073 million in 2030 from USD 4,571.64 million in 2025.

The collaborative robots market, often referred to as the cobot market, is a rapidly evolving segment of the industrial automation industry, driven by the need for flexible, safe, and efficient automation solutions. Collaborative robots are designed to work alongside human operators, enhancing productivity while maintaining safety through advanced sensors, force-limiting mechanisms, and intuitive programming interfaces. Unlike traditional industrial robots, which are typically isolated in cages, cobots operate in shared workspaces, making them ideal for industries requiring agility, precision, and human-robot collaboration. Sectors such as automotive, electronics, logistics, and healthcare are increasingly adopting cobots to streamline operations, reduce labor costs, and improve workplace safety. The market is propelled by technological advancements, including AI integration, IoT connectivity, and enhanced sensor technologies, which enable cobots to perform complex tasks with greater accuracy.

The automotive industry relies heavily on cobots for assembly, welding, and material handling, where they enhance production efficiency and flexibility. In electronics, cobots handle delicate components, ensuring precision in high-speed manufacturing environments. The logistics sector has seen significant cobot adoption for tasks like picking and packing, driven by the e-commerce boom and the need for rapid order fulfillment. Healthcare is an emerging market, with cobots assisting in tasks like surgical support and laboratory automation, driven by the need for precision and hygiene. The rise of Industry 4.0 and smart manufacturing has further accelerated cobot demand, as they integrate seamlessly with digital ecosystems for real-time monitoring and predictive maintenance.

Major market drivers include the increasing demand for automation to address labor shortages, particularly in developed economies where aging workforces and high labor costs are prevalent. The focus on workplace safety has driven cobot adoption, as their built-in safety features reduce injury risks. Additionally, the flexibility and cost-effectiveness of cobots make them accessible to small and medium-sized enterprises (SMEs), broadening market reach. The global push for sustainability also plays a role, as cobots optimize energy use and reduce waste in manufacturing processes.

Market restraints include the high initial investment costs for cobot systems, which can deter SMEs despite their long-term ROI. Integration challenges with legacy systems also pose barriers, as older infrastructure often lacks compatibility with modern cobot technologies.

Global Collaborative Robots Market Overview:

Collaborative robots (cobots) are robots that work in tandem with humans in the workplace. Some of the key elements driving demand for these robots are increased efficiency and production. In addition, booming expenditure on research and development of state-of-the-art products at competitive prices will further add to the growing demand for collaborative robots. However, the high expenditure involved in securing workers and the booming adoption of autonomous industrial robots are some of the factors restraining market growth. North America and Europe maintained a sizable market share, while the Asia Pacific region is expected to experience rapid growth throughout the projection period.

The surge in cobot adoption among Small and Medium-Sized Enterprises (SMEs) is a key factor in this growth. These companies are increasingly investing in cobots that work alongside humans in shared workspaces and streamline automated production. Advances in technology, particularly the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) industrial robots, have significantly boosted this expansion. The deployment of robots in industrial settings has reduced workplace accidents while markedly improving product quality, driving demand across various firms and sectors. The rising use of cobots in applications such as semiconductors, automotive, logistics, machine tooling, packaging, and assembly is poised to reshape the collaborative robot market in the coming years.

The expanding automotive industry is a major market driver. The sector has seen a notable increase in vehicle production, with cobots offering cost-effectiveness and efficiency compared to traditional robotic systems, depending on the assembly process. Cobots in the automotive sector are used for both manufacturing auto parts (such as assembling key vehicle components) and assembling finished vehicles. For example, according to the Press Information Bureau of India in March 2025, India’s vehicle production reached 28 million units in FY 2023-24, with domestic manufacturing promotion expected to drive further increases in the coming years. By leveraging cobots, manufacturers can shorten production cycles and boost output.

Cobots in automotive applications are seeing a significant boom, fueled by the proliferation of automotive plants in key Asian countries like China, India, and Vietnam, as well as growing demand for automotive robotics from North American automakers. Leading companies such as BMW, Mercedes-Benz, and Ford have integrated cobots into their production lines for tasks like welding, painting, and assembly. In April 2021, Universal Robots, a Danish producer of flexible industrial cobot arms, reached out to Malaysian automotive manufacturers to explore opportunities for robotic solutions in their facilities. This followed an announcement from the Malaysian Automotive, Robotics, and IoT Institute (MARii) projecting that the automotive sector, including Mobility as a Service (MaaS), would account for roughly 10% of the nation’s GDP. With billions invested in edge computing technology, cobots have become a transformative force on automotive factory floors.

Some of the major players covered in this report include Universal Robots A/S, ABB Ltd, FANUC Corporation, KUKA AG, Techman Robot Inc., Rethink Robotics GmbH, Precise Automation, Inc., F&P Robotics AG, Yaskawa Electric Corporation, Doosan Robotics Co., Ltd., AUBRobotics Technology Co., Ltd., Stäubli International AG, Kassow Robots, among others.

Global Collaborative Robots Market Drivers:

Increasing Demand for Automation: The rising demand for automation across industries is a primary driver for the collaborative robots market. Labor shortages, particularly in developed economies like the U.S. and Japan, are pushing companies to adopt cobots to maintain productivity. In manufacturing, cobots automate repetitive tasks like assembly and material handling, freeing human workers for higher-value roles. The e-commerce boom has further accelerated automation needs in logistics, where cobots handle picking and packing to meet rapid delivery demands. A 2024 report by the International Trade Administration highlighted that automation adoption in U.S. manufacturing grew by 15% to address labor gaps. Cobots’ ease of programming and deployment makes them ideal for SMEs, which are increasingly automating to remain competitive. As industries prioritize scalability and efficiency, cobots provide a cost-effective solution, driving market growth by enabling flexible automation that adapts to diverse production needs.

Focus on Workplace Safety: Workplace safety is a critical driver for the collaborative robots market, as cobots are designed with advanced safety features like force-limiting sensors and collision detection. These features allow cobots to operate safely alongside humans, reducing workplace injuries in industries like automotive and electronics. The Occupational Safety and Health Administration (OSHA) reported in 2024 that cobot integration reduced manufacturing injuries in facilities adopting automation. Unlike traditional robots requiring safety cages, cobots’ inherent safety mechanisms eliminate the need for extensive barriers, saving space and costs. This focus on safety aligns with stricter labor regulations globally, encouraging industries to adopt cobots for tasks like heavy lifting and repetitive motions that pose ergonomic risks. As companies prioritize employee well-being and compliance, cobots are becoming indispensable, driving market expansion by offering safe, efficient automation solutions.

Flexibility and Cost-Effectiveness for SMEs: The flexibility and cost-effectiveness of collaborative robots are key drivers, particularly for small and medium-sized enterprises (SMEs). Unlike traditional industrial robots, cobots require lower upfront costs and minimal infrastructure changes, making them accessible to smaller businesses. Their plug-and-play design and intuitive programming allow rapid deployment across diverse tasks like assembly and packaging. A recent Industry Week report noted that SMEs adopting cobots reduced setup costs notably compared to traditional automation. Cobots’ ability to be redeployed for multiple applications enhances their value, enabling SMEs to adapt to changing production needs without significant reinvestment. This flexibility supports high-mix, low-volume manufacturing, prevalent in electronics and consumer goods. As SMEs increasingly embrace automation to compete globally, cobots’ affordability and versatility are driving market growth, broadening the adoption of automation across diverse industries.

Global Collaborative Robots Market Restraints:

High Initial Investment Costs: High initial investment costs are a significant restraint for the collaborative robots market, particularly for SMEs with limited budgets. While cobots are more affordable than traditional industrial robots, their costs, including hardware, software, and integration, can range from $20,000 to $50,000 per unit. A recent Manufacturing Technology report highlighted that upfront costs deter 25% of SMEs from adopting automation. Additional expenses, such as training for operators and maintenance, further strain budgets. Although cobots offer high ROI over time, the initial financial barrier can delay adoption, especially in emerging markets with cost-sensitive industries. This restraint limits market penetration, as smaller firms prioritize short-term savings over long-term efficiency gains. Manufacturers are addressing this by offering leasing models, but high upfront costs remain a challenge, slowing cobot adoption in resource-constrained sectors.

Integration Challenges with Legacy Systems: Integration challenges with legacy systems pose a significant restraint for the collaborative robots market. Many manufacturing facilities rely on outdated programmable logic controllers (PLCs) and infrastructure lacking compatibility with modern cobot technologies, such as IoT and real-time Ethernet. A recent report noted that several factories face integration issues when deploying cobots, requiring costly upgrades to existing systems. These upgrades can disrupt production and demand specialized expertise, deterring adoption in industries like automotive and metals processing. The lack of standardized protocols across cobot brands further complicates integration, increasing implementation time and costs. While newer facilities benefit from seamless cobot integration, older plants face significant hurdles, limiting market growth in established manufacturing regions. This restraint underscores the need for universal standards and retrofit solutions to accelerate cobot adoption.

Global Collaborative Robots Market Segment Analysis:

Manufacturing and Assembly is expected to be the most common application boosting market growth: Manufacturing and assembly is the leading application segment in the collaborative robots market, driven by their critical role in enhancing production efficiency and precision. Cobots excel in tasks like screwdriving, part fitting, and component assembly, particularly in the automotive and electronics industries. Their ability to work alongside humans without safety barriers streamlines workflows and reduces production downtime. A 2024 report by the International Federation of Robotics highlighted that cobots in assembly applications improved productivity in automotive plants. The flexibility of cobots allows rapid reprogramming for high-mix, low-volume production, making them ideal for customized manufacturing. In electronics, cobots handle delicate tasks like circuit board assembly, ensuring accuracy and minimizing defects. The integration of AI and vision systems further enhances their precision, supporting complex assembly processes. As industries prioritize agility and quality, manufacturing and assembly remain the dominant applications, driving cobot adoption by offering scalable, human-collaborative automation solutions that meet diverse production demands.

Automotive End-User Industry: The automotive industry is the dominant end-user segment in the collaborative robots market, leveraging cobots for tasks like assembly, welding, and material handling. Cobots enhance production efficiency by working alongside human operators, ensuring precision in high-volume manufacturing. For instance, cobots handle delicate tasks like dashboard assembly, reducing errors and improving quality. A 2024 Automotive World report noted that cobot adoption in automotive plants increased throughput in final assembly lines. Their compact design and safety features allow integration into space-constrained environments without costly infrastructure changes. The industry’s push for electric vehicle (EV) production further drives cobot demand, as they support flexible manufacturing for diverse vehicle models. Cobots also reduce ergonomic risks by automating repetitive tasks, aligning with stricter safety regulations. As automotive manufacturers prioritize efficiency and sustainability, cobots remain critical, solidifying the segment’s dominance through their ability to enhance productivity, quality, and adaptability in dynamic production environments.

The Asia-Pacific market is expected to dominate the industry: Asia-Pacific leads the collaborative robots market, driven by rapid industrialization, government support, and a robust manufacturing base in countries like China, Japan, and South Korea. China’s dominance stems from its massive electronics and automotive sectors, where cobots are widely used for assembly and material handling. Japan’s focus on automation, supported by initiatives like Society 5.0, accelerates cobot adoption in smart factories. A recent report by the Asia-Pacific Economic Review noted that China’s automation investments grew in 2024, boosting cobot demand. South Korea’s logistics sector also drives growth, with cobots streamlining e-commerce fulfillment. Government incentives, such as China’s 2023-2027 robotics strategy, further fuel market expansion by promoting automation in SMEs. The region’s aging workforce and rising labor costs make cobots a cost-effective solution, particularly for high-mix manufacturing. Asia-Pacific’s leadership is reinforced by its innovation ecosystem, with companies like Universal Robots and FANUC driving technological advancements, making the region the epicenter of cobot market growth.

Global Collaborative Robots Market Key Developments:

FANUC introduced the CRX-30iA cobot in January 2025, targeting automotive and electronics manufacturing. This model offers a 30 kg payload and enhanced vision systems for precise assembly and material handling. Its intuitive programming interface reduces setup time, making it suitable for high-mix production. The CRX-30iA incorporates advanced safety features, ensuring safe human-robot interaction without barriers. FANUC’s innovation aligns with Industry 4.0 trends, supporting real-time data integration for smart factories. This launch enhances FANUC’s competitive edge in delivering high-performance cobots for complex industrial applications.

List of Top Collaborative Robots Companies:

Techman Robot Inc.

Yaskawa Electric Corporation

Precise Automation Inc.

Rethink Robotics GmbH

AUBO Robotics USA

Global Collaborative Robots Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 4,571.64 million |

| Total Market Size in 2030 | USD 8,362.073 million |

| Forecast Unit | Million |

| Growth Rate | 12.84% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Payload Capacity, Component, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Global Collaborative Robots Market Segmentation:

By Payload Capacity

Low-Payload Cobots (0 – 5 Kg)

Medium-Payload Cobots (6 – 10 Kg)

High-Payload Cobots (More than 10 Kg)

By Component

Hardware

Sensors

Control System

Actuator

Others

Software

Services

By Application

Manufacturing and Assembly

Material Handling

Inspection and Quality Control

Machine Tending

Welding & Soldering

Others

By End-User Industry

Automotive

Electronics and Semiconductor

Logistics and Warehousing

Healthcare and Pharmaceuticals

Food and Beverage

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

UK

France

Spain

Others

Middle East and Africa

UAE

Israel

Others

Asia-Pacific

China

Japan

South Korea

India

Indonesia

Taiwan

Thailand

Others