Report Overview

Global CBD Pet Care Highlights

CBD Pet Care Market Size

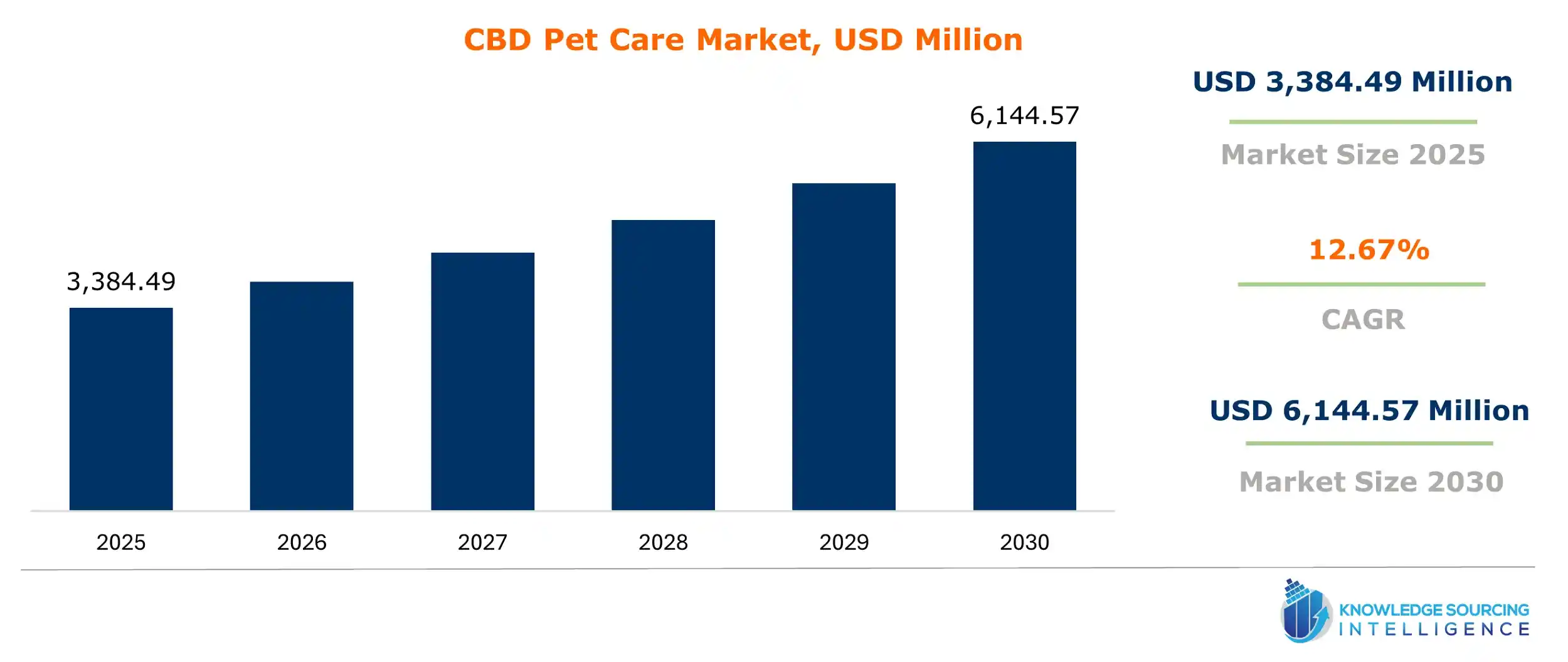

The global CBD pet care market is expected to grow at a CAGR of 12.67%, reaching a market size of US$6,144.57 million in 2030 from US$3,384.49 million in 2025.

Awareness of the effectiveness of cannabis for treating various physical and mental conditions in companion animals has resulted in an increased demand for CBD (Cannabidiol) products for pet care. One of the contributing factors to higher demand is the increasing demand for pet supplements with an all-natural composition and the effects of CBD-infused products that pet owners utilize. The growing incidence of anxiety disorders in pets, especially among dogs, has tremendously influenced the acceptability of CBD by consumers in pet care markets.

Within the last ten years, veterinary medicine has made rapid advancements in research regarding hemp- and CBD-based products. It is offering clinical data demonstrating improvements in health for companion animals from such products. Efforts are currently being made to investigate the clinical efficacy of such animals so that knowledge can be garnered on their pharmacokinetic characteristics in animal metabolism and general health. Several notable ways are being revealed through this study to use CBD-based products for therapeutic purposes in cats and dogs.

CBD Pet Care Market Growth Drivers:

- Growing consumer acceptance of CBD food products is contributing to the global CBD pet care market growth

The market has flourished because of CBD food products' increasing acceptability across the product range, including treats and chews. One example is Better Choice, which features several CBD pet-focused products under the Bona Vida brand: oils, soft chews, and a few more formulations that promote the health and well-being of pets. Their treatments specifically address the skin and body, muscle and joint, heart, and relief aspects.

Another reason that the market is expanding is the increasing need for organic food by pet owners. Pet nutrition expenditure also contributes greatly to this segment of the market growth.

- Increasing CBD product acceptance and awareness is anticipated to increase the global market share

However, pet owners are increasingly open to incorporating such products into their wellness routines. It also aids in fostering communication and generation sharing among pets' social media pages and online communities where they can share vital information and firsthand accounts on CBD. In addition, the industry has increasingly been supported by the general trend towards spending on high-end, natural products, including those infused with CBD, due to pet humanization, where owners tend to regard their pets as family members.

Pet owners are increasingly becoming knowledgeable about CBD pet products and their acceptance of them. As more news about the possible benefits of amber CBD for pets becomes available in features such as pain management, treating anxiety, and anti-inflammatory properties, pet owners are exploring these avenues further for their furry companions. Changes are brought about by multiple studies plus anecdotal evidence supporting the beneficial effect of CBD on various conditions of pet health.

- Legalization of CBD products and regulation will boost the global CBD pet care market.

CBD products have been entirely legalized in certain jurisdictions. Numerous nations and states that legalized CBD products have further expanded the options available to pet owners. They introduce this legal framework to develop consumer confidence while instilling assurance about the quality and safety of products offered. When there are regulations, manufacturers are likely to adhere to quality standards, raising overall market credibility.

Moreover, pet owners will likely find appropriate CBD options suitable for their pet's needs as the newly introduced deluge of brands and product offerings further propels market growth.

- Increasing pet ownership is anticipated to increase the demand

The increasing social acceptance of CBD products as a remedy for most health issues, ranging from pain management to anxiety relief, is overcoming the rising pet ownership, which is more inclined to dogs as house pets, and driving the market at the same time. Even though cats are in second place, as the popularity of this category grows, so does the demand for their CBD products. Horses are a unique but important section; the market can grow, partly due to the increased popularity of CBD in equine therapy and general well-being.

Moreover, with increasing awareness about pet welfare, other pets, such as exotic animals or small mammals, are beating new but important tracks into the CBD product arena. The uptick in pet owners seeking natural and holistic solutions has created a gap in the CBD market.

CBD Pet Care Market Restraints:

- Regulatory changes and high costs are anticipated to hamper the market growth

However, uncertainties concerning the legality of CBD, especially regarding its use for pets, can hinder market growth. The market can thus be defined geographically, as several countries or states still prohibit the use of CBD in its entirety. There is a lack of broad regulatory approval for CBD-based pet products, which has made customers and retailers cautious of its use. Moreover, CBD solutions are costly compared to normal pet care solutions, reducing access to price-conscious consumers.

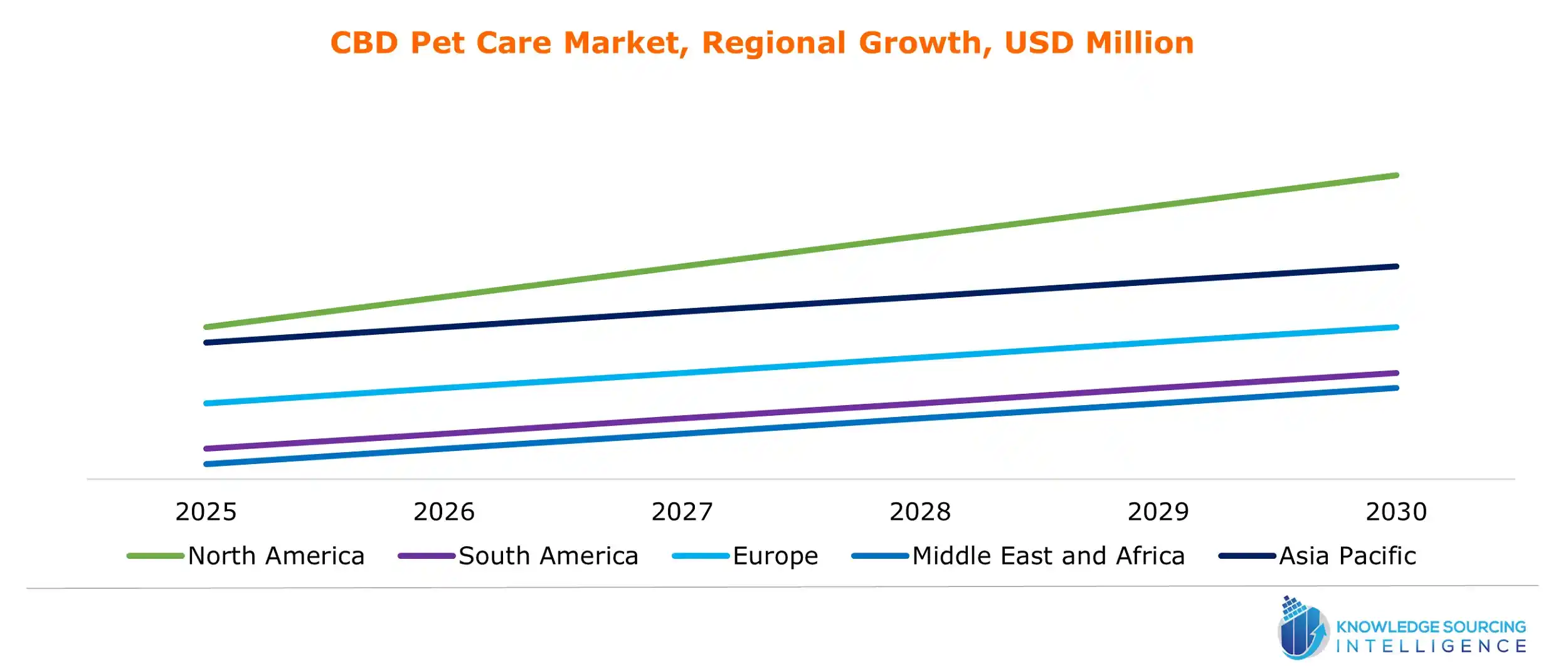

CBD Pet Care Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

Pet humanization is the main trend historically, making North America the largest pet market globally. The United States constitutes more than half the market share for CBD pet sales in North America, making it the region's largest market.

Moreover, a general acceptance of cannabidiol for wellness, medications, and pet care is expected to boost the market. The increasing investments in research and development by key CBD pet companies are contributing to the market growth. Companies strengthen their strategic partnerships with other market players by introducing new products. Besides this, many pet owners are changing their mindset from just being pet owners to considering themselves Pet Parents, contributing to the CBD pet market growth.

CBD Pet Care Market Key Launches:

- In September 2023, At SuperZoo 2023, Pet Releaf debuted travel-sized shampoos, conditioners, and a concentrated professional CBD shampoo. These new products, aimed at professional groomers and pet care companies, highlight natural, plant-based ingredients.

- In May 2023, Phillips Pet Food & Supplies, America's largest distributor in the pet specialty retail industry, partnered with Charlotte's Web to expand its distribution network. Through this partnership, more than 6,000 retail locations nationwide will have easier access to Charlotte's Web's CBD pet products, including specialty formulations like joint support chews and calming aids.

List of Top CBD Pet Care Companies:

- Joy Organics

- CBD Store India

- ItsHemp

- Quirst

- Hempstrol

CBD Pet Care Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| CBD Pet Care Market Size in 2025 | US$3,384.49 million |

| CBD Pet Care Market Size in 2030 | US$6,144.57 million |

| Growth Rate | CAGR of 12.67% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the CBD Pet Care Market |

|

| Customization Scope | Free report customization with purchase |

The global CBD pet care market is segmented and analyzed as follows:

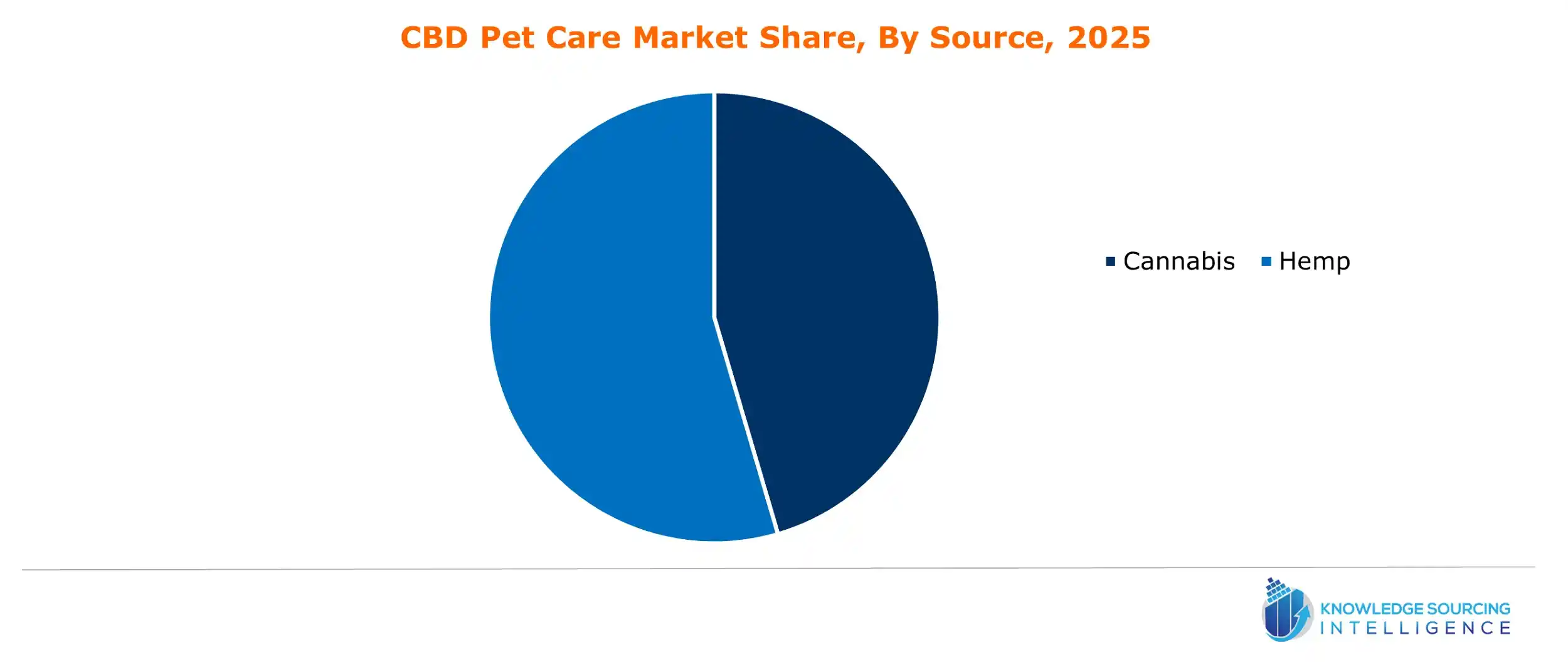

- By Source

- Cannabis

- Hemp

- By Grade

- Food

- Pharma

- By Animal Type

- Dog

- Cat

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America

Our Best-Performing Industry Reports

Navigation

- CBD Pet Care Market Size

- CBD Pet Care Market Key Highlights:

- CBD Pet Care Market Growth Drivers:

- CBD Pet Care Market Restraints:

- CBD Pet Care Market Geographical Outlook:

- CBD Pet Care Market Key Launches:

- List of Top CBD Pet Care Companies:

- CBD Pet Care Market Scope:

- Our Best-Performing Industry Reports

Page last updated on: September 16, 2025