Report Overview

Global Carbonated Soft Drink Highlights

Carbonated Soft Drink Market Size:

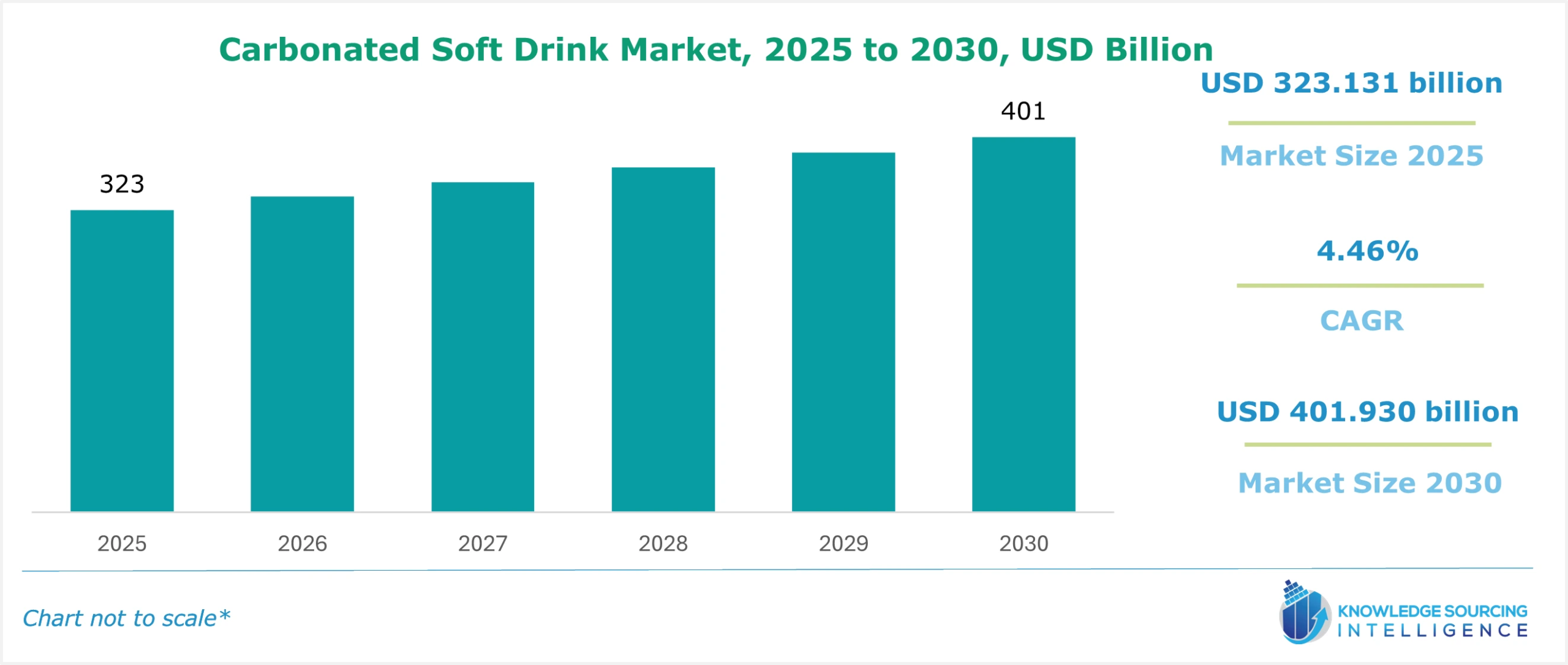

The carbonated soft drink market is estimated to grow at a CAGR of 4.46%, from USD 323.131 billion in 2025 to USD 401.930 billion in 2030.

Carbonated Soft Drink Market Trends:

Carbonated soft drinks are a type of beverage that consists of the dissolution of carbon dioxide (CO2) into liquid drinks. These drinks are nonalcoholic and use flavoring and sweeteners for taste. Various flavors of carbonated soft drinks are available globally, produced and distributed by multiple industry leaders. According to the British Soft Drink Association, carbonated soft drinks hold about 38.6% of the total beverage market in 2023. The association further stated that cola flavor occupies about 55.5% of the share among the different flavors of carbonated soft drinks, followed by orange and clear lemonade, accounting for 7.9% and 4.5%, respectively.

Rising disposable income, customer tastes, and a growing population all influence the demand for carbonated soft drinks. The sector has multiple important players and product offerings, all similar in size. Many of these firms launch new product lines and engage in advertising wars, propelling the market further. Carbonated soft drinks are developed in terms of flavour, appearance, texture, and ingredients depending on the target age range. Growing partnerships, acquisitions, and product launches are the major factors propelling the market forward.

Carbonated Soft Drink Market Growth Drivers:

- Increase in the global sales of food and beverage products.

The increasing global demand for processed food and beverage products is a major factor pushing the carbonated soft drinks market growth. The global demand for food and beverages has shown a steady growth pattern, primarily driven by increasing market competitiveness and the rise in consumers' disposable income. As global food and beverage products increase, the demand for carbonated soft drinks worldwide will also rise since the carbonated soft drinks segment holds a significant share of the global non-alcoholic beverages market.

The Farm Credit Canada, in its report, stated that during the first half of 2023, the total sales of the food and beverage market were recorded at US$80.6 billion, which increased to US$84 billion during the second half of 2023. The organization further stated that during the first half of 2023, the total sales of soft drinks in the nation were recorded at US$2.5 billion, which surged to US$2.6 billion during the second half of 2023. During the first half of 2024, the nation’s total sales of soft drinks were recorded at US$2.7 billion, which increased about 9.2% from the previous year.

Carbonated Soft Drink Market Major Challenges:

- Increasing global cases of diabetes and kidney disorders.

The global increase in cases of diabetes and kidney disorders is estimated to be a major hindrance to the growth of the carbonated soft drinks market. Carbonated soft drinks contain three major ingredients: carbonation, sweetener, and flavor. According to multiple research studies conducted worldwide, major institutes state that high or regular consumption of carbonated soft drinks can result in various health diseases, tooth decay, bone health deterioration, diabetes, and kidney or digestive disorders.

The global cases of diabetes witnessed a massive increase. The Canadian Diabetes Association, in its report, stated that in 2023, about 10% of the total population, or about 4.118 million individuals, were diagnosed with diabetes (Type 1 and Type 2), which is estimated to reach 5.192 million by 2033, an increase of about 26%. Similarly, the British Diabetic Association, in its 2023 report about diabetes, estimated that about 5.6 million individuals in the nation live with diabetes. The association further stated that about 8% of this population has type 1 diabetes, whereas about 90% have type 2 diabetes. The total cases of diabetes in 2022-23 observed an increase of about 167,822 compared to the total cases in 2021-22.

Carbonated Soft Drink Market Geographical Outlook:

- North America is forecasted to hold a major share of the global carbonated soft drink market.

The North American region is expected to have the largest global carbonated soft drinks market share. This region has some of the major players in the beverages market, like PepsiCo, The Coca-Cola Company, Keurig Dr Pepper Inc., and more. The region is also expected to witness growth in its market, mainly due to the e-commerce industry’s expansion.

Carbonated Soft Drink Market Product Offerings:

- PepsiCo, Inc. is among the leading global food and beverage manufacturers based in the USA. The company operates multiple international brands in the food and beverage industries, including Aquafina, Lipton, Gatorade, Mountain Dew, Pepsi, and Brisk, among many others. The company offers a wide range of beverages under multiple brands in the global carbonated soft drinks market. Some of the carbonated soft drinks of the company include Diet Mountain Dew, Caffeine Free Pepsi, Diet Pepsi, and Diet Pepsi Root Beer Zero Sugar.

- The Coca-Cola Company is one of the biggest soft drinks manufacturing companies based in the USA. The company produces various products, like non-alcoholic beverages, syrups, and concentrates. The Coca-Cola Company operates multiple brands worldwide, including Coca-Cola, Sprite, Fanta, Minute Maid, and Fresca, among many others. In the carbonated soft drinks market, the company offers a wide range of products, like Zero Sugar Oreo, Coca-Cola Original, Coca-Cola Zero Sugar, and flavored Coca-Cola, among others.

Carbonated Soft Drink Market Key Developments:

- March 2025: PepsiCo Agrees to Acquire poppi for US$1.95 Billion. PepsiCo announced on March 17, 2025, that it has entered into a definitive agreement to acquire Poppi, a fast-growing prebiotic soda brand, for US$1.95 billion — including US$300 million of anticipated cash tax benefits (net US$1.65 billion) and with an additional performance-based earn-out component.

- February 2025: The Coca-Cola Company Introduces Simply Pop, Its First Prebiotic Soda Line. The Coca-Cola Company launched the Simply Pop line in February 2025 (initially in select U.S. regions), featuring five flavors and formulated with six grams of prebiotic fiber, no added sugar, real fruit juice, plus vitamin C and zinc.

- September 2024: Jones Soda Co., in its press release, stated the launch of the S'mores Special flavor, which is the combination of melted chocolate, crisp graham crackers, and gooey marshmallows. The company launched these flavors during a series of its Special Releases, which aim to showcase its unique flavors.

List of Top Carbonated Soft Drink Companies:

- The Coca-Cola Company

- PepsiCo

- Keurig Dr Pepper

- National Beverage Corp.

- Jones Soda Co.

Carbonated Soft Drink Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 323.131 billion |

| Total Market Size in 2031 | USD 401.930 billion |

| Growth Rate | 4.46% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Packaging, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Carbonated Soft Drink Market Segmentation:

- By Type

- Regular

- Diet

- By Packaging

- Bottled

- Canned

- Soda Fountain

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America