Report Overview

Global Brown Sugar Market Highlights

Brown Sugar Market Size:

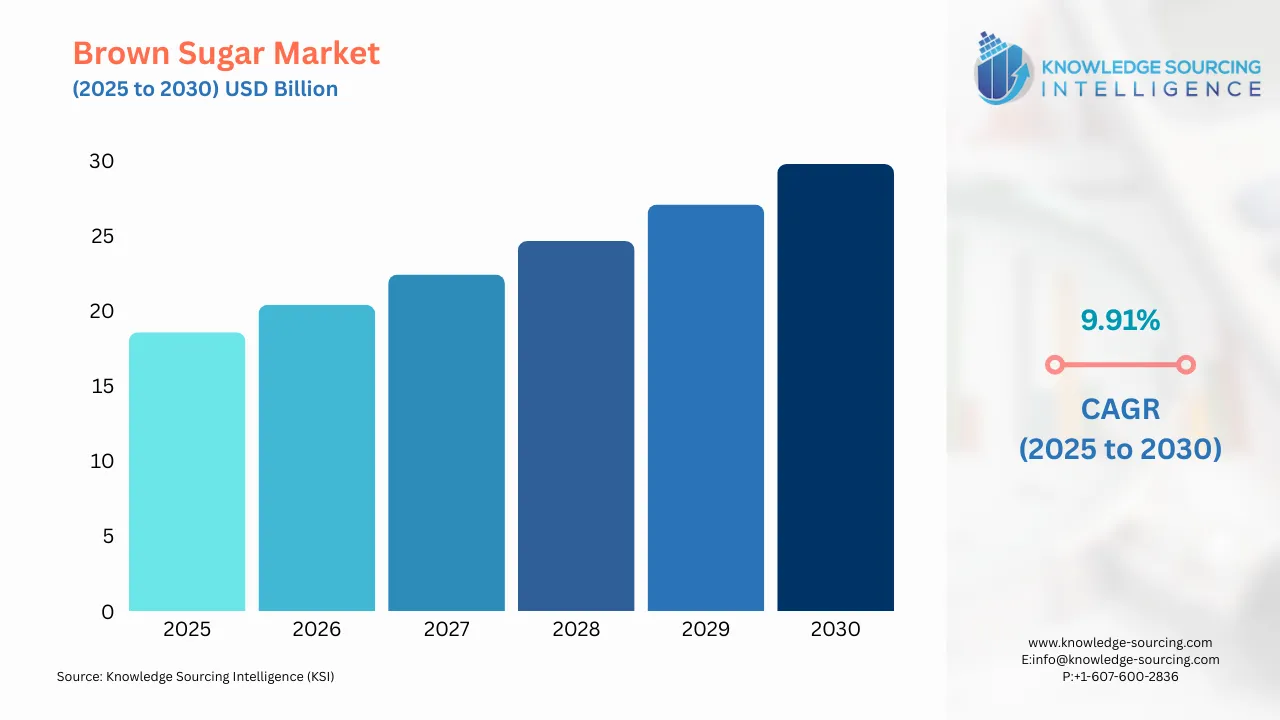

The global brown sugar market is projected to witness a compounded annual growth rate of 9.91%, growing to US$29.77 billion by 2030 from US$18.56 billion in 2025.

Brown sugar is manufactured by mixing white sugar with molasses. The dark color of the variety indicates the volume of molasses present in the brown sugar mixture. The difference in color between light and dark brown sugar simply comes from the fact that molasses is added to them in varying amounts. Brown sugar is stickier and tastier than white sugar because it contains molasses. Increased applications of brown sugar in bakery products will enhance market expansion in the projection period. Further propelling the market growth is the growing food and beverage industry’s production of bakery products. Bakery products, which, of late, are well prepared in homes, are using brown sugar as one of their ingredients, boosting market growth.

The growing FMCG sector will boost market growth in the forecast period. Light brown sugar is mostly used in baking, sauces, and glazes. Hence, using light brown sugar will add to the glazing of food and augment the market share. On the contrary, dark brown sugar is generally preferred in strong food recipes like gingerbread due to its rich color and flavor. Other reasons, like work stress and an active lifestyle, will make even more people drink more tea or coffee, contributing to market growth.

Additionally, the increasingly active working role of women in society, where coffee drinking among women is expected to increase and tends towards equity with men, is pushing the market during the projected period. The burgeoning home consumption of fine coffee will increase the demand for brown sugar. The younger generation, however, shows a significant tendency towards a bit of dislike of bitter coffee. Thus, such coffee varieties will also propel market expansion in the coming years.

Brown Sugar Market Growth Drivers:

- The increasing beverage consumption worldwide propels the market growth owing to the application of brown sugar in several beverages.

Different drinks use brown sugar, including coffee lattes, smoothies, hot green tea, mocha drinks, and several others. As disposable income increases in developing economies and stays relatively high in developed regions, the purchasing power is further boosted for the premium coffee consumer, providing market growth opportunities. Convenience foods and beverages are another potential area for positive market growth during the forecast period, given urbanization and the increasing adoption of busy lifestyles in fast-paced urban environments.

Other strategies utilized by several beverage industry majors in the global beverage industry are formed with acquisitions, mergers, and strategic alliances to increase market outreach and satisfy consumer demand. Heftier development increased distribution channels, both online and offline, for the forecast period, which further increased the market growth. The market would further get impetus due to continuous innovations in the beverage industry.

- The growing demand for bakery products is predicted to promote the global brown sugar market expansion

The increasing amounts of baked goods will likely augment the market growth in the forecast period. The changing consumption behavior of different individuals is complemented by a boost to the roaring market growth as brown sugar is increasingly used within the bakery industry. Growing spending power has created an affinity for high-end bakery products.

Further, although it is known that brown sugar is acquiring more of the use of white sugar in the kitchen for its hygroscopic quality, raw sugar has an even better mixture with bakery ingredients. This ingredient is widely used, getting extensive market growth in the forecast period. This will ensure a softer, more moisture-baked item since it is baked with brown sugar. It also imparts a rich color to the baked product.

In line with this, such developments are creating more demand for a new kind of bakery product, which is also frozen. Bakeries are becoming a comfortable option for millennial consumers with fast-paced living patterns that give less space and time for healthy eating. Manufacturers of bakery items are capitalizing on the millennial segment of superactive consumers and preparing food items according to trends in feeding practices from this population segment.

Brown Sugar Market Geographical Outlook:

- Asia Pacific region is expected to hold a significant share of the global brown sugar market

Geographical regions of the global brown sugar market include North America, South America, Europe, the Middle East, Africa, and the Asia Pacific. By geography, the Asia Pacific region is forecasted to hold a significant portion of the market, guided by a middle-class population whose increase will contribute to building a considerable consumer base. Other factors contributing to the regional market growth include disposable income, total family income, and urbanization, while developing a consumer lifestyle.

Moreover, several regions worldwide share a significant beverage-drinking culture, whether tea or coffee. Thus, the market in such regions is anticipated to grow rapidly in the coming forecast years. For instance, coffee drinking is an aspect of Portuguese culture; hence, people prefer drinking both at home and outside, in restaurants and cafes. This is likely to increase the market expansion during the forecast period due to coffee drinking for enjoyment among citizens of Portugal. When people meet friends and socialize, it is taken as an excuse to drink coffee.

Coffee drinking among the Portuguese is preferred outside the home environment, in cafes, kiosks, and restaurants. Hence, a café on every street is found due to the prevailing culture of dining out rather than inside. Such a dominant culture of beverage consumption, like coffee, is providing an impetus for soaring market growth in the forecast period.

Brown Sugar Market Key Developments:

- November 2025: Lanka Sugar Company opened its first retail brown sugar outlet in Nugegoda, expanding local product availability and supporting cane farmers with stable regional demand.

- May 2025: Südzucker and AFYREN expanded their bioeconomy partnership, utilizing brown sugar by-products to produce bio-based carboxylic acids, enhancing sustainability.

- December 2024: Brown sugar was officially named the 2025 “Flavor of the Year” by flavor manufacturer T. Hasegawa USA, Inc., highlighting rising ingredient prominence.

- December 2024: Dunkin'® partnered with international singing sensation Sabrina Carpenter to unveil a limited-time, handcrafted iced drink, "Sabrina's Brown Sugar Shakin' Espresso," available on December 31. The drink included brown sugar and oat milk, among other ingredients. It also included Dunkin's new $5 Meal Deal with Wake-Up Wrap® sandwiches and a medium coffee.

List of Top Brown Sugar Companies:

- Imperial Sugar Company

- American Crystal Sugar Company

- ASR GROUP

- British Sugar plc

- Louis Dreyfus Company

Brown Sugar Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Brown Sugar Market Size in 2025 | US$18.56 billion |

| Brown Sugar Market Size in 2030 | US$29.77 billion |

| Growth Rate | CAGR of 9.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Brown Sugar Market |

|

| Customization Scope | Free report customization with purchase |

Brown Sugar Market Segmentation:

- By Product Type

- Light Brown

- Dark Brown

- By Form

- Granulated Brown Sugar

- Powdered Brown Sugar

- Brown Sugar Syrup

- By Application

- Bakery

- Confectionery

- Dairy

- Beverages

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- Australia

- Indonesia

- Thailand

- Taiwan

- Others

- North America