Report Overview

Global Bottled Water Market Highlights

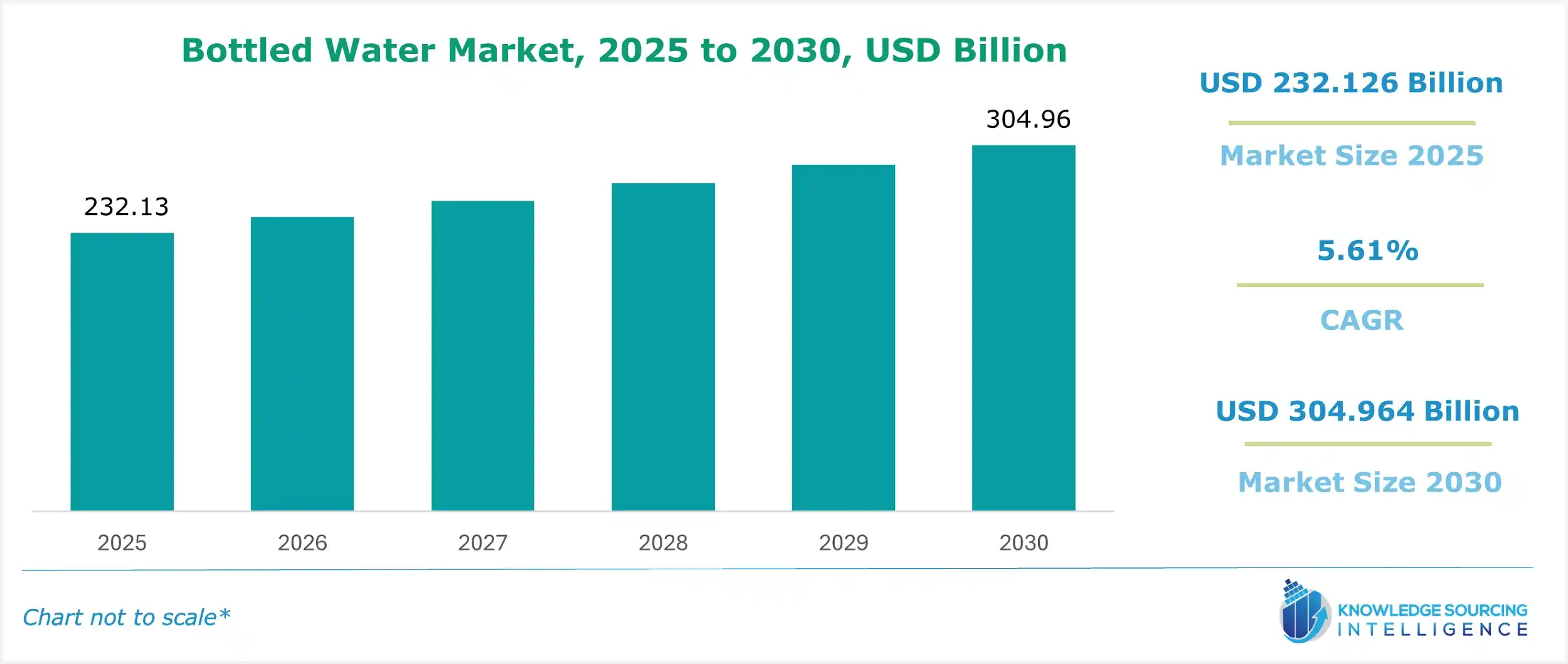

Bottled Water Market Size:

The Global Bottled Water market is projected to grow at a CAGR of 5.61% over the forecast period, increasing from US$232.126 billion in 2025 to US$304.964 billion by 2030.

The demand for bottled water is growing due to rising health consciousness and growing disposable income along with rising urbanization. The convenience offered by bottled water is the major factor driving the market expansion.

Global Bottled Water Market Overview & Scope:

The Global Bottled Water Market is segmented by:

- Type: The Global Bottled Water market, by type, is divided into still water, sparkling water, and functional water. Still water is bottled water without added flavors or carbonation, while sparkling water has a fizzy texture, and functional water is infused with electrolytes, vitamins, minerals, or fruits for health benefits.

- Flavor: The Global Bottled Water market, by flavor, is divided into flavored and non-flavoured. The non-flavored water segment caters to a wide consumer base that prefers plain, basic hydration. The flavored water segment includes water with natural or artificial flavors, sometimes sweeteners or other ingredients.

- Packaging: The Global Bottled Water market, by packaging, is divided into PET bottles, Glass bottles, and others. Till the end of the forecast period, PET bottles will continue to dominate the market share, while glass bottles will represent the premium segment and are anticipated to grow.

- Distribution Channel: The Global Bottled Water market, by sales channel, is divided into online and offline. Offline bottled water sales occur in retail outlets like supermarkets, hypermarkets, grocery stores, and convenience stores, whereas online retailers provide convenient purchasing and delivery options. The offline segment will constitute the largest segment; however, the online segment also has a growth trajectory.

- Region: The Global Bottled Water Market is segmented into North America, South America, Europe, the Middle East & Africa and Asia-Pacific. The Asia Pacific region is poised to hold a major share of the Global Bottled Water market due to the increasing disposable income of people along with rising urbanization and demand for safe drinking water.

Top Trends Shaping the Global Bottled Water Market:

1. Rising inclination towards sustainable recycled PET bottles

- There is a growing demand for sustainable and recycled PET (rPET) bottles due to increasing environmental awareness, stringent government regulations, and corporate sustainability initiatives.

2. Growing trend towards online distribution channel

- The growth in e-commerce and consumers' rising comfort with web-based purchasing have played an important role in boosting the size of the online bottled water market.

- According to the International Trade Administration, the UK has the third biggest e-commerce market in the world after China and the U.S. Consumer e-commerce accounts for 36.3% of the total retail market in the UK as of Jan 2021, with e-commerce revenue projected to increase to $285.60 billion by 2025.

- Nonetheless, in March 2022, e-commerce sales in Canada amounted to approximately US$2.34 billion, as stated by Statistics Canada. It is estimated that retail e-commerce sales in the nation will total US$40.3 billion by 2025.

3. Growing trajectories in sparkling water

- The market for sparkling water is growing in popularity due to various factors. With concerns about the negative impacts of sugary beverages such as soda increasing, consumers are going out of their way to find healthier alternatives.

- For instance, the sales of the sparkling beverages segment in Coca-Cola increased from US$35,21,273,000 in 2022 to US$38,92,133,000 in 2023.

Global Bottled Water Market Growth Drivers vs. Challenges:

Opportunities:

- Rising health consciousness: The rapidly growing awareness among consumers about their health and busy lifestyles leads to an increased preference towards bottled water, as consumers consider it as a pure, clean, and convenient source to stay hydrated. Moreover, people prefer healthier alternatives to tap water and sugary drinks, and the on-the-go population’s rising demand for portable bottled water will provide an opportunity for market expansion. As per the International Bottled Water Association (IBWA), in 2022, bottled water in the U.S. reached its highest volume ever, selling 15.9 billion gallons, surpassing carbonated soft drinks for the seventh year. Retail sales reached $46 billion, up from $40.8 billion in 2021. In addition, Americans consumed an average of 46.5 gallons of bottled water and 36 gallons of soda in 2022 alone. It highlights the growing consumer preference for bottled water by the US population, and one of the factors is the rising health consciousness among them.

Challenges:

- Environmental concerns: Environmental concerns pose a significant restraint in the global bottled water market, as the industry faces growing criticism for its contribution to plastic waste and carbon emissions. The damage done by the bottled water is leading the people to shift their preference towards sustainable alternatives.

Global Bottled Water Market Regional Analysis:

- North America: North America will continue to have a considerable market share in the global bottled water due to high usage by the people due to growing demand for hygienic drinking water along with demand due to convenience. The U.S. market for bottled water is growing rapidly, fueled by heightened consumer health awareness. With increasing awareness of the possible health dangers of sugary drinks, consumers are actively pursuing healthier alternatives for hydration. This has caused a sharp decline in the consumption of sugary beverages such as soda and a marked increase in the consumption of bottled water, which is seen as a healthier and more refreshing beverage. This increasing trend for healthier options is one of the driving factors for the market's growth. In addition, the increased level of convenience and accessibility is also one of the major drivers in the U.S. bottled water market growth. In July 2024, Chipotle launched a new range of ready-to-drink drinks found in all of its U.S. restaurants. These include Open Water and canned water in aluminum cans,

Global Bottled Water Market Competitive Landscape:

The market is fragmented, with the presence of some of the key notable players such as Bisleri International Pvt Ltd, Evamor Products, LLC, and FIJI Water Company LLC.

- Leading Player: Bisleri International Pvt Ltd is one of the leading providers of bottled water in India, with more than 50 years of experience and more than 122 operational plants. It has a strong distribution channel consisting of 4,500 distributors and 5,000 distribution trucks across India and neighbouring countries. It offers Bisleri 20 Litre Water Jar, Bisleri 10 Litre Water Jar Bisleri 5 Litre Water Jar, Bisleri 2 Litre Water Bottles, Bisleri 1 Litre Water Bottles, Bisleri 500ml Water Bottles, Bisleri Rockstar 300ml Water Bottles, Bisleri 250ml Water Bottles, Bisleri Vedica Himalayan Sparkling Water x Gauri Khan (Limited Edition) – 300 mlScalp Advanced, Vitamino Color Spectrum.

- Product line expansion: In September 2024, Waterloo Sparkling Water, with its genuine full flavors and vibrant carbonation, announced the latest addition to its lineup, Pomegranate Açaí. This distinct seasonal flavor is joined by repeat fan-favorite Spiced Apple, both offered as limited-time-only (LTO) products

- Product Launch: In August 2024, Flow Beverage Corp., with its dedication to offering premium, sustainably sourced mineral spring water, introduced its newest product, Flow Sparkling Mineral Spring Water. The new product line was launched in Canada in October 2024, with a rollout in the United States in the following months.

- Product Innovation: In March 2024, PepsiCo launched Bubly Burst, a refreshing, flavor-forward, lightly sweetened sparkling water beverage with bold fruit flavors, bright colors, zero added sugar, and minimal calories.

Bottled Water Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Bottled Water Market Size in 2025 | US$232.126 billion |

| Bottled Water Market Size in 2030 | US$304.964 billion |

| Growth Rate | CAGR of 5.61% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Bottled Water Market |

|

| Customization Scope | Free report customization with purchase |

Global Bottled Water Market Segmentation:

By Type

- Still Water

- Sparkling Water

- Functional Water

By Flavor

- Flavored

- Non-Flavored

By Packaging

- PET Bottles

- Glass Bottles

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others