Report Overview

Global Bioplastics Market Report, Highlights

Bioplastics Market Size:

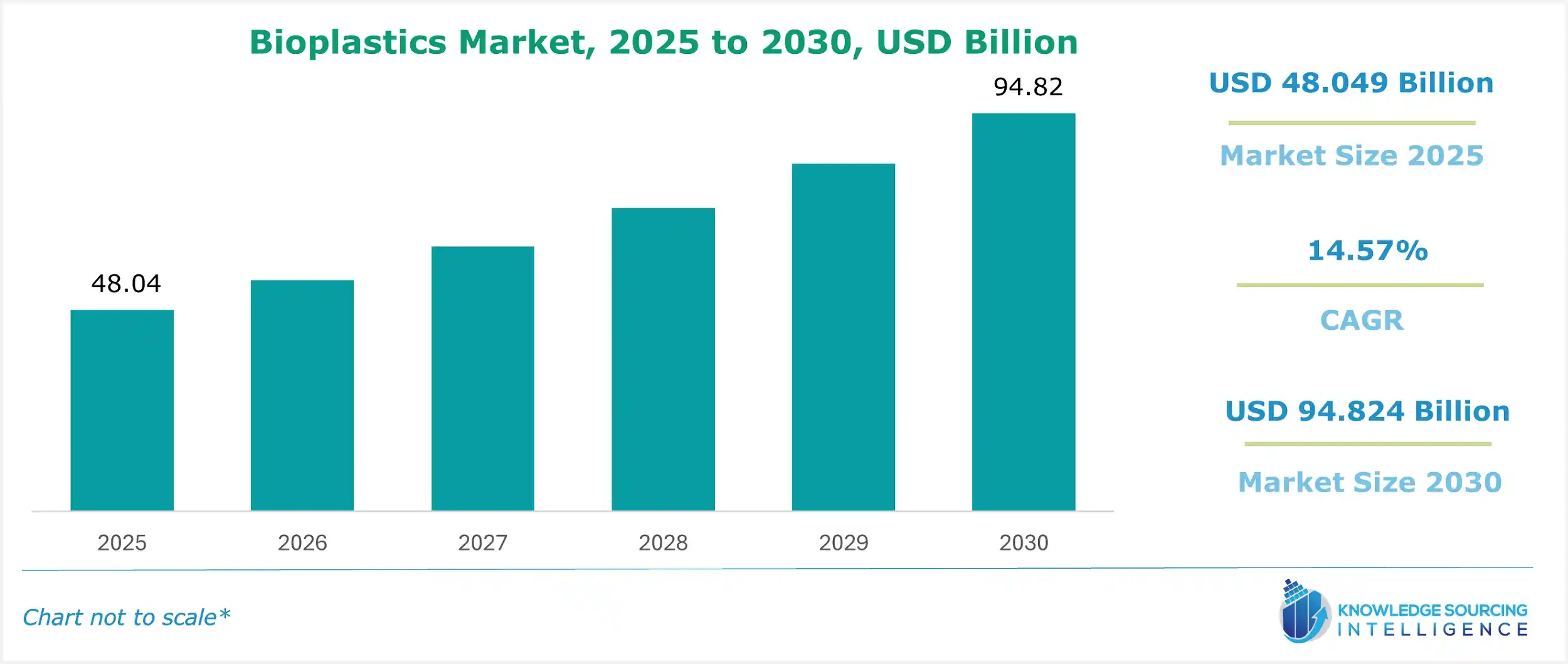

The global bioplastics market is expected to grow at a CAGR of 14.57% during the forecast period, reaching US$94.824 billion in 2030, up from US$48.049 billion in 2025.

Introduction to the Bioplastics Market:

The bioplastics market is rapidly evolving, driven by demand for sustainable plastics and green polymers. Bio-based plastics, derived from renewable sources like corn and sugarcane, and biodegradable plastics, which decompose naturally, are key segments. These renewable plastics support circular economy plastics by reducing reliance on fossil-based materials and minimizing waste. Innovations in production enhance performance, making them viable for packaging, automotive, and medical applications. The bioplastics market is undergoing a transformative phase, driven by heightened environmental awareness, technological advancements, and shifting consumer preferences toward sustainable materials. Bioplastics, defined as plastics derived from renewable biomass sources or designed to be biodegradable, represent a promising alternative to conventional petroleum-based plastics. These materials, which include bio-based polymers like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and biodegradable polyesters, are gaining traction across industries such as packaging, agriculture, automotive, and consumer goods. The global push for a circular economy and reduced carbon footprints has positioned bioplastics as a critical component of sustainable industrial strategies. Market players recognize their potential to address environmental concerns, with scalable solutions driving adoption. As regulations tighten and consumer preferences shift, the bioplastics market is poised for significant growth, reshaping sustainable material landscapes.

Bioplastics are categorized into two primary types: bio-based plastics, which are made from renewable resources like corn, sugarcane, or cellulose, and biodegradable plastics, which can break down naturally through microbial action. Some bioplastics, such as PLA and PHA, are both bio-based and biodegradable, while others, like bio-based polyethylene (PE), are derived from renewable sources but are not biodegradable. The versatility of bioplastics has led to their adoption in diverse applications, from single-use packaging to durable automotive components. The market is characterized by dynamic growth, with increasing demand driven by product innovation and supportive regulatory frameworks. For instance, the European Union’s Single-Use Plastics Directive, implemented in 2021 and expanded in subsequent years, has spurred demand for biodegradable alternatives in packaging and foodservice applications.

The bioplastics market is also benefiting from advancements in production technologies. Innovations in fermentation processes and enzyme engineering have improved the efficiency and cost-effectiveness of bio-based polymer production. For example, companies are now able to produce PHA using waste feedstocks, such as agricultural residues or wastewater, reducing reliance on virgin biomass and lowering production costs. A notable development in 2024 was the scaling up of PHA production by a European consortium, which utilized methane from industrial emissions as a feedstock, demonstrating a closed-loop approach to bioplastics manufacturing.

The bioplastics sector is witnessing rapid innovation and strategic partnerships. In 2025, a collaboration between academic institutions and industry players in Japan resulted in a novel bio-based polyethylene terephthalate (PET) with improved recyclability, reducing dependency on fossil-based PET in beverage bottles. Additionally, the adoption of bioplastics in agriculture is expanding, with biodegradable mulch films gaining popularity in Europe to reduce plastic waste in farming. The European Union, for example, has introduced its Single-Use Plastics Directive and Circular Economy Action Plan, promoting compostable and bio-based materials. Similarly, countries like India, Canada, and several U.S. states have created policies that support the production and use of biodegradable materials. Furthermore, certifications like EN 13432 and ASTM D6400 for compostability, along with carbon footprint labeling, are influencing product development and consumer choices. These evolving regulations not only create a supportive environment for adopting bioplastics but also foster innovation and investment in sustainable material technologies. These developments underscore the market’s potential to address environmental challenges while meeting industry needs.

Bioplastics Market Overview:

Bioplastics are sustainable materials derived from renewable feedstocks and act as an alternative to petroleum-based plastics. Rising awareness about eco-safety, growing demand for bioplastics in additive manufacturing, increasing demand from the packaging sector, high consumer preference for bio-based products, and supportive government regulations/ policies to promote sustainability are some of the major factors driving the global bioplastics market expansion. Owing to this, global bioplastics production capacity is set to increase significantly from around 2.47 million tonnes in 2024 to approximately 5.73 million tonnes in 2029.

Furthermore, the United Kingdom is one of the most advanced and innovative countries in terms of developing advanced and modified plastics. The government’s ban on single-use plastic, coupled with the growing awareness about the hazardous effects of plastic waste, is a key trend stimulating the regional market growth.

Additionally, the increased consumption of dairy milk worldwide has created an opportunity for renewable packaging solutions. Dairy production projection in 2022 accounted for 8,88,412 (kiloton product weight) and is expected to be 10,10,318 kt pw (kiloton product weight) by 2030. Large amounts of organic waste, including wastewater and whey from dairy farms, are now being used to create bioplastics.

Apart from this, key developments greatly influence the bioplastics market by fostering innovation, improving material performance, and broadening application areas. Improvements in biodegradability, durability, and compatibility with regular manufacturing processes make bioplastics more competitive with traditional plastics. Strategic partnerships, new product launches, and growing regulatory support also promote market growth by drawing in investment and encouraging wider use. These changes help establish bioplastics as a practical solution to environmental issues, supporting global efforts for sustainability and a circular economy.

Additionally, innovation continues to influence the market. Manufacturers are developing high-performance blends, drop-in bio-based polymers, and scalable production technologies. Companies are investing significantly in research and development while forming strategic partnerships to increase production capacity and meet rising demand. Key players like NatureWorks LLC, BASF SE, TotalEnergies Corbion, Novamont S.p.A., Braskem, and Danimer Scientific are at the forefront of this transition. As global sustainability targets become tighter and consumer awareness increases, the bioplastics market will experience significant growth. This growth will transform material choices across industries and contribute to a greener future.

Bioplastics Market Trends:

The bioplastics market is witnessing dynamic trends across diverse applications. Bioplastic packaging, including flexible and rigid packaging, dominates due to demand for sustainable alternatives in food service bioplastics. Automotive bioplastics are gaining traction for lightweight, eco-friendly components. Textile bioplastics offer innovative fibers for sustainable fashion, while agriculture bioplastics, particularly mulch film bioplastics, enhance crop efficiency and soil health. Consumer goods bioplastics are rising in everyday products, driven by eco-conscious consumers. Additionally, 3D printing bioplastics are revolutionizing manufacturing with customizable, green polymers. These trends reflect a shift toward versatile, environmentally responsible materials, aligning with global sustainability goals for industry experts.

Bioplastics Market Drivers:

- Environmental Awareness and Consumer Demand

Heightened public awareness of plastic pollution and its environmental impact is a primary driver for bioplastics adoption. Traditional plastics, which are made from fossil fuels, greatly worsen the environment by polluting the air, water, and land. Microplastics are now contaminating freshwater systems, oceans, agricultural land, and even the human food chain, making plastic pollution a global concern. Globally, 220 million tons of plastic waste, or 28 kg per person, were produced in 2024. 69.5 million tons, or one-third, of this waste was improperly handled and wound up in the environment, according to SAFE – Safe Food Advocacy Europe. China, Russia, India, Brazil, and Mexico are among the 12 nations that account for 60% of the world's improperly managed plastic garbage. With the rising plastic waste generated annually, of which less than 10% is recycled globally, consumers are increasingly favoring sustainable alternatives. This shift is evident in the rising demand for eco-friendly packaging in sectors like food and beverage, where brands are responding to consumer preferences for biodegradable or bio-based materials. For example, Unilever’s 2023 commitment to transition select product lines to bio-based packaging by 2025 reflects this trend, with the company reporting a 15% increase in consumer preference for sustainable packaging in recent surveys. Similarly, the rise of eco-conscious consumer movements, particularly in Europe and North America, has pushed retailers to adopt bioplastics in single-use items like cutlery, straws, and shopping bags, further accelerating market growth.

Ingestion and entanglement harm marine species, resulting in a loss of biodiversity and disturbance of ecosystems. Public awareness has increased due to this concerning situation, and demand for sustainable materials has risen. Customers now prefer eco-friendly options in their daily lives, especially in packaging, fabrics, and disposable goods, owing to the presence of environmental NGOs, social media campaigns, and climate activism. Customers from Generation Z and Millennials are very outspoken in their support of sustainable options, demonstrating a strong desire to pay more for goods composed of compostable or biodegradable materials.

Businesses are being pressured by this trend to meet the demands of environmentally conscious consumers by substituting bio-based, renewable, and biodegradable plastics for petroleum-based ones. Interest and investment in the bioplastics sector is rising as people learn more about the health hazards, lengthy disintegration times, and carbon footprint of conventional plastics. Furthermore, the need to promote biodegradable materials and lessen plastic pollution is being emphasized by the adoption of circular economy principles and global sustainability objectives such as the Sustainable Development Goals (SDGs) of the UN.

As a result, growing environmental consciousness is affecting business sustainability goals, policy frameworks, and product innovation in addition to altering consumer behavior, all of which are driving the market for bioplastics.

- Regulatory Support and Policy Initiatives

Governments worldwide are enacting policies to reduce reliance on fossil-based plastics, creating a favorable environment for bioplastics. The European Union’s Circular Economy Action Plan, updated in 2024, promotes the use of bio-based and biodegradable materials through incentives such as tax breaks and research grants for manufacturers. The EU’s Single-Use Plastics Directive, expanded in 2024 to include stricter bans on conventional plastic items, has driven demand for biodegradable alternatives, particularly in packaging and foodservice applications. In Asia, Japan’s 2025 Plastic Resource Circulation Strategy includes subsidies for bioplastics research, aiming to achieve a 25% market share for sustainable plastics by 2030. South Korea has also introduced tax incentives for companies adopting biodegradable plastics, fostering innovation in the sector. These policies not only stimulate demand but also encourage investment in bioplastics infrastructure.

- Technological Advancements

Innovations in biopolymer production and processing are expanding the functionality and affordability of bioplastics. Advances in fermentation technologies have reduced production costs for bio-based polymers like PLA and PHA. For instance, a 2024 breakthrough in PHA production by a European consortium utilized methane from industrial emissions as a feedstock, lowering costs by 20% compared to traditional methods. Additionally, a 2025 study published in ScienceDirect reported the development of a high-performance PLA variant with enhanced thermal stability, making it suitable for automotive and industrial applications. These advancements are enabling bioplastics to compete with conventional plastics in terms of performance, thereby broadening their market applications.

- Corporate Sustainability Goals

Multinational corporations are increasingly integrating bioplastics into their supply chains to meet ambitious sustainability targets. The automotive industry, for instance, is adopting bio-based composites to reduce carbon emissions. In 2024, BMW announced the use of bio-based materials in its electric vehicle interiors, achieving a 20% reduction in manufacturing-related emissions. Similarly, the packaging sector is seeing significant adoption, with companies like Nestlé piloting bio-based PET bottles in 2025 to align with their net-zero goals. These corporate commitments are driving demand for bioplastics while encouraging supply chain innovations, such as closed-loop recycling systems for bio-based materials.

Bioplastics Market Restraints:

- High Production Costs

Bioplastics are generally more expensive to produce than conventional plastics due to the cost of renewable feedstocks and complex manufacturing processes. For example, PLA production costs are estimated to be 20–30% higher than those of petroleum-based polyethylene, primarily due to the reliance on agricultural feedstocks like corn or sugarcane. While second-generation feedstocks, such as agricultural waste, are reducing costs, their scalability remains limited. This cost differential poses a challenge in price-sensitive markets, particularly in developing economies where cost considerations often outweigh environmental benefits.

- Limited Infrastructure for Disposal

The environmental benefits of biodegradable bioplastics depend on proper disposal systems, such as industrial composting facilities, which are scarce in many regions. A 2025 study highlighted that only 15% of global municipal waste management systems are equipped to handle compostable plastics, leading to improper disposal and reduced efficacy of biodegradable materials. In regions lacking composting infrastructure, biodegradable bioplastics may end up in landfills or incinerators, undermining their environmental value and creating confusion among consumers about their disposal.

- Feedstock Competition

The reliance on agricultural feedstocks raises concerns about competition with food production and land use. Crops like corn and sugarcane, commonly used for bio-based plastics, compete with food and feed supply chains, potentially driving up food prices in certain regions. A 2024 OECD report emphasized the risk of land-use conflicts, noting that scaling bio-based plastic production could exacerbate pressure on arable land. While second-generation feedstocks like agricultural residues or algae offer a solution, their commercial scalability is still in early stages, limiting their immediate impact.

- Performance Limitations

Some bioplastics, such as PLA, exhibit inferior mechanical properties compared to conventional plastics, restricting their use in high-performance applications. For example, PLA’s low heat resistance makes it unsuitable for certain industrial or automotive uses without modification. Although recent advancements, such as the 2025 PLA variant with improved thermal stability, are addressing these issues, widespread adoption in sectors like construction or electronics remains challenging. Additionally, the variability in bioplastics’ performance across different environmental conditions can complicate their integration into existing manufacturing processes.

Bioplastics Market Segment Analysis:

- By Type: Biodegradable Bioplastic – PLA is leading the market

Polylactic Acid (PLA) is the leading biodegradable bioplastic due to its versatility, cost-effectiveness, and established production processes. Derived from renewable resources like corn, sugarcane, or cassava, PLA is both bio-based and biodegradable under industrial composting conditions. It is widely used in packaging, foodservice items, and medical applications due to its transparency, rigidity, and compostability. PLA accounts for a significant share of the biodegradable bioplastics market, driven by its compatibility with existing manufacturing infrastructure and increasing demand for sustainable materials.

The PLA market is expanding rapidly, fueled by advancements in production efficiency and growing applications in single-use items like cups, trays, and films. In 2025, researchers developed a high-performance PLA variant with enhanced thermal stability, enabling its use in high-temperature applications such as automotive components. The material’s low carbon footprint—estimated to be 50–70% lower than petroleum-based plastics—makes it a preferred choice for environmentally conscious brands. Companies like Nestlé have adopted PLA for compostable coffee capsules, reflecting its growing adoption in consumer goods. However, PLA’s dependence on industrial composting facilities for effective biodegradation remains a challenge, as many regions lack such infrastructure.

The PLA market is driven by regulatory bans on single-use plastics, particularly in Europe and North America, and consumer demand for eco-friendly packaging. For instance, the EU’s Single-Use Plastics Directive has accelerated PLA adoption in foodservice applications. Additionally, innovations in feedstock diversification, such as using agricultural waste, are reducing production costs and mitigating food security concerns. The global PLA market is expected to grow significantly, with packaging applications leading due to PLA’s suitability for films and containers.

- By Type: Non-Biodegradable Bioplastic - Bio-PET (Polyethylene Terephthalate) segment is expected to grow significantly

Bio-PET (Polyethylene Terephthalate) is the dominant non-biodegradable bioplastic, valued for its durability, recyclability, and compatibility with existing PET recycling streams. Unlike biodegradable bioplastics, Bio-PET is derived from renewable feedstocks, such as sugarcane-based ethanol, but retains the same chemical structure as fossil-based PET, making it non-biodegradable. It is widely used in beverage bottles, food containers, and textiles due to its strength and clarity.

Bio-PET’s market growth is driven by its seamless integration into existing plastic supply chains, particularly in the beverage industry. In 2025, a Japanese research consortium developed a bio-based PET with improved recyclability, reducing dependency on fossil-based PET for bottle production. Major brands like Coca-Cola have expanded their use of Bio-PET in their PlantBottle initiative, with over 30% of their global bottle production now incorporating bio-based materials. Bio-PET’s recyclability aligns with circular economy goals, making it a preferred choice for companies aiming to reduce carbon emissions without compromising performance.

The Bio-PET market benefits from the global push for sustainable packaging and the material’s ability to replace fossil-based PET without requiring new infrastructure. Regulatory incentives, such as tax breaks for bio-based materials in the EU’s Circular Economy Action Plan, further support its adoption. However, high production costs and competition with recycled PET pose challenges to scalability.

- By Application, the packaging segment is rising considerably

Packaging is the largest application segment for bioplastics, accounting for approximately 45% of the total bioplastics market volume in 2024. Bioplastics like PLA, PHA, and Bio-PET are extensively used in food packaging, beverage bottles, and flexible films due to their environmental benefits and compatibility with consumer demands for sustainability.

The growing desire for sustainable, biodegradable, and compostable alternatives to traditional plastic packaging has led to significant growth in the packaging category, which now represents the greatest proportion of the worldwide bioplastics market. Packaging accounts for over 40% of the plastic trash produced worldwide, according to Our World in Data. The United States, Europe, and China are the three regions that produce the most plastic waste, and packaging accounts for a sizable portion of this waste. In the US, 37% of all plastic waste comes from packaging. In China, it is 45%, and in Europe, it is 38%. These areas collectively generate 60% of the world's packaging waste.

Food containers, bottles, trays, films, pouches, and shopping bags are just a few of the rigid and flexible packaging applications that are quickly embracing bioplastics like polylactic acid (PLA), polyhydroxyalkanoates (PHA), bio-based polyethylene (bio-PE), and starch blends. Consumer preference for eco-friendly products, an increase in e-commerce, and pressure on brand owners to include sustainable packaging to comply with corporate social responsibility (CSR) objectives are the major factors of this change.

Furthermore, food and beverage producers are increasingly using bioplastics to guarantee hygienic, safe, and biodegradable packaging that also lessens their carbon footprint. Regulations that encourage the use of recyclable and biodegradable packaging materials, like the Single-Use Plastics Directive in the European Union, and that forbid the use of non-biodegradable plastic packaging in nations like China and India are also helping the packaging industry.

Bioplastics are appropriate for several commercial applications because they provide similar functionality to conventional plastics, such as barrier qualities, transparency, heat resistance, and durability. Compostable laminates and multilayer biopolymer films are two innovations that are finding greater use in the luxury and protective packaging markets. The adoption of bioplastics is also being accelerated by global brands in the food service, retail, and consumer goods industries, including Nestlé, Coca-Cola, Danone, and Unilever, who are switching to packaging that is 100% recyclable, reusable, or compostable as awareness of climate change and marine plastic pollution rises.

Along with changing traditional supply chains, the rapid rise of bioplastics in packaging is also spurring investment in next-generation bio-based materials, infrastructure for industrial composting, and new production processes. Therefore, it is anticipated that for the foreseeable future, the packaging category will continue to be the most prevalent and rapidly expanding application in the global bioplastics market.

Additionally, major retailers like Unilever have committed to using bio-based packaging for select product lines by 2025, boosting market expansion. Innovations in bioplastic films, such as PHA-based flexible packaging, are also expanding applications in e-commerce and retail.

The packaging segment benefits from stringent regulations, such as Japan’s Plastic Resource Circulation Strategy, which promotes bio-based packaging. Technological advancements in barrier properties and shelf-life extension for bioplastic packaging are further driving adoption. However, the segment faces challenges related to cost competitiveness and the need for improved recycling and composting infrastructure.

Bioplastics Market Geographical Outlook:

- Europe is predicted to dominate the market

Europe is the leading region in the global bioplastics market, driven by robust regulatory frameworks, advanced infrastructure, and high consumer awareness. The region accounts for a significant share of bioplastics production and consumption, with countries like Germany, France, and Italy at the forefront.

Europe’s dominance is underpinned by policies like the EU’s Circular Economy Action Plan, which provides incentives for bio-based and biodegradable materials. In 2024, a European consortium scaled up PHA production using methane emissions, showcasing the region’s leadership in innovative bioplastics manufacturing. The adoption of biodegradable mulch films in European agriculture is also a key growth area, reducing plastic waste in farming. Germany, in particular, leads in bioplastics research, with universities and companies collaborating on next-generation materials.

Europe’s market leadership is supported by stringent regulations, such as the Single-Use Plastics Directive, and significant R&D investments. Consumer demand for sustainable products and well-developed composting infrastructure further drive growth. However, the region faces challenges in harmonizing regulations across member states and scaling second-generation feedstock production.

Bioplastics Market Key Developments:

- In May 2025, Intec Bioplastics, Inc. launched its latest sustainable packaging innovation, EarthPlus Hercules Bioflex Stretch Wrap, designed for versatile use in both pallet and food wrapping applications.

- In September 2024, CSIRO, Australia’s national science agency, and Murdoch University launched The Bioplastics Innovation Hub, an $8 million collaboration that will work with industry partners to develop a new generation of 100 per cent compostable plastic.

List of Top Bioplastic Companies:

- BASF SE

- Corbion

- NatureWorks LLC

- Novamont S.P.A.

- Cardia Bioplastic

Bioplastics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Bioplastics Market Size in 2025 | US$48.049 billion |

| Bioplastics Market Size in 2030 | US$94.824 billion |

| Growth Rate | CAGR of 14.57% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Bioplastics Market |

|

| Customization Scope | Free report customization with purchase |

The global bioplastics market is analyzed into the following segments:

- By Type

- Biodegradable Bioplastic

- Polyester

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates

- Starch Blends

- Others

- Non-biodegradable bioplastic

- Bio-PE (Polythene)

- Bio-PET (Polythene Terephthalate)

- Bio-PA (Polyamide)

- Others

- Biodegradable Bioplastic

- By Application

- Construction

- Packaging

- Agriculture

- Textile

- Automotive

- FMCG

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- Saudi Arabia

- United Arab Emirates

- Rest of the Middle East and Africa

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America