Report Overview

Bio-Based PET Market Size, Highlights

Bio-Based PET Market Size:

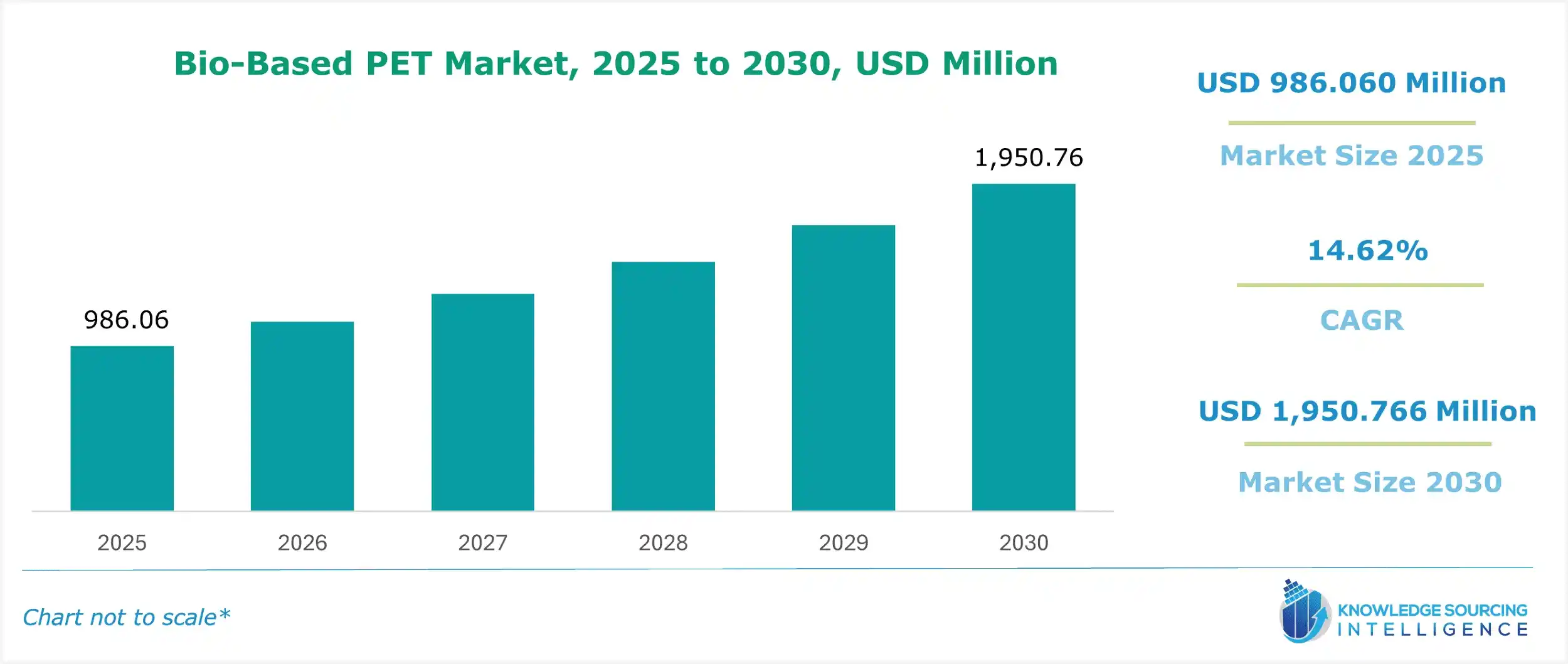

The Bio-Based PET Market, valued at US$1,950.766 million in 2030 from US$986.060 million in 2025, is projected to grow at a CAGR of 14.62% through 2030.

The bio-based PET market is expanding due to increased environmental awareness, government regulations, and potential future regulations, promoting sustainable alternatives and eco-friendly practices. Further, the beverage industry's worldwide expansion created a demand for Bio-Based PET. Moreover, the bio-based PET is increasing owing to environmental concerns in consumer choice. Consumers are seeking alternatives to conventional plastics, creating a favorable environment for bio-based PET from renewable resources. In addition, the ongoing trials and development seek to improve the production efficiency and economics of the bio-based PET worldwide.

Bio-Based PET Market Overview & Scope:

The Bio-Based PET Market is segmented by:

- Application: By application, the global bio-based PET market is divided into bottles, foam, synthetic fibers, and others. The bottles will hold a significant market share, witnessing a positive growth rate. Moreover, in October 2024, Indorama Ventures Public Company Limited started a collaboration with Suntory, ENEOS Corporation, Mitsubishi Corporation, Iwatani, and Neste, and launched the world’s first bio-PET bottle for commercial scale, made from ISCC+ certified bio-paraxylene. This collaboration marked a significant step toward sustainable packaging, introducing PET bottles derived from used cooking oil. PET bottles made from this technology can significantly reduce the CO2 emissions of products.

- End-User: Based on end-users, the global bio-based PET market is divided into automotive, packaging, personal care, electronics, and others. The automotive industry will witness significant growth due to the growing demand for electric vehicles. The packaging industry has a major share of the e-commerce business.

- Region: By geography, the Bio-Based PET Market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific.

Top Trends Shaping the Bio-Based PET Market:

1. Increasing consumer awareness about the environmental benefits of bio-based PET.

- Increasing consumer awareness about the environmental benefits of bio-based PET. The bio-based PET material is increasing owing to environmental concerns in consumer choice. The greenhouse gas emission and plastic waste concerns seem to be the recognized forces as bio-based PET provides a sustainable alternative to traditional petroleum-based PET, which uses renewable resources.

2. Governments worldwide are implementing regulations and incentives to promote the use of bio-based materials.

- Government regulations encourage corporations to invest in bio-based PET R&D, leading to better production processes, improved material properties, lower economic costs, and, thus, greater competitiveness of bio-based PET. For instance, with California's SB 54 or the Plastic Pollution Prevention Package Producer Responsibility Act, single-use plastic is being reduced by 25%, recycled by 65%, and all packaging and plastic foodware is recyclable or compostable by 2025. This will contribute to the demand for bio-based PET, resulting in companies rethinking their packaging strategies, rallying increasing market scale and potential for economies of scale, lowering the cost for bio-based PET production, and hence fulfilling regulatory guidelines.

Bio-Based PET Market: Growth Drivers vs. Challenges:

Drivers:

- Increased demand from the beverage industry: The growth of the beverage industry plays a major role in the adoption of Bio-Based PET. Major beverage companies are adopting bio-based PET for bottles and containers to meet consumer demand for environmentally friendly products. In January 2024, Coca-Cola Company’s sustainable packaging journey crosses a major milestone with the first-ever beverage bottle made from 100% plant-based plastic, excluding the cap and label. The breakthrough technologies used to produce the prototype are ready for commercial scale. The PlantBottle debuted as the world’s first recyclable PET plastic bottle with up to 30% plant-based material. A limited run of approximately 900 of the prototype bottles has been produced.

- Growing demand for sustainable packaging: Plastic bottles continue to be used in modern applications in various fields such as food and beverage, pharmaceutical, and automotive. As companies search for sustainable packaging solutions to meet consumer demand and lessen environmental impact, bio-based PET packaging is taking market share, thus stimulating this market’s expansion in the coming years.

Challenges:

- Price volatility: The price volatility due to the supply-chain constraint is a serious challenge in the industry. Further, the high costs of production and competition from alternatives are the restraints on market growth.

Bio-Based PET Market Regional Analysis:

- Asia-Pacific: The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as the ASEAN countries.

- North America: The United States bio-based PET market is witnessing substantial growth with the rise of awareness regarding environmental factors. Sustainable packaging solutions are being increasingly required, resulting in demand for bio-based PET. The market is also increasing due to the growing awareness of plastic waste and the pressure to take action against greenhouse gas emissions.

Bio-Based PET Market Competitive Landscape:

The market is fragmented, with many notable players including TORAY INDUSTRIES, INC., Anellotech, Inc., The Coca-Cola Company, SCG Chemicals Co., Ltd., FKuR Kunststoff GmbH, Iwatani Corporation, Neste, Plastipak Holdings, Inc., Suntory Holdings Limited, and Indorama Ventures Public Company Limited, among others:

Bio-Based PET Market Developments:

- October 2025: Braskem unveiled new bio-based and circular solutions at K 2025, emphasizing the expansion of its I'm green™ portfolio for packaging and consumer goods applications.

- September 2025: Indorama Ventures accelerated its textile transition by launching the deja™ Bio portfolio, offering scalable, high-performance bio-based PET fibers and yarns for the global fashion industry.

- July 2025: Anellotech and R Plus Japan announced the commercialization phase of Plas-TCat technology, which converts mixed plastic waste, including PET, back into bio-based chemical intermediates.

- April 2025: Chitose Group showcased what it describes as the world’s first 100 % bio-PET resin derived from microalgae at Expo 2025 Osaka, Kansai, indicating a new renewable feedstock for bio-PET.

- November 2024: Indorama Ventures, with Suntory, ENEOS, Mitsubishi, Iwatani, and Neste, announced the commercial launch of the world’s first bio-PET bottles made from ISCC+ certified bio-paraxylene, rolling out ~45 million bottles in Japan.

Bio-Based PET Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Bio-Based PET Market Size in 2025 | US$986.060 million |

| Bio-Based PET Market Size in 2030 | US$1,950.766 million |

| Growth Rate | CAGR of 14.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Bio-Based PET Market |

|

| Customization Scope | Free report customization with purchase |

Bio-Based PET Market Segmentation:

By Application

- Bottles

- Foam

- Synthetic fibers

- Others

By End-User

- Automotive

- Packaging

- Personal Care

- Electronics

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others