Report Overview

Global Beauty Drinks Market Highlights

Beauty Drinks Market Size:

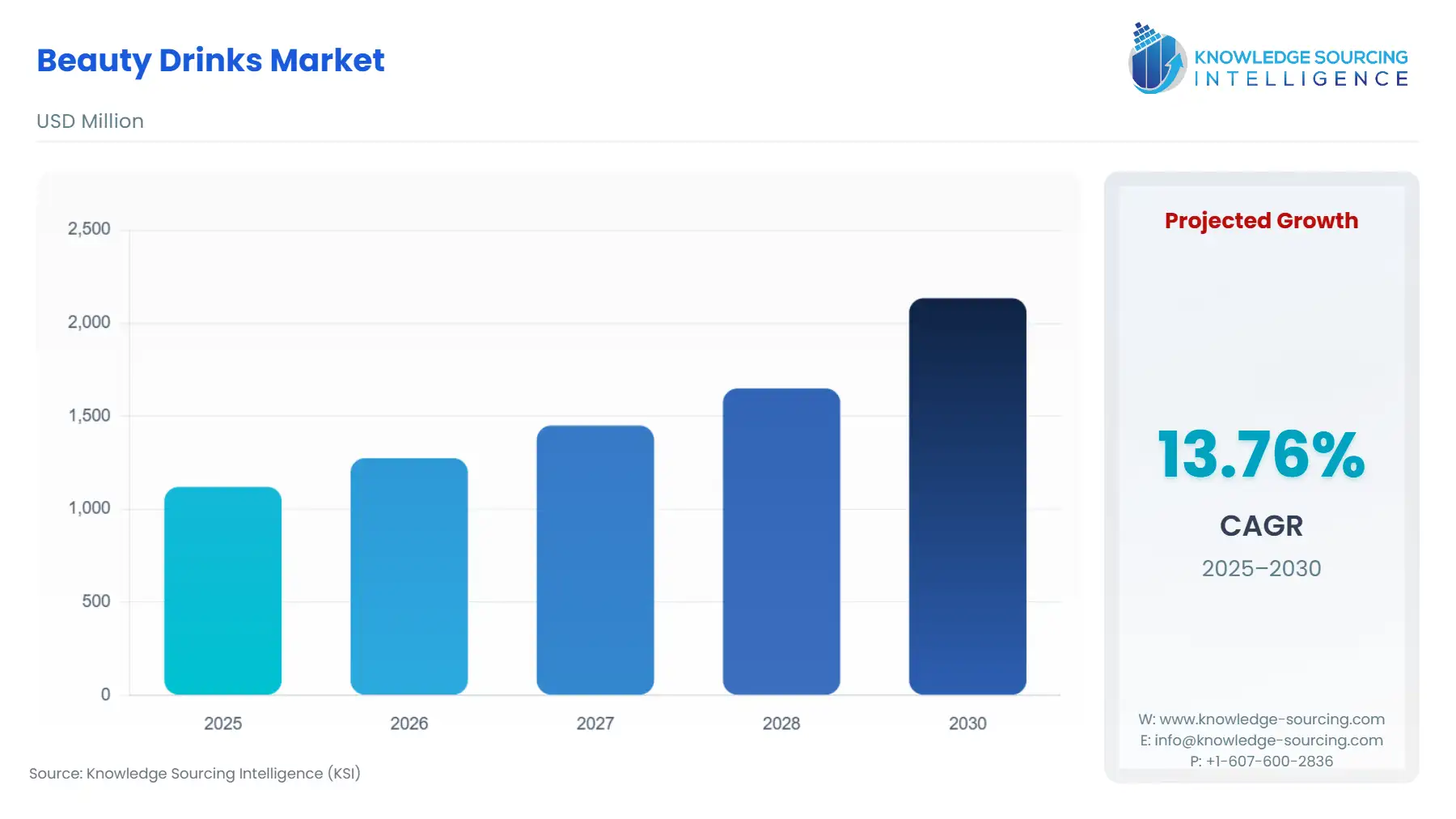

The global beauty drinks market will grow from US$1,120.208 million in 2025 to US$2,133.991 million in 2030 at a CAGR of 13.77%.

Beauty Drinks Market Analysis:

The growing demand for beauty drinks across the world is attributable to the rapid urbanization rate, coupled with the rising disposable income of consumers. In addition to the beauty benefits, the other nutritional and health benefits associated with functional beauty drinks and beverages, due to the incorporation of various minerals, vitamins, collagen, and protein sources, are further driving the beauty drinks market growth. Despite the presence of substitute capsules and pills for beauty drinks, the faster absorption and assimilation rates associated with beauty drinks and beverages continue to contribute to the significant demand for beauty drinks.

The recent developments in e-commerce and the willingness of consumers to spend on premium beauty beverages owing to the increasing use of chemicals in beauty products are driving the demand for beauty drinks. Furthermore, the appearance of early signs of skin aging among consumers as a result of busy and stressful lifestyles is further providing lucrative opportunities for the market players during the forecast period.

Beauty Drinks Market Growth Drivers:

- Rising aging population

As life expectancy rises and healthcare technology advances, the global population is witnessing a notable increase in its elderly demographic. According to World Bank data, individuals aged 65 and above now outnumber children under 5 worldwide, with more than two-thirds residing in less developed regions.

Projections suggest that by 2050, over 1.25 billion people in less developed areas will be aged 65 and above, from 493 million, marking a significant rise of approximately 757 million from 2020. Moreover, the World Health Organization predicts that the number of individuals aged 60 and above will double by 2050, reaching around 2 billion globally.

Concurrently, as the elderly population experiences declines in collagen, vitamin, and mineral levels, there is a proportional surge in demand for beauty drinks. These beverages, enriched with collagen supplements, are expected to witness further proliferation in the coming years. The degradation of collagen levels among the aging populace has led to the emergence of loose skin, prompting both men and women to increasingly gravitate towards beauty and nutrition-enhancing solutions to rejuvenate their skin and overall health. This trend is anticipated to drive the demand for beauty drink products in the foreseeable future.

Further, deficiencies in vitamins and minerals among the aging population, owing to a reduction in metabolism rates and changes in nutrition requirements, could lead to significant health problems. For instance, the presence of B12 Vitamin in lower concentrations could result in physical disabilities, nervous system disorders, and other heart-related diseases.

Therefore, certain health and beauty drinks are consumed by the aging population to maintain adequate levels of minerals and vitamins in the consumers’ bodies. Therefore, the increase in the aging population and the nutritional and beauty benefits offered by beauty drinks to the aging population shall accelerate the advancement of the international beauty drinks market.

Beauty Drinks Market Segment Analysis:

- The protein/collagen beauty drinks market is expected to grow

Consumers are becoming increasingly conscious of their appearance, which is leading to a steady demand for beauty drinks. This is related to rising economic levels in developing and underdeveloped nations, as well as the significant impact of social media marketing. Furthermore, the millennial generation is experiencing challenges due to busy lifestyles and bad eating habits. This has increased people's desire to maintain youthful skin across all age groups, which has fueled the collagen drinks industry's expansion globally.

Moreover, with growing awareness of anti-aging goods, consumers, particularly the elderly population, are increasingly looking for ways to maintain and enhance their appearance so that they appear young and beautiful. Data from the World Bank show that in Japan, the population over 65 made up 26.59% of the population in 2016 and will rise to 28.7% by 2021.

Due to the rising prevalence of aging indicators, middle-aged adults are also increasingly experiencing aging anxiety. Because they blur the line between cosmetics and pharmaceuticals, anti-aging skin care products are known as cosmeceuticals. The region, including Japan, has seen an increase in its aging population over the past 20 years as a result of the region's dropping fertility and death rates. Men's and women's overwhelming desire to maintain youthful appearances encouraged and evolved the market for collagen drinks.

Further, as per the statistics of the Sleep Foundation, the average amount of sleep that people obtain each night has decreased by 1.5 to 2 hours. In the UK, the average person reportedly sleeps for 6.5 hours every night. A common sleep condition in this area is somniloquy, or sleep talking. As collagen drinks aid in promoting sleep, users are drinking them frequently to enhance the quality of their sleep. For example, YourZooki is one of the top marine collagen drinks introduced in the UK in January 2021 that makes use of Liposomes, which are widely used in the pharmaceutical industry to increase the absorption and efficiency of different products.

Major market players are concentrating on the launch of vegan, gluten-free, and lactose-free products with no added sugars, preservatives, or flavorings to increase their market share. These elements present the profitable business potential for the collagen drinks industry to grow during the anticipated time frame. For instance, Reneva Collagen Drink will provide a new product formulation with a green apple flavor in April 2021.

Beauty Drinks Market Geographical Outlook:

- The market is projected to grow in the North American region.

Due to the increasing development of innovative products in the nation as well as market developments like player mergers and acquisitions, the market is anticipated to grow significantly.

Due to the involvement of regional and international companies seeking to improve their market positions, it is anticipated that the demand for beauty drinks in the nation will continue to be stable. For example, Nestle Health Science successfully purchased Chicago-based Vital Proteins, a manufacturer and supplier of supplements, in February 2022. Furthermore, it is anticipated that the creation of new products as a result of these market activities will spur even faster market growth. For instance, Vital Proteins introduced a range of Lemon Collagen Peptides in June 2022 under the Nestle brand. The beverage was sugar-free and included collagen from pasture-raised animals. Therefore, it is anticipated that the market will benefit from the introduction of such innovative products.

Moreover, being a developed country, the beauty drinks market is likely to experience significant growth in the US market in the coming years. According to the United States Bureau of Economic Analysis, the total personal income in the country amounted to a significant value of US$ 233.7 billion in 2022. Further, according to data from the World Bank, a significant portion of the population in the United States lives in urban areas. Such a high overall income, along with a substantial urban population, is thus expected to hold the market in good stead due to the broad consumer demographic present in the country.

Further, when it comes to cosmetic services and goods, women spend a little more than males. Compared to $2,928 spent annually, women spend $3,756.

In addition, expansion ventures by international players into the American market are further expected to boost the beauty drinks demand in the country. For instance, in January 2023, the Swiss company Collibre announced the availability of its hydrolyzed collagen beverages in the US. The company’s collagen drinks were made available in three distinct formulae in the country, namely, VITAL, BEAUTY, AND ACTIVE, after their success in the European market. Furthermore, the US is also likely to maintain steady growth owing to the presence of several market players that offer strategic price points for their products with a subscription model. For example, AETHERN offers its one-box supply of liquid collagen drinks for US$ 195, while a monthly subscription is offered at a lower price of US$ 149. The availability of such options is thus expected to attract more customers.

Moreover, SAPPE debuted a new, less sugary Sappe Beauti Drink line in October 2021 in an effort to give customers more innovative options while maximizing the commodity's value.

Beauty Drinks Market Key Players:

- Sappe is a leading player in the global beauty drinks market, offering innovative beverage solutions infused with natural ingredients. With a focus on wellness and beauty, Sappe has gained a significant presence by producing a diverse range of functional beverages tailored to consumer preferences.

- LR Beauty & Health is recognized for its high-quality skincare and beauty products, including beauty drinks. Leveraging its expertise in cosmetics and wellness, LR Beauty & Health has carved a niche in the global market with its refreshing and beneficial beauty beverage offerings.

- Kinohimitsu-Global stands out in the beauty drinks market with its emphasis on holistic health and beauty. Its products are formulated using natural extracts and nutrients to promote skin radiance and overall well-being. Kinohimitsu-Global's commitment to quality and innovation has earned it a loyal customer base globally, reinforcing its position as a key player in the beauty drinks industry.

Global Beauty Drinks Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Beauty Drinks Market Size in 2025 | US$1,120.208 million |

| Beauty Drinks Market Size in 2030 | US$2,133.991 million |

| Growth Rate | CAGR of 13.77% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Beauty Drinks Market |

|

| Customization Scope | Free report customization with purchase |

Beauty Drinks Market Segmentation:

- By Type:

- Vitamins

- Protein/Collagen

- Fruit Extracts

- Minerals

- By Application

- Anti-aging

- Detoxicating

- Radiance

- Vitality

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others