Report Overview

Global Balloon Catheters Market Highlights

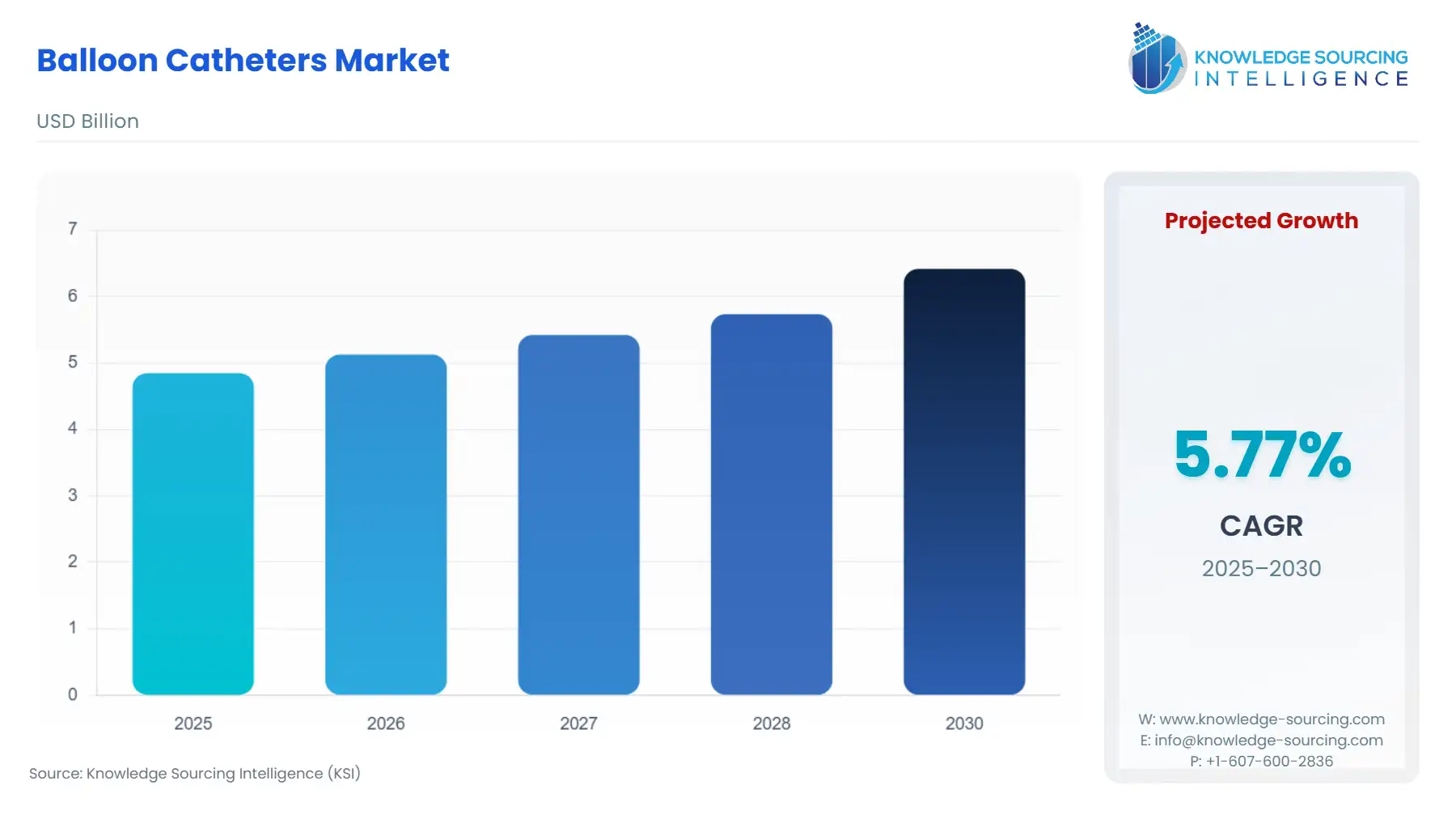

Balloon Catheters Market Size:

The Balloon Catheters Market is expected to grow from US$4.847 billion in 2025 to US$6.417 billion in 2030, at a CAGR of 5.77%.

The Global Balloon Catheters Market, a critical component of interventional cardiology, peripheral, and specialty medicine, is currently navigating a period of both significant regulatory rigor and profound technological advancements. The need for Class III invasive medical devices is fundamentally driven by the rising global prevalence of cardiovascular diseases and the shift toward minimally invasive procedures like Percutaneous Transluminal Coronary Angioplasty (PTCA). The market is moving beyond standard balloon dilatation to incorporate high-value innovations, such as drug-coated balloons (DCBs), which are creating new procedural paradigms, especially in cases of in-stent restenosis. This environment places a premium on clinical validation and the strategic capability of manufacturers to secure and maintain complex, localized reimbursement pathways across major global healthcare economies.

Global Balloon Catheters Market Analysis

- Growth Drivers

Aggressive medical society guidelines are a primary growth driver. The 2024 AHA/ACC/ACS guidelines for perioperative cardiovascular management emphasize early and judicious intervention, directly increasing the volume of non-cardiac surgery patients requiring prior cardiac assessment and potential revascularization, which translates to a greater demand for balloon catheters for pre-operative angioplasty. Furthermore, the expanding indication set for DCBs, particularly for in-stent restenosis and certain peripheral artery diseases, provides a high-value alternative to drug-eluting stents (DES). This technological progression directly increases the total demand for advanced balloon catheters by offering a superior clinical solution where DES may be suboptimal, such as at bifurcations or in small vessels, opening new therapeutic avenues and enhancing the per-procedure value. Finally, the adoption of centralized procurement in health systems, such as in Brazil, which favors high-volume, cost-effective purchasing, increases the overall unit demand for both basic and certain high-volume balloon catheter types.

- Challenges and Opportunities

A primary challenge is the increasing regulatory compliance burden, epitomized by the EU’s Medical Device Regulation (MDR), which requires extensive post-market clinical follow-up (PMCF) and places stringent demands on manufacturers to provide long-term clinical evidence. This increases the barrier to entry, which can limit competition and constrain the market's capacity for rapid innovation from smaller firms. However, this same environment creates a significant opportunity for established, well-capitalized market leaders like Medtronic and Boston Scientific to leverage their clinical evidence and regulatory expertise to consolidate market share. Another critical opportunity lies in specialty applications, particularly in non-coronary areas such as neonatal septoplasty and esophageal dilation, where balloon catheters offer a minimally invasive, low-trauma alternative to traditional surgical methods. The successful use of balloon dilatation in novel, delicate procedures demonstrates a new avenue for demand in pediatric and gastroenterological segments.

- Raw Material and Pricing Analysis

Balloon catheters, being physical products, are primarily dependent on specialized high-performance polymers, including polyamides (nylon), polyethylene, and polyether block amide (PEBAX), which are crucial for balloon strength, flexibility, and controlled inflation. The supply chain for these medical-grade materials is subject to global petrochemical market dynamics, with a significant dependency on a limited number of specialized compounders, creating a price volatility risk for manufacturers. Pricing of the final device is bifurcated: standard, high-volume angioplasty balloons face significant price pressure from global procurement bodies and Diagnosis-Related Group (DRG) fixed payments. Conversely, advanced devices like DCBs command a substantial premium—as seen with the initial high product cost of the first US-approved coronary DCB—justified by novel therapeutic mechanisms and superior clinical outcomes in difficult-to-treat lesions, allowing manufacturers to maintain high margins in the specialty segment.

- Supply Chain Analysis

The global balloon catheter supply chain is characterized by a high degree of specialization and a distinct geographical split between high-value manufacturing and consumption centers. Key production hubs are concentrated in North America (US), Western Europe (Ireland, Germany), and certain Asia-Pacific nations (Japan, China), reflecting the need for precision extrusion and high-standard cleanroom environments. Logistical complexities arise from the need for sterile packaging, temperature and pressure-controlled transportation, and managing expiration dates, particularly for advanced coated products. The supply chain's primary dependency is on a small, vetted ecosystem of specialized polymer and coating material suppliers, where a disruption can cascade rapidly. Furthermore, the reliance on a linear supply chain model of single-use disposable devices creates an inherent vulnerability to global manufacturing and transportation disruptions, which was starkly highlighted during global crises.

- Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Medical Device Regulation (MDR) |

Increases the cost of compliance and time-to-market due to stricter clinical evidence (PMCF) and documentation requirements. This acts as a barrier to smaller competitors and favors established companies like Medtronic and B. Braun. |

|

United States |

FDA Premarket Approval (PMA) / 510(k) |

The FDA's rigorous approval process for Class III devices (like transluminal coronary angioplasty catheters) ensures product safety but creates substantial development costs and timeline delays. The landmark 2024 DCB approval will catalyze new competition and demand in this approved segment. |

|

Germany |

New Diagnostic and Treatment Methods (NUB) |

Constrains the rapid adoption of innovative balloon catheters. Technologies not yet included in the G-DRG classification require a positive Federal Joint Committee (G-BA) assessment and successful negotiation with health insurers via NUB payments. |

|

Japan |

Health Technology Assessment (HTA) |

Japan’s use of HTA in determining reimbursement acts as a critical filter for new cardiovascular devices, requiring compelling evidence of superior clinical benefit to secure favorable pricing and increase demand through inclusion on the public reimbursement list. |

Balloon Catheters Market Segment Analysis

- By Application: Angioplasty

The angioplasty segment, which includes Percutaneous Coronary Intervention (PCI) and Peripheral Angioplasty, constitutes the core volume and value driver for the global balloon catheters market. Three main factors drive this growth. First, the rising global incidence of cardiovascular diseases (CVD), driven by demographic shifts (aging populations) and lifestyle factors. Second, the clinical pivot toward minimally invasive procedures; angioplasty using balloon catheters is the established, gold-standard, first-line intervention for restoring blood flow in stenosed arteries. Third, the revolutionary impact of Drug-Coated Balloons (DCBs). DCBs, which deliver an anti-proliferative drug to the vessel wall without leaving a permanent implant, directly create new, significant demand within the angioplasty segment. DCBs are particularly valuable where Stent failure is likely, such as in-stent restenosis or small vessel disease, establishing a premium-value niche that significantly increases the overall market's value. This high-value innovation in the angioplasty segment ensures its continued dominance and rapid evolution.

- By End-User: Hospitals & Clinics

Hospitals and Clinics are the paramount end-users, representing the point of care where the vast majority of balloon catheter procedures—from emergency cardiac intervention to elective peripheral angioplasty—take place. This segment is intensely influenced by health system infrastructure and financial dynamics. Capital expenditure constraints and cost-control initiatives are the primary drivers of purchasing behavior, compelling hospitals to favor suppliers who can offer bulk-purchasing contracts and favorable pricing for high-volume, standardized catheters. Simultaneously, the demand for advanced, single-use, high-end catheters remains robust, driven by the imperative to reduce cross-contamination risk and clinical liability. In environments like the US and Germany, reimbursement mechanisms linked to quality metrics increase the need for catheters that demonstrably lead to superior patient outcomes, which justifies the purchase of premium, technologically advanced products like DCBs. The transition from reusable to single-use disposables, fueled by regulatory scrutiny of in-house reprocessing, further increases the volume demand for new catheters by mandating their replacement after a single procedure.

Balloon Catheters Market Geographical Analysis

- Canadian Market Analysis

The Canadian market for balloon catheters is heavily influenced by the contentious issue of reprocessing single-use medical devices (SUMDs). While Canadian regulations mandate that medical devices sold must be supported by safety and efficacy studies, the practice of hospitals reusing SUMDs has been persistent due to cost pressures, although national consensus and clear legal frameworks are lacking. The absence of national, uniform regulation on reprocessing creates an increase in liability risk for hospitals that choose to reuse, which ultimately reinforces the need for new, certified single-use balloon catheters from manufacturers. This situation drives volume demand by ensuring the one-time-use lifecycle of the product and benefits manufacturers by leveraging hospital risk mitigation strategies.

- Brazilian Market Analysis

The Brazilian market is uniquely impacted by its centralized public health procurement policies and the use of innovative payment mechanisms. The Brazilian Ministry of Health has increasingly adopted centralized purchasing strategies, particularly for high-volume devices like coronary stents. This policy increases the total volume demand for the market by ensuring a steady, high-volume buyer, but also reduces the per-unit price for standardized catheters. Furthermore, the recent introduction of Outcome Protection Programs and other innovative payment mechanisms by large multinational companies like Medtronic in the Latin American region is shifting the financial risk from the hospital/payer to the manufacturer, which increases a hospital's willingness to adopt new, high-cost, high-tech balloon catheters with guaranteed performance metrics.

- German Market Analysis

The German market operates under a stringent reimbursement and technology assessment framework that serves as a key constraint on rapid market entry for innovation. New, high-value balloon catheter technologies that are not yet integrated into the Diagnosis Related Group (G-DRG) system must undergo the New Diagnostic and Treatment Methods (NUB) process. This requires the Federal Joint Committee (G-BA) to assess the technology's benefits and effectiveness, often necessitating coverage with evidence development (CED). This rigorous process constrains short-term demand for truly novel catheters until their long-term clinical superiority is unequivocally demonstrated, which limits initial sales velocity. Consequently, this system favors demand for established, clinically proven balloon catheter products already within the G-DRG and limits the initial market for new entrants.

- Japanese Market Analysis

The Japanese market is distinguished by its highly structured and evidence-based Health Technology Assessment (HTA) and reimbursement system. The need for advanced balloon catheters is critically dependent on securing inclusion in the national reimbursement tariff, which is a significant barrier to entry. Manufacturers must present compelling clinical evidence to demonstrate superiority over existing technologies to secure favorable pricing, which directly impacts the sales and market share of a new product. This system acts as a catalyst for evidence-based demand, rewarding manufacturers who prioritize rigorous clinical trials, thereby accelerating the adoption of new devices like DCBs once their efficacy and cost-effectiveness are proven to the Ministry of Health, Labour and Welfare.

- South African Market Analysis

The South African market is governed by the South African Health Products Regulatory Authority (SAHPRA), which classifies high-risk invasive devices, such as balloon catheters, which are Class III devices. Its necessity is strongly driven by the dual healthcare system: a well-resourced private sector that seeks advanced, imported technology, and a public sector where cost-effectiveness and volume are paramount. The regulatory requirement for all medical devices to be registered for safety, quality, and performance increases the need for compliance from global manufacturers to access the private sector's high-value demand, where the latest Western-approved devices are preferred. Moreover, the push for greater access to care in the public sector creates a volume demand for high-quality, but lower-cost, standard angioplasty balloon catheters.

Balloon Catheters Market Competitive Environment and Analysis

The global balloon catheters market is dominated by a few multinational corporations that compete through a combination of expansive portfolios, control over distribution channels, and deep investment in clinical evidence to secure regulatory and reimbursement approvals. Competition is characterized by the strategic introduction of high-value, coated products (like DCBs and drug-eluting balloons) to differentiate from the price-sensitive, commoditized standard balloon segment.

- Boston Scientific Corporation

Boston Scientific is strategically positioned as a leader in high-value, minimally invasive interventional solutions across cardiology and peripheral vascular disease. The company's strategy focuses on securing first-to-market advantage and leveraging a robust portfolio of high-end balloon catheters. A core example is the AGENT Paclitaxel-Coated Balloon Catheter, which received US FDA approval in March 2024. This product’s approval for coronary in-stent restenosis immediately grants the company a leading strategic position in the most critical, high-value segment of the US DCB market, allowing it to drive demand for a premium-priced therapeutic option where stenting has previously failed.

- Medtronic plc

Medtronic maintains a formidable strategic position as one of the world's largest diversified medical technology companies, offering a vast array of devices across four major business segments, including the Cardiovascular Portfolio. The company's strategy is centered on achieving market agility through internal portfolio management and addressing chronic diseases globally. While known for its comprehensive cardiovascular offerings, Medtronic also focuses on mitigating the financial risk for payers through innovative mechanisms, such as its Outcome Protection Programs in Latin America. This strategic approach is designed to accelerate the adoption of high-cost medical devices, including advanced catheters, by linking payment to successful patient outcomes and directly addressing the financial barriers to demand in emerging markets.

- Abbott Laboratories

Abbott is a major player whose strategic positioning centers on a broad and integrated portfolio across diagnostics, vascular, and structural heart devices. The company competes by leveraging its extensive clinical data and regulatory expertise to achieve approvals for new generations of minimally invasive devices. Abbott’s focus on vascular interventions ensures a continuous demand base for its catheter products, and its participation in post-market surveillance registries for neurovascular devices, a high-risk Class III category, demonstrates its commitment to the extensive regulatory requirements necessary to maintain market access and a strong safety profile.

Balloon Catheters Market Developments

- March 2024: The US Food and Drug Administration (FDA) approved Boston Scientific's AGENT Paclitaxel-Coated Balloon Catheter for the treatment of coronary in-stent restenosis (ISR). This marks the first US coronary DCB approval, a landmark event that structurally shifts the competitive landscape by introducing a major, non-implant-based therapeutic alternative to drug-eluting stents in a high-incidence clinical indication. This product launch validates the DCB technology as a high-value category within the core US coronary market.

Balloon Catheters Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.847 billion |

| Total Market Size in 2031 | USD 6.417 billion |

| Growth Rate | 5.77% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Balloon Type, Catheter Type, Applications, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Global Balloon Catheters Market Segmentation:

By Balloon Type

- High-pressure balloons

- Elastomeric balloons

By Catheter Type

- Rapid Exchange balloon catheters

- Over-the Wire balloon catheters

- Fixed-Wire balloon catheters

By Applications

- Atherectomy

- Stent delivery

- Esophageal dilation

- Angioplasty

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Thailand

- Taiwan

- Indonesia

- Others