Report Overview

Global Baby Care Products Highlights

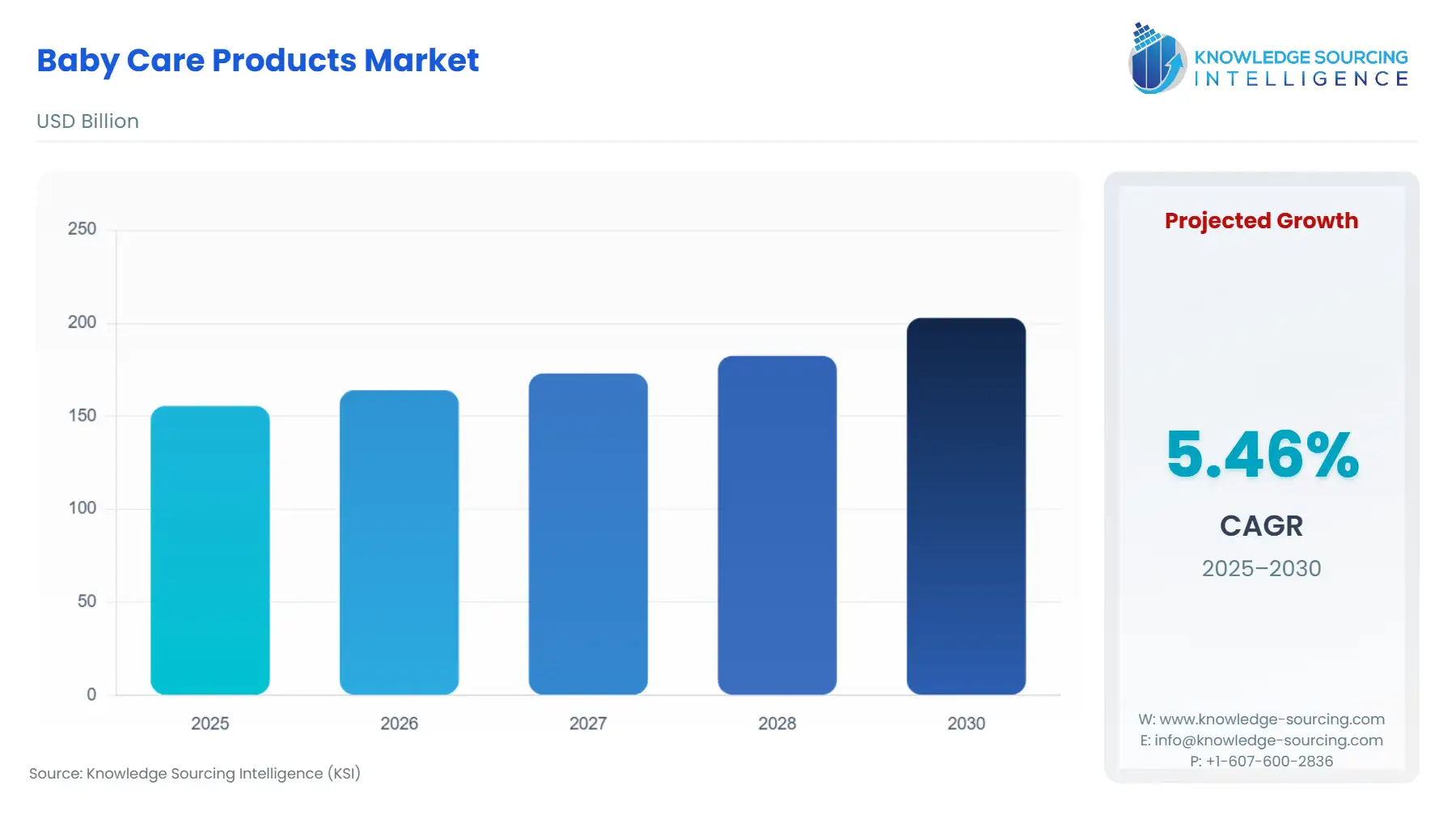

Baby Care Products Market Size:

The global baby care products market is expected to grow at a CAGR of 5.48%, reaching a market size of USD 202.859 billion in 2030 from USD 155.498 billion in 2025.

The industry is rapidly expanding as parents demand high-quality, luxury infant items. As they become more aware of the dangers of synthetic goods, there is a greater emphasis on vegan, paraben-free, and synthetic-free products, even for baby products. The baby care product market is projected to grow significantly during the forecast period, owing to the increase in the number of healthcare services for infants, the rising standard of living, and aid from social support systems such as WHO programs and NGOs. These factors are helping to create awareness about baby care factors, boosting the baby care products.

Moreover, rapid urbanization and higher income in developing countries are additional factors boosting the baby care products market growth. In addition, the trend towards healthcare and hygiene is further resulting in people spending more money on health and wellness for babies worldwide. In addition, major market players are investing heavily in new product lines and marketing strategies to increase their market share, which is expected to raise the competition in the market, thus further propelling the growth opportunities for vendors and manufacturers in the coming years. According to the World Bank’s data, in 2022, the urban population accounted for 57% of the global population, which represented a 1% increase over 2021.

Baby Care Products Market Overview & Scope:

The Global baby care products market is segmented by:

Type: The global baby care products market, by type, is divided into baby food, body care, and safety and convenience. Body care is further divided into diapers and Wipes, while safety and convenience are further segmented into prams, strollers, and car seats. The baby food market has been growing steadily in recent years, driven by several factors, such as increasing urbanization, rising disposable incomes, and changing lifestyles. It is also driven by high birth rates as well as government efforts to increase the safety of baby food products. As more people move to urban areas and lead busy lifestyles, the demand for convenient and easy-to-prepare baby food products has increased. With increasing income, parents are willing to spend more on premium and organic baby food products that offer higher nutritional value and safety for their babies. The rules and laws set by different governments to ensure the safety of baby care products have also benefited the market. For instance, the Food and Drug Administration (FDA) in the United States has set a provision that requires certain labeling, nutrient content, manufacturing quality control procedures, as well as company records and reports.

Furthermore, the growing demand for plant-based as well as organic baby food has also had an impact on the baby food market. Organic baby food products have gained popularity due to their perceived health benefits and the fact that they are often free from common allergens. Many plant-based baby food products are also organic, appealing to health-conscious consumers willing to pay a premium for high-quality, natural baby food products.

Distribution Channel: The global baby care products market, by distribution channel, is divided into online and offline. The online category of the distribution channel segment is projected to grow rapidly due to the growth in e-commerce worldwide.

Region: The global baby care products market, by geography, is segmented into regions including North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. Asia Pacific is poised to hold a prominent position in the global baby care market, particularly due to its growing working population coupled with urbanization.

Baby Care Products Market Growth Drivers:

Drivers:

Growing Demand for Organic Baby Products: Growing concerns over newborns’ health are driving the baby care products market. Some of the most prevalent skin problems include skin rash, cradle cap, and atopic eczema. Consumers choose infant care items such as baby oils, lotions, moisturizers, and many others to avoid such problems in their newborns. Chemicals can occasionally be present in baby wipes and diapers, which can irritate the skin and cause rashes.

As a result, customer demand for organic infant care products is increasing. Happy Family Organics, the number one organic baby food brand in the United States, announced an exciting range of innovations that expand its diverse offering of solutions for families navigating their infants' and toddlers' eating journeys in September 2022. Thus, the growing number of organic baby products is indeed a key driver for the global baby care products market.

The Indian D2C baby goods firm R for Rabbit offers a new line of infant care products called 'Pure & Beyond'. The firm created an exclusive variety of baby creams, lotions, soaps, body wash, shampoo, baby powder, and baby oils with a strong dedication to safety and quality. Created with chosen organic plant-based components such as oatmeal, coconut, lavender, almond, and avocado, the brand delivers the finest infant care products to nurture the baby's skin with all-natural ingredients. With this latest addition, the company hopes to provide the purest baby skincare line manufactured with unrivaled quality ingredients that are completely safe and suited for all baby skin types. R for Rabbit uses natural plant-based components to keep their products pure, and they are backed by various tests and considerable research to ensure the baby's safety.

Another brand, named “Oh My Bebe” in May 2025, launched a fully organic cotton baby brand, targeting conscious parents for babies aged o to 4 years.

Growing Infant Population: The baby food market has been growing steadily in recent years, driven by several factors, such as increasing urbanization, rising disposable incomes, and changing lifestyles. It is also driven by high birth rates as well as government efforts to increase the safety of baby food products. As more people move to urban areas and lead busy lifestyles, the demand for convenient and easy-to-prepare baby food products has increased. With increasing income, parents are willing to spend more on premium and organic baby food products that offer higher nutritional value and safety for their babies. The rules and laws set by different governments to ensure the safety of baby care products have also benefited the market. For instance, the Food and Drug Administration (FDA) in the United States has set a provision that requires certain labeling, nutrient content, manufacturing quality control procedures, as well as company records and reports.

Furthermore, the growing demand for plant-based as well as organic baby food has also had an impact on the baby food market. Organic baby food products have gained popularity due to their perceived health benefits and the fact that they are often free from common allergens. Many plant-based baby food products are also organic, appealing to health-conscious consumers willing to pay a premium for high-quality, natural baby food products.

Baby Care Products Market Regional Analysis:

North America: The baby care products market of North America, especially in the USA, is expected to witness a rise due to the rising busy lifestyle of parents and the increase in disposable income.

In the USA, disposable incomes are high, which enables parents to afford high-end products made using natural materials free from toxic chemicals or materials, as they have a bigger perception of adverse effects on health. According to the FRED’s latest report on personal real disposable income in the USA, reported in April 2024, this value stood at US$17,501.0 billion and increased to US$17,614 billion by August 2024. One of the factors for this is that more disposable income available to parents would allow them to spend money on valuable and premium baby care products like organic, hypoallergenic, and dermatologically tested, safer products for the baby. It, thus, boosts the overall market sales in the region.

Moreover, the predominance of e-commerce will lead to a rise in the US baby care products market as online shopping platforms such as Amazon, Walmart, and others are increasing quickly. It raises their adoption by parents due to their convenience, and wider selection offerings are further predicted to drive market expansion.

Baby Care Products Market Key Developments:

October 2025: Mammoth Brands announced a definitive agreement to acquire premium baby-care brand Coterie (net revenue > US$200 million in the last 12 months; growth ? 60 % YoY) for a potential valuation over US$1 billion.

August 2025: Procter & Gamble (P&G) launched luxury aloe-infused “bumbum” diapers made in China and sold at Target Corporation in the U.S., marking a strategic shift as its leading diaper brands’ market share falters.

May 2025: Ontex Group NV, a global developer and manufacturer of personal care solutions, introduced a 360° leak protection system in baby diapers. The new 360° leak protection provides all-around front, back, and side-to-side coverage designed to provide all-around protection that keeps babies feeling comfortable, dry, and secure. The 360° anti-leak barriers are available in Ontex’s smallest diaper sizes, delivering reliable protection. These sizes feature added barriers for extra leak protection in all areas, as well as a built-in navel cutout to protect the umbilical area and support healing during early development.

September 2024: Nestle signed an agreement with MODON to establish its first food factory in Saudi Arabia with a 270 million riyal investment and will be located in Jeddah's Third Industrial City, aiming to increase local food production.

List of Top Baby Care Products Companies:

Procter & Gamble Company

Unilever plc

Nestle S.A.

Johnson & Johnson

Abbott

Baby Care Products Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 155.498 billion |

| Total Market Size in 2030 | USD 202.859 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.48% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Baby Care Products Market Segmentation:

By Type

Baby Food

Body Care

Diapers and Wipes

Skin and Hair Care

Safety and Convenience

Prams and Strollers

Car Seats

By Distribution Channel

Online

Offline

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Taiwan

Others