Report Overview

Global Automotive Seatbelt Market Highlights

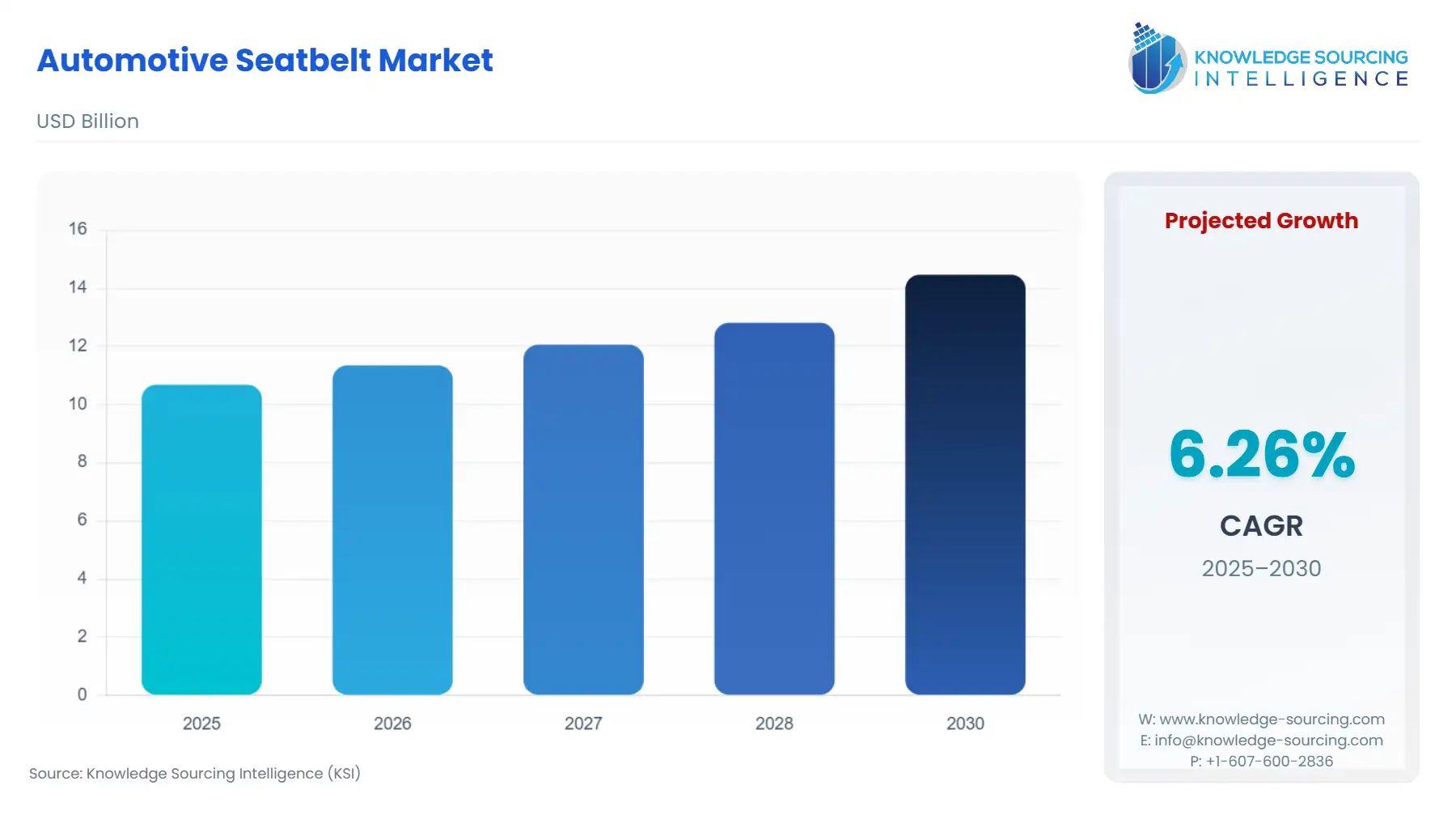

Automotive Seatbelt Market Size:

The Global Automotive Seatbelt Market is expected to grow from USD 10.682 billion in 2025 to USD 14.468 billion in 2030, at a CAGR of 6.26%.

Automotive Seatbelt Market Trends:

The automotive seatbelt market is expected to witness a significant increase in demand over the coming years owing to growing awareness regarding safety and strict traffic rules. A seat belt which is also called a safety belt or a safety harness is a vehicle safety device designed to secure the people present inside the vehicle in case the vehicle crashes or comes to a stop. A seat belt reduces the chances of death or serious injury in a traffic collision and does this by reducing the force of secondary impacts with interior strike hazards, by keeping persons inside positioned correctly so that they are in the range where the airbag has maximum effectiveness (if equipped): and by preventing the people inside being ejected from the vehicle in the event of a crash or if the vehicle rolls over. Increasing automotive production across the region, combined with stricter regulations and standards regarding safety, is boosting the growth of the automotive seat belt market across the globe.

Automotive Seatbelt Market Growth Drivers:

- Government initiatives and investments in automotive and safety to drive market growth

The active involvement of various governments in the automotive industry is expected to propel the growth of the market. For instance, the finance ministry of India a stimulus program valued at USD 266 billion in 2020 in order to reverse and even boost the downturn of the industry due to the pandemic. Additionally, the 5-star safety rating program in the US by the NHTSA (National Highway Traffic Safety Association) in order to enhance the safety of the occupants in a vehicle is further expected to augment growth in the market.

Automotive Seatbelt Market Segment Analysis:

- By Type

By type, the global automotive seat belt market is segmented as two-point, three-point, belt-in-seat, automatic, and others. The three-point seat belt is expected to prevail as the significant segment of the global automotive seat belt market. It is widely preferred across vehicle types because it provides a good amount of protection to the driver and passengers

- By Vehicle Type

By vehicle type, the global automotive seatbelt market is segmented into compact cars, mid-size cars, and large cars. The compact car segment promises to hold a significant market share in the global automotive seat belt market due to its preference over other vehicle types.

- By Geography

Geographically, the global automotive seat belt market is segmented into North America, Europe, Middle East & Africa, Asia-Pacific, and South America. Asia Pacific is the most lucrative region in the global automotive seat belt market, both in terms of value and volume. The Asia Pacific automotive industry is booming on the back of rapid urbanization in the emerging economies of China and India. Europe is also one of the biggest manufacturers of automobiles, which is expected to have a positive impact on the automotive seatbelt market.

Automotive Seatbelt Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 10.682 billion |

| Total Market Size in 2031 | USD 14.468 billion |

| Growth Rate | 6.26% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Type, Technology, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Seatbelt Market Segmentation:

The global automotive seatbelt market has been analyzed through the following segments:

- By Component

- Webbing

- Buckles

- Others

- By Type

- Two-Point

- Three-Point

- Belt-In-Seat

- Automatic

- Others

- By Technology

- Retractor

- Pre-tensioner

- Active Seat Belt

- Bag-In-Belt

- Load Limiter

- By Vehicle Type

- Compact Car

- Mid-Size Car

- Large Car

- Other

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America