Report Overview

Global Automotive Armrest Market Highlights

Automotive Armrest Market Size:

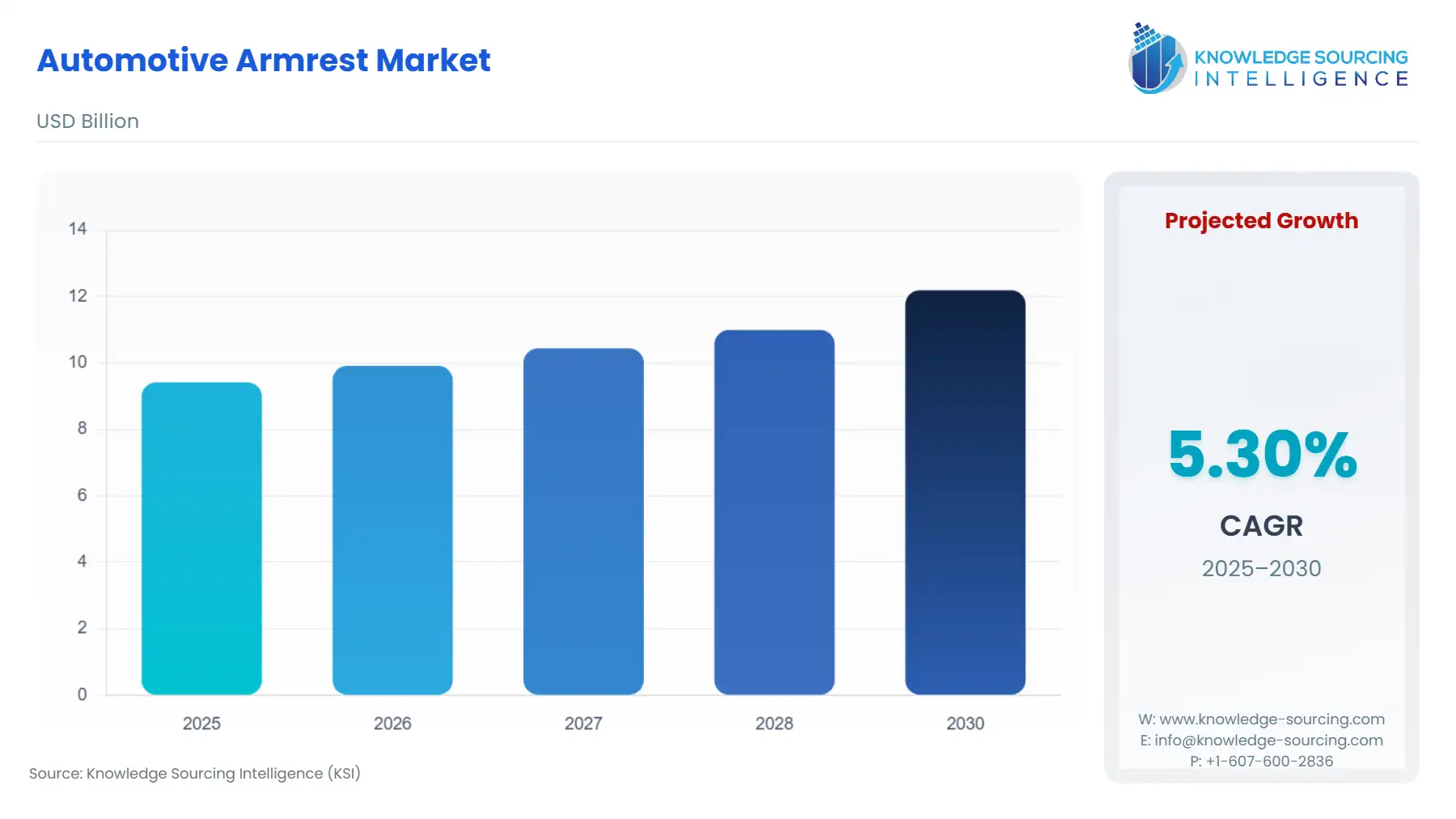

The Global Automotive Armrest Market is expected to grow from USD 9.418 billion in 2025 to USD 12.191 billion in 2030, at a CAGR of 5.30%.

To further improve the comfort of those in the back, cup holders and air - conditioning system vents can be added to the edge of the front armrest. The provision of an automotive armrest allows the occupants of the car to rest their arms on it.

The armrest adds to the overall comfort of the car and makes the driving experience convenient for the driver. The armrest is located either at the front of the vehicle, the rear of the vehicle, or both. All luxury vehicles and some midrange cars have armrests. However, people who are interested in installing this feature can also purchase these parts through the after-market. The driver can keep items inside the front armrest, which also has a storage compartment. To further improve the comfort of those in the back, cup holders and air - conditioning system vents can be added to the back of the front armrest.

This rising demand for additional comfort features in vehicles will result in an increase in demand, resulting in the growth of the automotive armrest market. There has been an increase in the production of passenger vehicles due to increasing demand, which can be attributed to the rising disposable income of people and an increase in spending power, which will fuel the market for automotive armrests during the forecasting period. However, declining vehicle sales in some countries will act as a restraint in the market’s growth. By position, vehicle type, sales channel, and geography, the automotive armrest market has been divided into subgroups. The front armrest holds a significant share in the market owing to the fact that it is the most common feature in some mid-range models and also has an additional storage feature. By vehicle type, passenger car is expected to hold a considerable amount of market share, which is attributable to the rising disposable income of people coupled with increasing purchasing power.

Automotive Armrest Market Segment Analysis:

- By Position

Front and rear armrests are separate segments of the worldwide vehicle armrest market. Due to the prevalence of these types of armrests in mid-range vehicles sold by manufacturers, the front armrest is predicted to hold a sizable market share.

- By Vehicle Type

The passenger car, light commercial, and large commercial vehicle segments make up the worldwide automotive armrest market. A passenger vehicle is expected to hold a significant share in the market owing to the increasing demand for passenger vehicles, which is a result of an increase in disposable income and rising urbanization.

- By Sales Channel

Segmented as OEMs and aftermarket, the aftermarket is expected to hold a considerable market share as a majority of the users prefer to purchase armrests from aftermarket vendors due to their absence from most economy vehicles.

- By Geography

By geography, the global automotive armrest market is segmented into North America, Europe, Middle East & Africa, Asia-Pacific, and South America. The Asia Pacific region is expected to hold a notable amount of market share in the market owing to the fact that countries like India and China are among the biggest producers of passenger vehicles.

Automotive Armrest Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive Armrest Market Size in 2025 | US$9.418 billion |

| Automotive Armrest Market Size in 2030 | US$12.191 billion |

| Growth Rate | CAGR of 5.30% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Automotive Armrest Market |

|

| Customization Scope | Free report customization with purchase |

Automotive Armrest Market Segmentations:

- By Position

- Front

- Rear

- By Material

- Leather

- Fabric

- Others

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Sales Channel

- OEMs

- Aftermarket

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Taiwan

- Others

- North America