Report Overview

Global Automatic Coffee Machine Highlights

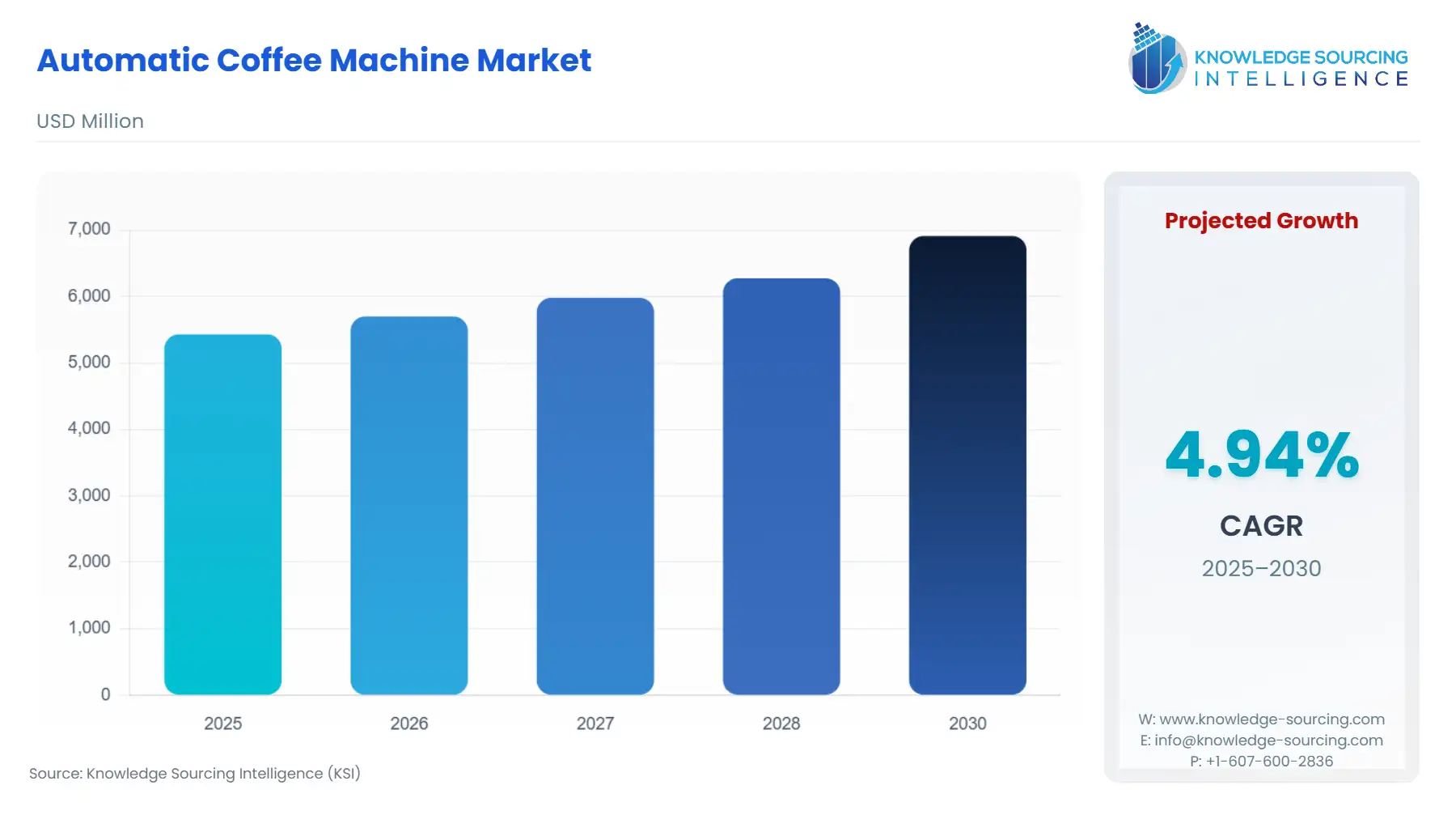

The Global Automatic Coffee Machine market is expected to grow at a rate of 4.94% CAGR, reaching a market size of US$6912.339 million in 2030 from US$5431.927 million in 2025.

Automatic coffee machines are used in homes, offices, cafés, restaurants, and other commercial places to make a wide variety of coffee beverages. Rising disposable incomes and living standards, coupled with increasing urbanization, have increased the consumption of coffee.

The rising consumption of coffee and the number of quick-service restaurants and cafés worldwide are driving the demand for automatic coffee machines.

At the same time, the convenience offered by automatic coffee machines is driving its demand in offices, homes, cafes, and many other places. It also offers consistent quality by controlling the brewing parameters, thus appealing to customers.

What are the Global Automatic Coffee Machines Market drivers?

- The increasing consumption of coffee is driving the market of automated coffee machines market

With a hectic work life, people are increasing their coffee consumption to boost their energy levels owing to the high quantity of stimulant caffeine present in coffee. Thus, the rising working population is fuelling the market growth of automatic coffee machines globally. Rising awareness about the health benefits of consuming coffee is another major driver of the automatic coffee machine market. Coffee consumption in the right amount significantly lowers the risk of liver cancer and Parkinson’s disease. As such, people are consuming more coffee at home and in the workplace, boosting the demand for automatic coffee machines, which allow making various coffee beverages easily and quickly.

- The rise in QSRs and cafes are propelling the demand

The rise in the number of quick-service restaurants and cafés worldwide is also driving the demand for automatic coffee machines to prepare coffee drinks faster. Market players are continuously adding new products to their portfolios to keep up with the growing demand for innovative automatic coffee machines. As such, manufacturers are focusing on integrating advanced technological features, including touchscreens and Wi-Fi, into these machines, making it convenient for end-users to use them. With the ongoing trend of rising coffee consumption, players are adopting growth strategies such as acquisitions and partnerships to expand their reach, thereby positively impacting the automatic coffee machine market growth.

Segment analysis of the Global Automatic Coffee Market:

- Commercial segment will have the higher market share during the forecast period

By application, the commercial segment accounted for the major market share in 2019 and will remain in its position during the forecast period. This dominance is attributed to well-established coffee specialty shops across various regions, such as Starbucks and Barista. These international specialty coffee shops are further expanding their reach in emerging markets.

However, the residential segment will witness a significant CAGR during the forecast period as there is a growing demand among consumers to make freshly brewed coffee at home. Moreover, automatic coffee machine manufacturers also include cost-effective products in their product portfolio, encouraging people to buy automatic coffee machines for home use, thereby bolstering the overall market growth.

Geographical outlook of the Global Automatic Coffee Machines Market:

- Asia-Pacific will be the fastest-growing market

The global automatic coffee machine market has been divided into five regions: North America, South America, Europe, the Middle East and Africa, and the Asia Pacific.

Europe is a major market for automatic coffee machines. In the European region, the market is poised to grow on account of the rising consumption of coffee coupled with the growing trends of specialty cafes in numerous countries. Furthermore, the increasing coffee culture in countries such as Ireland, Hungary, and the Czech Republic will also bolster the regional market growth in the coming years.

North America also holds a decent market share due to rising coffee consumption in the U.S. and Canada. According to the United States Department of Agriculture (USDA) statistics, the country is the second-largest importer of coffee beans, with suppliers including Brazil, Colombia, Vietnam, and Guatemala. The presence of many coffee specialty stores across the North American region is another major factor behind the growing demand for automatic coffee machines.

The increasing middle-class population across many countries majorly drives the market growth in the Asia Pacific. The increasing influence of Western culture on the lifestyle and tastes of people is also shaping the automatic coffee machine market in this region. According to the 2023 China Urban Coffee Development Report, Shanghai had the world's highest number of coffee shops, accounting for 8,530 coffee stores, an increase of 673 from 2022 and accounting for 6.4% of the national total. Moreover, expanding global coffee shops and cafés in countries like India, Australia, and Thailand is further contributing to the growing demand for automatic coffee machines.

Key launches in the Global Automatic Coffee Machines Market:

- In August 2024, Breville, an Australia-based coffee machines brand, launched the Oracle™ Jet, marking 10 years after the launch of Breville's signature Oracle™ innovation. The Oracle™ Jet is a fully integrated Baratza European Precision Burr that automatically grinds, doses, and tamps, offering 45 grind settings to tailor to each specific roast. It features Breville's Auto MilQ technology with its automatic steam wand designed for alternative milk settings. The Oracle Jet's ThermoJet® heating system is up to 32% more energy efficient.

- In May 2024, Bosch home appliances introduced an all-new line of fully automated espresso machines. It is designed in 300 and 800 series now, catering to diverse tastes of coffee as it offers quality and customization for various beverages.

Automatic Coffee Machine Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automatic Coffee Machine Market Size in 2025 | US$5431.927 million |

| Automatic Coffee Machine Market Size in 2030 | US$6912.339 million |

| Growth Rate | CAGR of 4.94% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Automatic Coffee Machine Market | |

| Customization Scope | Free report customization with purchase |

The Global Automatic Coffee Machines Market is analyzed into the following segments:

- By Type

- Semi-Automatic

- Fully Automated

- By Product Type

- Residential

- Commercial

- By Sales Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America