Report Overview

Aquaculture Market Size, Share, Highlights

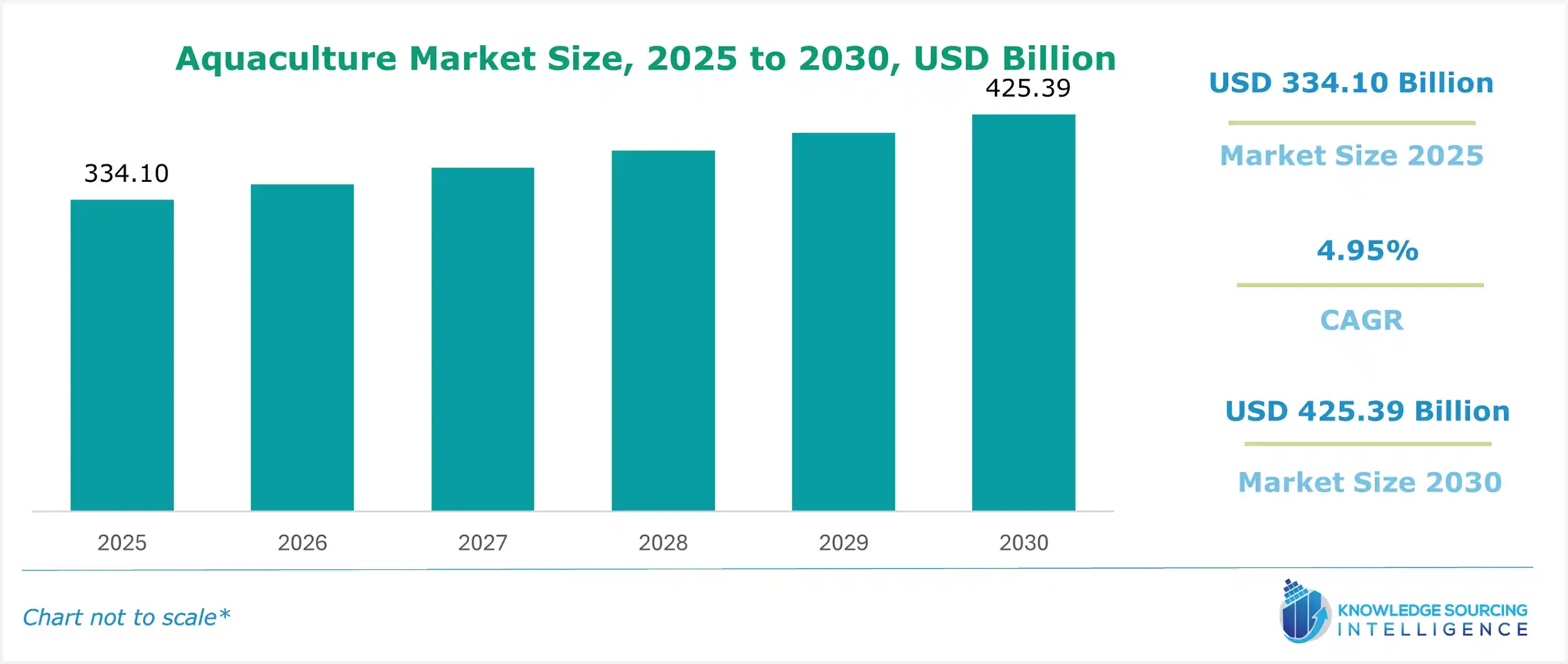

Aquaculture Market Size:

The aquaculture market will grow at a CAGR of 4.95% to reach USD 425.39 billion in 2030 from USD 334.10 billion in 2025.

Aquaculture Market Highlights:

- Increasing demand for fish oil is driving the aquaculture market growth globally.

- Growing Asia Pacific production is boosting aquaculture with rising fish output.

- Advancing government initiatives are promoting sustainable aquaculture practices in India.

- Enhancing technological innovations are improving efficiency in aquaculture farming systems.

Aquaculture Market Trends:

Aquaculture, commonly known as aqua farming, is the methodical cultivation of aquatic organisms and plants under controlled conditions. This comprehensive approach involves careful management of aquatic life, including processes such as breeding, rearing, and eventual harvest. The practice extends to various water environments, encompassing rivers, ponds, lakes, oceans, freshwater bodies, and brackish waters. One of the primary objectives of aquaculture is the conservation of endangered species, as it provides a controlled environment for their reproduction and growth. Beyond its conservation role, aquaculture significantly contributes to boosting productivity in the seafood industry and addressing trade deficits associated with seafood imports. This cultivation method also plays a pivotal role in waste reduction by creating a controlled system for the disposal of organic matter.

Aquaculture stands out as offering a secure and sustainable breeding environment, ensuring the responsible use of aquatic resources. This sustainable approach aligns with global efforts to address overfishing and environmental concerns associated with traditional fishing practices. As a result, aquaculture has become a crucial and globally significant practice with widespread applications, serving commercial, recreational, and scientific objectives. In essence, aquaculture is a multifaceted and indispensable tool that not only supports the biodiversity of aquatic life but also addresses pressing issues related to food security, conservation, and environmental sustainability on a global scale.

Aquaculture Market Growth Drivers:

- Increasing demand for aquaculture products, owing to associated health benefits, boosts the growth of the market.

The surging demand for fish oil, attributed to its rich omega-3 fatty acid content, is poised to drive market growth. Omega-3 fatty acids, recognized for their therapeutic benefits in treating cardiovascular diseases, have been noted for their capacity to lower blood fat levels. As per the Marine Ingredients Organisation (IFFO) report, approximately 75% of fish oil is now allocated for aquaculture, 15% for human consumption, and 10% for other purposes, reflecting a slight shift toward greater aquaculture utilization compared to 2020. There is an increasing trend of producing fishmeal and fish oil from by-products of fish processing in both capture and aquaculture, leading to a positive impact on reducing waste. While fillets hold the highest value in terms of protein, various parts such as heads, frames, fillet cut-offs, belly flaps, and specific viscera components like liver and roe serve as valuable sources of nutrients. These include long-chain omega-3 fatty acids, as well as essential vitamins A, D, and B12, along with minerals such as iron, zinc, calcium, phosphorus, and selenium.

In July 2022, the National Institutes of Health (NIH) issued a fact sheet on Omega-3 fatty acids, stating that the American Heart Association (AHA) advises incorporating one to two servings of seafood into one’s weekly diet. This is to lower the risk of certain heart problems, particularly when replacing less healthy food choices. For individuals with heart disease, the AHA suggests a daily intake of about 1 g of EPA plus DHA, preferably from oily fish. However, supplements are a viable option under the supervision of a healthcare provider.

Aquaculture Market Geographical Outlook:

- It is projected that the aquaculture market in the Asia Pacific will grow steadily.

Fisheries is one of the pivotal segments in the Indian economy, and India is the second-largest producer of fish after China. In 2023, India's total fish production reached 16.2 million metric tons, with aquaculture contributing nearly 75% of this output. Moreover, factors such as increasing population, changing dietary habits, and rising disposable income among the people are also facilitating market growth for Indian aquaculture in the projected period.

Additionally, the Indian government has been taking various initiatives to promote the growth of aquaculture in the country. For instance, the government has set up the National Fisheries Development Board (NFDB), which is a government body that aims to promote and develop the fisheries and aquaculture sectors in the country. This board also provides financial assistance and aid to farmers and entrepreneurs who are engaged in the aquaculture industry. Various other steps are also taking place, by some private organizations, to promote the growth of aquaculture in the country. For instance, in November 2022, on World Fisheries Day, Tamil Nadu Dr J. Jayalalithaa Fisheries University launched insurance for freshwater fish farming and shrimp farming. The project aims to provide shrimp aquaculture facilitation in terms of affordable finance and insurance to guarantee continuous production. Further, the public-private partnership, new farming technologies, and enhanced digital literacy among farmers are expected to boost the Indian aquaculture market in the forecast period.

According to the Ministry of Fisheries, Animal Husbandry & Dairying, the inland production of fisheries and aquaculture has doubled from 2013-14 to 2021-22. In 2013-14, the total inland production was 61.36 lakh tons in 2013-14 which increased to 121.12 lakh tons in 2021-22. These production metrics mark a significant achievement in boosting the economic prospects of aquaculture farmers. They also indicate a rising interest among the younger population in the fisheries and aquaculture sector as a profitable avenue for employment, revenue generation, and entrepreneurial ventures. As per the 2022 FAO-State of World Fisheries and Aquaculture report, India stands as the leading global producer of inland capture fish, showcasing its dominance in this sector.

The global aquaculture market report provides a detailed analysis of the industry landscape, offering strategic and executive-level insights supported by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It explores consumer demand across various regions and product types, such as freshwater, marine, and brackish water aquaculture, while also examining purchasing behaviors and key customer segments. Additionally, the report delves into technological advancements, key government policies, regulations, and macroeconomic factors, delivering a comprehensive overview of the global aquaculture market

Aquaculture Market Segmentations:

Global Aquaculture Market Segmentation by species:

The market is analyzed by species into the following:

- Fish

- Sea Bass

- Salmon

- Carp

- Others

- Prawns & Shrimps

- Oysters & Clams

- Others

Global Aquaculture Market Segmentation by environment:

The market is analyzed by environment into the following:

- Brackish Water

- Marine Water

- Fresh Water

Global Aquaculture Market Segmentation by farming type:

The market is analyzed by farming type into the following:

Global Aquaculture Market Segmentation by regions:

The study also analyzed the global aquaculture market into the following regions, with country-level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, France, United Kingdom, Spain, Italy, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, India, Japan, South Korea, Taiwan, Thailand, Indonesia, and Others)

Global Aquaculture Market Competitive Landscape:

The global aquaculture market features key players such as Cooke Aquaculture Inc., MOWI ASA, Nireus Aquaculture SA (Andromeda Seafood), Tassal, Blue Ridge Aquaculture Inc., Cermaq, Stolt Sea Farm Limited, Stehr Group, Maruha Nichiro Corporation, and Lerøy Seafood Group, among others.

Global Aquaculture Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Global aquaculture market size, forecasts, and trends by species, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Global aquaculture market size, forecasts, and trends by environment, with historical revenue data and analysis.

- Global aquaculture market size, forecasts, and trends by farming type, with historical revenue data and analysis.

- The global aquaculture market is also analyzed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario, and other complementary factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents a complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation of the competitive structure of the market presented through a proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players, and recent major developments undertaken by the companies to gain a competitive edge.

- Research methodology: The assumptions and sources that were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure the most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhances the reliability of forecasts, further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you, and reasons for the purchase?

- The report provides a strategic outlook of the aquaculture market to the decision-makers, analysts, and other stakeholders in an easy-to-read format for making informed decisions.

- The charts, tables, and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and emails for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports to help cater to additional requirements with significant cost savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Aquaculture Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Aquaculture Market Size in 2025 | USD 334.10 billion |

| Aquaculture Market Size in 2030 | USD 425.39 billion |

| Growth Rate | CAGR of 4.95% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Aquaculture Market |

|

| Customization Scope | Free report customization with purchase |