Report Overview

Global Anti-Fibrinolytic Drug Market Highlights

Anti-Fibrinolytic Drug Market Size:

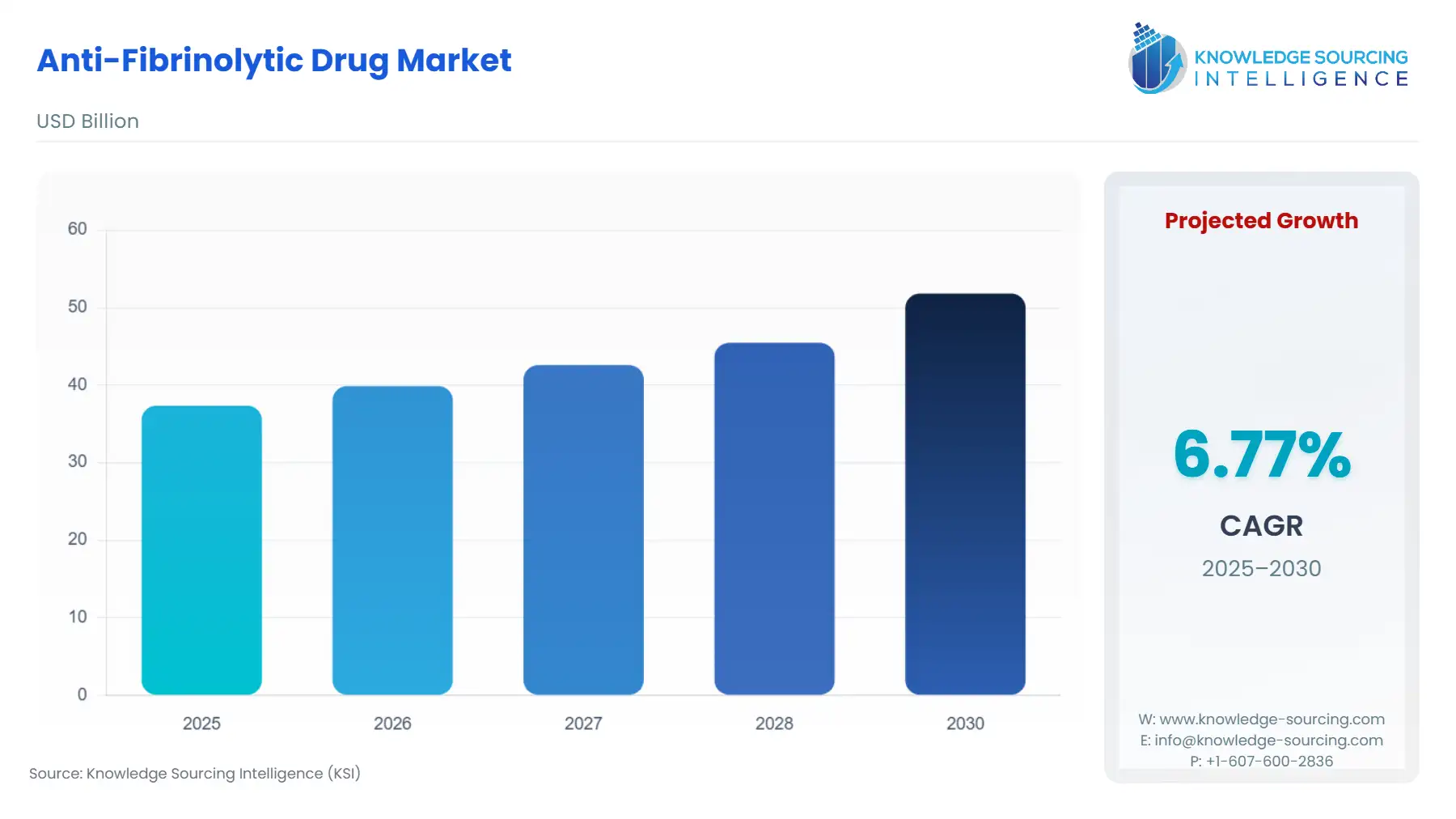

The global anti-fibrinolytic drug market is anticipated to grow at a CAGR of 6.77%, increasing from US$37.354 billion in 2025 to US$51.827 billion by 2030.

The antifibrinolytic drugs slow down the process through which the blood clot is dissolved. These antifibrinolytic agents are mostly used to cure heavy menstrual bleeding and also to treat other hemorrhages. Antifibrinolytic drugs are necessary to avert clot degradation in fibrinolysis-prone areas such as the nasal cavity, oral cavity, and female reproductive tract. By end-user, hospitals and clinics segment dominates the global anti-fibrinolytic drug market as most of the surgeries take place in hospitals. With the increasing number of surgeries worldwide, the increased demand for these drugs in hospitals bolsters the global anti-fibrinolytic drug market growth during the forecast period.

The global antifibrinolytic drug market is expected to grow due to an increase in bleeding disorders, a rise in trauma and surgical incidence, technological advancements, and the growth of the elderly population.

All these factors demand anti-fibrinolytic medications to control the episodes of bleeding, manage the loss of blood in trauma cases, and improve efficacy, safety, and targeted delivery mechanisms. This aging population is also prone to more bleeding disorders and their complications which leads to an increase in the requirement for such drugs as they match the needs of the elderly population.

Anti-Fibrinolytic Drug Market Growth Drivers:

- The rise in the number of surgeries around the globe is the primary driver of the global anti-fibrinolytic drug market.

These drugs are used in various surgeries, including cardiovascular and dental surgeries. Another factor that is fuelling the market growth of the global anti-fibrinolytic drug is the increasing number of road accidents. The World Health Organization (WHO) predicts that around 1.35 million deaths yearly are caused by road traffic accidents. Also, road traffic injuries are the leading cause of death among children and young adults from 5 to 29 years of age. Since these drugs avert clot lysis and reduce blood loss, their demand is augmented by increasing road accidents and injuries, thus spurring the overall market growth.

The increase in the number of operations worldwide is one important driving force of the anti-fibrinolytic drug market. Surgery will cause a lot of bleeding which will require such anti-fibrinolytics to minimize it. These agents work by preventing the breakdown of blood clot formed which is necessary for a wound to heal and blood to clot. Further, they reduce the need for blood transfusions, which come about with some risks and complications.

- The growing geriatric population is expected to fuel the global anti-fibrinolytic drug market growth.

According to the United Nations statistics, the number of people aged 60 years or above is projected to rise from 962.3 million in 2017 to 2080.5 million by 2050. The rising aging population is boosting the demand for these drugs as the demographic shift towards an older population is putting a higher burden on various age-associated diseases worldwide. Increased life expectancy as well as decreasing fertility are the prime reasons for the rising global aging population. Since it is challenging to keep the blood clot in case of surgery or any injury among this population group, the demand for anti-fibrinolytic drugs is escalating with the increasing number of older people worldwide.

- Menstruation and angioedema prevalence is anticipated to increase the market share globally.

Furthermore, these drugs are increasingly used by women to control heavy menstrual flow, which is also a prominent factor behind the growth of the global anti-fibrinolytic drug market. The growing prevalence of angioedema will continue to spur the global anti-fibrinolytic drug market growth during the forecast period. Also, the anti-fibrinolytic drug market will gain an advantage from the availability of the drug product in oral and injectable forms.

Some of the recent offerings include those in May 2024 when Maxwellia unveiled two of its new pharmacy brands, Evana Heavy Period Relief 500mg tablets, and Ultravana Period Pain Relief 250mg gastro-resistant tablets, to assist women in managing heavy and painful periods. Evana is an anti-fibrinolytic agent that can help lessen heavy menstrual bleeding by up to 60% and is for women aged 18 to 45. Ultravana is indicated primarily for patients between the ages of 15 and 50 who experience painful menstrual cramps. These two can work together to significantly lower the amounts of blood loss and pain associated with heavy periods in women.

The prescribed anti-fibrinolytic drug market holds a noteworthy market share throughout the forecast period. The heavy menstrual bleeding segment accounted for a significant market share in the projected year and is poised to witness a prominent growth rate during the forecast period. A rise in the prevalence of menorrhagia among women forces them to visit gynecologists to get prescribed anti-fibrinolytic drugs, thereby spurring overall market growth. Tranexamic acid (TXA) is the most widely used anti-fibrinolytic drug for this purpose. An increasing number of cardiac and brain surgeries will lead to the growth of the surgery segment during the forecast period.

Anti-Fibrinolytic Drug Market Geographical Outlook:

- North America region to hold considerable shares of the global anti-fibrinolytic drug market.

Geographical regions of the global anti-fibrinolytic drug market include North America, South America, Europe, the Middle East, Africa, and Asia Pacific. Geographically, the North American region is predicted to account for a considerable share of the market during the forecasted years. The presence of major pharmaceutical companies in the region contributes significantly to the notable share of this region in the global anti-fibrinolytic drug market.

The growing adoption of anti-fibrinolytic drugs to control menstrual flow significantly contributes to the market growth of anti-fibrinolytic drugs in this region. Moreover, a continuous rise in surgeries in countries like the U.S., Canada, and Mexico further augments the demand for anti-fibrinolytic drugs, thus positively impacting regional market growth.

Asia Pacific (APAC) is projected to witness a substantial compound annual growth rate during the forecast period due to a surge in road traffic injuries and accidents. For example, in the Asia-Pacific region, road accidents claim 645,000 lives every year while an estimated 60 percent of world deaths and injuries due to accidents, occur in Asia every year. The rising focus among women on their health is also leading to the demand for anti-fibrinolytic drugs to control heavy menstrual flow, thus propelling the anti-fibrinolytic drug market growth in this region.

Anti-Fibrinolytic Drug Market Key Developments:

- February 2024- The first patient was enrolled by Hyloris Pharmaceuticals SA for its Phase 3 trial involving the use of an innovative mouth rinse preparation for bleeding control post-dental procedures. A uniquely innovative solution for oral hygiene, tranexamic acid is meant to embody in its form a locally active antifibrinolytic, designed for patients on anticoagulation therapy to address the severe bleeding associated with dental procedures.

Anti-Fibrinolytic Drug Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Anti-Fibrinolytic Drug Market Size in 2025 | US$37.354 billion |

| Anti-Fibrinolytic Drug Market Size in 2030 | US$51.827 billion |

| Growth Rate | CAGR of 6.77% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Anti-Fibrinolytic Drug Market |

|

| Customization Scope | Free report customization with purchase |

Anti-Fibrinolytic Drug Market Segmentation:

- By Indication

-

- Surgeries

- Cardiac

- Dental

- Others

- Menorrhagia

- Hereditary Angioedema (HAE)

- Surgeries

-

- By Route of Administration

- Oral

- Injection

- By End-User

- Hospital and Clinics

- Ambulatory Surgical Centers

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America