Report Overview

Global Acaricide Market - Highlights

Acaricide Market Size

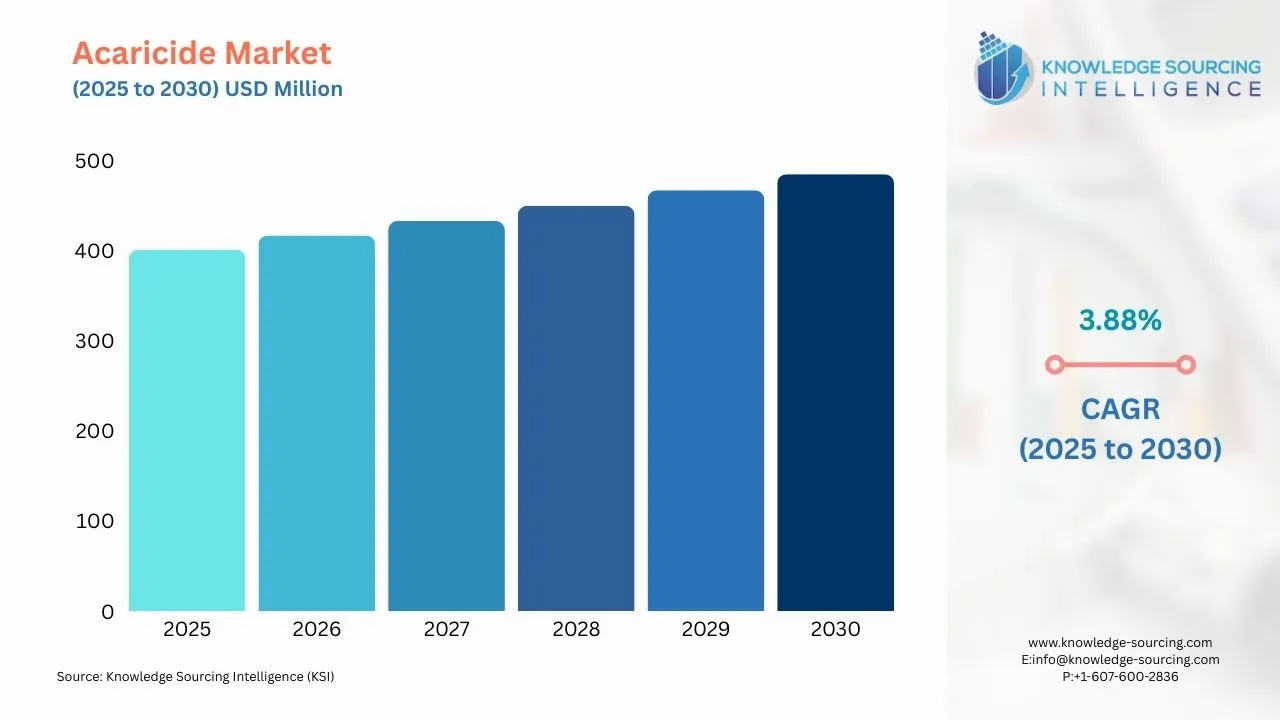

The global acaricide market is estimated to attain US$485.081 million by 2030, growing at a CAGR of 3.88% from US$401.025 million in 2025.

Acaricides are a form of pesticide used to kill ticks and mites. Acaricides include combining chemicals like chlorinated hydrocarbons, organophosphorus compounds, carbamates, and pyrethroids. It offers key applications in eliminating rodents, pests, and other harmful organisms from food and agricultural land. Acaricides are similar to insecticides, destroying mites and preventing and repelling insects. These help in controlling tricks and also prevent the multiplication of the insects. It also offers long-lasting tick control effects and is used as an efficient solution.

The increasing global demand for agricultural products is expected to propel the acaricide market during the forecasted timeline. In the agricultural sector, acaricide helps in protecting the harvested crops from various types of insects and mites. The global demand for agricultural products witnessed significant growth, majorly with the increasing consumer preference for vegetarian and vegan food products. The acaricide market’s expansion is estimated to be hindered by increasing consumer preference towards chemical-free agricultural products. Furthermore, the acaricide chemical can also lead to various types of health problems, especially neurotoxic diseases, such as paralysis.

Acaricide Market Growth Drivers:

- Increasing global production of the agricultural sector

The increasing global agricultural sector production is a major factor propelling the acaricides market worldwide. With the rising global demand for agricultural products, there is a need for solutions like pesticides, fertilizers, insecticides, and others. The United States Department of Agriculture, in its report, stated that in the past few years, the total area planted in the nation increased significantly. The agency stated that in 2022, the total area planted for all purposes was recorded at 88,162 thousand acres, which increased to 94,641 thousand acres in 2023. Similarly, the total production of the agricultural sector in the nation was recorded at 13,650,531 thousand bushels, which increased to 15,341,595 thousand bushels in 2023.

Similarly, the Ministry of Agriculture & Farmers Welfare of the Indian Government of India, in its report, stated that in the fiscal year 2023-24, the food grain production of agricultural crops witnessed massive growth over the past few years. The department stated that foodgrain production in the nation was recorded at 3,322.98 LMT, whereas rice and wheat production was recorded at 1,378.25 LMT and 1,132.92 LMT, respectively.

Acaricide Market Restraints:

- Harmful residual effects on human

The harmful residual effects of the chemical on individuals are estimated to be a major challenge to the global acaricide market. Acaricide is a chemical substance that helps in controlling ticks and insects, but the chemical has severe harmful effects on human health. The acaricide chemical can cause harmful residual effects on meats and milks and can also lead to the development of resistant tick strains. The acaricide chemical can cause various types of neurotoxic effects on individuals.

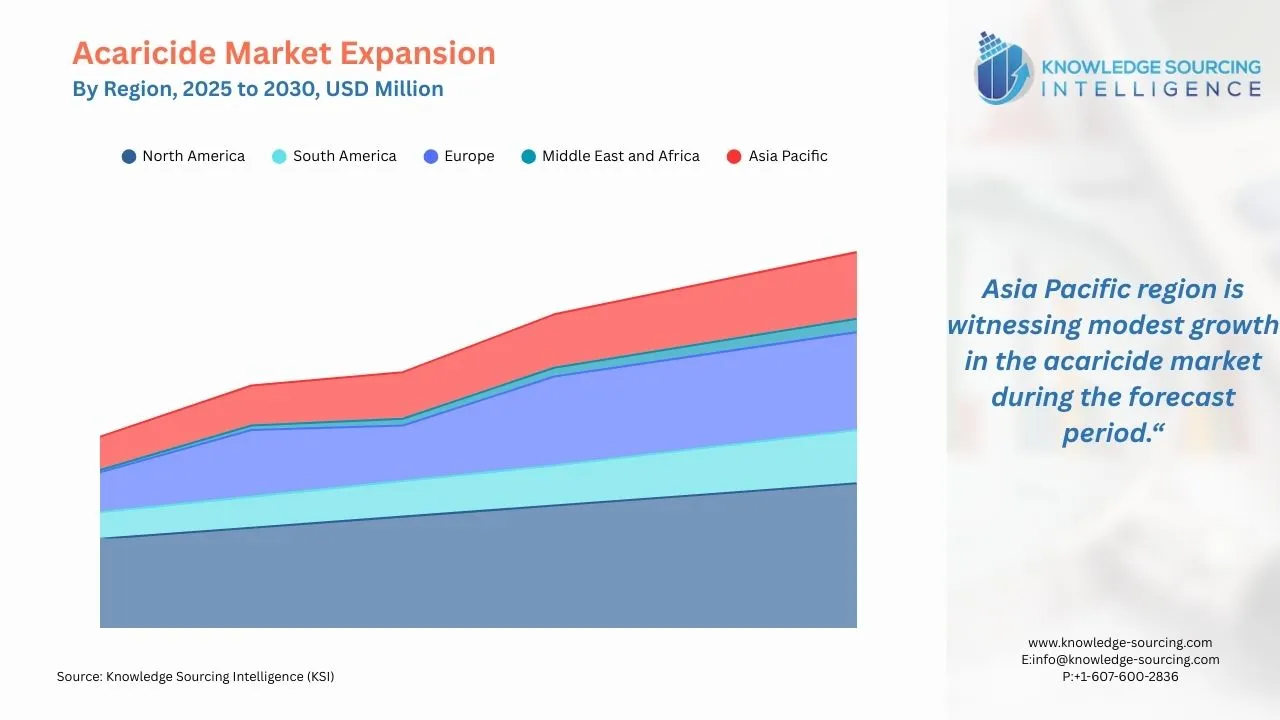

Acaricide Market Geographical Outlook:

- Asia Pacific is forecasted to hold a major share of the Global Acaricide Market.

The Asia Pacific region is forecasted to attain a greater share in the global acaricides market due to the growth of its agricultural sector. This region is among the leading producers of agricultural products, especially in nations like China, India, Vietnam, and Malaysia.

It is also among the global leaders in agricultural solutions, like demand for pesticides, fertilizers, and insecticides. The Foreign Agriculture Service of the US Department of Agriculture stated that in the 2023-24 FY, China, India, and Bangladesh accounted for the largest share of rice production across the globe. The total production of rice in China and India was recorded at 144.62 million MT and 137.83 million MT, respectively. In the global production of rice, China accounted for 28%, whereas India and Bangladesh accounted for 26% and 7%, respectively.

Acaricide Market Products Offered by Key Companies:

- Nichino is a leader in Japanese life science and pesticide formulation, a subsidiary of Nihon Nohyaku Co. Ltd, Japan (NNC). The company offers a wide range of herbicides, fungicides, insecticides, and other agricultural solutions. Its products include Buprofezin, Fenpyroximate, Flubendiamide, Flutolanil, Isoprothiolane, Pyraflufen-ethyl, Pyraziflumid, Pyrifluquinazon, and Tebufenpyrad, among others. In the global acaricide market, the company offers fenpyroximate, a form of meti acaricide. The solution provides protection from tetranychidae, eriophyidae, and tarsonemidae types of mites, and cicadellidae, aleyrodidae, and psyllidae types of insects.

- Bayer AG is a global leader in biotechnology and pharmaceutical solutions provider based in Germany. The company is among the largest pharmaceutical and biomedical companies worldwide. It mainly offers products and solutions for agriculture and health, including pharmaceuticals, personal health, regenerative agriculture, and food security. The company provides Oberon, which contains spiromesifen, a novel form of foliar contact insecticide/acaricide, in the global market. It helps in protecting multiple crops like chilli, tea, okra, tomato, brinjal, and apple, among others.

- Oro Agri is among the leading developers and manufacturers of agriculture, home care, and industrial application solutions. The company offers a wide range of products and solutions, including biopesticides, soil products, adjuvants, fertilizers/nutrients, and biostimulants. In the biopesticide category, the company offers all-in-one insecticides, fungicides, and acaricides. In the global acaricide market, the company provides PREV-AM, an all-in-one insecticide, fungicide, and acaricide developed using a blend of cold-pressed and natural orange oil.

Acaricide Market Key Developments:

- In April 2024, Bayer AG, a multinational leader in life science, healthcare, and nutrition, announced that the company aims to launch bioinsecticide for arable crops. Bayer signed an agreement with AlphaBio, a UK-based company, for an exclusive license of a new bioinsecticide.

- In December 2023, the GALVmed launched the Managing Animal Health and Acaricides for a Better Africa (MAHABA) Initiative. The initiative is aimed at facilitating farmers' access to acaricide applications. The initiative also aims to review the nation's existing policy and implementation of tick-and-tick control.

List of Top Acaricide Companies:

- ORO AGRI Group

- SAL Business Corporation (P) Ltd

- Syngenta International AG

- Corteva Agriscience

- Nissan Chemical Industries Ltd

Acaricide Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Acaricide Market Size in 2025 | US$401.025 million |

| Acaricide Market Size in 2030 | US$485.081 million |

| Growth Rate | CAGR of 3.88% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Acaricide Market |

|

| Customization Scope | Free report customization with purchase |

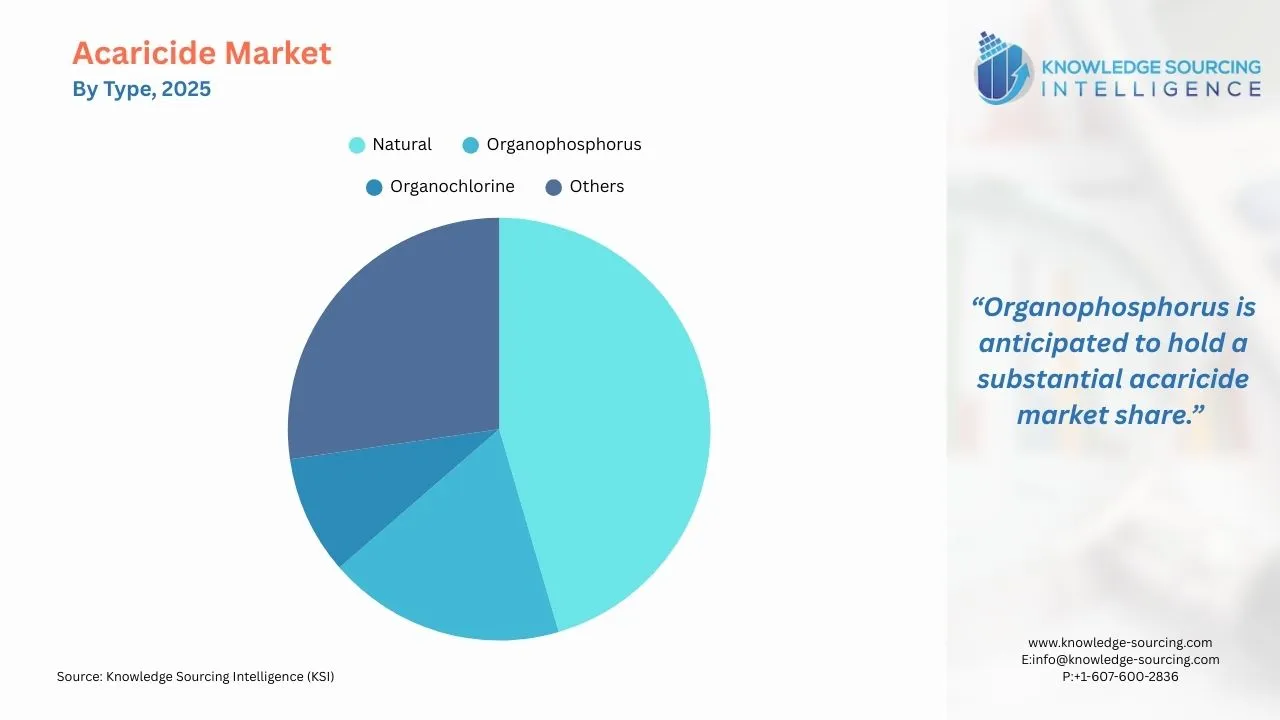

The Global Acaricide Market is segmented and analyzed as follows:

- By Type

- Natural

- Organophosphorus

- Organochlorine

- Others

- By Method

- Hand Dressing

- Spray

- Dipping Vat

- Others

- By Applications

- Industrial

- Animal Husbandry

- Agriculture

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- Spain

- United Kingdom

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- Australia

- India

- Indonesia

- Thailand

- Others

- North America