Report Overview

Genomic Biomarkers Market - Highlights

Genomic Biomarkers Market Size:

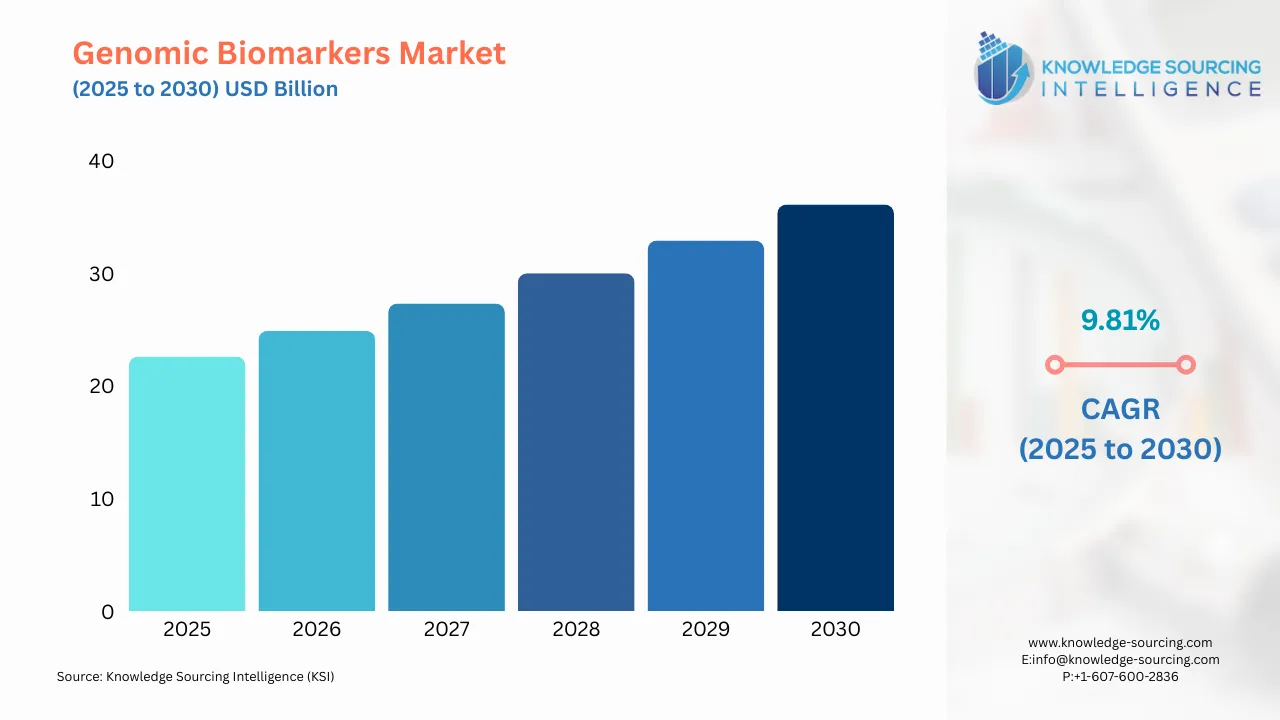

The genomic biomarkers market is projected to grow at a CAGR of 9.81% over the forecast period, increasing from US$22.631 billion in 2025 to US$36.127 billion by 2030.

Genomic biomarkers are defined as measurable DNA or RNA characteristics that an indicators of biologic processes, pathogenic processes, and responses to therapeutic or other interventions. It can be the measurement of the expression of a gene, the function of a gene, and the regulation of a gene. The market demand for genomic biomarkers is driven mainly by the growing cases of chronic ailments like cancer, cardiovascular diseases, or neurological syndromes. Further, the increased investment by the government in the healthcare sector has moved research and development in this direction. Besides, innovations and developments by various players are streaming the expansion of its application, especially by the growing use of artificial intelligence. Moreover, increasing awareness of the importance of early disease detection is a crucial market driver.

- Advancement in the application of genomic biomarkers in different diseases is a notable development in the expansion of the market. In February 2023, Almirall S.A. announced a new research partnership with the Centre for Genomic Regulation (CRG), an international biomedical research institute headquartered in Barcelona. Almirall S.A. is a pharmaceutical company dedicated to medical dermatology. The collaboration aimed at the identification of molecular pathways and biomarkers specific to atopic dermatitis (AD). This ongoing research collaboration would be aimed at developing novel preclinical models as the basis for new treatment options for non-melanoma skin cancer (NMSC).

Genomic Biomarkers Market Growth Drivers:

- Increasing number of cancer cases worldwide will propel the demand for the genomic biomarkers diagnotics

Globally, the growing number of cancer cases has been a concern for society and government simultaneously. According to the National Center for Health Statistics, 1,958,310 new cancer cases and 609,820 cancer deaths are projected in the United States In 2023. These numbers indicate the severity of the situation. However, the integration of cancer biomarkers into oncology has changed cancer treatment. The development of personalized medicine represents a turning point and a new paradigm in cancer treatment.

In June 2023, Invivoscribe announced that together with Complete Genomics, they entered into a partnership to develop and commercialize biomarker tests on Complete Genomics’ NGS platforms. Invivoscribe would develop the biomarker tests, including test controls and associated bioinformatics software. These biomarker tests can be used for upfront screening of research specimens, surveillance, monitoring, and detection of measurable residual disease (MRD). This was a significant development in the oncology and cancer research.

- The development and breakthrough in the field of artificial intelligence is fuelling the advancement and rapid development

In recent years, breakthroughs in genomic research and immunotherapy have been greatly enhanced by the development of artificial neural networks for training models using large data sets of different genetics. This resulted in the rapid development of approved biomarker-based therapies Artificial Neural Networks (ANNs) facilitate the analysis of extensive genetic and clinical datasets for the identification of interrelationships and patterns between various variables. Such as, in June 2024, BioAI announced a strategic collaboration with Genomic Testing Cooperative (GTC). This collaboration would bring the AI capabilities of both companies to deliver innovative solutions. Customers would benefit from solutions encompassing screening tests and comprehensive genomic profiling using DNA and RNA for tissue and liquid biopsies. This significes the use of the artificial intelligence in the new reserch and developments.

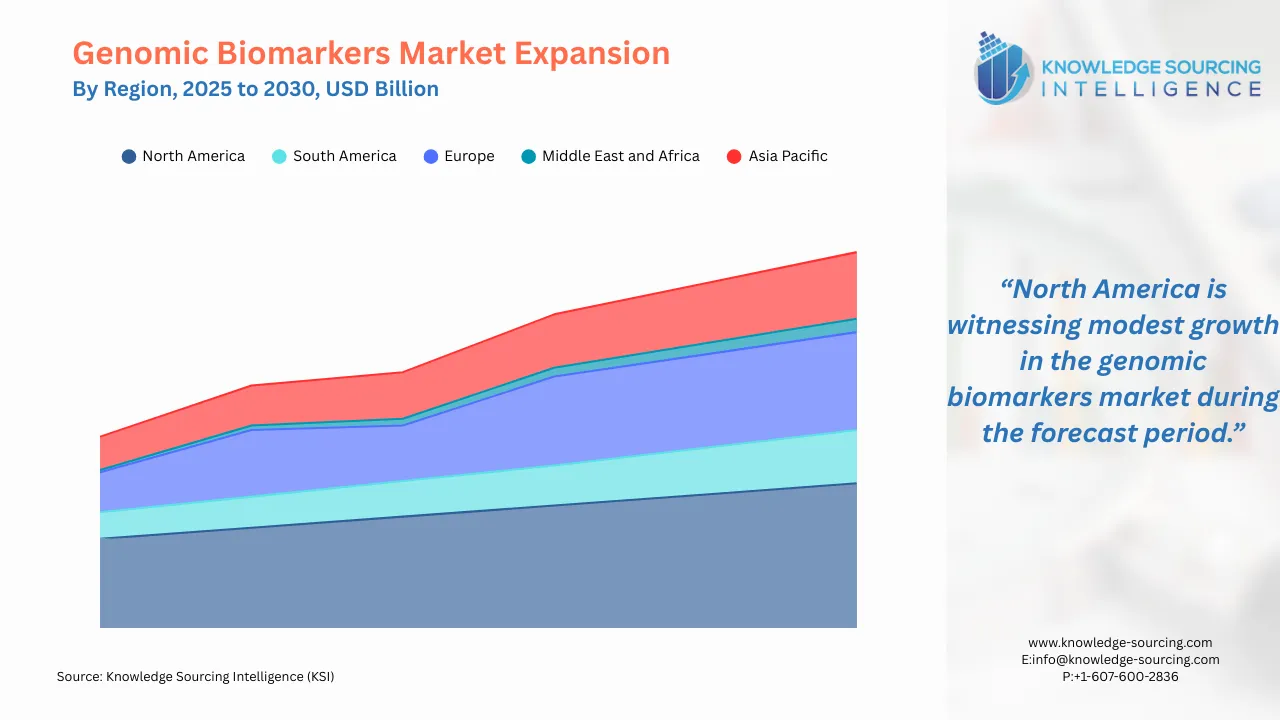

Genomic Biomarkers Market Geographical Outlook:

By geography, the genomic biomarkers market is segmented into North America, South America, Europe, Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region such as ASEAN countries.

The Asia Pacific region is expected to see notable growth in the genomic biomarkers market. As in India, the projected number of new cancer cases in India was 1,461,427 in 2022. The projected cancer burden in India is expected to be 29.8 million in 2025, according to the Indian Council of Medical Research. These numbers have significantly fueled the growth and application of genomic biomarkers.

North America is expected to have a significant market share in the genomic biomarkers market. The market is propelled by the presence of major players like MEDiC Life Sciences, Illumina, Inc., Guardant Health, Inc., etc. and ongoing research and development in the field.

Genomic Biomarkers Market Challenges:

- The use and analysis of genomic biomarkers are anticipated to limit market expansion during the forecast period. Few body samples cannot be a stand-alone diagnostic tool for the detection of the disease. Hence, the development of the technology is necessary for the broader application.

Genomic Biomarkers Market Key Developments:

The market leaders for the genomic biomarkers market are Almac Group, Bio-Rad Laboratories Inc., Eurofins Scientific, Myriad Genetics Inc, QIAGEN, Thermo Fisher Scientific Inc, Illumina, Inc., REVEAL GENOMICS, S.L., Guardant Health, and Complete Genomics Incorporated.. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc. to gain a competitive advantage over their competitors. For Instance,

- In October 2024, MEDiC Life Sciences announced that it has entered a research collaboration with Hanmi Pharmaceutical. In this collaboration, MEDiC would use its MCAT platform to identify cancer biomarkers for one of Hanmi’s clinical assets. MCAT is MEDiC’s functional genomics platform that can measure millions of gene-to-drug interactions between a cancer drug and all possible genetic mutations. Using this platform, MEDiC identifies SLS biomarkers and maximizes response rates in patients whose cancer harbors these mutations. This platform also expanded the market potential of cancer drugs by providing multiple biomarkers.

- In August 2024, Illumina, Inc. announced that the Food and Drug Administration (FDA) approved their in vitro diagnostic (IVD) TruSight Oncology (TSO) Comprehensive test and its first two companion diagnostic (CDx) indications. This single test can assimilate over 500 genes to profile a patient's solid tumor, helping to increase the likelihood of identifying an immuno-oncology biomarker that targets clinical trial enrollment. This IVD kit for comprehensive genomic profiling and accompanying CDx would be a valuable clinical tool for the oncology community to match patients with targeted therapies.

- In June 2024, Guardant Health, Inc. announced the launch of a new version of its Guardant360 TissueNext test. This would expand the number of genes it identifies in a tumor tissue sample to 498. These genes, or cancer biomarkers, enable oncologists to identify the targeted therapies that are most effective for patients with advanced cancer. The company also improved its test’s operational workflow for a faster turnaround time. The new Guardant360 TissueNext test would be covered for Medicare fee-for-service patients with advanced solid tumor cancers as a standalone service.

List of Top Genomic Biomarkers Companies:

- Almac Group

- Bio-Rad Laboratories Inc.

- Eurofins Scientific

- Myriad Genetics Inc

- QIAGEN

Genomic Biomarkers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Genomic Biomarkers Market Size in 2025 |

US$22.631 billion |

|

Genomic Biomarkers Market Size in 2030 |

US$36.127 billion |

| Growth Rate | CAGR of 9.81% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Genomic Biomarkers Market |

|

| Customization Scope | Free report customization with purchase |

Genomic Biomarkers Market Segmentation:

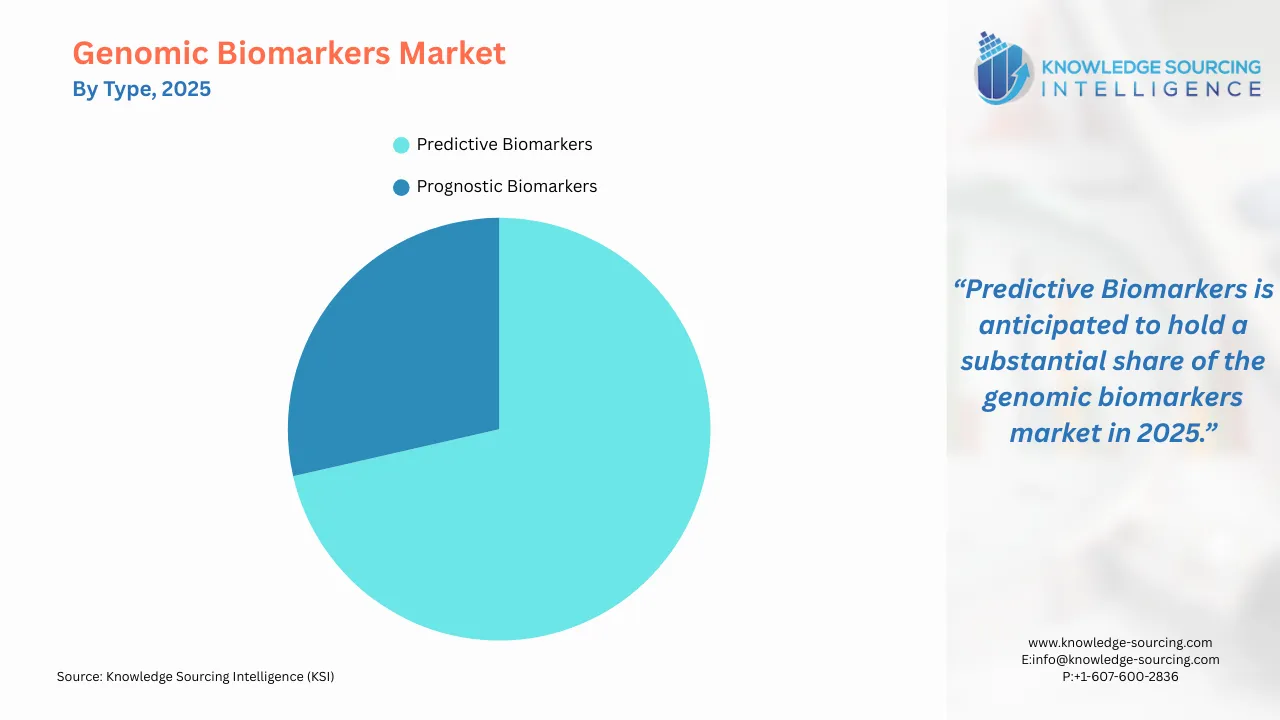

- By Type

- Predictive Biomarkers

- Prognostic Biomarkers

- By Indication

- Oncology

- Cardiovascular diseases

- Neurological diseases

- Renal Disorders

- Others

- By End User

- Hospitals

- Diagnostic Centers

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America