Report Overview

Gas Phase Filtration Market Highlights

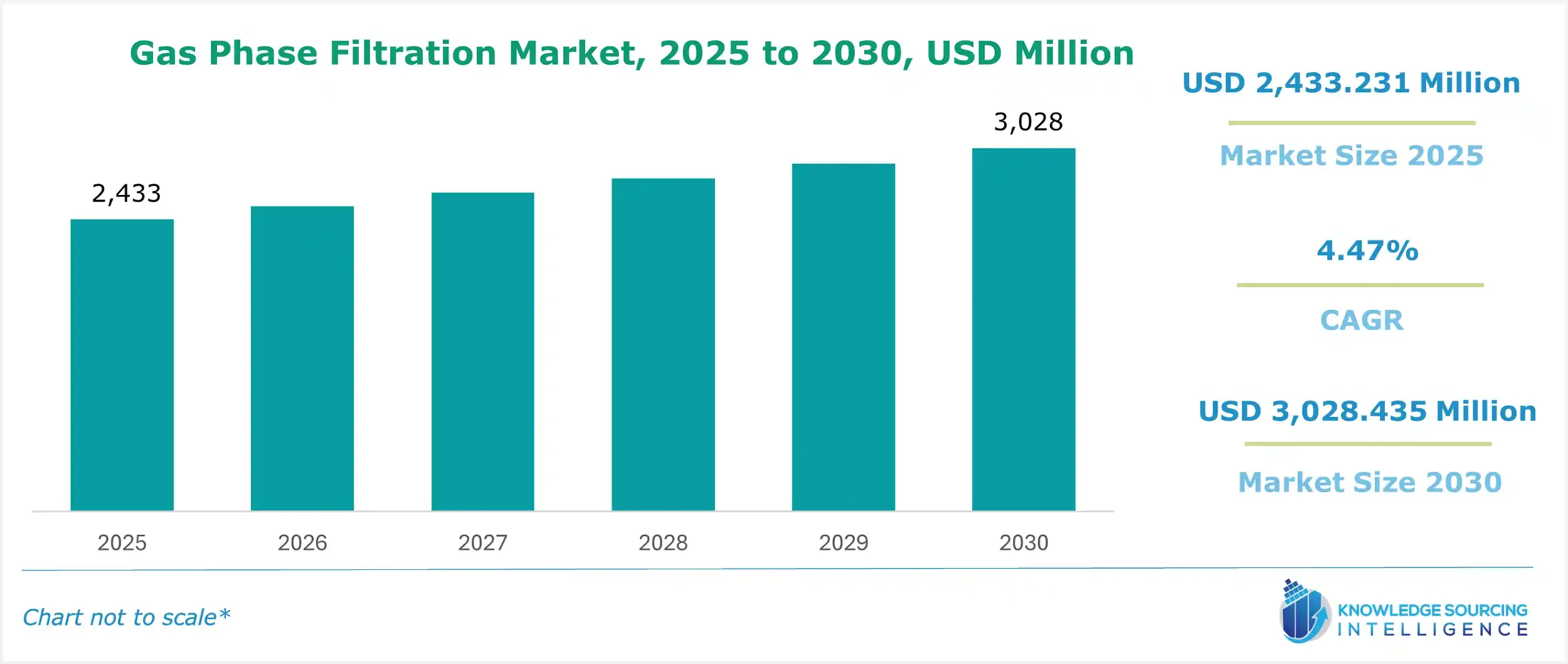

Gas Phase Filtration Market Size:

The gas phase filtration market is evaluated at US$2,433.231 million in 2025, growing at a CAGR of 4.47%, reaching US$3,028.435 million by 2030.

The method of purifying the air present in the surroundings of the filter is gas phase filtration. These are available in the form of pellets and require timely replacement once they have reached their absorption limit of impurities.

The market for gas-phase filtration will continue to develop as people become more concerned about the negative health implications of poor air quality in outdoor and indoor environments. Gas filtration systems safeguard electronic equipment from corrosion caused by airborne pollutants while also purifying odorous air.

Sulfur and nitric oxides, formaldehyde, hydrocarbons, organic acids, volatile organic compounds, and other impurities are removed using a gas phase filtering system.

Gas Phase Filtration Market Drivers:

- Growing industrialization and increased industrial waste

The market is expected to develop rapidly due to growing industrialization and increased industrial waste. The gas-phase filtration market is driven by increased awareness of the negative effects of poor air quality on human health and a strong focus on the filtration of corrosive and poisonous gases in various end-user sectors.

- Adoption of the system by business and commercial environments

The adoption of gas phase filtration systems is growing in various business and commercial environments, including data centers, computer rooms, museums, and libraries. Additionally, these filters are increasingly accepted as air quality monitors across multiple industries, contributing to the market’s expansion.

Technological developments and untapped potential in emerging countries all present significant growth opportunities. The gas phase filtration market would also benefit from regulations relating to carbon dioxide emission restrictions.

- Growing use of packed bed filters is predicted to boost the gas phase filtration market

Packed bed filters are highly efficient in removing unwanted odors and gases in many industries, such as petrochemical and chemical, healthcare, metal and mining, pulp and paper, and semiconductor production, where volatile compounds and highly toxic gases are emitted during production. Moreover, packed bed filters are cheaper compared to other filters. Furthermore, these factors enhance the necessity of removing the indoor air pollution of the industry.

Gas Phase Filtration Market Restraints:

- High investment costs and limited awareness may hamper the overall market

The initial costs of equipment, installation, and maintenance for gas phase filtration systems tend to be quite high. This cost might discourage certain prospective clients, particularly for smaller enterprises or businesses operating in low-cost industries.

Further, several companies and end users remain unaware of the advantages and merit of gas phase filtration systems, even with increased pollution and air quality concerns. Ignorance of these technologies can hinder market expansion because potential customers might not entirely understand their efficiency or value.

Gas Phase Filtration Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period.

The Asia Pacific market is predicted to develop rapidly owing to the economic growth of various rising economies, including India and China. Furthermore, because of the low-cost labor and readily available raw materials, some foreign corporations have been drawn to establish production facilities in this region.

In addition, new power production stations are being built to meet the region's expanding energy demand from various sectors, driving its gas phase filtration market forward.

Gas Phase Filtration Market Key Launches:

- In September 2024, Metso's Filtration Technology Center in Finland introduced an upgraded Larox® PF 60 series pressure filter and a new machining unit. The latest iteration of the Larox® PF 60 series filter represents a significant advancement in tower filter technology. Because of its innovative technological solutions, it greatly increases safety, process efficiency, and dewatering capacity in mining and other process industry applications.

Gas Phase Filtration Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Gas Phase Filtration Market Size in 2025 | US$2,433.231 million |

| Gas Phase Filtration Market Size in 2030 | US$3,028.435 million |

| Growth Rate | CAGR of 4.47% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | Americas, Europe, Middle East, and Africa, Asia Pacific |

| List of Major Companies in the Gas Phase Filtration Market | |

| Customization Scope | Free report customization with purchase |

Gas Phase Filtration Market is analyzed into the following segments:

- By Type

- Packed Bed Filters

- Combination Filters

- By Media

- Activated Carbon

- Potassium Permanganate

- Blend

- By Application

- Corrosion & Toxic Gas Control

- Odor Control

- By End-user

- Pulp & Paper Industry

- Chemicals and Petrochemicals Industry

- Metals & Mining Industry

- Food & Beverages Industry

- Healthcare Industry

- Utilities Industry

- Semiconductor Manufacturing Industry

- Data Centers

- Others

- By Geography

- Americas

- US

- Europe, the Middle East, and Africa

- Germany

- Netherlands

- Others

- Asia Pacific

- China

- Japan

- Taiwan

- South Korea

- Others

- Americas