Report Overview

Furniture Market Report, Size, Highlights

Furniture Market Size:

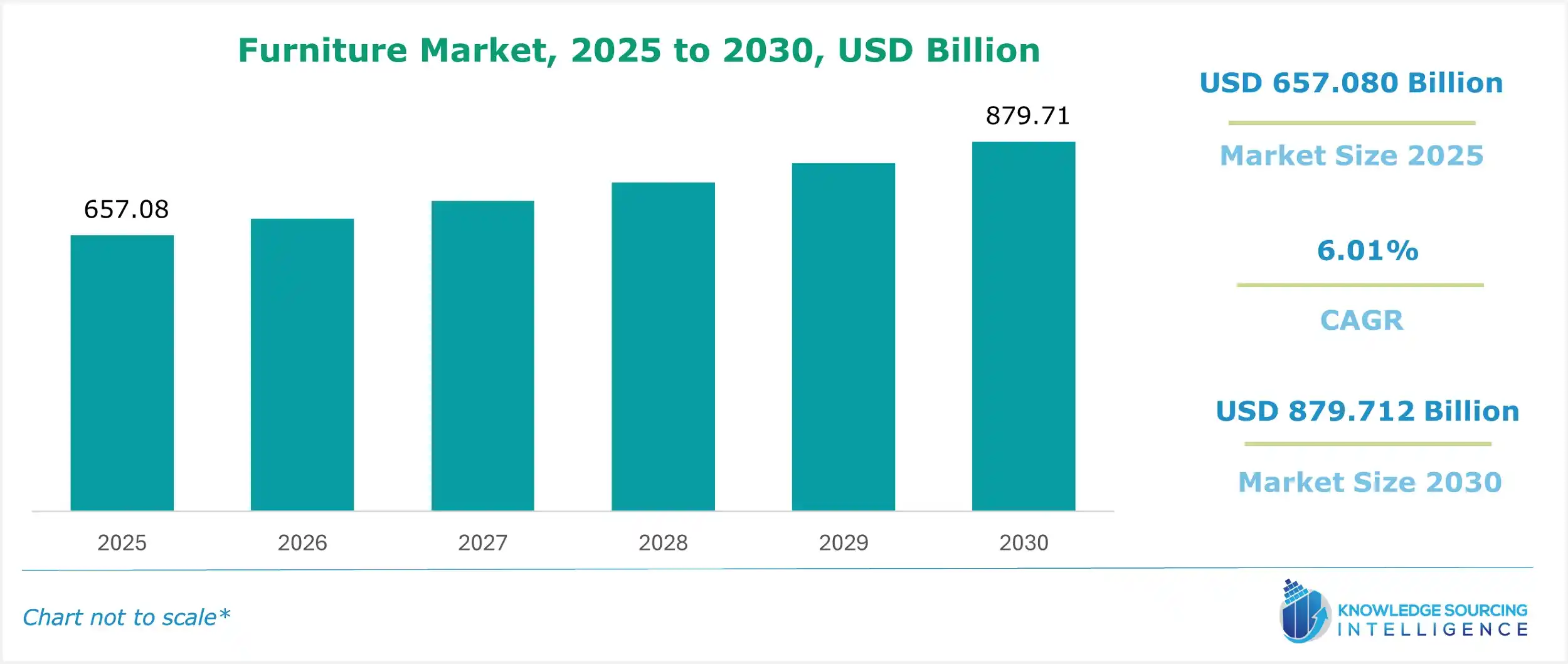

The furniture market is projected to grow at a CAGR of 6.01% to attain a value of USD 879.712 billion by 2030 from USD 657.080 billion in 2025.

Furniture Market Introduction:

The global furniture industry is a dynamic sector encompassing the home furnishings market, commercial furniture, and residential furniture. Recent trends in office furniture emphasize ergonomic designs and flexible workspaces, while furniture retail adapts to e-commerce and consumer preferences. Interior design trends drive innovation, blending aesthetics with functionality in the home decor market. Advanced manufacturing and sustainable materials enhance product offerings, meeting demands for style and durability. As urbanization and remote work reshape consumer needs, the furniture market delivers versatile solutions for residential and commercial spaces, empowering industry experts to address evolving design, sustainability, and market accessibility challenges.

Furniture Market Trends:

The furniture market is evolving with smart furniture and connected furniture, integrating IoT furniture for enhanced functionality like automated adjustments. AI in furniture design optimizes aesthetics and ergonomics, while furniture manufacturing automation boosts efficiency. AR furniture shopping and VR furniture showrooms revolutionize consumer experiences, enabling immersive product visualization. 3D printed furniture supports innovative, sustainable designs, and custom furniture technology meets demand for personalized solutions. Digital transformation of furniture drives e-commerce growth and supply chain optimization. These trends reflect a shift toward technology-driven, consumer-centric solutions, empowering manufacturers to deliver innovative, efficient, and customizable furniture for modern residential and commercial spaces.

The growing population, along with an increase in disposable income, is giving a major boost to the demand for furniture. In the residential sector, there is a rising trend for customized furniture that meets the aesthetic preferences and requirements of compact spaces.

Additionally, the growing focus on environmental sustainability is driving the demand for furniture that is eco-friendly and sustainable, such as the use of recycled materials for furniture. Alongside this, there is increasing demand for furniture that helps in maintaining good posture and can reduce the bad effects of sitting for long hours, especially driven by office spaces and the emerging work-from-home class. Promotes good posture. Further, the growth of e-commerce will significantly change the method of distribution channels.

Furniture Market Growth Drivers:

- Expanding Residential and Commercial Infrastructure Development: The global residential construction market is expanding due to rising disposable income and a growing middle-class population, with an increasing trend towards urbanization. Further, the growing travel and tourism sector worldwide is leading to the construction of new hotels and airports, which are also expected to supplement market expansion.

Governmental initiatives for promoting smart cities are one of the key factors expected to propel the furniture market's growth. This leads to an increase in the infrastructural development of buildings and commercial space, driving the demand for furniture.

For instance, the Smart Cities Mission by the government of India, where the government has identified 100 cities to be converted into smart cities, is leading to development in residential and commercial spaces, driving the demand for furniture. Similarly, in the Middle East, the government's focus on boosting the real estate sector, leading to the expansion of residential and commercial construction activities, is driving demand for furniture. Government policies aimed at infrastructural development in the Middle East, such as initiatives like Saudi Vision 2030, UAE Vision 2021, and UAE Vision 2023, are expected to significantly increase the demand for furniture, particularly in the residential and commercial sectors.

- Robust Growth Trends in Emerging Markets: The robust economic growth in developing and developed economies is one of the major factors driving the furniture market’s expansion throughout the forecast period. The rising economic conditions in countries like China and India are leading to a rise in disposable incomes, driving investments in construction activities by both the private and government sectors. This increased investment is enhancing construction in both residential and commercial infrastructure, positively impacting market growth.

Furniture Market Segmentation Analysis by Furniture Type

- Residential: Residential furniture is used for household purposes. The market for residential furniture is poised to hold a noteworthy share, as there is a growing demand for furniture in this segment due to the rising global residential construction market, driving the demand for furniture. Similarly, growing investments in housing projects also support the market growth for residential furniture during the forecast period. The residential segment is driven by demand for customized furniture as per the requirements of compact spaces and aesthetically appealing, minimalistic furniture.

- Commercial: Commercial furniture is used in hotels, offices, industries, and other places such as airports and metros. The commercial segment is expected to experience significant growth due to the increasing development of commercial infrastructure in various countries, particularly in airports and the corporate sector. Additionally, the expansion of the hospitality industry, marked by the construction of new hotels, is driving demand for commercial infrastructure during the forecast period.

Furniture Market Geographical Outlook:

- Asia-Pacific will have significant growth during the forecast period

The Asia-Pacific region is poised to capture a significant market share in the global furniture market, driven by rapid urbanization, population growth, and economic development in countries like India, China, and Indonesia. These developing economies are experiencing a surge in demand for residential furniture and commercial furniture due to expanding real estate and construction sectors.

India and China, with their large and growing populations, are key drivers of furniture demand. China’s urban population reached 65.2% in 2023, while India’s urban population grew to 36%, fueling the need for housing (World Bank, 2023). This urbanization trend drives demand for residential houses, increasing the need for furniture such as sofas, beds, and office furniture. The rising middle-class population and increasing disposable incomes in these countries have boosted spending on premium and customized furniture, reflecting consumer preferences for stylish and functional designs.

The real estate boom in Asia-Pacific, supported by initiatives like India’s Smart Cities Mission, has spurred construction activities, further propelling furniture market growth. China’s Belt and Road Initiative also supports infrastructure development, enhancing demand for commercial furniture in offices and hotels. E-commerce growth, with platforms like Alibaba and Flipkart, improves market accessibility for furniture products.

North America and Europe follow, with demand for sustainable furniture, while South America, and Middle East and Africa are emerging markets. Challenges like raw material costs persist, but sustainable materials and automation mitigate these issues. The furniture market thrives on urbanization, real estate growth, and consumer trends, with Asia-Pacific leading due to its economic dynamism and population-driven demand.

List of Top Furniture Companies:

- Inter IKEA Systems B.V.Herman Miller, Inc.

- Godrej and Boyce Mfg. Co. Ltd.

- Steelcase Inc.

- Ashley Home Stores Ltd.

- Haworth Inc.

These companies are some of the major market players in the furniture market. They have an extensive presence in markets with a focus on innovative designs to cater to the changing preferences of furniture.

Furniture Market's Latest Developments

- In May 2024, Remax Furniture announced the opening of its furniture store, which will be offering premium furniture pieces.

Furniture Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Furniture Market Size in 2025 | US$657.080 billion |

| Furniture Market Size in 2030 | US$879.712 billion |

| Growth Rate | CAGR of 6.01% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Furniture Market |

|

| Customization Scope | Free report customization with purchase |

Furniture Market Segmentation:

- By Furniture Type

- Residential

- Commercial

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others

- North America