Report Overview

Fuel Pump Market Report, Highlights

Fuel Pump Market Size:

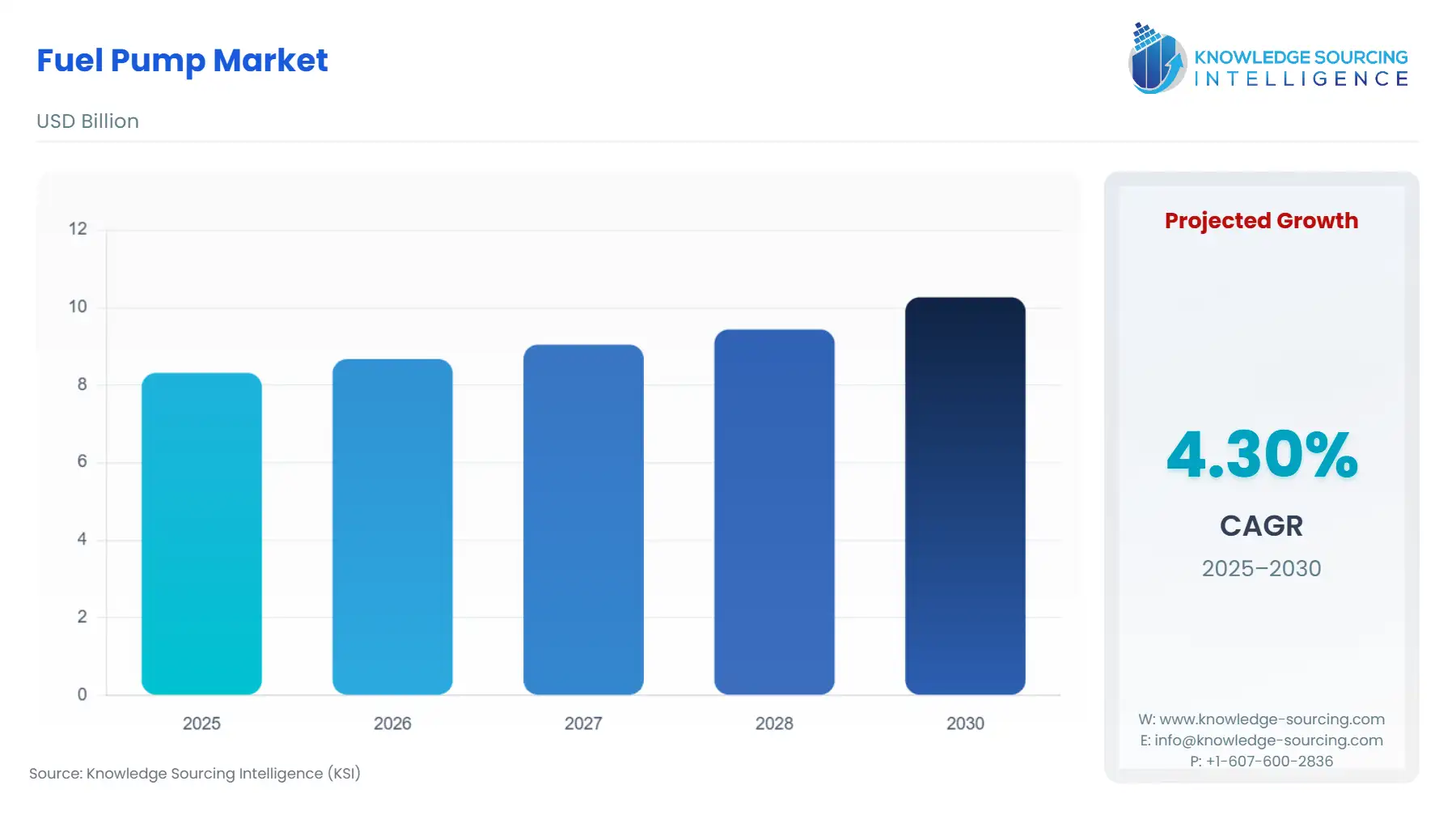

Fuel Pump Market, at a 4.30% CAGR, is projected to increase from USD 8.317 billion in 2025 to USD 10.268 billion in 2030.

A fuel pump is a device, either mechanical or electrical, that moves fuel from the fuel tank to the engine of a vehicle. It is essential for maintaining the proper fuel pressure and flow rate required by the engine for smooth operation. In a typical gasoline engine, the fuel pump functions by extracting fuel from the tank and propelling it through the fuel lines to the engine.

The pump generates pressure that drives the fuel through the fuel injectors or carburetors, which then mix the fuel with air and transport the fuel-air mixture to the combustion chamber. The fuel pump is a crucial component for ensuring the proper functioning of a vehicle's engine, and any fuel system problems can lead to diminished performance and potential engine damage. The increasing production and consumption of petroleum, growing demand for vehicles, strict norms regarding emissions of CO2, technological advancements, etc. are some of the driving factors of the fuel pump market.

Fuel Pump Market Growth Drivers:

- The demand for fuel pumps is expected to grow with the rising production and consumption of petroleum.

Fuel pumps play a critical role in transferring fuel from the fuel tank to the engine of a vehicle. As more fuel is consumed, there is a corresponding need for more fuel to be pumped, which translates into greater demand for fuel pumps. For instance, global oil (petrol) production increased from 48,508 TWh (Terawatt hours) in 2020 to 49,094 TWh in 2021 as per IEA data. According to data from the Organization of the Petroleum Exporting Countries, crude oil production in Saudi Arabia rose from 10435 thousand barrels per day in 2022 to 10453 thousand barrels per day in 2023. Similarly, according to the U.S. Energy Information Administration, In 2022, crude oil production in Brazil rose to 3244.52 thousand barrels per day. The growing consumption of petroleum is also an important reason behind the growth of the fuel pump market. Data from IEA indicates that around 94,959,512.0 TJ (Terajoule) of oil was consumed globally in 2020. Crude oil consumption in Saudi Arabia and Brazil in 2020 was recorded at 1,712,055.0 TJ and 2,430,718.0 TJ respectively, as per the same source. Therefore, the rising demand for petroleum is an important factor in the growth of the fuel pump market globally.

- The growth of the fuel pump market is anticipated to be propelled by the increasing trend in vehicle production and sales.

Fuel pumps are used in vehicles to transfer fuel from the fuel tank to the engine. They play a crucial role in ensuring that the engine receives an adequate and consistent supply of fuel at the correct pressure and flow rate required for optimal performance. Overall, fuel pumps are a critical component in ensuring the proper functioning of a vehicle's engine, and any issues with the fuel system can result in reduced performance and potential damage to the engine. The growing demand for vehicles across the world plays a vital role in the growth of the fuel pump market According to data from The International Organization of Motor Vehicle Manufacturers, global vehicle production increased by 3% in 2021 compared to 2020, and global vehicle sales increased from 78,774,320 in 2020 to 82,684,788 in 2021. Additionally, data from OICA shows that the United States produced approximately 9167214 vehicles in 2021, representing a 4% increase compared to 2020 and the same increase was seen in Argentina in 2021 where around 434753 vehicles were produced in the same year indicating an increase of 69% as compared to 2020. Portugal experienced an increase in vehicle production by 10% between 2021 and 2020, as per the same source. Thus, as the demand for vehicles continues to increase, the fuel pump market will also experience significant growth.

Fuel Pump Market Geographical Outlook:

- The Asia Pacific region holds the greatest potential for growth in the fuel pump market.

Fuel pumps play a critical role in the aviation industry by providing the necessary fuel flow to power an aircraft's engines. Therefore, the growing aviation industry of this region will drive the growth of the fuel pump market. For instance, It was announced by the government of India in January 2023 that the country's airlines would increase their capacity by 15% or add 100 to 110 aircraft per year. As a result, the aviation sector is projected to reach nearly 12,000 aircraft by 2027. Similarly, Around 142 aircraft were delivered by Airbus to China in 2021, which increased the total number of commercial aeroplanes in the country to approximately 21,000. This region is also known for being a major automotive manufacturing centre, with countries such as China, India, and Japan contributing significantly and as a result, the fuel pump market is also expanding in this area. The Japan Automobile Manufacturers Association (JAMA) reported that car production in Japan reached 644,799 units in 2022. Meanwhile, the Department of Commerce and the Ministry of Commerce and Industry noted that the number of automobiles produced in India increased from 22.7 million to 22.93 million between 2021 and 2022. According to the same source, approximately 17.51 million units of vehicles were sold in 2021. Fuel pumps play a critical role in controlling emissions by ensuring the proper fuel-air mixture is delivered to the engine. The governments of this region have also implemented strict regulations regarding emissions, which is another factor contributing to the growth of the fuel pump market. For instance, in August 2019, China introduced the "China VI" vehicle emission standards to combat the significant contribution of automobiles to air pollution. Such regulatory measures by governments are expected to increase the demand for advanced fuel pumps that can help reduce the carbon emissions generated by vehicles. Thus, all of these factors combine to boost the growth of the fuel pump market in the Asia Pacific region.

Fuel Pump Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 8.317 billion |

| Total Market Size in 2031 | USD 10.268 billion |

| Growth Rate | 4.30% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Fuel Type, Installation, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Fuel Pump Market Segmentation:

- FUEL PUMP MARKET BY TYPE

- Mechanical

- Electric

- High-Pressure

- FUEL PUMP MARKET BY FUEL TYPE

- Gasoline

- Diesel

- FUEL PUMP MARKET BY INSTALLATION

- OEM

- Aftermarket

- FUEL PUMP MARKET BY END-USER

- Automotive

- Aerospace & Defense

- Marine

- Others

- FUEL PUMP MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America