Report Overview

France Electric Vehicle Charging Highlights

France Electric Vehicle Charging Stations Market Size:

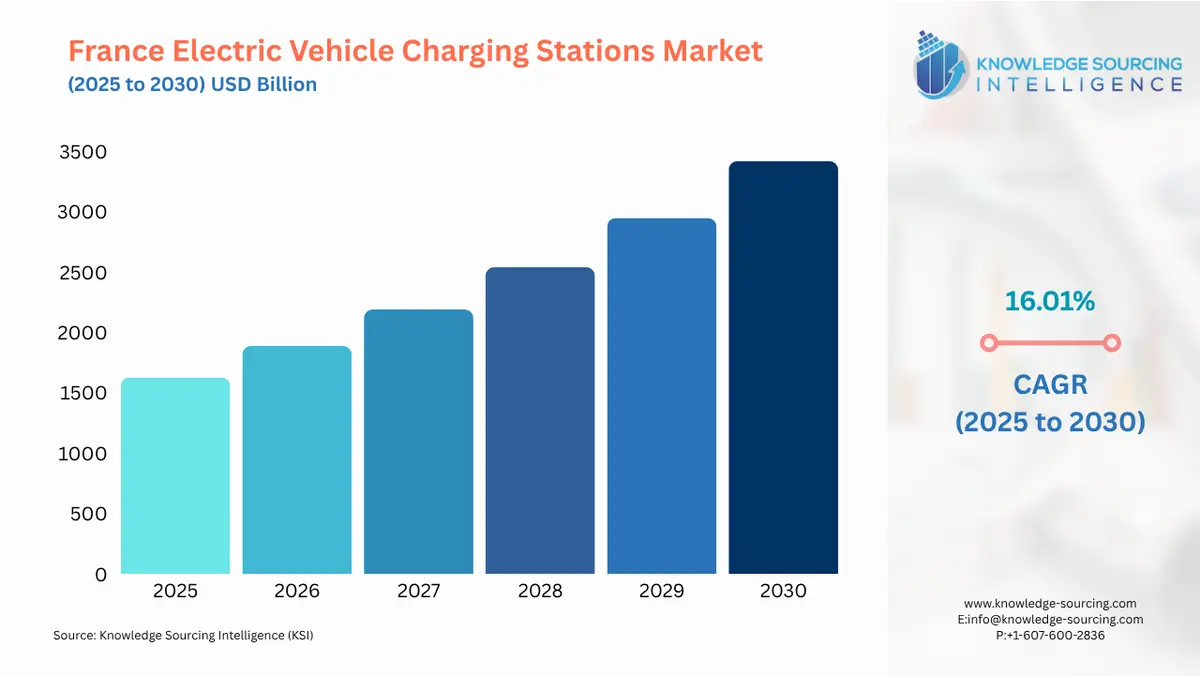

France EV charging station market is estimated to grow at a CAGR of 16.01%, attaining US$3,420.480 billion by 2030, from US$1,627.865 billion in 2025.

The French Electric Vehicle (EV) Charging Stations Market is undergoing a rapid, policy-driven transformation, shifting from a nascent phase to a mass-deployment environment. The market is fundamentally underpinned by the French government's aggressive decarbonization agenda, which has translated into significant financial incentives and strict regulatory requirements for infrastructure deployment. This market structure is driving strong demand for charging hardware and comprehensive network services across the public, private, and fleet segments. The strategic contract for the automotive sector reflects this national commitment, targeting 400,000 publicly accessible charging points by 2030, a direct multiplier for charging station hardware and operational service demand.

France Electric Vehicle Charging Stations Market Analysis:

- Growth Drivers

Government financial initiatives are the most significant growth catalyst. The ADVENIR program explicitly funds the installation of charging infrastructure in private settings, such as corporate vehicle fleets and collective residential properties, thereby directly reducing the capital expenditure barrier for companies and property owners. This subsidy mechanism translates directly into sustained, project-based demand for certified charging hardware and installation services. Furthermore, the massive increase in Battery Electric Vehicle (BEV) sales—a crucial market precondition—creates an inelastic demand for charging capacity. As EV registrations grow, the need to maintain an adequate EV-to-charger ratio to prevent charging anxiety compels further private and public investment in new station deployment.

- Challenges and Opportunities

The primary challenge constraining market acceleration is grid integration complexity and capacity limitations, particularly for high-power DC fast-charging sites. The necessity for complex grid upgrades and long connection lead times acts as a structural bottleneck, tempering the immediate demand for high-power DC chargers. Conversely, the opportunity lies in vehicle-to-grid (V2G) technology and smart charging solutions. The mandatory data reporting and interoperability requirements stipulated by the ADVENIR program create a direct, growing demand for sophisticated Charging Point Operator (CPO) software platforms capable of smart load management, energy data transmission, and seamless roaming functionality.

- Raw Material and Pricing Analysis

The EV Charging Station Market is a physical product market that depends heavily on specialized electronic hardware. The core components are power electronics (rectifiers, inverters, power management ICs), connectors (Type 2/CCS2 standard), and microcontrollers. The supply chain is highly exposed to global semiconductor shortages, as power management and control systems rely on microcontrollers and IGBTs (Insulated Gate Bipolar Transistors) often sourced from Asian fabrication hubs. Pricing for the final product, particularly DC fast chargers, remains sensitive to the cost of copper for cabling and specialized cooling systems, creating upward pressure on CapEx for CPOs and potentially slowing deployment when commodity prices spike.

- Supply Chain Analysis

The global EV charging supply chain exhibits a high degree of dependence on component manufacturers, primarily in Asia, for key electronic hardware like power modules and semiconductors. European and French players, such as Schneider Electric and TotalEnergies, typically focus on the final assembly, branding, network operation (CPO/eMSP), and software layers. Logistical complexity centers on managing the just-in-time delivery of standardized, quality-certified components to maintain rapid deployment schedules, especially as France pushes for widespread roll-out. Dependence on the Combined Charging System (CCS2) and Type 2 connector standards, mandated in the EU, streamlines the final-product assembly but ties the market to the established European manufacturing ecosystem.

France Electric Vehicle Charging Stations Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

France |

Mobility Orientation Law (LOM) |

Mandates that new or renovated non-residential buildings (and parking lots with over 20 spaces) reserve a percentage of spaces for EV charging. This directly creates and mandates B2B requirement for workplace and destination charging hardware and installation services. |

|

France / Avere-France |

ADVENIR Program |

Provides subsidies for installing charging points in private settings (collective residential, fleet, employee parking). This mechanism directly stimulates and finances demand in segments otherwise underserved by public networks. |

|

European Union |

Alternative Fuels Infrastructure Regulation (AFIR) |

Sets mandatory targets for charging capacity along the European road network, including TEN-T corridors. This regulation indirectly but powerfully propels demand for high-power DC charging stations on major French highways and primary road networks. |

France Electric Vehicle Charging Stations Market Segment Analysis:

- By Propulsion Type: DC Charging Station

The need for DC charging stations is overwhelmingly propelled by the increasing penetration of long-range BEVs and the imperative to electrify high-utilization commercial fleets. High-capacity battery packs (e.g., 80 kWh+) necessitate DC rapid charging to achieve acceptable journey times, driving demand for units capable of 150 kW and above. The core requirement shift originates from the utility segment: the need for fast turnaround times on major transit routes and in urban logistics centers. Public-facing CPOs are deploying high-power DC hubs to mitigate 'range anxiety' on inter-city routes, while fleet operators (e.g., last-mile delivery, taxis) require high-speed DC charging at depots to minimize vehicle downtime. The French government's focus on highway and major road network coverage, often in response to EU mandates, further concentrates demand on these powerful, CapEx-intensive solutions.

- By End-User: Workplace

The confluence of fiscal incentives and regulatory compliance primarily drives the workplace segment’s growth. The ADVENIR program provides explicit financial support for charging points in employee and company fleet parking areas, directly converting a high-CapEx project into an economically viable one. Furthermore, large employers increasingly view charging infrastructure as a crucial element of corporate social responsibility (CSR) and a non-pecuniary employee benefit, essential for attracting and retaining personnel who drive BEVs. This non-regulatory growth factor, combined with the LOM mandate for non-residential buildings, ensures steady, high-volume deployment of primarily AC (Level 2) stations, which are ideal for the 4-8 hour dwell time of an employee vehicle.

France Electric Vehicle Charging Stations Market Competitive Analysis:

The French market exhibits intense competition, pitting major energy and automotive players against dedicated charging specialists. TotalEnergies and IZIVIA (a subsidiary of the EDF Group) represent the incumbent power-utility dominance, leveraging established energy supply chains, brand recognition, and existing real estate footprints.

TotalEnergies has strategically positioned itself as a comprehensive mobility service provider, expanding beyond fossil fuels to become a major Charge Point Operator (CPO) and e-Mobility Service Provider (eMSP). Their strategy focuses on deploying ultra-fast charging points at existing service stations and developing urban charging solutions, directly targeting the high-utilization public charging segment.

IZIVIA, backed by the state-owned EDF Group, focuses on providing end-to-end solutions for local authorities and businesses, including supply, installation, supervision, and maintenance. Their core strength lies in managing vast, geographically dispersed public and semi-public charging networks. The collaboration with global hardware specialists, such as Delta, highlights a strategy of integrating best-in-class technology with its extensive operational network to rapidly scale its ultra-fast charging presence, notably at partner locations like McDonald's restaurants.

France Electric Vehicle Charging Stations Market Developments:

- October 2024: Delta and IZIVIA Strategic Partnership

IZIVIA, an EDF Group subsidiary, announced a partnership with Delta, a power management specialist, to deploy Delta's Ultra-Fast EV chargers (UFC150 and UFC200) across the IZIVIA Fast charging network, including installations at McDonald's sites in France. This capacity addition aims to rapidly expand the high-power public charging availability for French EV drivers.

- December 2024: TotalEnergies Opens First EV-Only Service Station in Paris

TotalEnergies officially opened its first service station dedicated solely to electric vehicles in the Porte de Saint-Ouen area of Paris. The site features eight ultra-fast charging points, each capable of delivering up to 300 kW, powered by 100% renewable energy. This new product launch represents a shift in real estate strategy towards dedicated high-speed charging hubs in dense urban environments.

France Electric Vehicle Charging Stations Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| France Electric Vehicle Charging Stations Market Size in 2025 | US$1,627.865 billion |

| France Electric Vehicle Charging Stations Market Size in 2030 | US$3,420.480 billion |

| Growth Rate | CAGR of 16.01% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| List of Major Companies in France Electric Vehicle Charging Stations Market |

|

| Customization Scope | Free report customization with purchase |

The France EV Charging Station Market is analyzed into the following segments:

BY VEHICLE TYPE

- Passenger Vehicle

- Commercial Vehicle

- Others

BY PROPULSION TYPE

- AC Charging Station

- DC Charging Station

BY OWNERSHIP TYPE

- Public

- Private

- Residential

- Workplace