Report Overview

France Colocation Market Report, Highlights

France Colocation Market Size:

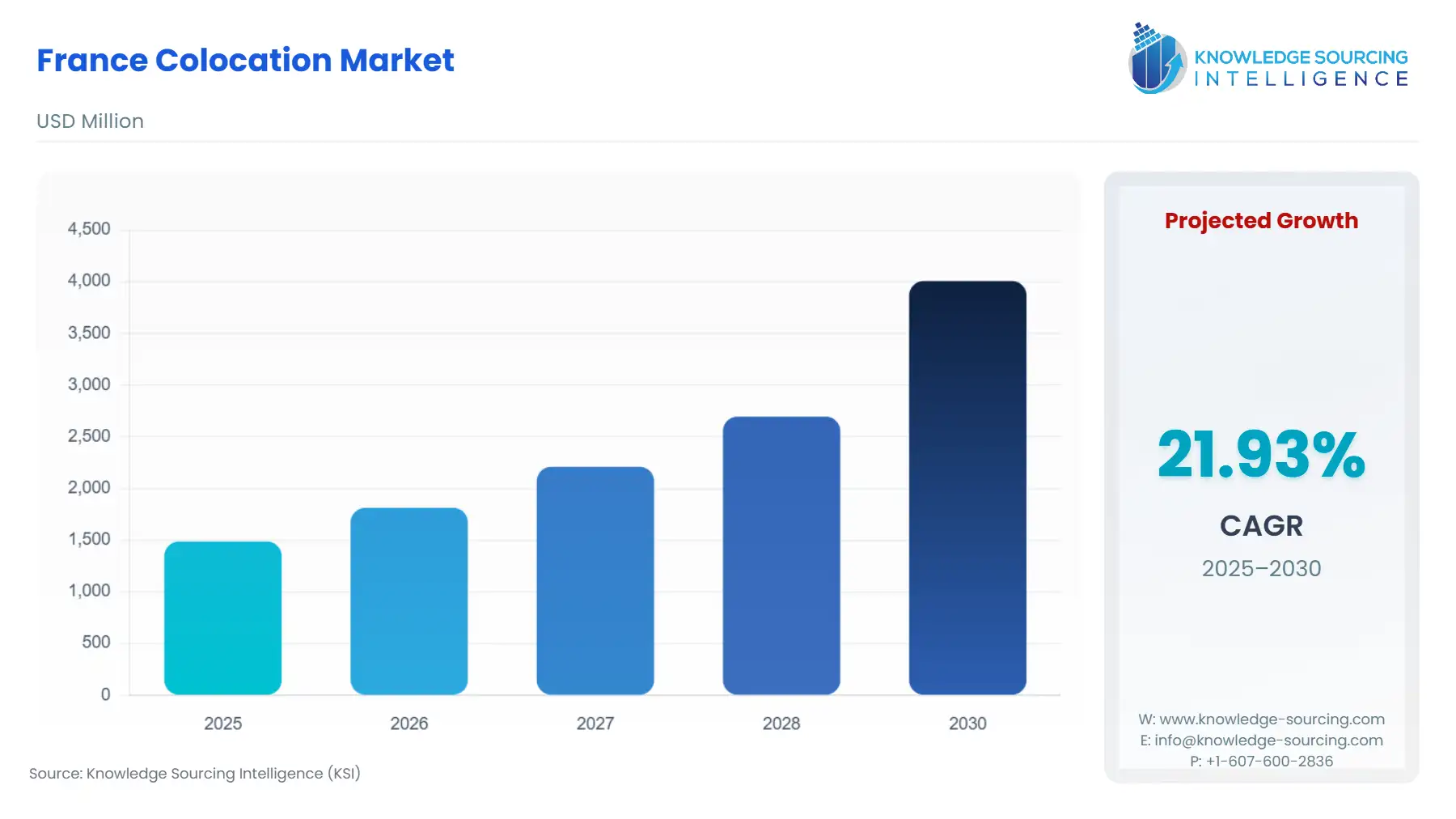

The France Colocation market will grow at a CAGR of 21.93% from USD 1.487 billion in 2025 to USD 4.008 billion in 2030.

France Colocation Market Trends:

Being one of the major European economies, France is experiencing positive growth in its technological advancements which is attributable to the investments by major Tech firms to establish their base units, followed by favourable government policies and initiatives such as Industry 4.0. Such initiatives will create a significant surge in the data traffic which is anticipated to create demand for storage spaces for advanced data processing and storage in the country.

France Colocation Market Growth Drivers:

- The growing internet penetration and data traffic are expected to stimulate market expansion

Rapid urbanization coupled with bolstering growth in smartphone penetration has stimulated the demand for high-speed internet access in France, for instance, according to the ARCEP, by December 2023, about 75% of France’s all internet subscription were superfast broadband and as per the source metropolitan area accounted for a major portion of the subscription. Such high internet penetration has accelerated the requirement for proper infrastructure to enhance data storage and management, thereby driving the demand for colocation data centers in France.

- Favourable initiatives and investments to promote 5G technology bolster market growth.

The 5G deployment is anticipated to create a drive in the demand for colocation data centers in the French economy, as the introduction of 5G has created a boom in the volume of data transmission over the years which has made companies shift from traditional on-premises data centers to the flexible colocation data center that offers high operability, security and scalability to organizations during data processing. As per GSMA, in 2022, France’s 5G penetration stood at 8% and is projected to reach 90% by 2030

The French government has undertaken various investments to bolster 5G network expansion in the country. For instance, in January 2022, France in collaboration with Germany announced to pledge €17.7 million to the “5G-OPERA” which involves four projects that aimed to deliver innovative solutions for 5G applications across the two countries. Such investments have opened new opportunities for efficient data management for personal as well as business-related data, thereby driving colocation service demand in France.

- Large enterprises are projected to account for a significant share of the market

Based on enterprise size, the France colocation market is segmented as small, medium, and large, where the large enterprise is anticipated to show significant growth owing to the growing corporate culture in the country, establishment of MNC units followed by the investment by market players in sectors such as healthcare, BFSI, retail, and manufacturing. Such investments will bolster the colocation data center development to improve the overall management and processing of enterprise data, and also the services would further enable the user to have remote data ac

France Colocation Market Key Developments:

- In November 2023: Morgan Stanley Infrastructure formed an agreement with Altech France for the acquisition of a 70% stake in data center company UltraEdge. The joint partnership aimed to establish the first nationwide colocation data centre in France.

- In October 2023: Telehouse announced the establishment of its data centre in the TH3 Paris Magny campus which formed a part of the company’s data center expansion projects in Europe inclusive of the improvement of its TH2 data center in France.

- In September 2023: Penta Infra acquired the Sungard data center campus in Paris with which the company has also acquired the colocation business. Through the acquisition, the company aimed to provide high-quality colocation & hosting services in one of the major European colocation markets.

France Colocation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.487 billion |

| Total Market Size in 2031 | USD 4.008 billion |

| Growth Rate | 21.93% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Enterprise Size, Industry Vertical |

| Companies |

|

France Colocation Market Segmentation:

- By Type

- Retail

- Wholesale

- Hybrid

- By Enterprise Size

- Small

- Medium

- Large

- By Industry Vertical

- BFSI

- Communication and Technology

- Education

- Healthcare

- Media and Entertainment

- Retail & E-Commerce

- Others