Report Overview

Fox Nuts Market Size, Highlights

Fox Nuts Market Size:

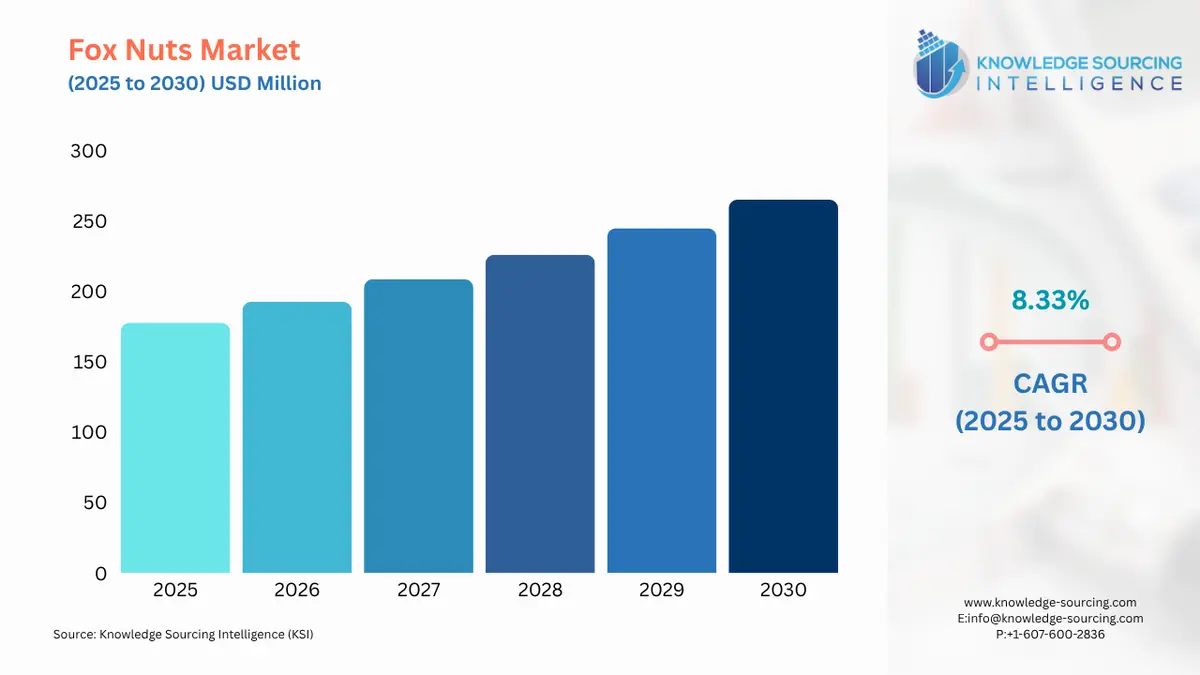

The fox nuts market is expected to grow at a CAGR of 8.33%, reaching a market size of US$265.120 million in 2030 from US$177.706 million in 2025.

Fox Nuts Market Trends:

Fox nuts are the seeds of the Euryale ferox plant, and they've gained popularity in recent years due to their numerous health benefits. The fox nuts market is expanding significantly globally due to their growing appeal as a nutritious snack and their use in various culinary preparations.

There are many benefits of fox nuts, which have quite a regular fat and calorie level and contain proteins, fibers, minerals, potassium, and magnesium. The shift towards healthy snacking has ignited the demand for this product. It is a popular snack among kids and adults that can work as a substitute for conventional snack foods like popcorn or chips.

Since they are plant-based, fox nuts are fit for vegans and also gluten-free. The popularity of vegan diets has expanded the market for fox nuts. These foodstuffs fall under the category of clean foods. The fox nuts can be added to different recipes just like any other dish due to their taste, or one can even eat them as a snack. This quality allows it to be mixed with several recipes, making it fit for home and professional cooking.

Fox Nuts Market Growth Drivers:

- The growing demand for healthy snacks is contributing to the fox nuts market growth

Customers are demanding healthier snack options. The most nutritious of all snacks is fox nuts. Because they are completely low in calories and fat and high in protein, dietary fiber, carbohydrates, and important minerals such as potassium and magnesium, fox nuts are the best alternative. Moreover, they are also vegan and gluten-free to meet numerous diet preferences, making them an attractive product for health-conscious people.

The fox nuts market is also witnessing a surge as people prefer to munch on clean, organic fox nuts. They are grown entirely without toxic chemicals or pesticides, making fox nuts satisfy the need for ingredients that are all-natural, organic, and clean. As consumers become more health-conscious, they prefer tasty products with no artificial additives or preservatives.

- The increasing popularity of vegetarianism is anticipated to boost the fox nuts market.

The burgeoning growth of the vegan movement has opened great markets for Fox Nuts. Spurred on by the growing number of people leading a vegan lifestyle, the requirements for plant-based and cruelty-free alternatives to traditional snacks and ingredients have increased. Fox Nuts has many benefits for vegans, making it an appropriate product for a movement. Being the seeds of the lotus plant, makhanas fall in the category of vegan food, and they are much sought after by vegans since they are completely natural, animal-free snacking items. Consequently, they endow rich protein, dietary fiber, and some of the most required minerals with a truly nutrient-rich supplement for a vegan regimen.

Moreover, the versatility of fox nuts assures their use in most savory and sweet vegan recipes, making them even more popular among vegans. Because it is a healthy vegan snack for the environmentalist, it can also provide opportunities for capitalizing on the fox nuts market expansion.

Fox Nuts Market Restraints:

- Fluctuations in raw material prices are anticipated to hamper the fox nuts market growth

The major reason for price fluctuations in Fox Nuts is the production costs, such as labour and land, and water inputs. The costs of fox nuts are also subject to inherent market changes, government intervention, and weather conditions. Further, price hikes in the Fox Nuts field can be related to increasing production costs. Evolving price swings in raw materials cause their supply disruption, making Fox Nuts less available. This scarce availability, in turn, drives the pricing upward and leads to a decline in the fox nuts market growth, causing troubles for suppliers and end-users.

Fox Nuts Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

Factors fueling the growth include changing consumer preferences towards snacks, various sources of sales such as the internet, unexploited market players, opportunities, and government incentives for adopting healthy foods. Nevertheless, it has increasingly gained fame in North America over the years, especially in selling food products online.

Moreover, there has been an increasing trend of Americans opting for healthier snack foods. The opening of new opportunities to the regional food market, which is attributed to globalization, has also affected the food trade. Influential marketing and social media also help American food companies build their brands.

Fox Nuts Market Key Launches:

- In July 2024, a Singaporean startup called Strictly Nuts introduced a popular snack for people of all ages, emphasizing its adaptability and healthfulness to advance its market expansion. Additionally, the studies find that they provide health advantages like helping women lose weight and ease menstrual cramps.

- In March 2024, research on the cultivation of makhana was funded at the Central University of South Bihar (CUSB), India. The CUSB claims that a grant has been made available for the study aimed at improving crop cultivation. It is anticipated that the research will be completed in three years. The main goal of the study is to enhance the makhana species through tissue culture.

List of Top Fox Nuts Companies:

- Satjeevan Organic

- Maruti Makhana

- Madhubani Makhana

- Snackible

- Millet Amma

Fox Nuts Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Fox Nuts Market Size in 2025 | US$177.706 million |

| Fox Nuts Market Size in 2030 | US$265.120 million |

| Growth Rate | CAGR of 8.33% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Fox Nuts Market |

|

| Customization Scope | Free report customization with purchase |

The fox nuts market is segmented and analyzed as follows:

- By Product

- Inorganic

- Organic

- By Application

- Human consumption

- Industrial

- By Distribution Channel

- Online

- Offline

- Hypermarkets

- Supermarkets

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America