Report Overview

Foldable Display Market - Highlights

Foldable Display Market Size:

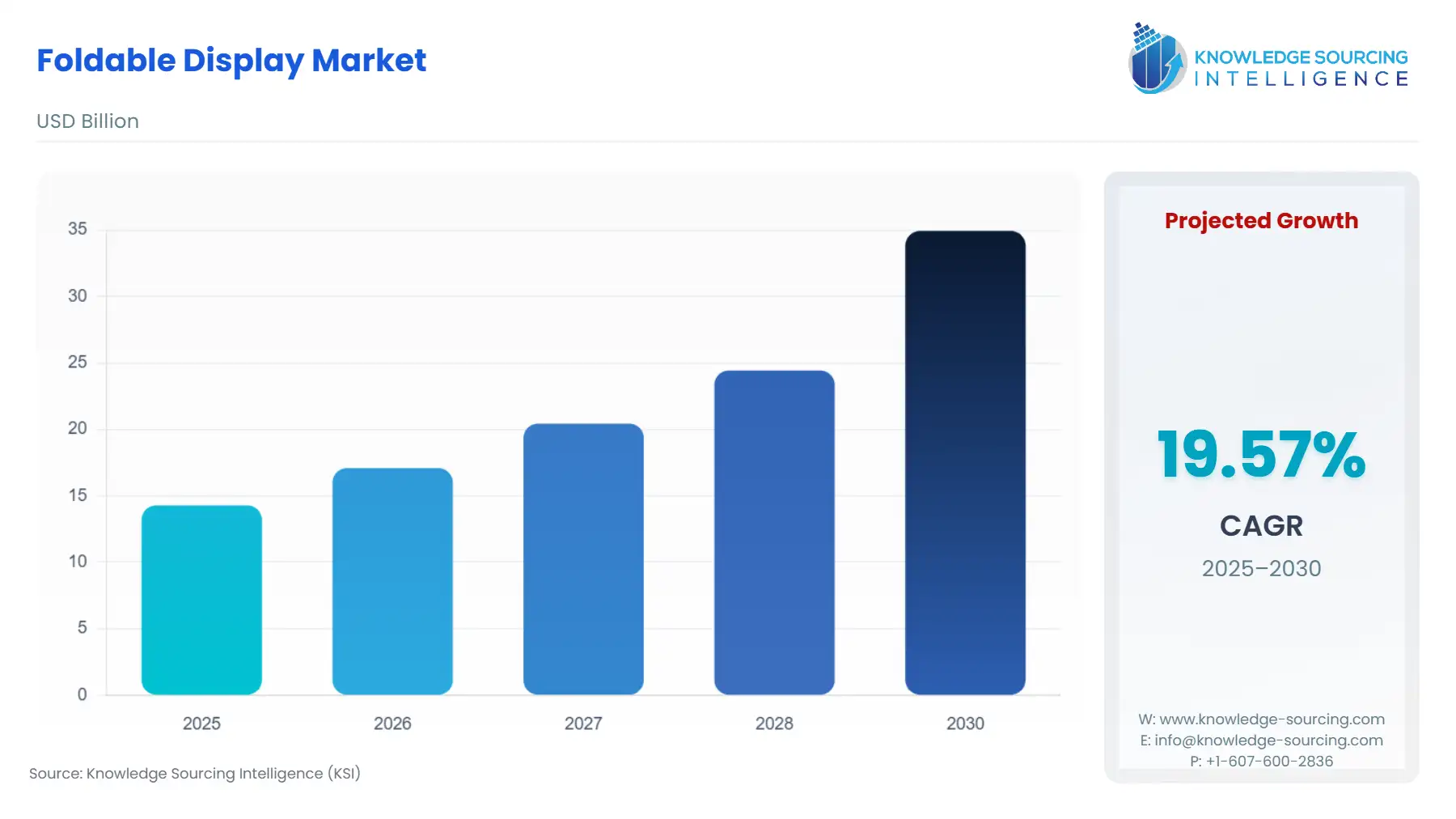

The foldable display market is valued at US$14.297 billion in 2025 and is expected to grow at a CAGR of 19.57% over the forecast period to reach a total market size of US$34.943 billion in 2030.

A foldable display is a screen technology that offers bending or folding without damaging the display itself. The primary areas of application include smartphones, tablets, and many portable devices because of the additional benefit of enlarged screens with retention of portability. Flexible OLED is commonly used in this kind of display, such that the curvaceous display will bend when necessary but does not compromise image quality.

The primary benefit of foldable displays is that they allow for the integration of compact convenience with the functionality of larger screens. For instance, a foldable phone may be closed up in a small form factor but open up into a tablet-like experience. Such flexibility also opens up more versatile use cases, such as multi-tasking on a larger screen or watching videos in a more immersive format.

However, foldable displays are prone to several problems, including damage, because the folding mechanism might degrade with use and the display itself can develop creases. Nonetheless, through materials science advancements, engineering innovation, and design, the reliability and durability of foldable devices are being made better with every passing day. With maturing technology, foldable displays are likely to go mainstream and thus unlock new experiences and applications.

Foldable Display Market Growth Drivers:

- Increasing innovation in consumer electronics.

Innovation in consumer electronics is a major driving force behind the foldable display market, as it changes the way people interact with their devices. Foldable displays present a new approach to design, enabling devices to transition between compact and expansive forms. This flexibility is particularly appealing in smartphones, where foldable designs enable users to carry a compact device that unfolds into a larger screen for enhanced usability. For example, Samsung Galaxy Z Fold and Huawei Mate X illustrate that foldable technology can relate portable smartphones with the functionality of a tablet. These types of innovations respond to the growing consumer demand for multi-function devices maximizing convenience and productivity.

Beyond smartphones, the usage of foldable displays is driving innovation in other categories also such as tablets, laptops, and wearable devices. For instance, foldable tablets have compact designs that can expand into larger screens for content creation, gaming, and video editing. Foldable laptops are also revolutionizing the workplace by providing larger screens and enhanced multitasking capabilities without sacrificing portability. Foldable displays in the area of wearable tech will enable smartwatches with larger interfaces while simultaneously offering compact, and sleek styles for improved user experiences in the areas of fitness tracking, notifications, and much more.

This trend of innovation is not only attracting technology enthusiasts but also attracting a wider audience of people looking for something unique, versatile, and functional. Manufacturers are utilizing foldable displays to make their products stand out in a crowded marketplace, creating new possibilities for consumers about how they interact with technology. Foldable devices will continue to be mainstream, and this will be changing the landscape of mobile computing, entertainment, and wearable technology, providing an improved user experience and pushing the limits of what can be done with devices.

- Growing product offering by major market players.

Foldable screens are driving innovation in smartphone form factors, allowing for the integration of big display sizes into compact devices. With the release of several foldable smartphones by manufacturers such as Samsung and Lenovo, foldable displays are not only positioned to cause substantial upheavals in the mobile device market over the next decade, but also to catalyse the growth of the display industry as a whole.

Companies such as Samsung Display and LG, two of the world's most renowned display manufacturers, as well as others such as BOE Technology Group Co., Ltd. (BOE) and Visionox, are presently investing heavily in various types of foldable displays. With a high degree of differentiation in their displays, in terms of thickness and bending radius, each of these innovators aims to offer a unique solution to their customers. For instance, while some companies are offering folding foldable devices using all-outed displays, others are offering folding folding devices using either a partially outed display or an additional display. Not only that, but displays' bending radius has improved, with displays with bending radius less than or equal to 1.5 mm and 1.1 mm now under development, which is significantly lower than the 5 mm of bending radius in previous generations. The thickness of prior generation displays was less than or equivalent to 19 mm, but it has now been reduced to 15 mm and 12 mm, which is outstanding.

Foldable Display Market Geographical Outlook:

- The foldable display market is segmented into five regions worldwide

The global foldable display market is segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. To give a clearer view, these regional markets have been further segmented into countries that account for a significant market share. North America and Europe, which are renowned as significant markets for innovative technologies, account for a sizable portion of the global market. Market expansion in these areas is primarily driven by the presence of a strong research infrastructure, which includes several high-tech laboratories and technology-intensive manufacturing lines.

Moreover, Asia-Pacific accounts for a sizable portion of the worldwide industry. This area has some key market participants, like Samsung, LG, and BOE, among others. These firms are making significant expenditures in R&D and boosting manufacturing of these displays. Not only that, but the presence of a significant number of end-solution makers throughout the area is driving market expansion. The rapid growth of the consumer electronics industry in this region is expected to act as a supporting pillar for this market over the projected period. For instance, the output of mobile phones rose 6.9 percent year on year to 1.57 billion units, within which the number of smartphones went up 1.9 percent year on year to 1.14 billion, the data revealed. Since many of the major smartphone and tablet manufacturers in the world have production facilities in this region, demand for foldable displays is expected to strengthen over the forecast period.

Foldable Display Market Key Developments:

- In July 2024, Samsung Electronics collaborated with KRAFTON to deliver the ultimate gaming experience for DARK AND DARKER MOBILE on Galaxy smartphones.

List of Top Foldable Display Companies:

- Koppers Inc.

- KEC International Ltd.

- Samsung Electronics Co. Ltd

- Visionox Company

- AU Optronics Corp.

Foldable Display Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Foldable Display Market Size in 2025 | US$14.297 billion |

| Foldable Display Market Size in 2030 | US$34.943 billion |

| Growth Rate | CAGR of 19.57% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Foldable Display Market |

|

| Customization Scope | Free report customization with purchase |

Foldable Display Market Segmentation:

- By Display Type

- OLED

- AMOLED

- By Application

- Smartphones

- Tablets

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America