Report Overview

Fluid Loss Additives Market Highlights

Fluid Loss Additives Market Size:

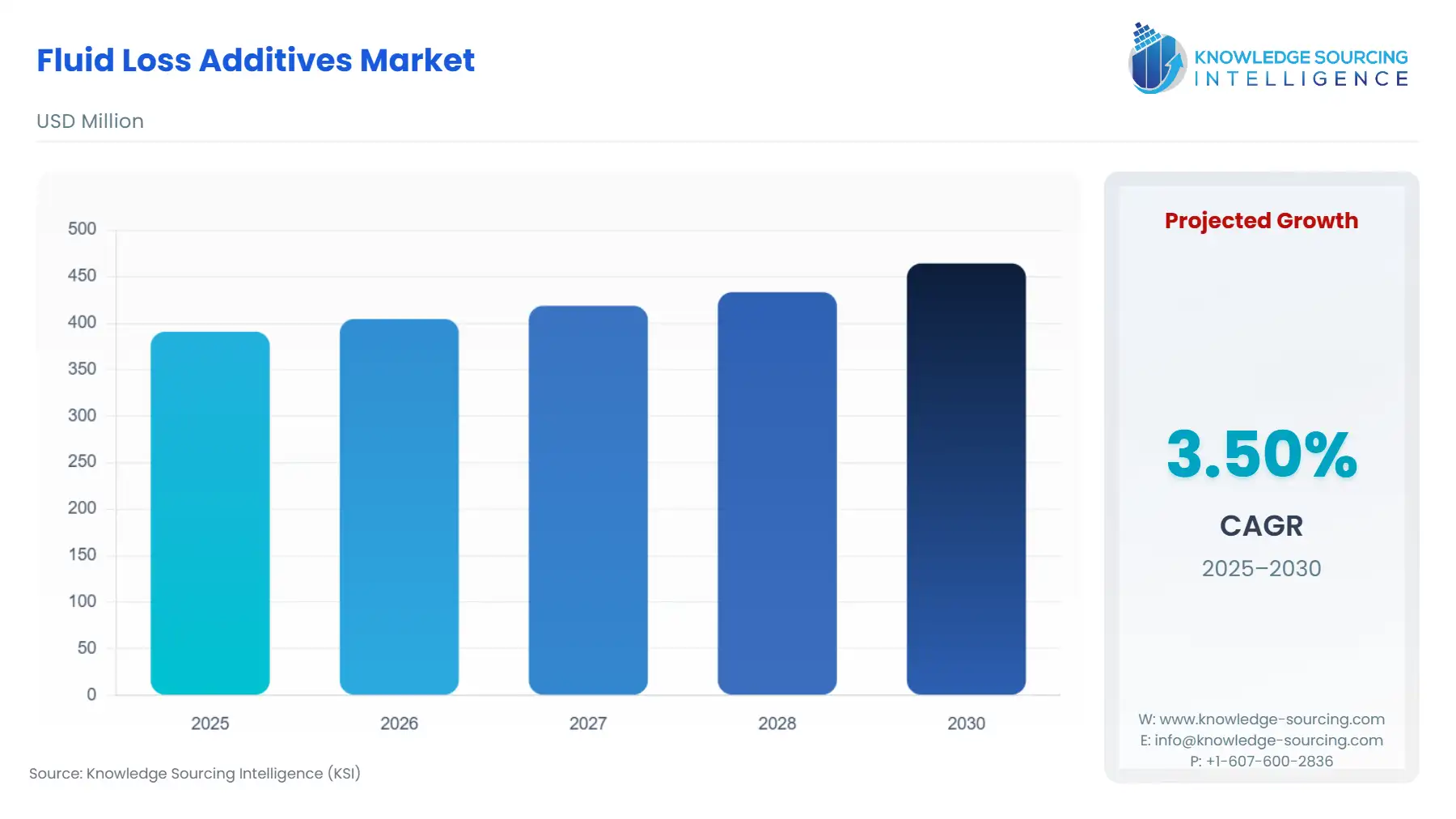

The Fluid Loss Additives Market, valued at US$390.808 million in 2025, is projected to grow at a CAGR of 3.5%, reaching a market size of US$464.234 million by 2030.

The fluid loss additives market is growing steadily at a CAGR of 3.5% during the forecast period due to the rise in oil and gas exploration and increasing deepwater drilling and geothermal drilling to meet the growing demand for energy worldwide. Technological advancements and the demand for eco-friendly additives are also driving the market growth.

Fluid Loss Additives Market Overview & Scope:

The Fluid Loss Additives market is segmented by:

- Composition: The market is segmented into natural polymer-based additives, synthetic polymer-based additives, inorganic additives, and specialty and advanced additives.

- Solubility Type: The fluid loss additives market is segmented into water-insoluble and water-soluble.

- Application: The market is segmented into Drilling fluids, Well Cementing, Construction, Water wells, Groundwater drilling, and Others.

- End-User: The market is segmented into the oil and gas industry, geothermal drilling, mining industry, construction, and others.

- Region: The Fluid Loss Additives market is segmented by region into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Top Trends Shaping the Fluid Loss Additives Market:

1. Increase demand for high-performance fluid loss additives

2. Demand for sustainable fluid loss additives

- There is an increase in demand for sustainable and eco-friendly fluid loss additives due to the rising industry’s commitment to sustainability and increasing environmental regulations.

- For instance, at ADIPEC 2023, Halliburton launched BaraFLC Nano-1, a wellbore sealant that uses a nanoparticle approach for more effective fluid loss additive formulation. The company emphasizes manufacturing sustainable fluid loss additives by designing them to work with water-based fluid systems and using nanoparticles to minimize the environmental footprint by reducing fluid waste.

Fluid Loss Additives Market Growth Drivers vs. Challenges:

Opportunities:

- Rise in oil and gas exploration: There is a growing energy demand, particularly in emerging economies, with sustained global consumption. This is driving the continuous rise in oil and gas exploration activities. It is raising the sustained growth in demand for fuel loss additives to enhance wellbore stability and minimize fluid loss. According to the U.S. Energy Information Administration, global liquid fuel production increased by 1.8 million b/d in 2025, highlighting the increasing fuel production. As per the global Energy Tracker, as of March 2024, there are 189 total in-development gas extraction areas worldwide, with 5316 operating gas extraction areas, highlighting the increasing oil and gas exploration areas driving demand for the fluid loss additives market for enhancing operational efficiency.

Challenges:

- Growing environmental concerns: The fluid loss additives market is facing serious restraints from growing environmental concerns as conventional fluid loss additives based on synthetic polymer-based additives are toxic and non-biodegradable.

Fluid Loss Additives Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region is projected to have a considerable share in the fluid loss additives market. As per the Global Energy Tracker, Asia accounts for 1057.7 bcm/y in global gas production, with 59 in development and 513 operating oil extraction areas, highlighting the significant share in the oil and gas production directly correlating with the rising demand for fluid loss additives. There is an increasing energy need for feeding the growing economies of Asia-Pacific, such as China, Japan, Indonesia, Australia, and India, driving growth in oil and gas exploration with offshore drilling projects and increasing investment in renewable energy, such as geothermal energy projects. For instance, India’s offshore and onshore well meterage grew from 792,000 in 2001-02 to 1353000 in 2011-12 as per the OGD platform of India, directly driving its fluid loss additives market expansion.

- North America: North America is projected to hold the largest significant market share in the fluid loss additives market. According to the Global Energy Tracker, the United States is the top oil and gas producer as of March 2024, with 1235.6 bcm/y, making for 31.25% of the total gas production and 3929 bbl/y oil production. Canada also produces 218.2 bcm/y of gas and 1524 bbl/y of oil. It highlights the dominance of North America, making up for 1453.9 bcm/y in gas production and a substantial share in oil production, leading to dominance in the fluid loss additives market, which is directly dependent on oil and gas exploration.

Fluid Loss Additives Market Competitive Landscape:

The market is moderately consolidated, with the presence of some of the key notable players such as Halliburton, Schlumberger, Borregaard AS, and BASF, among others. The market is highly competitive, with a growing focus on high-performance additives for the HPHT wells and expanding digital solutions. Players are increasingly focusing on nanotechnology-based and eco-friendly additives to maintain their position in the highly competitive market. The market strategies include:

- Product Expansion: In August 2023, Aubin Italmatch Chemicals Group extended its suite of fluid loss additives by adding Aubin CFL-600L. Aubin® CFL-600L has been qualified up to 200 °C (400 °F), providing high quality, reliable, high-temperature fluid loss additive.

Fluid Loss Additives Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Fluid Loss Additives Market Size in 2025 | US$390.808 million |

| Fluid Loss Additives Market Size in 2030 | US$464.234 million |

| Growth Rate | CAGR of 3.5% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Fluid Loss Additives Market |

|

| Customization Scope | Free report customization with purchase |

The Fluid Loss Additives Market is analyzed into the following segments:

By Composition Type

- Natural polymer-based additives

- Synthetic polymer-based additives

- Inorganic additives

- Specialty and advanced additives

By Solubility Type

By Application

By End-User

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa