Report Overview

Floating Offshore Wind Energy Highlights

Floating Offshore Wind Energy Market Size:

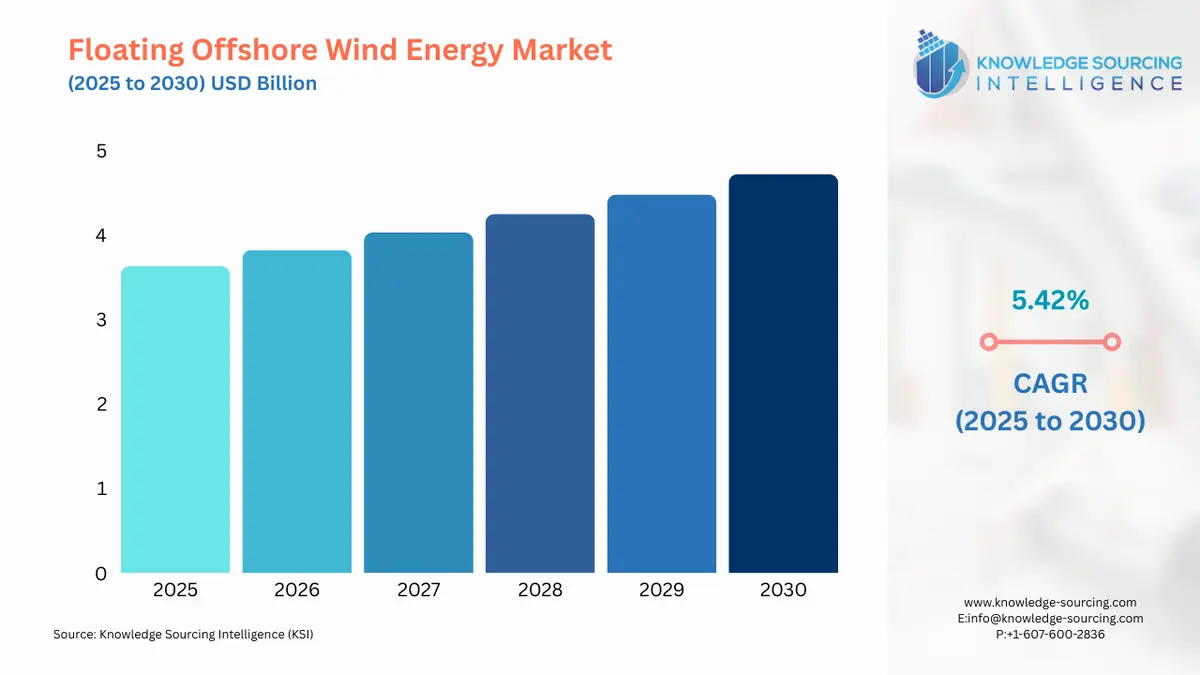

Floating Offshore Wind Energy Market, growing at a 5.26% CAGR, is projected to achieve USD 4.934 billion in 2031 from USD 3.628 billion in 2025.

Floating Offshore Wind Energy Market Trends:

Floating offshore wind energy refers to the generation of electricity from wind turbines that are mounted on floating structures anchored in deep waters, typically located far from the shoreline. There are abundant sources of wind energy in deep waters which is a major growth driver of the floating offshore wind energy market. Moreover, the rising environmental concern followed by commitments to reduce carbon emissions is also expected to stimulate market expansion. Further, government policies along with technological advancements and institutional support are accelerating the floating offshore wind energy market.

Floating Offshore Wind Energy Market Growth Drivers:

Abundant Wind Resources in Deep Waters

Many regions with significant offshore wind potential have deep waters that are unsuitable for fixed-bottom installations. Floating offshore wind technology enables access to these untapped wind resources which is expected to propel the floating offshore wind energy market. For instance, within 50 nautical miles of the U.S. coast, deep-water wind resources can produce 900 GW of energy as per the NCBI study. Moreover, about 68 percent of the offshore wind resources in the US are located in regions with deep water according to the Office of Energy Efficiency & Renewable Energy. Additionally, more than 80% of potential offshore wind sources in Europe are located in deep waters.

Rising Carbon Reduction Commitments

Governments and international agreements such as the Paris Agreement have set ambitious targets to mitigate climate change and reduce carbon emissions. Floating offshore wind energy is a renewable energy source that plays a crucial role in achieving these goals therefore these increasing commitments are accelerating the floating offshore wind energy market. For instance, the European Commission aims to increase the EU's goal to reduce greenhouse gas emissions to at least 55% below 1990 levels by 2030 under the 2030 Climate Target Plan. Moreover, a High-Level Expert Group on the Net-Zero Emissions Commitments of Non-State Entities was established by the UN Secretary in March 2022.

Government and Institutional Supportive Policies

Many governments worldwide have implemented supportive policies and financial incentives to encourage the development of renewable energy, including floating offshore wind. These policies include feed-in tariffs, tax credits, and renewable energy targets which are stimulating the floating offshore wind energy market. For instance, the US Department of Energy's Floating Offshore Wind Energy Shot initiative aims to lower the cost of floating offshore wind energy by more than 70%, to $45 per megawatt-hour for deep ocean locations far from shore by 2035. Moreover, the coalition agreement (2021) and the climate accord (2019) both contain commitments to uphold the Netherlands' offshore wind energy policy.

Technological Advancements

There have been significant technological advancements in floating offshore wind technology, leading to cost reductions and increased efficiency. For example, various innovative designs for floating platforms have been developed, such as semi-submersible, spar-buoy, tension leg platform (TLP), and barge-like structures. These platforms are engineered to withstand harsh offshore conditions and provide stable foundations for wind turbines. The construction of the world’s largest floating farm named Hywind Tampen using spar-buoy technology was started in October 2020 in Norway. Moreover, wind turbine technology has seen continuous improvements including larger rotor diameters, higher hub heights, and more efficient blade designs. These enhancements increase the energy capture and efficiency of floating offshore wind turbines.

Floating Offshore Wind Energy Market Restraints:

The floating offshore wind energy market has experienced growth and development however some restraints or challenges can impact its expansion. For example, it is still considered relatively new and less mature than fixed-bottom offshore wind or other renewable energy sources. Additionally, increased use of solar and gas energy, which are among the greener energy sources, is anticipated to reduce the need for wind energy. Further, floating offshore wind turbines are exposed to harsh marine environments and extreme weather conditions, which can impact their performance and require robust engineering solutions. Each project site presents unique challenges and designing suitable floating platforms for specific locations can be complex.

Floating Offshore Wind Energy Market Geographical Outlook:

Europe is Expected to Grow Considerably

Europe is expected to hold a significant share of the floating offshore wind energy market during the forecast period. The factors attributed to such a share are increasing installations of wind energy plants, numerous collaborations and projects, favorable government policies, and abundant sources in deep waters. For instance, an agreement for offshore oil and gas facilities that offshore wind turbines would mostly power was executed between Cerulean Winds and Ping Petroleum UK in August 2022. Moreover, the programs such as European Wind Initiative (WIP), and the Wind Energy R&D program are further expected to accelerate the market expansion.

List of Top Floating Offshore Wind Energy Companies:

Vestas Wind Systems AS, founded in 1945 is a Danish wind turbine manufacturer and one of the largest companies in the wind energy industry globally. The company's recent introduction of the V236-15.0 MWTM, the world's first 15 MW turbine aims to reduce energy costs and upend the status quo with cutting-edge technology.

Siemens Gamesa Renewable Energy SA is headquartered in Spain and it designs, manufactures, installs, and services onshore and offshore wind turbines. In July 2021, Siemens Gamesa was involved in the TetraSpar Demonstration Project, which marked a significant milestone as the first large-scale trial of a commercially-developed floating offshore wind power foundation.

General Electric Company is a multinational conglomerate with a diverse range of businesses including involvement in the renewable energy sector such as wind energy. The Haliade-X developed by the company was the first 14 MW offshore wind turbine in the sector to become operational.

Floating Offshore Wind Energy Market Scope:

Report Metric | Details |

Floating Offshore Wind Energy Market Size in 2025 | USD 3.628 billion |

Floating Offshore Wind Energy Market Size in 2030 | USD 4.723 billion |

Growth Rate | CAGR of 5.42% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Floating Offshore Wind Energy Market |

|

Customization Scope | Free report customization with purchase |

Floating Offshore Wind Energy Market Segmentation

By Water Depth

Shallow Water (less than 30 m depth)

Transitional Water (30 m to 60 m depth)

Deep Water (Higher than 60 m depth)

By Turbine Capacity

Up to 3MW

3MW-5MW

Above 5MW

By Application

Pre-Commercial Pilot

Commercial Utility-Scale

Hybrid Wind-To-X

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others