Report Overview

The Finland hearing aid market is projected to grow at a CAGR of 4.00% between 2025 to 2030.

A hearing aid is a device designed to improve hearing by making sound audible to a person with hearing loss. A hearing aid works by amplifying sound through a three-part system: The first part is a microphone that receives sound and converts it into a digital signal. The amplifier is the second part that increases the strength of the digital signal, and the speaker is the third part that produces the amplified sound into the ear of the user. The key market driver of the hearing aid market in Finland is the increasing prevalence of hearing loss due to the growing geriatric population in the country. According to the Finnish Institute for Health and Welfare, Finland's population is aging rapidly. The number of individuals aged 65 years and older was 15% in 2000, which shot up to 22% in 2019. Researchers further expect it to increase to 28% by 2050, which will accelerate the growth of the hearing aid market in the country. In addition, other factors such as the rising adoption of these devices, and the increasing awareness about technologically advanced devices for the treatment of deafness in the country will further bolster the market growth during the forecast period.

The creation of noise pollution also has a significant impact on the hearing abilities of people. Noise emission in heavy-duty industries, and public carnivals, may damage the hearing capacity of adults. According to a report by, the Finnish Federation for Hard of Hearing, in adolescents, the most common cause of hearing impairments is noise exposure during leisure time. Hearing impairments in the working-age population are usually hereditary or are caused by noise exposure, diseases such as Otosclerosis and Meniere’s disease, or infections. The prevalence of Meniere’s disease is estimated to be at least 43 cases per 100 000, with an average annual incidence of 4.3 per 100 000 in Finland, which will further result in driving the growth of the hearing aid market in the country. Furthermore, the hearing service offices and general healthcare service associations of the Finland government are emphasizing early screening of deafness and the provision of hearing aids to the population. The healthcare infrastructure in the country is rapidly developing to meet the growing medical needs of the population. Finland offers its residents universal healthcare facilities. The prevention of diseases and other types of health promotion has been the main focus of Finnish healthcare policies for decades which has resulted in the eradication of certain communicable diseases and improvement in the overall health of the population, such initiatives by the government will further proliferate the market growth as more number of people will be tested for hearing problems which will subsequently increase the demand for hearing aids in the country.

By type, the behind-the-ear (BTE) hearing aid device segment is expected to hold a significant market share due to better connectivity, high efficiency, easy usage, a wide range of applications, and wider target patients. BTE is considered to be ideal for most people with hearing problems owing to which it is projected to grow at a high CAGR during the forecast period. By end-user, the adult population is estimated to have a dominant market share owing to the growing number of hearing loss cases associates with aging population as compared to the infants in the country. However, in Finland, one out of approximately every 1,000 newborns has at least a moderate hearing impairment, which will increase the market share of infants over the next five years.

Growth Factors.

- Increasing incidence of people with hearing loss.

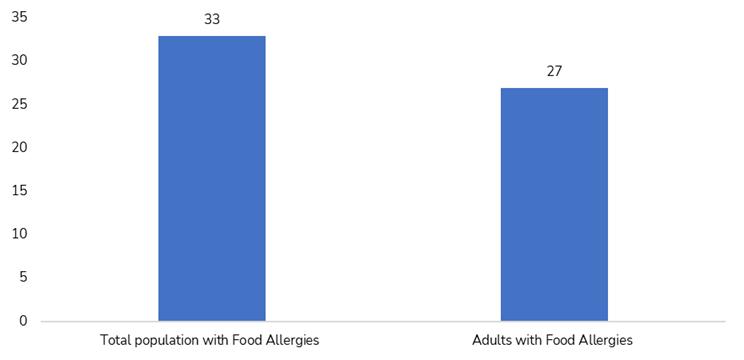

The Finland population has been witnessing a constant surge in the number of patients suffering from hearing loss or hearing difficulties over the last few years. The incidence of hearing loss in the Finnish population has been on a surge right from infants to adolescences to the geriatric population. The increasing incidence of hearing loss will provide lucrative growth opportunities for hearing aid in the country as the growing number of patients will subsequently increase the demand during the forecast period.

COVID–19 Impact On Finland Hearing Aids Market

The Covid-19 pandemic negatively impacted the Finland Hearing Aid market as due to the lockdown restrictions imposed by the Government of Finland the production of hearing aids came to a halt. The companies could not produce products for months at a stretch which caused a gap between the supply and the demand. Also, many patients deferred their visits to the hospitals to get their ears checked to avoid crowded places which further reduced the demand for hearing aids in the market. However, with the lockdown restrictions being eased out in the country, the market is expected to rebound especially since due to the increasing use of masks, people suffering from hearing difficulties who would earlier resort to lip-reading will be unable to do so which will further increase the demand for hearing aids in the country.

Competitive Insights.

The market leaders for the Finland Hearing Aid Market consist of GN ReSound Finland Oy/Ab, Phonak-Sonova Holding AG, Widex Akustik OY, and William Demant A/S[1]. The key players in the market implement growth strategies such as product launches, mergers, and acquisitions, etc. to gain a competitive advantage over their competitors. For instance, 3D app from GN ReSound allows users to communicate with their hearing care professional and receive an adjustment without an office visit.

Segmentation:

- By Product Type

- Behind-the-ear (BTE)

- In-the-ear (ITE)

- In-the-canal (ITC)

- Receiver-In-The-Ear (RITE)

- Completely-in-the-Canal (CIC)

- Cochlear Implants

- Others

- By Type of Hearing Loss

- Sensorineural

- Conductive

- By Age Group

- Above 65 years

- 18 to 65 years

- Below 18 years

- By Technology

- Conventional

- Digital