Report Overview

Film Adhesives Market Report, Highlights

Film Adhesives Market Size:

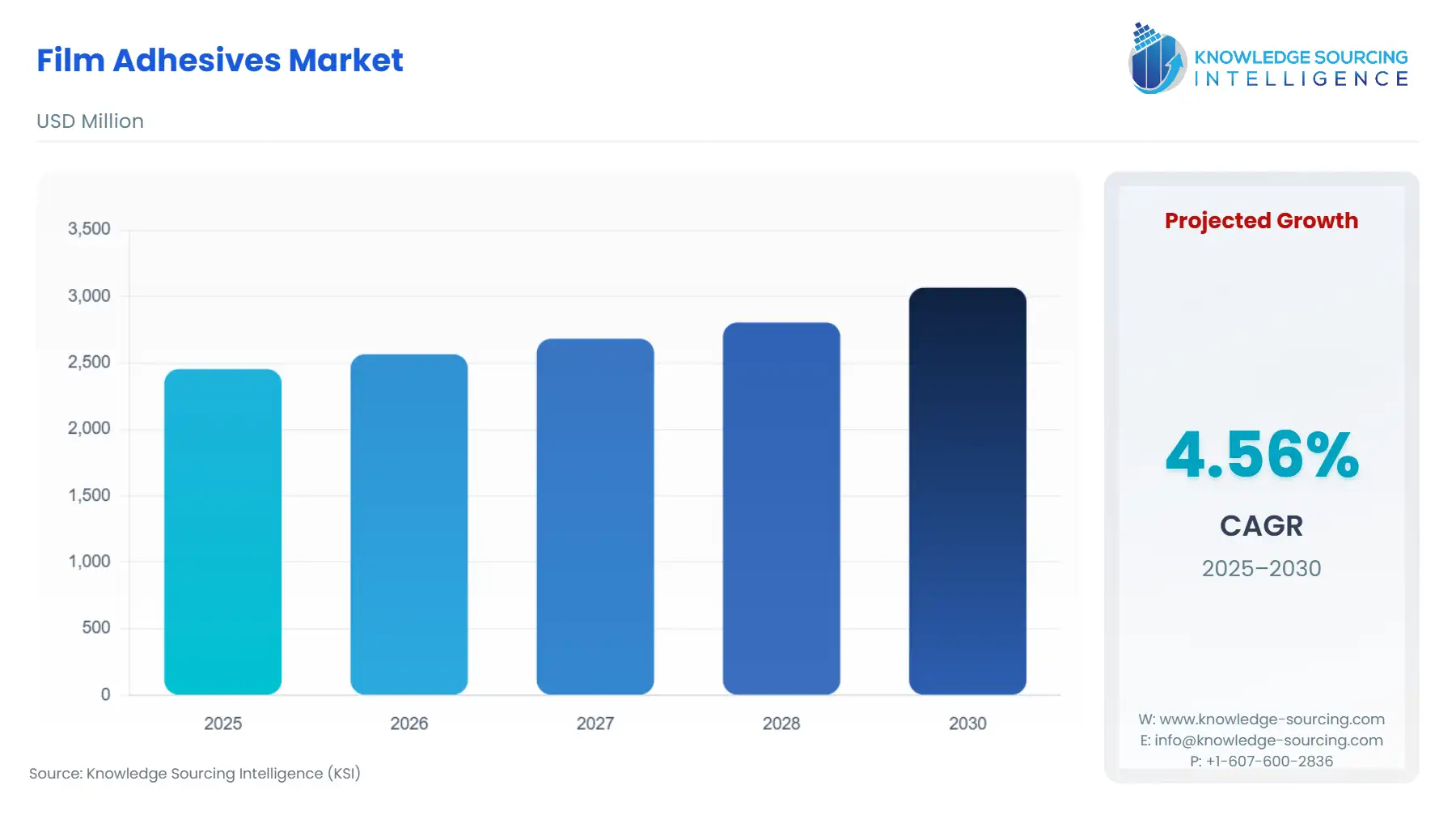

The Film Adhesives Market will reach US$3.067 billion in 2030 from US$2.454 billion in 2025 at a CAGR of 4.56% during the forecast period.

Adhesive films are materials that have been coated with adhesives, such as tapes, films, and sheets. These films have a wide range of applications and are simple to apply. Adhesive films are used to bond two surfaces together. RFID, LED lighting, aerospace electronics, construction, portable computers, consumer electronics, and automotive electronics all make use of these films. Polyethene, polyvinyl chloride, polypropylene, polyvinyl acetate, and polyvinyl butyral are among the materials used to make them.

In the electronics sector, adhesive films are used to hold information labels and warning labels. These adhesives are also utilized as an insulating wrap. Similarly, these adhesives are used in the packaging industry to improve the safety of packing materials. After the curative process, adhesive films create a permanent structural link with the attaching surface and provide great resistance in difficult conditions such as high temperatures.

Stringent government regulations to reduce carbon emissions by lowering vehicle weight, as well as demand for fuel-efficient vehicles, are driving the growth of the adhesive film market. Furthermore, advancements in the electrical and electronics, automotive and transportation, packaging, and medical industries all contribute to the growth of the adhesive film market. Another factor driving market expansion is the widespread usage of adhesive films in the automobile sector for reinforcing plates, door hinge washers, and bracket attachments.

However, the volatility of raw material costs and environmental laws concerning volatile organic compound emissions from adhesive films limit the market's growth. Furthermore, high manufacturing costs, production complexity, and product customization limit market expansion. During the projected period, however, the market is likely to benefit from the manufacture of bio-adhesive films.

During the forecast period, the Asia-Pacific region is likely to lead the market for adhesive films. The market for adhesive films has been quickly expanding in countries such as China, India, and Japan as a result of increased demand from sectors such as packaging and the automobile industry.

The demand for adhesive films in the Asia-Pacific area has been rising as a result of the region's industrial growth and improved economic conditions, as well as the region's record use of e-commerce. In the midst of the e-commerce boom, the Indian packaging sector is seeing rapid expansion and is one of the fastest-expanding categories.

Film Adhesives Market Growth Factors:

- Increase in applications of film adhesives:

Demand for film adhesives is increasing in a variety of end-use sectors, including aerospace, consumer electronics, automotive & transportation, etc. This increase in demand might be attributed to exceptional characteristics of these adhesives, such as high strength and high-temperature resistance, which are vital in the automobile sector. Film adhesives can also be applied directly. As a result, the simplicity of use of film adhesives is fueling the film adhesives industry. Because of their excellent performance and strength, epoxy film adhesives are in high demand in the automotive and transportation industries. Epoxy film adhesives can withstand high pressure and have a high fatigue resistance. The increased use of film adhesives in consumer electronics presents attractive prospects for the industry.

Film Adhesives Market Restraints:

- High cost of production:

The global film adhesives market is being held back by high production costs and a difficult manufacturing process. Demand for film adhesives is also being hampered by the availability of alternatives.

The global film adhesives market report provides an in-depth analysis of the industry landscape, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various film adhesive types and technologies, such as epoxy, acrylic, and polyurethane-based adhesives, while exploring applications across industries including aerospace, automotive, electronics, and consumer goods. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive view of the market.

Film Adhesives Market Segmentations:

Film Adhesives Market Segmentation by type

The market is analyzed by type into the following:

- Light-Curable Adhesives

- Hot Melt Adhesives

- UV-Curable Adhesives

- Epoxy Film Adhesives

Film Adhesives Market Segmentation by material

The market is analyzed by material into the following:

- Polyurethane (PU)

- Acrylics

- Epoxy Resins

- Silicone-Based Materials

Film Adhesives Market Segmentation by end-user:

The market is analyzed by end-user into the following

- Packaging Industry

- Renewable Energy

- Medical Devices and Equipment

- Construction and Infrastructure

- Consumer Goods

Film Adhesives Market Segmentation by regions:

The study also analysed the film adhesives market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Film Adhesives Market Competitive Landscape:

The global film adhesives market features key players such as Henkel AG & Co. KGaA, Hexcel Corporation, 3M H.B. Fuller Company, and Bostik (Arkema S.A.), among others.

Film Adhesives Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by type, with historical revenue data and analysis.

- Market size, forecasts, and trends by material, with historical revenue data and analysis.

- Market size, forecasts, and trends by end-user, with historical revenue data and analysis across various segments.

- Film adhesives market is also analysed across different regions, with historical data, regional share, attractiveness and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the film adhesives market to the decision-makers, analysts and other stakeholders in the easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Film Adhesives Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Film Adhesives Market Size in 2025 | US$2.454 billion |

| Film Adhesives Market Size in 2030 | US$3.067 billion |

| Growth Rate | CAGR of 4.56% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Film Adhesives Market |

|

| Customization Scope | Free report customization with purchase |