Report Overview

Fatty Acid Ester Market Highlights

Fatty Acid Ester Market Size:

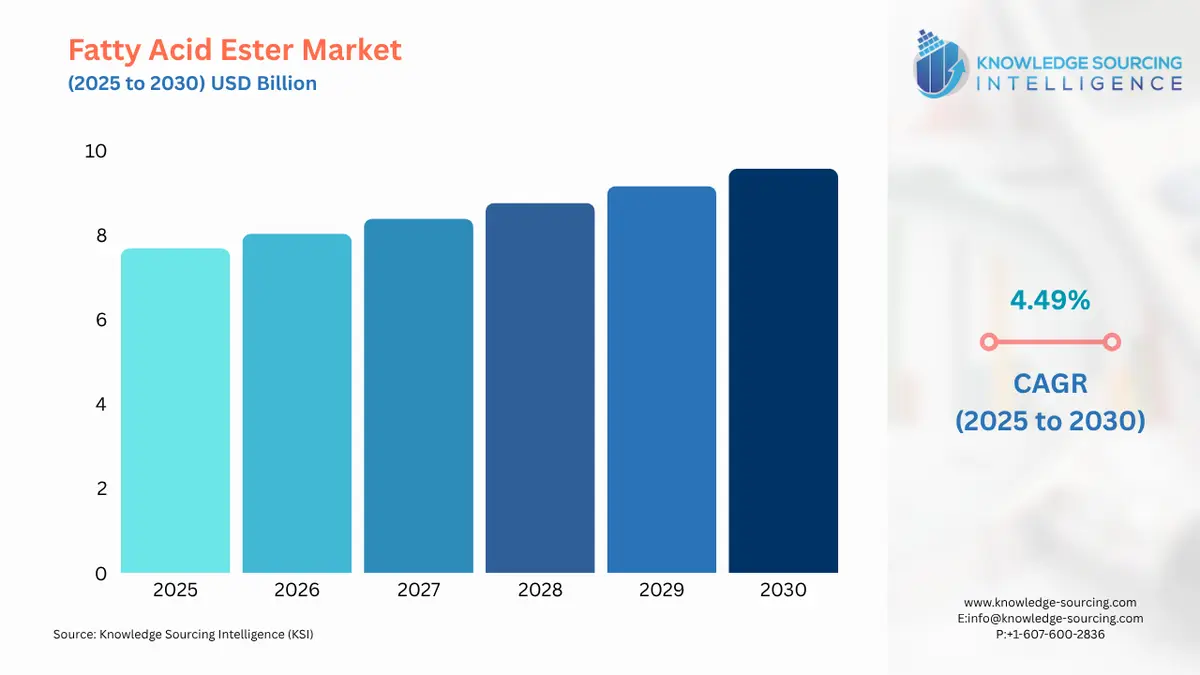

The fatty acid ester market is anticipated to grow at a CAGR of 4.49% from US$7.682 billion in 2025 to US$9.569 billion in 2030.

Fatty acid esters are compounds made by the dehydration of fatty acids and alkyl alcohol, known for softening and smoothing the skin. Fatty acid esters are majorly applied in cosmetics for the dissolution of high-polarity active ingredients and UV absorbers. Various types of fatty acid esters have been used for specific applications, including emollients and adjusting the touch of skin creams.

The demand is rising for bio-based and environment-friendly products in industries such as cosmetics, pharmaceuticals, or food processing, where fatty acid esters from renewable sources such as vegetable oils offer biodegradable and non-toxic properties that make the alternatives appear even less advantageous than synthetic chemicals. Furthermore, the fact that they are increasingly used as an alternative fuel in the production of biodiesel increases demand. High awareness of sustainability and favorable regulatory policies on green technologies further boost the market growth. Increased personal care and cosmetic product usage creates demand for fatty acid esters, which are used in emulsifiers, moisturizers, and surfactants.

Fatty Acid Ester Market Growth Drivers:

- Growth in the Personal Care and Cosmetics Industry

The personal care and cosmetics market is growing, serving as a significant growth driver of the fatty acid ester market.

Due to their versatility, these esters find significant application in skincare, haircare, and cosmetic formulations. They act as emulsifiers in skincare to stabilize and mix the oil and water-based ingredients in products like lotions, creams, and sunscreens. They also act as an emollient and moisturizer, hydrating the skin and making it soft and smooth. In hair care, fatty acid esters act as conditioners for the hair, improving hair texture and giving shine to the hair.

South Korea is one of the top ten worldwide beauty markets in terms of market share and is known for its innovative products, natural ingredients, and eye-catching packaging. According to Korea Customs Service estimates for 2022, skincare cosmetics remained the most popular import category, accounting for 41.8%, or $711 million, of total cosmetic imports.

As the trend requires natural and environment-friendly clean-label products, mainly from renewable plant sources such as coconut and palm oil, fatty acid esters are preferred as gentle and non-toxic. The increasing popularity of anti-aging and sensitive skin care products has also made fatty acid esters a commodity because they can soothe and protect the skin. Moreover, the trend of organic, cruelty-free, and sustainable beauty products increases the demand for fatty acid esters to be an essential product in the modern cosmetics industry.

- Rising Focus on Sustainability

Demand for sustainable and bio-based products is driving the market for fatty acid esters. As demand for environment-friendly alternatives against synthetic chemicals builds among consumers and industries, the derivatives found in renewable sources, from vegetable oils to animal fats, will solve the problem of biodegradable, non-toxic fatty acid esters. They have particularly taken ground in categories such as personal care, food, and biofuels, where fatty acid esters are applied as natural emulsifiers, stabilizers, and moisturizers, replacing synthetic additives.

Gaining consumer awareness of environmental impact and supportive government policies are encouraging sustainability, and industries respond to these renewable, bio-based ingredients. This trend is further strengthened by the rising demand for biofuels, particularly biodiesel, where fatty acid esters play a crucial role. As sustainability continues to be a key focus, the market for fatty acid esters will expand across multiple sectors.

Fatty Acid Ester Market challenges:

The fatty acid ester market faces several challenges, including volatility in raw material prices, particularly for vegetable oils and animal fats, which impact production costs. Supply chain disruptions and competition from cheaper synthetic alternatives also hinder growth. Limited awareness in emerging markets slows adoption, while varying regulatory standards create market entry barriers.

Additionally, the technical complexity and energy intensity of esterification processes increase production costs. The environmental factors associated with sourcing palm oil create another hurdle in market expansion by requiring sustainable alternatives. Together, these factors hinder optimal market growth.

Fatty Acid Ester Market Geographical Outlook:

- The fatty acid ester market is segmented into five regions worldwide

Geography-wise, the fatty acid esters market is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. North America and Europe, while mature markets, continue to innovate and focus on natural and organic formulations, aligning with consumer preferences for clean beauty. Europe, for instance, is a worldwide flagship market for cosmetics and personal care goods, with a retail sales value of €96 billion in 2023. The largest national markets for cosmetics and personal care goods in Europe are Germany (€15.9 billion), France (€13.7 billion), Italy (€12.5 billion), the United Kingdom (€11.0 billion), Spain (€10.4 billion), and Poland (€5.2 billion).

The Asia-Pacific fatty acid ester market, on the other hand, is gaining weight with the escalating demand for bio-based and sustainable products in several industries. The rising personal care and cosmetics sector increases the use of fatty acid esters as emulsifiers and moisturizers. Following this, the Indian cosmetics sector is segmented mainly into skin care, hair care, oral care, fragrances, and color cosmetics categories. The market share is expected to reach $20 billion by 2025, with a compound annual growth rate of 25%. On the other hand, the global cosmetics industry is growing at a 4.3% CAGR and is projected to reach US$ 450 billion by 2025. These characteristics foster significant development and opportunities in the Asia Pacific emollient ester industry.

Growing health-conscious and wellness-driven awareness further accelerates the adoption of fatty acid esters in food and cosmetics markets. Apart from this, rapid industrial growth in emerging economies further supports market expansion.

Fatty Acid Ester Market Recent Developments:

- In October 2023, at the SEPAWA Congress in Berlin, BASF presented its latest solutions for the home care and industrial & institutional (I&I) cleaning and personal care markets.

List of Top Fatty Acid Ester Companies:

- Umicore

- Cremer Oleo

- Cargill

- Govi

- Emery Oleochemicals

Fatty Acid Ester Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Fatty Acid Ester Market Size in 2025 | US$7.682 billion |

| Fatty Acid Ester Market Size in 2030 | US$9.569 billion |

| Growth Rate | CAGR of 4.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Fatty Acid Ester Market |

|

| Customization Scope | Free report customization with purchase |

Fatty Acid Ester Market Segmentation:

- By Product

- By Application

- Personal Care & Cosmetics

- Lubricants

- Food Processing

- Surfactants & Detergents

- Pharmaceuticals

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America