Report Overview

Explainable AI Market - Highlights

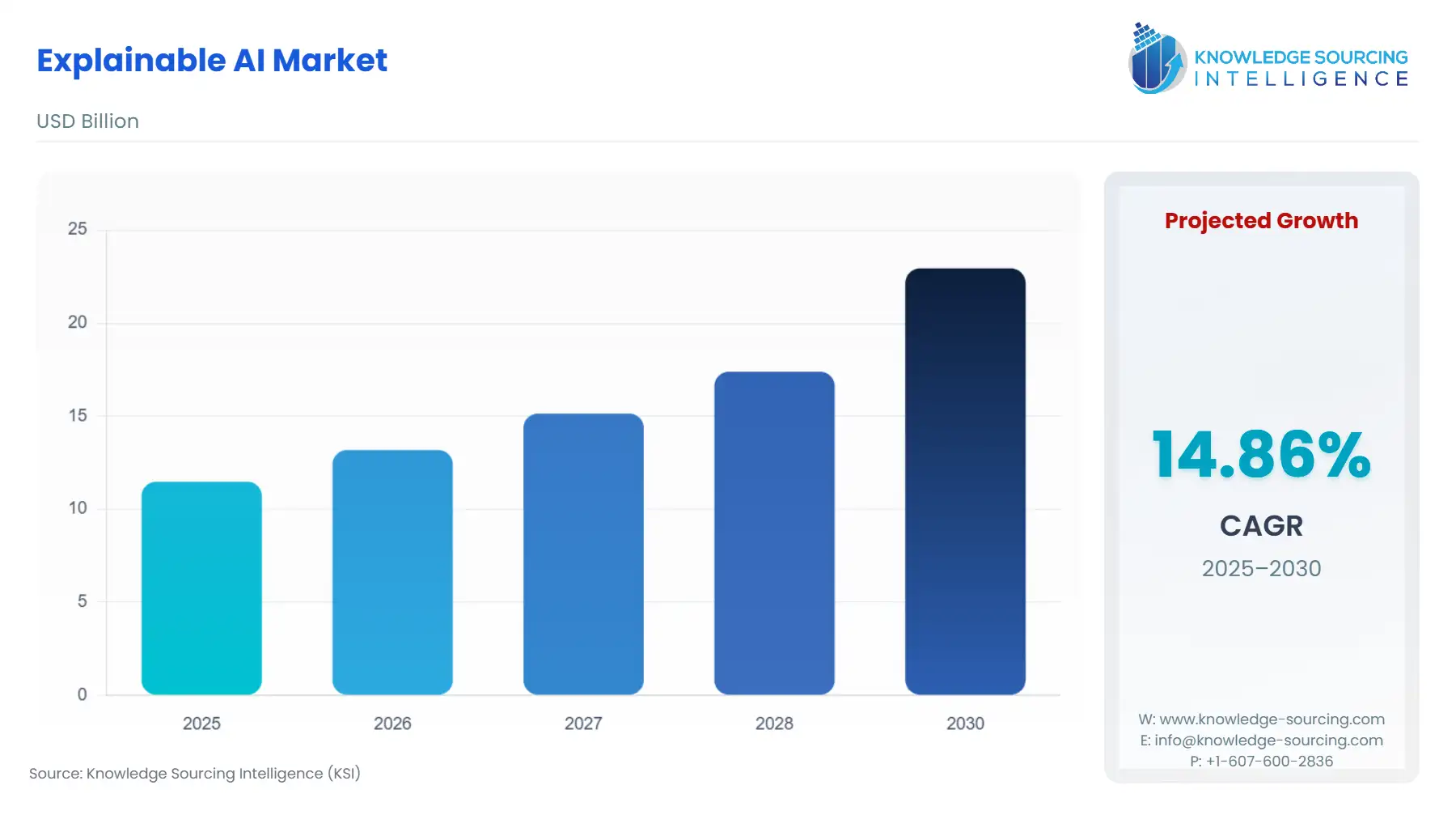

Explainable AI Market Size:

The Explainable AI Market is expected to grow at a CAGR of 14.86%, reaching a market size of US$22.944 billion in 2030 from US$11.476 billion in 2025.

Explainable AI is an artificial intelligence model that helps find the accuracy, transparency, and outcomes in AI-powered decision-making. It refers to processes and methodologies that help human users comprehend and create trust in the results and output produced by machine learning algorithms. As users face challenges in understanding how AI-powered decision-making systems have come to a result, explainable AI helps them overcome those challenges by building trust in users about these outcomes. Thus, explainable AI plays a crucial role in any organization where the AI model is used for building consumer trust and confidence.

This market is experiencing significant growth due to its usage and value offered among various industries. It helps build trust and confidence in AI decision-making production, helps manage the risk and cost of model governance, and speeds up AI results. Moreover, with the growing adoption of AI across industries such as healthcare, finance, etc., the demand for transparency and confidence in decisions made by AI is important, driving this market. Government regulatory requirements are also pushing accountability and transparency in AI systems.

Explainable AI Market Growth Drivers:

- Rising AI adoption across sectors fuels the need for explainable AI to build trust and ensure transparency.

The demand for AI is growing. Various industries such as healthcare, finance, retail, manufacturing, e-commerce, and government services are increasingly demanding AI-based models to be incorporated into their systems to drive efficiency in their critical decision-making. The increasing adoption of AI in business can be enumerated by a new survey done by SAP on its customers. The survey highlights that 96% of its 2000 surveyed customers said that they have mandates from their executives for exploring and implementing AI technologies in their businesses. Only 4% said that they have not received any mandate. The increase in demand by the customers can also be understood by the fact that 52% of respondents said that they would increase AI expenditure by 25% to 50% in the next two years, and 14% of respondents said that they would increase their AI budgets by 50% to 70%. Thus, the data highlights the increasing trend towards AI adoption and rising expenditure on AI.

The growth in AI adoption creates challenges for users and organizations in comprehending the decisions made by AI algorithms. As a result, the demand for explainable AI for building trust, confidence, and transparency in decision-making increases. This is validated by Stanford University's “Artificial Intelligence Index Report 2024”, which highlights that 44% of surveyed organizations consider transparency and explainability to be key concerns in AI adoption.

- Regulatory requirements are driving the market growth

The number of AI-related regulations in the U.S. has risen significantly in the past year and over the last five years. In 2023, there were 25 AI-related regulations, up from just one in 2016.

Explainable AI Market Segmentation Analysis:

- By Industry vertical, the Healthcare segment will grow at a constant rate during the forecast period

The healthcare segment is growing continuously in the explainable AI market due to its increasing adoption of AI in the healthcare segment for diagnostic precision, guiding treatment decisions, and many other reasons. In 2022, the FDA approved 139 AI-related medical devices, a 12.1% increase from 2021. Since 2012, the number of FDA-approved AI-related medical devices has increased 45-fold, highlighting the increasing adoption of AI in healthcare, as the Artificial Intelligence Annual Report Index 2024 suggests. The increasing AI adoption has increased the demand for building trust and confidence in the AI decision-making process, particularly due to the critical nature of the sector. This is driving the demand for explainable AI. For instance, XAI is used to accelerate diagnostics and image analysis. Governments' growing regulatory requirements are driving the market expansion of XAI in healthcare.

Explainable AI Market Geographical Outlook:

- North America will hold the largest market share during the forecast period

Based on Geography, North America is estimated to hold a significant share of the explainable AI Market. The USA will particularly drive this market dominance. North America is continuously growing in the AI market, leading to the market growth of explainable AI. Additionally, strict regulations for transparency and accountability in decision-making are driving the explainable AI market. Further, the investment and research into developing XAI models by universities and market players is propelling the market. The data from Standard University reports highlights that the U.S. is leading China, the EU, and the U.K. as the leading sources of top AI models. In 2023, 61 notable AI models originated from U.S.-based institutions, far outpacing the European Union’s 21 and China’s 15.

The European market will also grow significantly due to the increasing adoption of AI and demand for explainable AI. Government regulatory requirements, such as GDPR, drive market growth.

The Asia Pacific region will witness market growth during the forecast period due to the increasing adoption of AI by countries like China, Japan, South Korea, India, and others, boosting the need for XAI.

Explainable AI Market Recent Developments:

- In February 2024, Ericsson launched the new Explainable AI within its cognitive software portfolio for communication service providers. It also introduced a new user interface to boost the CSPs.

- In May 2024, Fujitsu Limited introduced the deployment of “Explainable AI” technology for genomic medicine and cancer treatment planning. This newly developed XAI technology combines data from images to differentiate between the pictures. This identification technology improves the accuracy of object identification by 2% compared with conventional technologies. This new XAI will help classify lung cancer and determine survival predictions for breast cancer patients and others.

Explainable AI Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Explainable AI Market Size in 2025 | US$11.476 billion |

| Explainable AI Market Size in 2030 | US$22.944 billion |

| Growth Rate | CAGR of 14.86% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Explainable AI Market |

|

| Customization Scope | Free report customization with purchase |

Explainable AI Market Segmentation:

- By Type

- LIME (Local-Interpretable Model-Agnostic Explanations)

- SHAP (Shapely Additive Explanations)

- Partial Dependence Plots (PDP)

- Others

- By Deployment

- On-Premises

- Cloud

- By Application

- Error detection and Debugging

- Fraud Detection and Management

- Supply chain management and Predictive Maintenance

- Others

- By Industry Vertical

- Healthcare

- Financial & Banking Services

- Government and Public sector

- IT and Telecommunication

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America