Report Overview

EV Powertrain Market - Highlights

EV Powertrain Market Size:

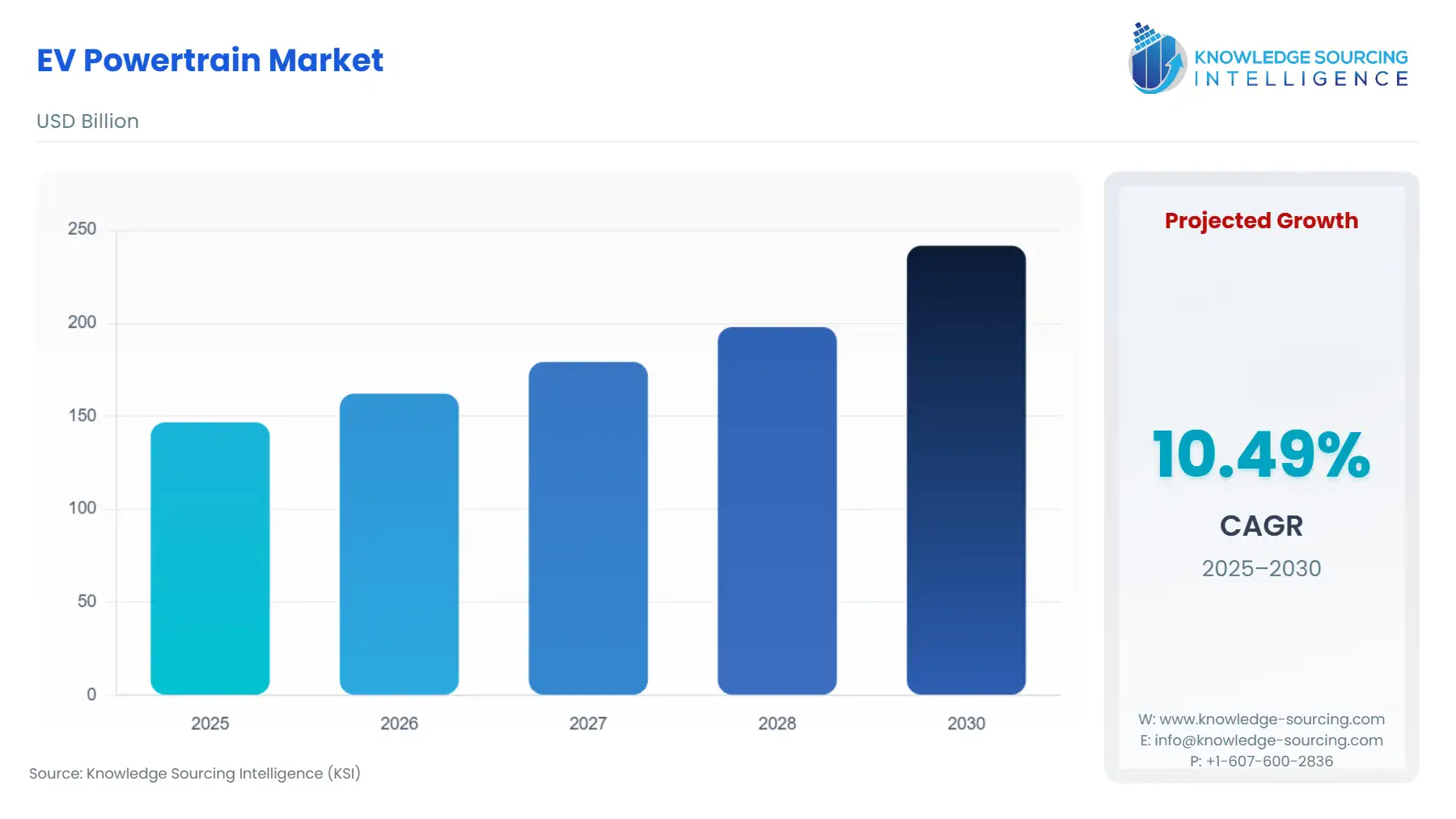

The EV powertrain market will grow from USD 146.718 billion in 2025 to USD 241.632 billion in 2030 at a CAGR of 10.49%.

EV Powertrain Market Trends:

The electric vehicle (EV) powertrain market is experiencing robust growth, driven by the global surge in electric vehicle adoption. The EV powertrain, comprising the motor, battery pack, inverter, converter, power management system (PMS), and reduction gears, is the core system generating motion in EVs. The Asia-Pacific region, led by countries like China, Japan, and India, dominates this market due to supportive policies and rapid EV market expansion.

Key drivers include stringent government emission regulations, rising public demand for eco-friendly vehicles, and advancements in battery technology and electric motors. These factors enhance energy efficiency and vehicle performance, boosting the EV powertrain market. Original Equipment Manufacturers (OEMs) are prioritizing innovative EV platforms, focusing on optimized battery architecture and intelligent packaging to improve range and efficiency. The adoption of design-to-cost strategies in developing lithium-ion powertrains further supports affordability and scalability.

The Asia-Pacific region leads due to its strong EV manufacturing base and government incentives promoting clean energy. Policies targeting zero-emission vehicles and subsidies for EV production in China and India drive market growth. Innovations in powertrain technology, such as enhanced thermal management and lightweight reduction gears, address challenges like cost and efficiency. As global demand for sustainable transportation rises, the EV powertrain market is poised for sustained expansion, supported by technological advancements and green mobility initiatives.

EV Powertrain Market Growth Drivers:

One of the major factors is a global rise in the sales of electric cars, which calls for the rapid improvement of EV technology by automobile manufacturers. This is evidenced by the fact that there is an increasing call towards the use of EVs because of several measures implemented by different governments worldwide, such as the provision of subsidies and the setting of CO2 emissions targets. Over time, as manufacturers of vehicles increase their capabilities and research new frontiers to meet the growing market, powertrains for the EV market are being promoted.

The cost of electric powertrains and their evolution are important elements. Concern for EVs, especially in developed countries, is the cost reduction of electric power trains, which has been decreasing. Battery technology had further advancements with the mass manufacturing technology being introduced; the costs of electric power trains came down, making EVs relatively cheaper and more accepted. The ever-growing application of lithium-ion batteries, which are integral parts of EV powertrain systems, presents great potential to the market. Manufacturing industries tend to focus more on research & development of better batteries in performance and cost, thus giving rise to the EV powertrain market.

Another factor aiding the EV powertrain market’s growth is the increased adoption of hybrid electric vehicles (HEVs) in developed countries. HEVs are equipped with an internal combustion engine as well as one or more electric motors, which helps in increasing fuel efficiency and minimizing emissions as compared to standard gasoline vehicles. With the increasing awareness of global warming and climate change, especially as governments continue to enforce stricter laws regarding emissions, the need for HEVs has increased, thereby widening the adaptability of the EV powertrain.

EV Powertrain Market Segment Analysis:

- The transmission segment, according to components, is anticipated to be the fastest-growing segment during this forecast period

The demand for various power transmission components is anticipated to rise during the forecast period and in the coming years, owing to several factors, including the level of industrialization and urbanization, the need for renewable energy, and the enhancement of transmission technology, among other factors, contributing to the power transmission component market’s growth. The market segmentation along the different components shows that component transformers are singled out in terms of both products and services to increase the market share. This segment’s growth will increase because of the expensive technological adaptations of new installations involved. This segment has grown owing to the emphasis on enhancing grid stability and the reliability and growth of a microgrid system that uses conductor technologies for improving performance and perfection.

The transformer component is expected to boost the power transmission component segment’s growth. This is because power transmission systems have one of the largest units, like transformers. Therefore, the effectiveness of these elements over time, including their appropriate functioning in terms of efficiency, influences the operation of the total system.

As the demand for electric supply items increases due to a growing reliance on electricity, the overall demand for these products is expected to rise, contributing to market growth. Furthermore, increasing energy needs and investments associated with upgrading power grid systems will also promote market growth. The increase in the transformer component segment is believed to have a major impact on the growth of the power transmission component sector, as this particular component is pivotal in power transmission systems.

- The battery-electric vehicle segment is anticipated to grow the most throughout the projected period.

Out of all the EV types, battery electric vehicles (BEVs) are among the primary factors assisting in the growth of the EV powertrain market. The worldwide acceptance of EVs, previously known as solely BEVs, was mainly related to the zero emissions phenomenon of the tailpipe, affordable cost in running small distances, and the higher range of electric systems in BEVs. This concern arises because, in the future, increased demand for such technologies should be expected as emission norms are emphasized, and the public becomes more interested in the green aspects of their purchase.

The segment of BEV is driving the EV powertrain market for cars, as these cars have advanced specifications with greater complexity. Safety lubricants, for example, a specific fluid needed in those vehicles, serve such purposes as thermal management, lubrication, and electric parts interaction management concerning advanced elements. Such developments minimize the risk of rusting and the clogging of the cooling enclosures' interiors so that their operation is performed at optimal capabilities.

In addition to this, the acceptance of BEV has profoundly boosted the EV market. As the production and use of BEVs increased, a need arose for fluids that would be used to improve the efficiency of these vehicles. In that way, the enterprises are working on designing appropriate formulations and improving the existing ones for the requirements of the operating ranges and lifetimes of batteries in the case of BEV systems.

Additionally, projections indicate that the sustainability of the BEV sector will not be a passing phase, owing to the progress in battery technology and the availability of charging stations. This indicates that as new BEV technology expands, so will the processing of automotive EV fluids and their applications. In terms of segments, forecasts predict that the BEV segment will transition to a sustainable shift due to positive developments in battery technology and charging station forecasts. This indicates that with the rise of the new BEV, which will be technologically advanced, the need for EV fluids in automotive applications will increase significantly.

EV Powertrain Market Geographical Outlook:

- The Asia Pacific region is projected to dominate the EV powertrain market during the forecasted period.

The region comprises a few major economies, such as China, Japan, India, and South Korea. This region also has some of the fastest-developing nations, such as the ASEAN nations. The combined population of India and China constitutes about 35.5 percent of the world’s total population. For this reason, it is estimated that the region of Asia that encompasses Japan, China, and India in the powertrain market promotion will come first because they already have very large production facilities and are promoting this type of green product.

The demand for EV powertrains is also expected to increase rapidly in this region. The reasons range from policies such as EV sales subsidies and the imposition of fuel efficiency ceilings on automotive companies within the marketplaces. They also include favorable taxation of EVs in the form of number plates, especially in countries such as India and China. On top of this, this region has lithium reserves; thus, battery-making plants are being established in the market. Additionally, Tesla started offering the Model 3 in South Korea at a much more affordable price, given the existing government policies and affirmative response to the adoption of EV powertrains.

Distributors in the Asia-Pacific region are urging China to capture a portion of the eastern EV powertrain supply market, which is essential. Cars are subjected to stringent emission norms, starting with the BS-VI standards in India and China’s VI standards for vehicles, which also helps in raising the stakes in the EV powertrains business.

Moreover, quite a few optimistic agreements have been signed with leading companies, which are also effectively improving the charging infrastructure in the region and facilitating market growth. To illustrate, one of Uber's rivals in China, Didi Chuxing, partnered with BP, a British oil and gas company, and established electric vehicle charging stations in the country. The Chinese automobile manufacturers CATL and BYD, which manufacture electric vehicles in China, produce batteries at a cheaper rate than all battery manufacturing companies overseas, which is conducive to the region's electrification. The EV powertrains market is also expected to undergo similar growth patterns in India.

EV Powertrain Market Key Developments:

- In June 2025, Nissan announced the launch of its third-generation e-POWER technology in Europe. It is equipped for efficiency, reducing emissions, and providing a quieter drive on its Qashqai crossover starting in September 2025.

- In January 2025, JATCO Ltd announced the opening of a new manufacturing plant in North East England, which is focused on producing a 3-in-1 electric vehicle powertrain for Nissan Sunderland Plant.

List of Top EV Powertrain Companies:

- GKN PLC (Melrose Industries PLC)

- NVIDIA

- Magna International Inc.

- Hitachi Astemo, Ltd.

- Bosch Limited

EV Powertrain Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| EV Powertrain Market Size in 2025 | USD 241.632 billion |

| EV Powertrain Market Size in 2030 | USD 146.718 billion |

| Growth Rate | CAGR of 10.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in EV Powertrain Market |

|

| Customization Scope | Free report customization with purchase |

EV Powertrain Market Segmentation:

- By Component

- Transmission

- Motors

- Battery

- By Propulsion Type

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- By Vehicle

- Passenger Car

- Commercial Vehicle

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America