Report Overview

Europe Middle East and Highlights

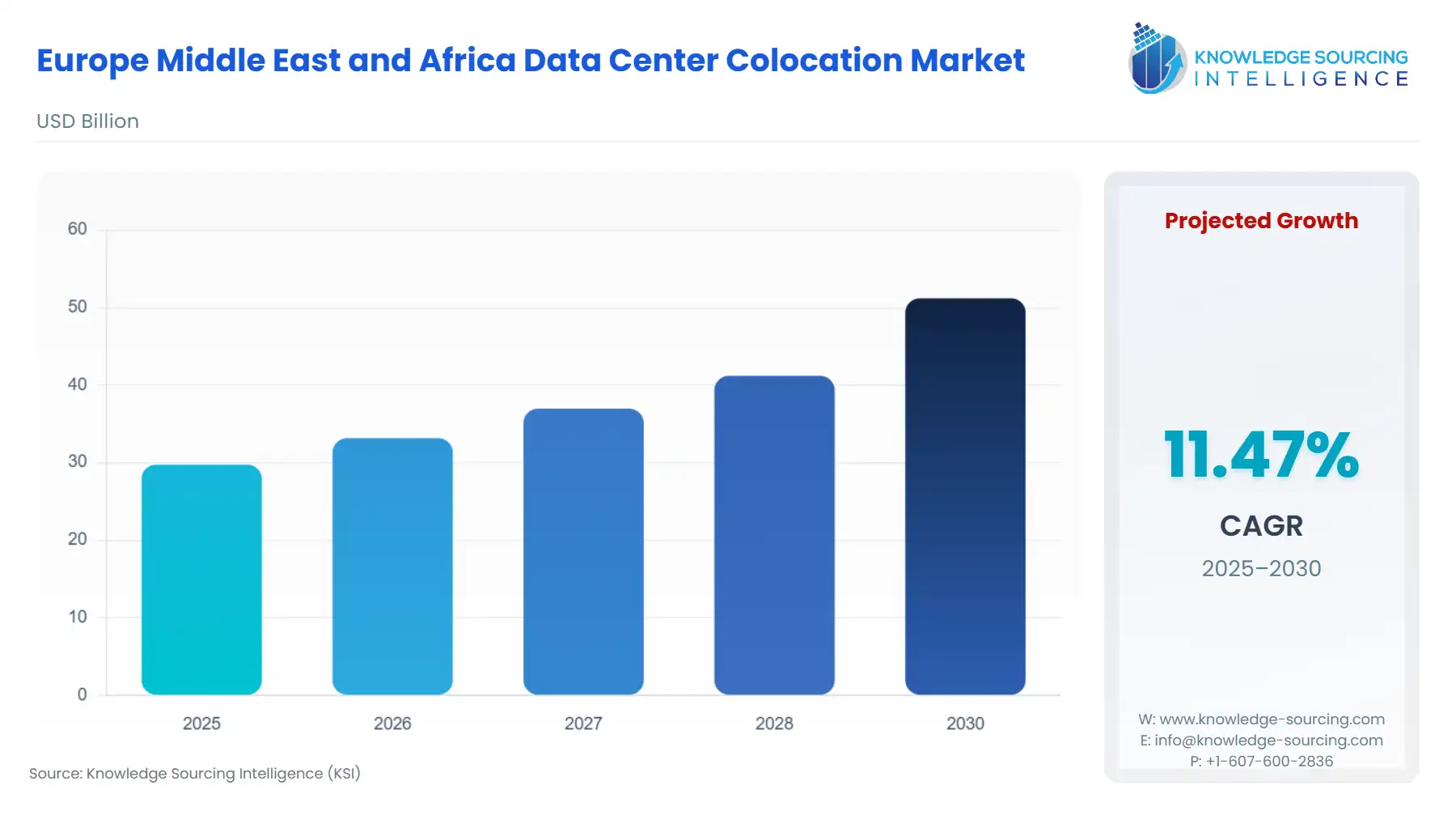

The Europe Middle East and Africa (EMEA) data center colocation market is expected to grow from USD 29.7 billion in 2025 to USD 51.2 billion in 2030, at a CAGR of 11.4%.

The increasing demand for colocation services among hyper-scale data centers users, such as big internet companies and public cloud service providers, is the major factor driving the Europe Middle East, and Africa data center colocation industry.

Europe Middle East and Africa (EMEA) Data Center Colocation Market Drivers:

Initiatives by Multinational Giants in the Region

Major cloud service providers like Facebook, Microsoft, and Google have been leasing tonnes of capacity from the colocation businesses in heavily populated cities across the European region. To draw in international investment, the Middle Eastern and African nations are seeking to implement digital transformation. The fourth industrial revolution, IoT, smart cities, and digital transformation are all fueled by the implementation of 5G networks. In the Middle East and Africa, several telecom providers have introduced 5G network services, and others are conducting 5G tests. The Greater London Authority announced intentions to alter the data center construction application procedure in August 2022 to address and alleviate the West London power problem through improved electricity management laws.

Industry Players Focussing on Market Development

The data center colocation market in EMEA is growing significantly due to rising business investment and product development in the area. For instance, the Data4 data center corporation established a new location in Hanau, Germany, in February 2023. P3 Logistic Parks, a European logistics real estate business financed by GIC, unveiled plans for a major data center park on the site of a former army barracks in Hanu, east of Frankfurt, in 2022. Additionally, in July 2022, the third data center availability zone became operational, according to a statement from Huawei South Africa. Its $5.8 million (R100 million) Cloud Spark program is anticipated to help more than 1000 small and medium-sized enterprises (SMEs). Tech startups and SMEs are both accelerated through this hybrid program.

Government Initiatives

Growing investments by the government and major manufacturers have led to an increase in data centers throughout the region. According to a report by the United States international trade commission, in 2021, some of the major European countries like the United Kingdom hold 6% while Germany, France, and Italy hold 5%, 3%, and 2% respectively of the total data center share globally. An increase in government initiatives is anticipated to fuel the data center colocation market. For instance, the French government lowered the tariffs on energy centers, which will encourage further investment there. Additionally, the Federal Act on Data Protection (FADP) in Switzerland incorporates GDPR modifications, which encourages more investment.

The UK is Expected to Grow Significantly

With the development of Infrastructure & services in the Information & communication technology sector, the UK market is emerging as a prime location for colocation services in the region. Major investment initiatives by the government are expected to boost market growth till the forecast period. According to estimates from Brand Finance, UK’s most valuable brand, Vodafone registered a rise in brand value in 2022, a rise of around 6% from 2021. This presents favorable prospects for the growth of the telecom Industry in the UK market which will positively impact the growth of the colocation market in the UK with increasing demand for data center professional services by the telecom industry.

Middle-Eastern Region is Growing Rapidly

The Middle Eastern region is witnessing various market expansion strategies. For instance, in July 2021, Saudi Arabia unveiled a USD 18 billion plan to build a national network of massive data centers. Local companies Gulf Data Hub, Al-Moammar Information Systems, and Saudi FAS Holding are among the first batch of investment partners, according to the Saudi Ministry of Communications and Information Technology. In the Middle East and Africa, several telecom providers have introduced 5G network services, and others are conducting 5G tests.

Europe Middle East and Africa (EMEA) Data Center Colocation Market Key Developments:

In January 2023, CyrusOne purchased a building in Frankfurt, Germany to convert it into a campus for data centers. Before declaring that CyrusOne was the buyer, the investment firm Corum had sold the Europark office complex in Frankfurt for EUR 95 million (USD 102.3 million).

In October 2022, Khazna Data Centers, Masdar, and EDF signed an agreement to construct a ground-mounted solar photovoltaic (PV) plant to power Khazna's new data center in Masdar City, which is part of the well-known network of hyperscale data centers in the Middle East and North Africa area.

STACK Infrastructure, the digital infrastructure partner to the majority of businesses worldwide, revealed in December 2022 that it has acquired an additional 74 acres in the heart of Prince William County. This acquired land is anticipated to add 100MW to the campus' 250MW capacity.

In August 2022, for an estimated $3.5 billion, Digital Realty, a top provider of cloud- and carrier-neutral data center, colocation, and interconnection solutions, successfully purchased Teraco, a significant South African provider of carrier-neutral data centers and connectivity services. South Africa would bring Digital Realty's total number of markets on the continent to four, including Kenya, Nigeria, and Mozambique.

Europe Middle East and Africa (EMEA) Data Center Colocation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 29.7 billion |

| Total Market Size in 2031 | USD 51.2 billion |

| Growth Rate | 11.4% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Colocation Type, Enterprises, End-User, Geography |

| Geographical Segmentation | United Kingdom, Germany, France, Spain, Italy, Saudi Arabia, UAE, Others |

| Companies |

|

Europe Middle East and Africa (EMEA) Data Center Colocation Market Segmentation:

By Colocation Type

Retail Colocation

Wholesale Colocation

By Enterprises

Small

Medium

Large

By End-user

BFSI

IT & Telecommunication

Manufacturing

Healthcare

Energy

Government

Media and Entertainment

Others

By Geography

United Kingdom

Germany

France

Spain

Italy

Saudi Arabia

UAE

Others