Report Overview

Epigenetics Drugs And Diagnostic Highlights

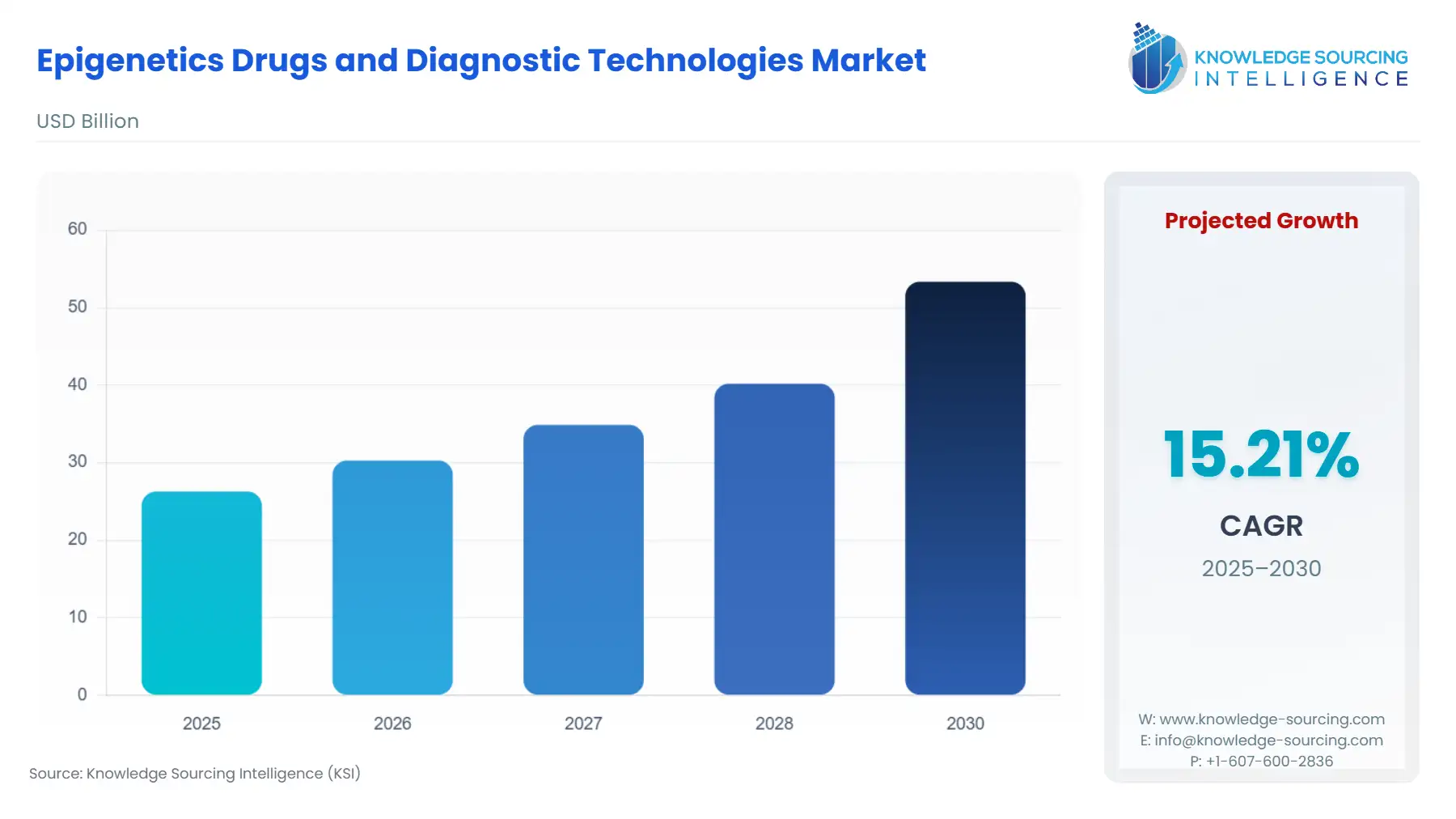

Epigenetics Drugs And Diagnostic Technologies Market Size:

The epigenetics drugs and diagnostic technologies market is expected to grow at a CAGR of 15.21%, reaching a market size of US$53.345 billion in 2030 from US$26.283 billion in 2025.

Epigenetics diagnosis is the study of genetic, cellular, and physical characteristic changes and developmental biology. Epigenetics does not change the sequence of DNA, but it shows up as an indicator of these changes. The market for epigenetics drugs and diagnostic technologies is propelled by growing disorders such as diabetes and obesity, which cause inflammatory, metabolic, cardiovascular, and oncology diseases.

Further, epigenetics also plays a role in diagnosing mental wellness. Gene expression plays a significant role in behavior, and scientists can now study neurogenetics influenced by the environment or its development. This can help the study of addiction and depression. The increasing popularity of personal genomics aids the collection of individual epigenetics and DNA sequencing. The rising focus on health has made personal genomics increasingly important to consumers. With an increase in data on DNA, epigenetic testing becomes more capable of conducting research and returns value by making personalized medicine.

Epigenetics Drugs And Diagnostic Technologies Market Drivers:

- The rising number of cancer cases

According to the American Cancer Society (ACS), in 2022, there were 20.2 million new cancer cases and 9.7 million cancer deaths globally. The commonly diagnosed cancers were breast cancer, lung cancer, prostate cancer, colorectal cancer, and stomach cancer. These are estimated to have almost 50% of the total cases.

The progression of cancer has now been identified as epigenetic abnormalities along with genetic alterations. Epigenetics development in the field of cancer shows extensive application in DNA methylation, histone modifications, nucleosome positioning, and non-coding RNAs, specifically microRNA expression. This created an emergence in the field of epigenetic therapy. Further, epigenetic tests like the Galleri test improved the diagnosis at multiple levels, as it is used to recognize cancer-specific methylation patterns. It goes beyond the routine cancer screenings to screen for more cancers, such as pancreatic and ovarian cancer.

- The increasing cardiovascular diseases caused by lifestyle habits

In the United States, there were 702,880 people who died from heart disease in 2022. This number is equivalent to 1 in every 5 deaths. Heart disease severely affects the country's economy. This included the cost of health care services, medicines, and lost productivity due to death.

Every year, about 805,000 people in the United States have a heart attack, according to the Centers for Disease Control and Prevention. As the discoveries of epigenetic mechanisms progress for cardiovascular diseases, new drug discoveries and diagnoses are possible. This includes targeting epigenetic key enzymes, especially the DNA methyltransferases, histone methyltransferases, histone acetylases, histone deacetylases, and their regulated target genes can alter the treatment of cardiovascular diseases. These developments will greatly enhance the treatment and diagnostic procedures.

- The increased usage of AI in diagnostics and drug development

The increasing use of artificial intelligence (AI) in epigenetics has been driving the growth of precision medicine, transforming the delivery of targeted interventions, enhancing patient outcomes, and reducing costs, thus alleviating the global healthcare burden.

Cardio Diagnostics launched an AI-powered precision cardiovascular medicine that makes cardiovascular disease prevention and early detection more accessible and precise. They launched multiple products leveraging proprietary AI-driven integrated Genetic–genetic-epigenetic engine, such as Epi+Gen CHD for the epigenetics-based test for coronary heart disease risk assessment, PrecisionCHD, an epigenetics-based test for coronary heart disease detection, Actionable Clinical Intelligence is a platform that offers new epigenetic and genetic insights to clinicians, etc.

The AI-driven integrated Genetic-Epigenetic Engine can leverage proprietary AI-Driven Integrated Genetic-Epigenetic Engine to complete the rapid design, development, and launch of new synergistic tests. This can generate products with lab profiling using assays and interpretive predictive ML models.

Epigenetics Drugs And Diagnostic Technologies Market Geographical Outlook:

By geography, the epigenetics drugs and diagnostic technologies market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see notable growth in the epigenetics drugs and diagnostic technologies market. The emerging new players in the region propel the market. Further, an estimated 4,824,700 new cancer cases and 2,574,200 cancer deaths occurred in China in 2022. The morbidity of chronic diseases is rising quickly in China. This impacts the epigenetics drugs and diagnostic technologies market’s expansion.

Epigenetics Drugs And Diagnostic Technologies Market Key Developments:

The major leaders of the epigenetics drugs and diagnostic technologies market are Roche Diagnostics, Thermo Fisher Scientific, Inc., Element Biosciences, Inc., Dovetail Genomics LLC., Abcam plc., Eisai Co., Ltd., Novartis AG, Cantata Bio, Illumina, Inc., Promega Corporation, and Merck KGaA. The key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In November 2024, Oxford Nanopore Technologies collaborated with UK Biobank to create the world’s first comprehensive, large-scale epigenetic dataset. Oxford Nanopore Technologies is the company that generates nanopore-based molecular sensing technology. This project utilizes information-rich DNA/RNA sequencing technology to map the epigenome of 50,000 participant samples. This could unlock crucial insights into disease mechanisms to improve patient outcomes. This would be publicly available data for the scientific community and bring new opportunities.

- In May 2024, Novartis acquired Mariana Oncology. Mariana Oncology is a preclinical-stage biotechnology company developing novel radioligand therapies (RLTs) to treat cancers with high unmet patient needs. This acquisition would transform the Novartis RLT pipeline and expand the company’s research infrastructure and clinical supply capabilities. It encompasses a robust portfolio of RLT programs for a range of solid tumor indications such as breast, prostate, and lung cancer.

- In February 2024, Element Biosciences, Inc. collaborated with DNAnexus. DNAnexus is a provider of the Precision Health Data Cloud. This would stream data directly from Element’s AVITI System to their DNAnexus account to facilitate customers. This collaboration would be necessary for AVITI sequencing with the secure and full-featured multi-omic analysis platform of DNAnexus.

- In January 2024, AtlasXomics and EpiCypher partnered to develop CUT&Tag kits and assay services. This was for spatial epigenomics applications. These assays would be developed on AtlasXomics’ DBiT-seq platform using CUT&Tag reagents and antibodies from EpiCypher. This would expand the spatial ‘omics toolbox to histone post-translational modifications (PTMs), transcription factors, and other chromatin regulators.

Epigenetics Drugs And Diagnostic Technologies Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Epigenetics Drugs And Diagnostic Technologies Market Size in 2025 | US$26.283 billion |

| Epigenetics Drugs And Diagnostic Technologies Market Size in 2030 | US$53.345 billion |

| Growth Rate | CAGR of 15.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Epigenetics Drugs And Diagnostic Technologies Market |

|

| Customization Scope | Free report customization with purchase |

Epigenetics Drugs And Diagnostic Technologies Market Segmentation:

- By Drugs

- Histone Deacetylase (HDAC) Inhibitors

- DNA Methyltransferase (DNMT) Inhibitors

- Others

- By Technology

- Reagents

- Kits

- Chip Sequencing Kit

- Whole Genomic Amplification Kit

- Bisulfite Conversion Kit

- RNA Sequencing Kit

- Instruments

- Services

- Others

- By Application

- Oncology

- Non-oncology

- Inflammatory Diseases

- Metabolic Diseases

- Infectious Diseases

- Cardiovascular Diseases

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America