Report Overview

Enterprise Analytics Software Market Highlights

Enterprise Analytics Software Market Size:

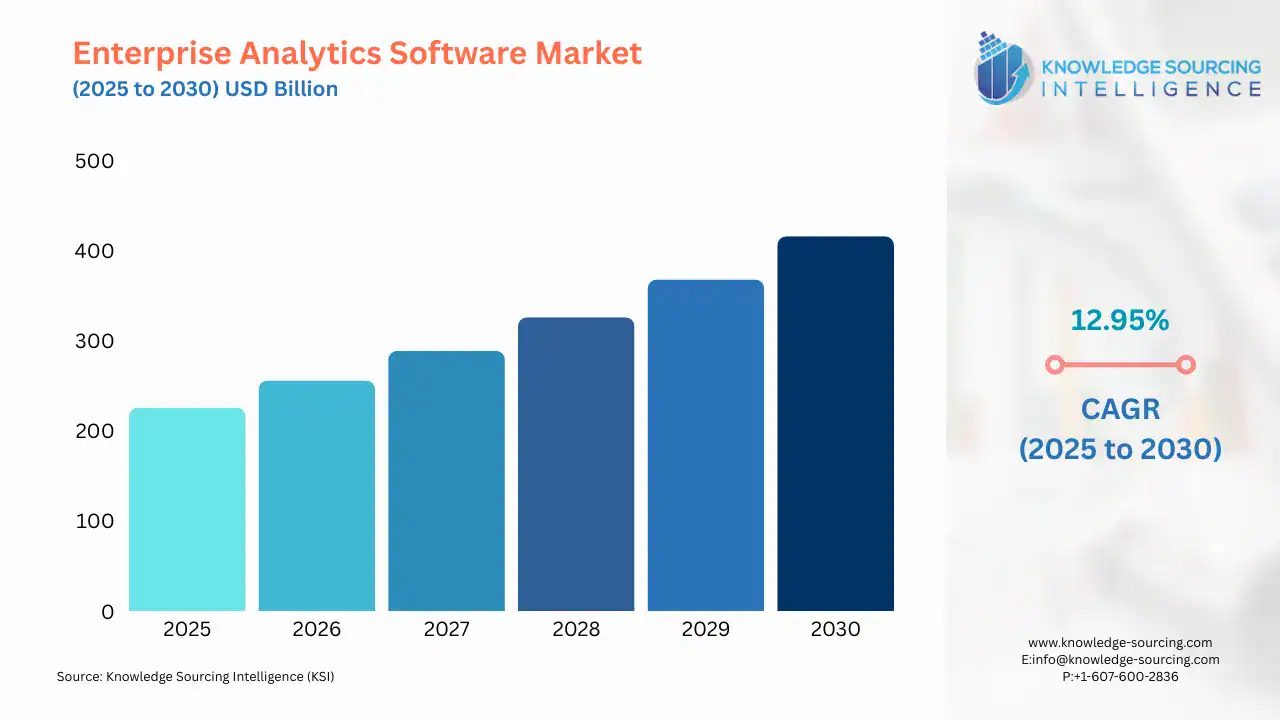

The enterprise analytics software market is projected to grow at a CAGR of 12.95%, from a market value of US$226.404 billion in 2025 to US$416.205 billion by the end of 2030.

Enterprise analytics majorly refers to big data, where organizations can perform analytical processes over the data to extract meaningful insights by using BI and analytical tools and make various decisions based on the insights. The market is projected to show robust growth during the next five years due to the rapid adoption of these tools across various industries, indicating a continuous increase in the quantity of data generation. As the amount of data across organizations is increasing, the need for streamlining business activities is also rising. Hence, the need for various tools to help the organization's rapid analysis, management, and data optimization is increasing.

As all the functionalities are integrated into a single tool, it enables organizations to analyze the required data in less time, offering numerous economic benefits to companies and instigating its adoption across small and medium enterprises, significantly boosting market growth. Furthermore, the rising implementation of data-driven operations across various industries, such as healthcare, retail, transport, and logistics, among others, is also significantly driving the demand for various BI solutions, contributing to the market in the coming years.

Furthermore, the business environment is currently highly volatile and competitive. Thus, there is an increase in the demand for strategic decisions at every step of the business, coupled with the rapid proliferation of data due to the increase in the number of data sources, widening the opportunities for market expansion. Moreover, decision-making is also considered an integral part of the business process in today’s era, which further requires thorough analytical processing of the data and models. These tools can offer smarter decisions and more actionable insights, increasing their adoption in the coming years.

The enterprise analytics software market has been segmented based on offerings, enterprise size, deployment, industry verticals, and geography. The market has been segmented by offering into business intelligence (BI) platforms, traditional BI platforms, data science platforms, and analytics applications. Based on enterprise size, the market has been classified into small, medium, and large. By deployment, the segmentation is done based on the cloud and on-premise. By geography, the segmentation has been done based on North America, South America, Europe, the Middle East, Africa, and the Asia Pacific.

Enterprise Analytics Software Market Growth Drivers:

- Increasing the small and medium enterprises sector is expected to propel the enterprise analytics software market growth

Remarkable growth is anticipated for small and medium enterprises in terms of enterprise size segment of the market during the forecasted period, as the increasing adoption of such solutions by the companies from this segment proves to be crucial owing to the rising data-driven operations and a very significant amount of data being generated. The extent to which this has opened up the organization's doors to inexpensive data centers from the cloud solutions vendors is a major factor for its adoption across this segment. Because this further reduces the upfront investments for the companies falling under this category, it becomes critical for their adoption.

Leading market players are developing small and medium-sized enterprise analytics software to be competitive, innovate, and democratize advanced analytics for small businesses. This makes the solution one that could spur similar capabilities in smaller vendors in its emphasis on 5G network data analysis. At the same time, its AI and machine learning tools would inspire smaller companies to incorporate the technologies in their products.

For instance, in February 2023, Nokia introduced AVA Customer and Mobile Network Insights, a cloud-native analytics application intended for simplifying gathering and analyzing data from a 5G network. It offers data-rich capabilities in collecting and analyzing network data from customer and mobile networks, providing CSPs with more robust and economical analytical capabilities through AI and machine learning; intelligent decisions will be based on correlated reporting generated from data across 5G networks. It is possible that these developments would inspire smaller and medium firms to follow cloud-native solutions for reduced costs, superior flexibility, and better scalability. There is potential for the solution to make data collection and analysis very simple, leading to a rise in demand for analytics software in small and medium enterprises.

Enterprise Analytics Software Market Geographical Outlook:

- North America region to hold significant shares of the enterprise analytics software market

In geographical terms, the enterprise analytics software market can be segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. Owing to superior infrastructure, early technology adoption, and having the most key players, North America will significantly contribute to the market share. Moreover, established industries in the region, besides other factors, also strengthen the market and allow it to take upper strides in years to come.

In the next five years, Asia Pacific is predicted to show modest growth because of the strong rise in small and medium enterprises and decent growth in other industry verticals, fueling the analytics software market.

Enterprise Analytics Software Market Key Developments:

- December 2024- Sigma, the only cloud analytics platform with data warehouse write-back, launched major platform updates, including natural language querying and advanced operational reporting along with Redshift write-back, for empowering business users and analytics teams. Combining advanced, enterprise-grade reporting tools and infrastructure upgrades with independent governance and reliability of these updates enable the shrewdest AI development.

- October 2024- Restroworks launched its new cloud computing cloud for analytics, available on Demand for Enterprise use, providing restaurant operators with a 360-degree view of their enterprise operations. The platform supports real-time reports, intuitively designed dashboards, revenue performance insights, menu level insights, and comparative historical analysis across brand formats and regional clusters.

- September 2024- Zoho Corporation rolled out the new release of its self-service BI and analytics platform- Zoho Analytics. The latest version, laden with AI, includes over 100 enhancements such as advanced diagnostic insights, predictive analysis, automatic report and dashboard generation, a custom ML model-building studio, built-in integration with Open AI, and extensions to third-party BI platforms. It's meant to empower its users further and to offer a much broader range of businesses and users than other offerings in the market.

List of Top Enterprise Analytics Software Companies:

- IBM Corporation

- Microsoft Corporation

- Information Builders

- Oracle

- SAP

Enterprise Analytics Software Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Enterprise Analytics Software Market Size in 2025 | US$226.404 billion |

| Enterprise Analytics Software Market Size in 2030 | US$416.205 billion |

| Growth Rate | CAGR of 12.95% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Enterprise Analytics Software Market |

|

| Customization Scope | Free report customization with purchase |

The Enterprise Analytics Software Market Segmentation:

- By Offering

- Business Intelligence (BI) Platforms

- Traditional BI Platforms

- Data Science Platforms

- Analytics Applications

- By Enterprise Size

- Small and Medium

- Large

- By Deployment

- Cloud

- On-premise

- By Industry Verticals

- BFSI

- Healthcare

- Retail

- IT and Telecom

- Manufacturing

- Media and Entertainment

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Thailand

- Others

- North America