Report Overview

Energy Harvesting System Market Highlights

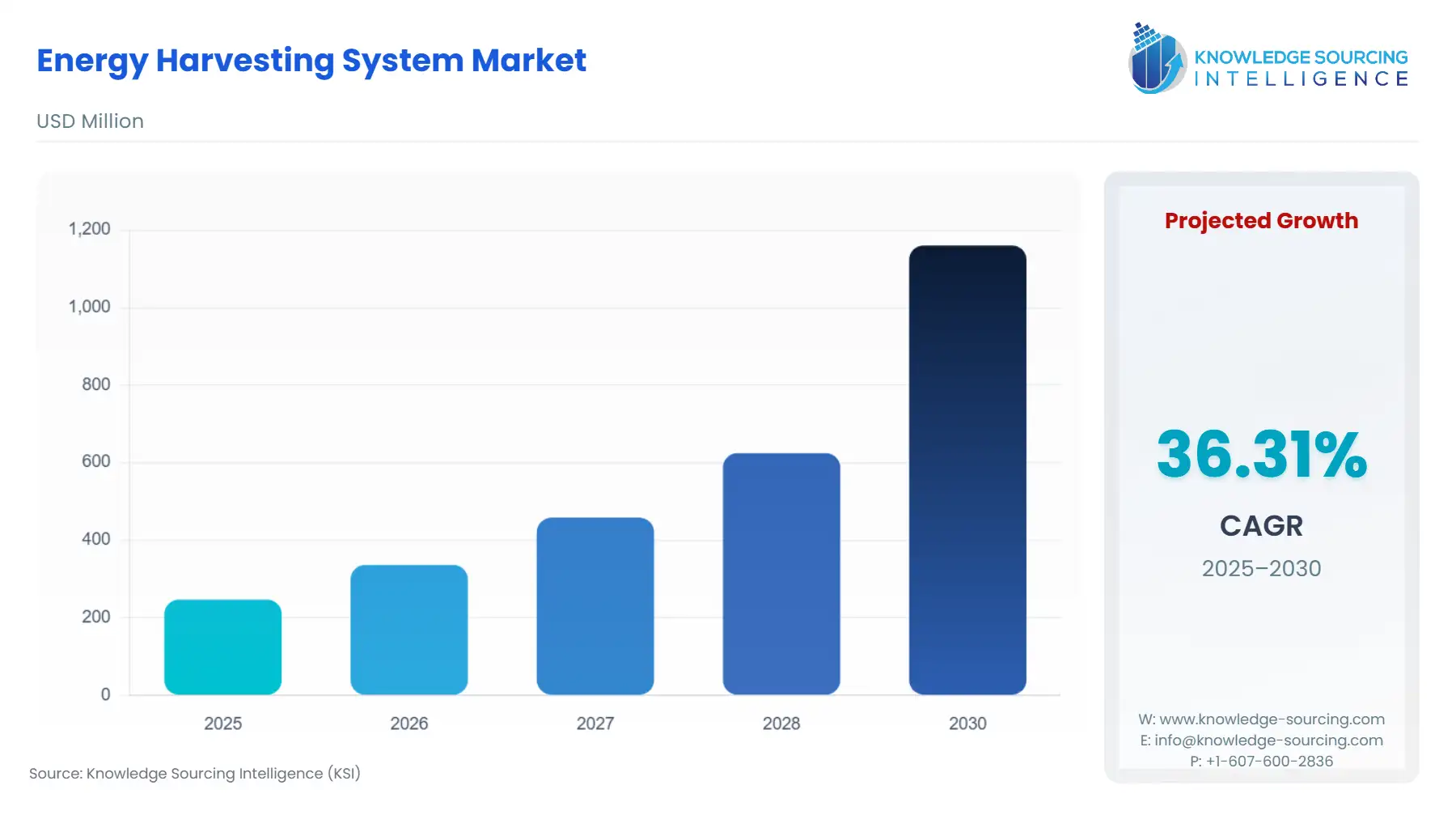

Energy Harvesting System Market Size:

The global energy harvesting system market will grow from US$246.650 million in 2025 to US$1,160.698 million in 2030 at a CAGR of 36.29%.

Energy harvesting can be defined as energy conversion from a system's environment to electrical power, which can be fed and used for a narrow range of purposes. A converged set of factors fluctuates the energy harvesting system market, including the growing energy demands of renewable energies, say solar power, wind power, thermal power, etc., among commercial enterprises. Population growth has an ultimate enumeration. In turn, there will be an increased demand for energy use, contributing to the systems that harvest energy to mitigate the demand and energy supply gap.

Therefore, GHG emissions from these energy sources in the world's major economies have a significant downward trend, like the United States, China, and India. Therefore, one such example is the increase in solar power capacity in India, which, over the last five years (2016-2021), has seen an expansion of more than 600% between 6.7 GW to 41 GW.

Global Energy Harvesting System Market Drivers:

- The rising use of wind energy is anticipated to fuel the market.

The growing trend towards wind power as an effective renewable energy option is also expected to drive the market share in energy harvesting systems. For instance, the US Department of Energy reports by the OEER reveal that the installation of wind power capacity has risen by more than threefold over the past decade. As a result, wind generation’s growth rate in 2021 was around 10%, bringing the wind capacity’s total to 135 GW in 2021.

- Various companies are moving toward sustainability.

Major companies are reorienting towards renewable energy deployment to electrify their operations. According to ABB's 2021 report, the company's shift from 24% renewable energy in its total power production in 2019 to 53% in 2021 shows that it has diverted all its operating goals related to the electricity industry.

This, however, comes along with the growing demand for decentralized power solutions, particularly in areas far away, which further gives the energy harvesting technologies market a chance to grow. For instance, PowerFilm Solar has created thin and lightweight solar panels to be inserted in portable power systems appropriate for camping, outdoor activities, and emergency response cases.

- Government focus on renewable energy is predicted to fuel the market.

The government of India has a New and Renewable Energy Ministry, which focuses on developing new renewable energy sources in the country, improving their availability, and increasing their use. The ministry declared the introduction of new initiatives to save energy in the buildings sector in 2021 in the sphere of the Bureau of Energy Efficiency.

Moreover, the US government has designed programs that promote clean energy applications, such as the Production Tax Credit (PTC). The Inflation Reduction Act of 2022 is the most significant climate legislation in the history of the United States, which created handy financing facilities and programs, as well as incentives for the accelerated implementation of the clean energy economy, and triggered massive deployment of new clean electricity resources.

The Inflation Reduction Act supports lower renewable energy prices for organizations such as Green Power Partners, which include corporations, NGOs, educational institutions, and state, municipal, and tribal governments. Using Inflation Reduction Act incentives, such as tax credits, is critical for reducing GHG emissions and driving the renewable energy transition.

- Growing industrial applications of the energy harvesting system market.

By application, the global energy harvesting system market is segmented as industrial, consumer electronics, home automation, transportation, etc. The industrial application of energy harvesting systems spreads to manufacturing, chemicals, upstream oil & gas, power plants, and refining. The primary sources of energy harvesting in industrial applications are photovoltaic, thermal, RF, and mechanical vibration, with each being different in terms of power conversion and intermittent nature.

The thermal source of energy harvesting in industrial applications is the most suitable option, as the power density of thermoelectric devices with steep gradients can reach up to 100m/W cm^3. Moreover, thermal energy harvesters are more common in heavy industry than light industry scenarios with a low power load and high efficiency. Moreover, thermoelectric power generation is used in many industries. Cogeneration power plants are used in the industrial sector with high amounts of waste energy, thus being more profitable, and the heat produced during electricity generation is applicable for numerous uses.

Global Energy Harvesting System Geographical Insights:

The global power harvesting market is divided by region into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The North American market is forecasted to continue its growth, driven by the growing preference for sustainable and renewable energy sources, technological developments, and government institutions' support for clean energy initiatives. Furthermore, the Asia Pacific region is propelled by rapid industrialization, urbanization, increasing adoption of renewable energy sources, supportive government initiatives, and rising awareness about energy efficiency and sustainability.

- North America is anticipated to hold a significant market share.

The USA has the biggest market share because of the growing concern about energy conservation, progressive technology that allows the efficient harvesting of energy, mounting interest in the use of renewable energies, and the government that facilitates its adoption through incentives and policies that improve the unclean energy system. Canada is another country positioned next to the USA, retaining a considerable market share.

This country's market expansion is largely driven by the following factors: growing interest among investors in renewable energy technologies, supportive government initiatives aimed at promoting the approval of clean energy, ease of implementation of energy efficiency policies, and increasing awareness among both companies and private individuals about the environmental benefits of using harvesting energy technologies.

Global Energy Harvesting System Market Developments:

- In September 2023, Nanoprecise Sci Corp launched MachineDoctor™ LUX, the first Zone 0-compliant light energy harvesting sensor. As a pioneer in predictive maintenance solutions, Nanoprecise continues to push the frontiers of innovation while prioritizing sustainability.

- In September 2023, Sony Semiconductor Solutions Corporation (SSS) revealed that it has created an energy harvesting module that utilizes electromagnetic wave noise energy.

- In January 2023, Global Power Technologies launched a sentinel thermoelectric generator, a reliable energy source for low-power applications. It is certified for HAZLOC applications. Moreover, it enables single-person installation with low maintenance costs.

- In March 2022, Nowi, a Dutch semiconductor firm specializing in energy harvesting and power management, announced the acquisition of Diatom to its portfolio. Nowi, known for developing one of the smallest and most cost-effective energy-harvesting PMICs on the market, has released a new chipset with several new capabilities.

Energy Harvesting System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Energy Harvesting System Market Size in 2025 | US$246.650 million |

| Energy Harvesting System Market Size in 2030 | US$1,160.698 million |

| Growth Rate | CAGR of 36.29% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Energy Harvesting System Market |

|

| Customization Scope | Free report customization with purchase |

Energy Harvesting System Market Segmentation:

- By Technologies

- Photovoltaic

- Electromagnetic

- Thermoelectric

- RF

- Piezoelectric

- Others

- By Application

- Industrial

- Consumer Electronics

- Home Automation

- Transportation

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America