Report Overview

Electronic Shelf Label Market Highlights

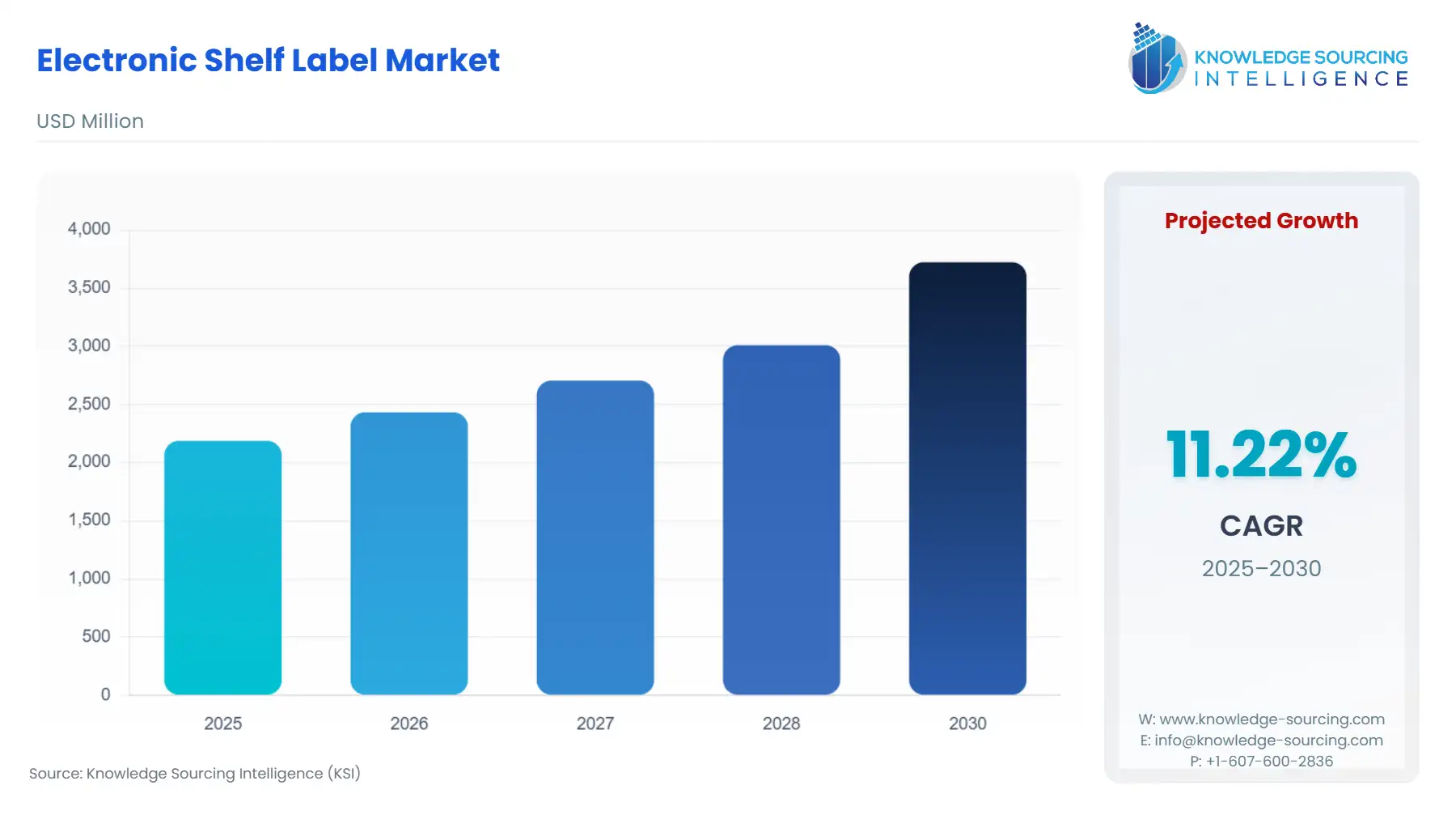

Electronic Shelf Label Market Size:

The Electronic Shelf Label market will grow from US$2.188 billion in 2025 to US$3.724 billion in 2030 at a CAGR of 11.18%.

Electronic Shelf Labels are used by retailers for displaying prices and other product-related information on shelves. The main controller server updates product prices automatically every time the price changes.

The digitalization of stores and the prevalence of the retail automation trend, as well as a cost-effective and less time-consuming substitute to paper labels, followed by booming price optimization demand among major retailers, and improvement in real-time product positioning and operational effectiveness, are augmenting the market expansion on a global scale. Additionally, the market has been further influenced by the increasing spread of the Internet of Things (IoT) and expanding digitization in the retail sector.

Electronic Shelf Label Market Growth Drivers:

- Bolstering growth in the retail sector and supermarket establishments has propelled the market growth.

Consistent retail growth has resulted in the rapid development of retail outlets, particularly supermarkets & hypermarkets, across key established and emerging nations globally. According to Mexico’s National Retailer and Departmental Store Association, in 2022, the country’s supermarket strength stood at 3,333 units which represented an increase of 49 units in comparison to 2021.

Besides electronic shelf labels, other related technologies such as self-checking robots, and self-checkout terminals, among other comparable technologies have assisted retailers in improving their profit margin. Additionally, NFC technology adoption in devices such as smartphones and POS systems is expected to show positive growth and this NFC penetration will assist retailers in combining their devices with ESL, thereby reducing the overall label installation cost. Such penetration is likely to accelerate in industrial sectors in the future which will drive the ESL market expansion.

Electronic Shelf Label Market Challenges:

- High-cost association with E-shelf labelling will restrain the market’s growth.

Retailers are required to have a certain strength of electronic shelves to qualify for ESL tags, and to employ a high number of electronic shelves, huge capital investment is required which can increase the cost of ESL technology adoption, especially for small-scale or disorganized merchants. Additionally, necessary infrastructure support which is lacking in developing or underdeveloped nations can also pose a challenge to overall product installation.

Moreover, retailers before installation also take into factor the initial return on investments and the time required for an appropriate ROI. Small-scale retail firms especially in the African region may pass on the ESL technology adoption to reduce their operations expenditures which can hamper the market growth.

- E-paper-based is expected to grow at a significant rate.

The electronic shelf label market based on type is analyzed into LCD-based, and e-paper labels, from which the E-paper label is expected to account for a considerable market share which is attributable to e-paper’s high-performance benefits such as the ability to project items in graphical form, combined with the possibility of improved energy efficiency. For ESL offerings, various firms such as Innolux Corporation and E Ink Holdings Inc. are forming partnerships to strengthen the e-paper ecosystem, thereby bolstering the e-paper business.

The major applicability of e-papers will be for retail advertising, and in-vehicle advertising, among other applications. E-paper-based is further sub-segmented into full-graphic labels which is anticipated to capture a significant share of the market due to its high contrast capabilities and vast viewing angles, coupled with the adoption of reflecting technology with a maximum white background.

- The near-field communication segment is expected to show significant growth during the forecast period.

Technology-wise the electronic shelf label market is divided into infrared, field communication, radio frequency, and Bluetooth, in which the near-field communication technology is expected to constitute a remarkable market share. The growing OEMs' preference for developing 2-way communications systems that maintain price integrity for retailers, followed by the rising usage of NFC in the retail sector due to the growing NFC-enabled smartphone technology adoption has further stimulated the segment growth.

NFC is an embedded technology that employs proximity to simplify transactions, data sharing, and short connections. NFC-enabled digital packages and signs can provide clients with timely product details and a real-time digital offer before purchase.

- Hypermarket is expected to hold a considerable share of the electronic shelf-label market.

The difficulties of manually managing huge stores have contributed to the expansion of this market. As a result, computerized shelf labels are becoming more widely used in hypermarkets to streamline shop operations. Hypermarkets can change prices as well as other commodity-related information in less time by using these labels.

Electronic Shelf Label Market Geographical Outlook:

- Europe is anticipated to constitute a significant share of the market.

Because nations like Germany and France were early adopters of ESL in the region, Europe is expected to hold the highest share of the industry. In major EU nations such as France, electronic shelf labels have found their usage, since 1991. As a result, Europe has a head start in the market, and it is predicted to account for the largest share of the overall market. Market expansion in the region is likely fuelled by government laws and regulations. In France, for instance, the French Parliament approved a Consumer Code stipulating that the price of goods, including shipping and postal costs, must be explicit & transparent to customers.

Electronic Shelf Label Market Key Developments:

- In September 2023: Shenzhen Minew Technologies Co., Ltd launched “STag58P” which is the latest version of its electronic shelf label powered by Nordic Semiconductor’s nRF52833 multiprotocol SoC chip offering Bluetooth 5.4 connectivity.

- In February 2023: Qualcomm formed a collaboration with SES-imagotag for the development of electronic shelf label technology based on ESL wireless standards. The collaboration aimed to enhance the retail experience by enhancing the retailer's operational efficiency.

- In January 2023: Ynvisible Interactive Inc. launched its latest “Large Format Electronic Shelf Label Display.” Which is primarily designed for grocery stores and offers an easy-to-read solution for displaying product pricing and basic information.

Electronic Shelf Label Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Electronic Shelf Label Market Size in 2025 | US$2.188 billion |

| Electronic Shelf Label Market Size in 2030 | US$3.724 billion |

| Growth Rate | CAGR of 11.18% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Electronic Shelf Label Market |

|

| Customization Scope | Free report customization with purchase |

Electronic Shelf Label Market Segmentation:

- By Type

- LCD Based Label

- E-Paper Based Label

- Segmented Label

- Full-Graphic Label

- By Technology

- Infrared

- Near Field Communication

- Radio Frequency

- Bluetooth

- By Component

- Display

- Battery

- Software

- Others

- By End-User

- Supermarket

- Hypermarket

- Pharmacy

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America