Report Overview

Electronic Manufacturing Services Market Highlights

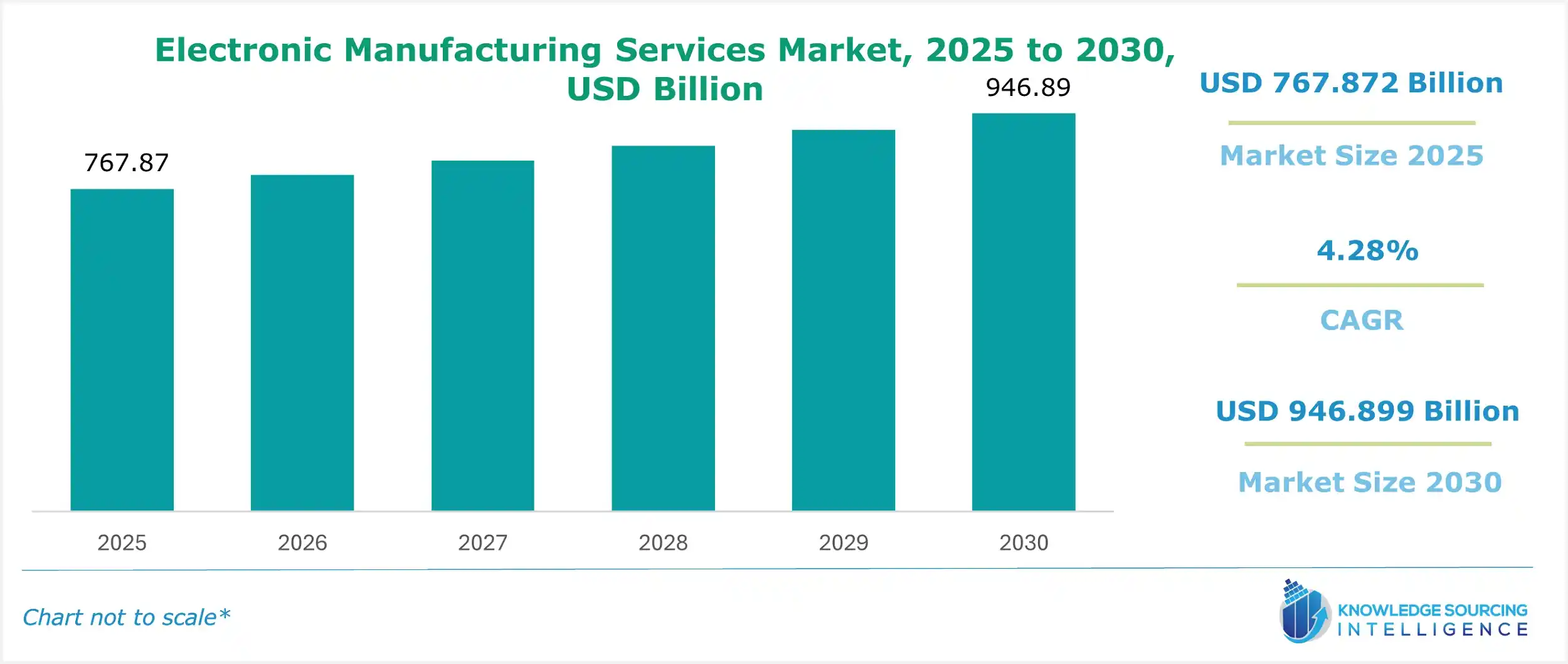

Electronic Manufacturing Services Market Size:

The electronic manufacturing services market, valued at US$946.899 billion in 2030 from US$767.872 billion in 2025, is projected to grow at a CAGR of 4.28% through 2030.

The market’s growth in the coming years is anticipated due to the rise in electric vehicles, cost reduction in the manufacturing process, and boosting R&D investments. Further, the continued growth of connectivity products like gaming, audio, wearables, and virtual reality drives demand for electronics manufacturing services (EMS) in consumer electronics. Significant investments in the semiconductor industry are also projected to support the market growth. For instance, global semiconductor sales in June 2024 totaled $50.0 billion, representing an 18.3% growth.

Electronic Manufacturing Services Market Overview & Scope:

The electronic manufacturing services market is segmented by:

- Service: The electronic manufacturing services market by service is segmented into design & engineering, manufacturing, assembly, testing, and others. The increasing demand for product innovation and manufacturing design is fueling the high demand for engineering services within the market. The rising emphasis on innovation and technological advances increases the demand for special engineering services. Moreover, demand for engineering services will be further increased by the demand for quicker product development with a shorter cycle, thus increasing potential.

- End-User: The end-user is segmented into healthcare, aerospace and defence, automotive, telecom and IT, consumer electronics, and others. Companies offer services of manufacturing, testing, designing, and repairing either electronic components or assemblies for OEMs. Electronic manufacturing can be applied in various industries across the global market, augmenting widespread adoption across industry verticals. Further, the consumer electronics market is estimated to hold a significant share, while the automotive category is estimated to grow rapidly during the forecast period.

- Region: The North American electronic manufacturing services market will expand throughout the forecast period to attain a notable market size by the end of the forecast period.

Top Trends Shaping the Electronic Manufacturing Services Market:

1. Rising EV Sales

- The market is expected to surge in the coming years due to the rising sales and number of electric vehicles worldwide. The electrification of the automobile has been one of the most disruptive and innovative changes in the automobile sector globally. In the transition towards complete electrification, auto producers and manufacturers have been matching the pace in innovation and advances in component and technical capabilities. This has given rise to the demand for advancement in EMS in electronic component manufacturing and processing, developing electronics in the automotive industry to be more reliable, cost-efficient, and smaller.

2. Increasing Demand for Smart Devices

- One of the major drivers boosting the EMS market forward is the growing demand for smart devices and Internet of Things (IoT) technology. The rising users' demand for EMS services in connected devices, such as wearables, personal electronics, and home automation, contributes to this growing demand. The trend is accelerating in the industrial sector with the integration of IoT solutions.

Electronic Manufacturing Services Market Growth Drivers vs. Challenges:

Opportunities:

- LED Technology Adoption: The EMS global market is also witnessing a strong trend of awareness of e-waste recycling driven by regulatory actions, environmental concerns, and growing comprehension of the impact of the ecosystem on electronic waste. Electronic waste has dramatically increased with the rapid rise in electronic consumption, causing severe environmental problems. Hence, governments and international organizations have implemented laws to address the effects of electronic waste on the environment. Therefore, manufacturing companies must adopt ecologically friendly procedures for properly handling and recycling electronic devices.

Challenges:

- Lack of IP Rights: The violation and lack of protection of intellectual property rights severely hamper the global market for electronic manufacturing services. The problem affects the EMS market growth in many ways, such as influencing industry trust, innovation, and competitiveness. IP rights violations facilitate the spread of fake electronic goods and parts.

Electronic Manufacturing Services Market Regional Analysis:

- North America: The increasing demand for electronics in the country is further facilitating the North American market growth. Moreover, increasing services provided by the key market players are propelling OEMs' wide adoption of contractual services to increase their focus on core operations and further invest in improving their productivity.

Electronic Manufacturing Services Market Competitive Landscape:

The market is fragmented, with many notable players, including Benchmark Electronics, Flex Ltd., Plexus Corp, and Jabil Inc., among others:

- Launch: ROHM created surface-mount SiC Schottky barrier diodes (SBDs) in November 2024. By extending the creepage distance between terminals, SBDs increase insulation resistance.

- Expansion: In November 2024, Shindengen Electric Manufacturing increased the number of products in its SLSBD series. This product helps reduce loss and miniaturize automotive ECUs by suppressing thermal runaway and reducing leakage current by about 99% compared to the conventional products.

Electronic Manufacturing Services Market Key Developments:

- October 2025: L&T mulls entry into EMS — Larsen & Toubro is exploring entering the electronics manufacturing services sector, with preliminary talks to set up EMS capacity near Chennai.

- April 2025: Top-50 EMS companies revenue growth — According to Manufacturing Market Insider, the top 50 global EMS companies grew 12.7% in 2024 to reach US$477 billion in assembly revenue.

- April 2025: Indian EMS firms accelerate China supply-chain talks — EMS companies like Dixon, Syrma SGS, and others are reportedly in talks with Chinese suppliers ahead of an Indian RS 25,000-crore electronics component incentive scheme.

Electronic Manufacturing Services Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Electronic Manufacturing Services Market Size in 2025 | US$767.872 billion |

| Electronic Manufacturing Services Market Size in 2030 | US$946.899 billion |

| Growth Rate | CAGR of 4.28% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Electronic Manufacturing Services Market |

|

| Customization Scope | Free report customization with purchase |

Electronic Manufacturing Services Market Segmentation:

By Service

- Design & Engineering

- Manufacturing

- Assembly

- Testing

- Others

By End-User

- Healthcare

- Aerospace & Defense

- Automotive

- Telecom & IT

- Consumer Electronics

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa