Report Overview

Electron Beam Machines Market Highlights

Electron Beam Machines Market Size:

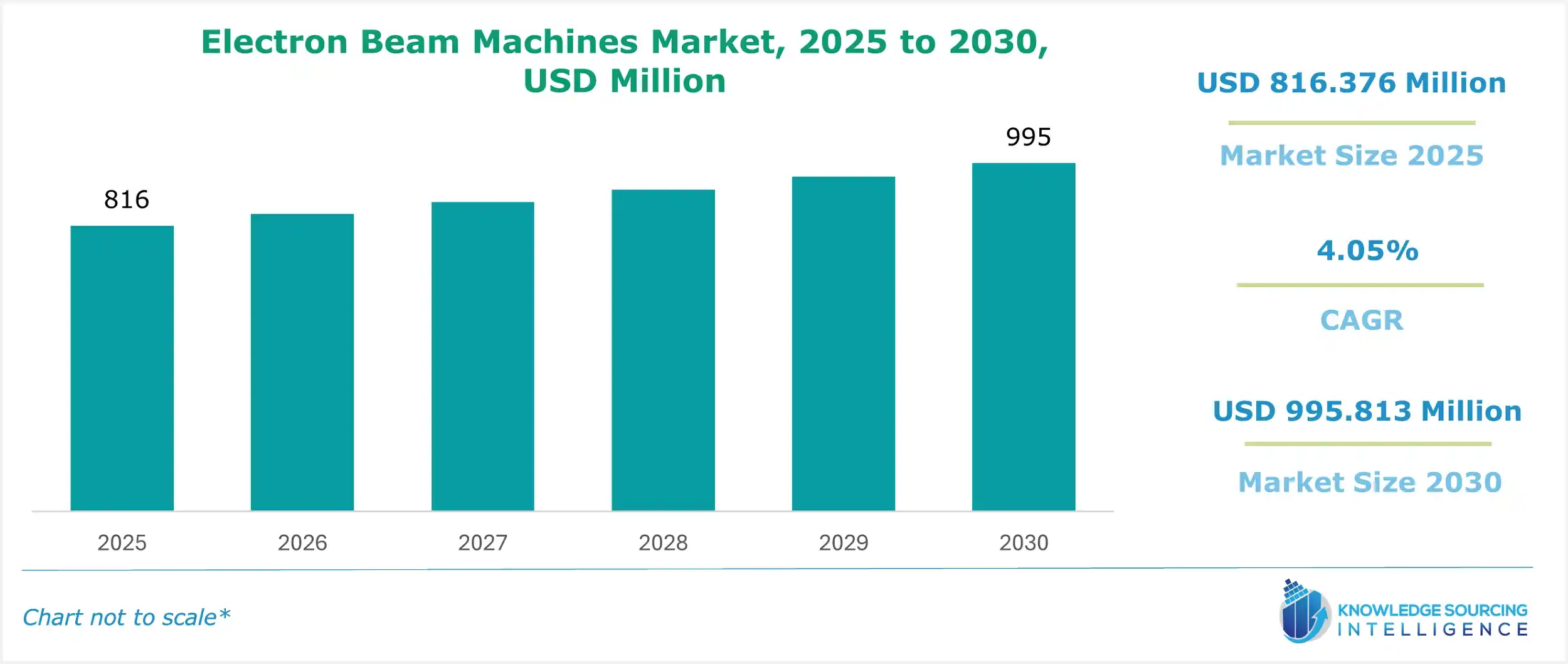

The electron beam machines market is projected to grow at a CAGR of 4.05% to reach a market size of US$995.813 million in 2030 from US$816.376 million in 2025.

The demand for electron beam machines is estimated to grow in the coming years due to an increasing need for advanced machines with greater accuracy to meet stringent product quality and industry regulations and standards. In addition, to raise the accuracy, flexibility, and precision of the different production processes, the market players are increasingly adopting electron beam machines to improve the quality aspect of the production process. However, the high cost of the equipment and the need for skilled labor is restraining the market’s growth. Consequently, laser beam machines, which are also used to carry out operations in different industries, are a substitute for electron beam machines and remain a challenge to the widespread adoption of these machines.

Geographically, North America is estimated to hold a considerable share over the forecast period owing to R&D investments to accelerate the development of different end-user industries. Additionally, the early adoption of technologies is contributing to being one of the key regional markets globally. The Asia Pacific region is expected to witness significant growth over the forecast period owing to initiatives such as “Make in India” being taken by the government to boost the manufacturing sector in countries such as India. The well-positioned automobile industries in China and India are also contributing to the growing its demand.

Electron Beam Machines Market Drivers

- The growing requirement for precision during the component manufacturing process is driving the market growth.

Due to rapid industrialization, the manufacturing sector is advancing significantly, leading to the requirement for quality products. There is an increasing need for electron beam machines in manufacturing different parts and components to cater to the different applications in various sectors, such as automobiles, aerospace, and semiconductors, among others. This is attributable to the fact that the usage of these machines can provide a more accurate joining of two dissimilar products (when it is used for welding purposes); they can provide a greater degree of flexibility and precision whilst designing different components.

The changes and amendments in the industry regulations and standards have encouraged end-users to make use of technologically advanced machines to ensure their product complies with the different industry standards such as ISO (The International Organization for Standardization) standards, including the ISO 990 (which deals with quality), ISO 45001 (which deals with occupational health and safety), among others. The ANSI (American National Standards Institute) standards are also in place, affecting the different aspects of products and end-user industries. Therefore, these factors are augmenting the market’s growth over the forecast period.

In addition, the semiconductor and automobile industries use electron beam machines more often as they are suitable for accurately fabricating and joining small parts with high precision. Moreover, several market players are involved in advancing the quality and accuracy of the machines, thereby making them more reliable and improving the process they perform.

Electron Beam Machines Market Segment Analysis:

- The welding segment is anticipated to hold a noteworthy market share.

The electron beam machine market has been segmented by application into welding, drilling, fabrication, and melting. The welding segment is anticipated to hold a noteworthy market share owing to the wide application of these machines across various industries, including automotive, aerospace, and defense, among others. The application segment is anticipated to grow at a notable rate on account of the growing investments by the key market players in R&D for the development of new systems and solutions to meet the increasing market requirements.

- The European region offers good growth opportunities.

The region is the home of major players. With the increasing investment in research and development, the market is expected to grow significantly during the forecast period. There is also a rising demand for welding and fabrication technology in the aerospace and automotive industries, driving the demand for electron beam machines. Increasing collaborative partnerships between companies also widens the market's growth potential, and due to its excellent process of micro-finishing, it is widely adopted among various end-users.

BEAMIT (based in Italy) collaborated with TEMA Energy to manufacture gas turbine components for power generation, oil and gas, and aviation components using metal additive manufacturing, which includes electron beam melting technology. In April 2019, General Electric Additive opened its Arcam EBM center of excellence in Gothenburg, Sweden, with a capacity of 500 employees. The investment is made to increase the company’s manufacturing footprint and focus on R&D to meet the growing global demand.

Electron Beam Machines Market Key Developments:

- In June 2024, Colibrium Additive, a part of the General Electric Company, launched Spectra M, a range of electron beam melting (EB-PBF) printers. The machine features high-resolution images and a 270x430 mm build envelope.

Electron Beam Machines Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Electron Beam Machines Market Size in 2025 | US$816.376 million |

| Electron Beam Machines Market Size in 2030 | US$995.813 million |

| Growth Rate | CAGR of 4.05% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Electron Beam Machines Market | |

| Customization Scope | Free report customization with purchase |

The Electron Beam Machines Market is analyzed into the following segments:

- By Type

-

- Conventional Electron Beam Machining (CEBM)

- Electron Beam Melting

- Electron Beam Surface Treatment

- Others

- By Application

-

- Welding

- Drilling

- Fabrication

- Melting

- By End-user Industry

-

- Manufacturing

- Automotive

- Oil and Gas

- Semiconductor

- By Geography

-

- North America

-

-

- USA

- Canada

- Mexico

- Others

-

-

- South America

-

-

- Brazil

- Argentina

- Others

-

-

- Europe

-

-

- Germany

- France

- United Kingdom

- Spain

- Others

-

-

- Middle East and Africa

-

-

- Saudi Arabia

- UAE

- South Africa

- Israel

- Others

-

-

- Asia Pacific

-

-

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Taiwan

- Others

-