Report Overview

Drug Eluting Stent Market Highlights

Drug Eluting Stent Market Size:

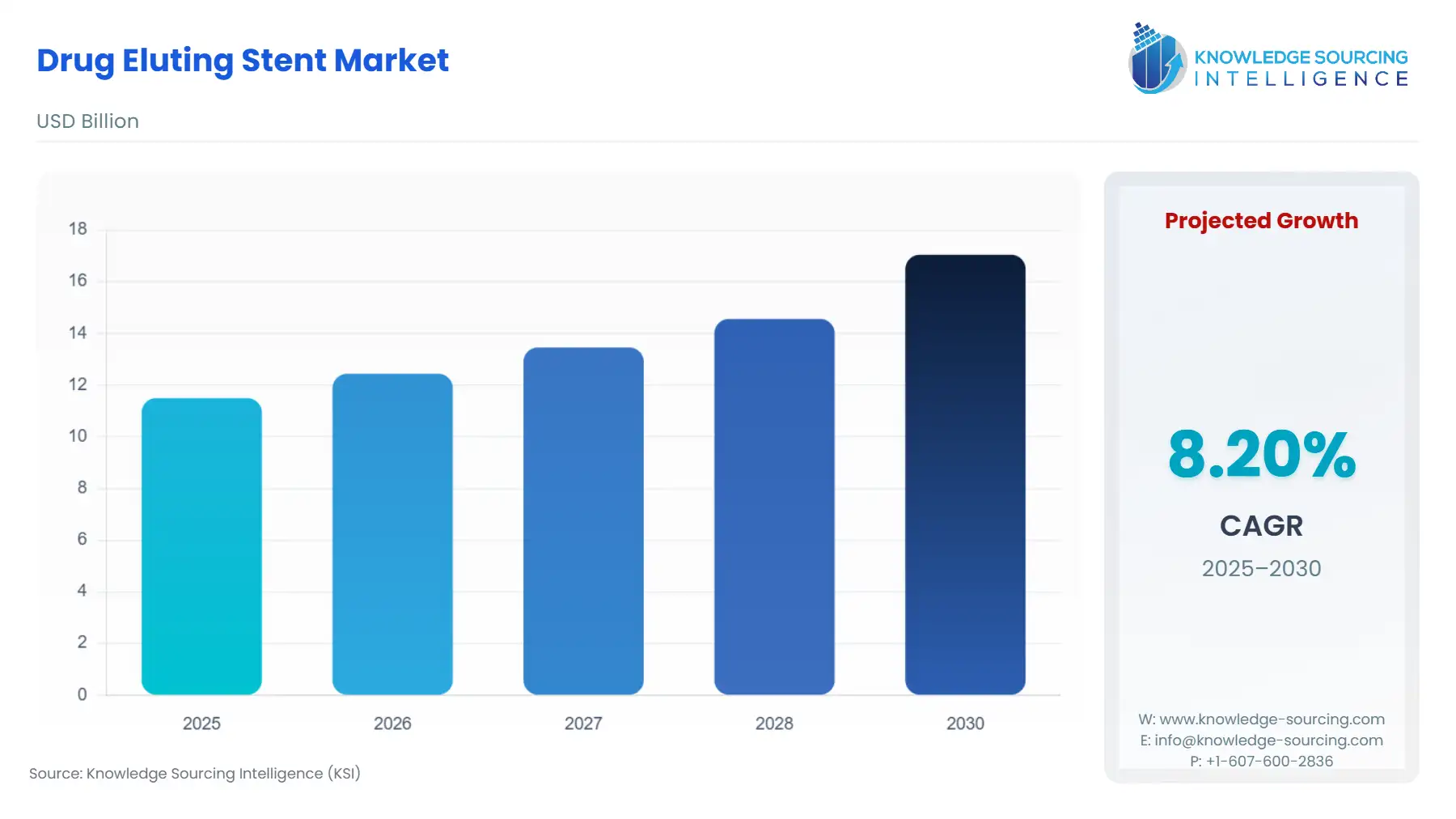

The Drug eluting stent market is projected to grow at a CAGR of 8.20% over the forecast period, increasing from US$11.499 billion in 2025 to US$17.049 billion by 2030.

A drug-eluting stent is a metallic, semi-rigid, tubular structure to which a drug has been attached. The drug is subjected to a slow release to prevent recurrence of the stenosis or obstruction of the arteries. Very quick innovative developments in stent designs and delivery technologies are likely to bring down the restenosis rate, even in the most complicated lesions. This will reduce the incidence of both early and late thrombosis, even as such technologically advanced stents are introduced into the market by major players. Growing geriatric population across the globe has been a major driver for the drug eluting stent market. As more people become elderly, the chances of suffering from a vascular disease will also increase, which is creating a higher demand for efficient treatment solutions like drug-eluting stents. Sedentary lives combined with poor eating habits are also increasing the number of patients affected by atherosclerosis, which is defined as plaque buildup within arteries.

Drug Eluting Stent Market Growth Drivers:

- Rising technological advancements are increasing the Drug eluting stent market growth.

The change from standard angioplasty to DES has been significant, as this incorporates medication therapy onto the stent, being able to use one of the most advanced techniques. This minimally invasive approach has many benefits: less stress to blood vessels, faster recoveries, and decreased complication risks. For instance, the Orsiro Mission is the technological leap that produces drug-delivery systems directly into the target arteries, more efficaciously improving patient outcomes. The first Orsiro Mission implant was successfully done with this approval, and this surely having an implementable approach to the treatment of artery disease towards medical technology in the industry. Introduction of novel technologies such as Orsiro Mission into the market exponentially increases consumer activity in the market as medical professionals interested in providing such more and less invasive treatment modalities of arterial disorders increase.

- Growing demand of minimally invasive surgeries is anticipated to increase the market demand.

Drug-eluting stents prevent the re-narrowing of blood vessels through the inhibition of proliferation of smooth muscle cells while reducing the risk of restenosis. Moreover, the market is also anticipated to grow due to increasing demand for minimally invasive surgeries. With small surgical incisions, drug eluting stents are put in to restore the lumen of either restricted or occlusive coronary arteries. More than three million such interventions carried out using minimally invasive techniques is expected to be seen in the United States each year, according to research conducted by the National Library of Medicine. Such techniques endowed patients with many benefits such as less physical trauma, shorter hospital stays, recovery times of less duration, and fewer complications.

- Introduction of drug-eluting stent with bioabsorbable polymers is anticipated to increase the market demand.

The advancement in drug-eluting stents has paved new pathways for performing percutaneous procedures in cardiac disorders. The research and commercialization of fully bioresorbable polymers are aimed at preventing restenosis and ensuring patient safety with improved procedural outcomes. Many of the market players have focused on their research and approached the market with improved stents made from bioabsorbable polymers. The DES promotes rapid repair of the vessel and less tissue damage. Moreover, Absorb GT1 is the bioabsorbable polymer-based DES that also gained an approval for the FDA. The Absorb GT1 Bioresorbable Vascular Scaffold System (BVS), in turn, includes the delivery of everolimus to inhibit scar tissue formation, which is further absorbed by the system into the body.

Drug Eluting Stent Market Key Segments:

- By coating type, the polymer-based coating segment is anticipated to grow during the forecast period.

The DES market is dominated by polymer-based coatings due to their proven effectiveness and versatility. Their intense research and application for stent development give manufacturers a dependable option from which to choose. Regulated medication release ensures that even the dregs are made available, thus reducing the possibility of restenosis and giving the patient a better outcome.

For instance, XIENCE Skypoint Stent by Abbott, which boasts a unique polymer-coating technology with shorter durations of blood thinner treatment in patients whose bleeding risk is high. Such innovations amplify the attractiveness of polymer-based coatings further, asserting its leadership in the market. The drug eluting stent market has been into two categories of coatings polymer-based and polymer-free.

- By application, Coronary Artery Disease (CAD) is anticipated to grow during the forecast period.

Coronary artery disease (CAD) is a cardiovascular disorder characterized by narrowing or blockage of the coronary arteries, which deliver oxygenated blood to the heart muscle. The fatty plaques, accumulated with cholesterol and other chemicals, are the main cause of blockage within the arteries. This caused angina, a type of chest pain or discomfort. Coated with anti-proliferative medicines, DES are slowly released through time to hinder the formation of smooth muscle cells within the artery walls and to prevent narrowing of the arteries. The CAD segment growth due to increasing burden of the disease, as well as advancements in technology in drug-eluting stent during the forecast period.

Drug Eluting Stent Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

North America is anticipated to have a significant share in drug-eluting stent markets in favor of the deployment beneficial reimbursement policies and alleged an increased incidence rate of artery-related diseases in the region. Furthermore, advancements in technology with regard to drug-eluting stents and the availability of solid healthcare infrastructure have contributed to the overall expansion of the market. It has been recorded on the authority of the Journal of the American College of Cardiology, published in February 2023, that among those individuals who have elevated 10-year predicted risk, the incidence rate of atherosclerotic cardiovascular disease in the United States was 2.60 per 1,000 person-years. This incidence rate was 1.87 for those with low 10-year but elevated 30-year predicted risk and 0.32 among those with low 10-year and 30-year predicted risk.

Drug Eluting Stent Market Key Developments:

- In May 2024, Elixir Medical, a developer of transformative technologies to treat cardiovascular and peripheral disease, today announced the two-year results of the BIOADAPTOR Randomized Controlled (1:1) Trial (RCT), which compared the DynamX® Coronary Bioadaptor System to the standard of care Resolute OnyxTM Drug-Eluting Stent (DES) at 34 centers in Japan, Europe, and New Zealand. For the first time, the results show a significant reduction in adverse events and a clinical advantage of the DynamX bioadaptor in target lesion failure (TLF) and secondary endpoint of target vessel failure (TVF), which is driven by sustained low event rates with DynamX compared to a two-fold increase in DES. The findings were presented in a late-breaking clinical session at the EuroPCR 2024 conference in Paris.

Drug Eluting Stent Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Drug Eluting Stent Market Size in 2025 | US$11.499 billion |

| Drug Eluting Stent Market Size in 2030 | US$17.049 billion |

| Growth Rate | CAGR of 8.20% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Drug Eluting Stent Market |

|

| Customization Scope | Free report customization with purchase |

Drug Eluting Stent Market Segmentation:

- By Coating Type

- By Application

- By End-User

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Taiwan

- Thailand

- Others

- North America