Report Overview

Direct Fuel Injection Market Highlights

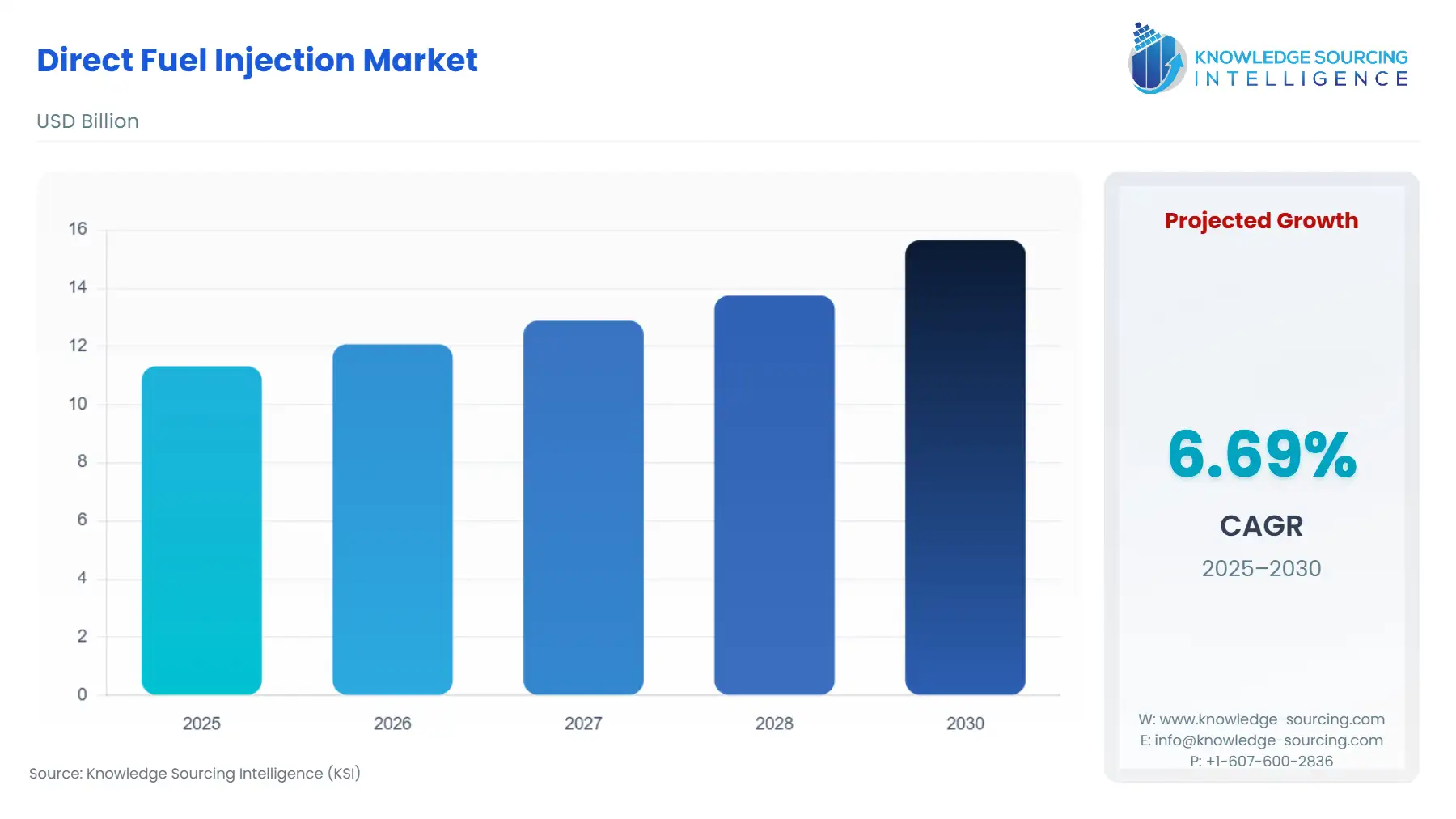

The Direct Fuel Injection Market is forecasted to rise at a 6.69% CAGR, reaching USD 15.652 billion by 2030 from USD 11.321 billion in 2025.

Direct Fuel Injection Market Key Highlights

The Direct Fuel Injection (DFI) market represents a mature yet continually evolving segment within the automotive powertrain landscape, characterized by the persistent tension between achieving high engine efficiency and adhering to increasingly restrictive global emissions regulations. DFI systems, by precisely metering and injecting fuel directly into the combustion chamber at high pressure, fundamentally alter the combustion process, leading to improved thermal efficiency and power output. This technology has transitioned from a niche application in diesel engines and high-performance gasoline platforms to a near-ubiquitous solution across modern internal combustion engines (ICEs) and hybrid electric vehicle (HEV) architectures. The market's immediate trajectory is thus defined by its indispensable role as an enabling technology for OEMs to manage the transition toward electrification while maximizing the efficiency lifespan of conventional and hybrid powertrains under intense regulatory scrutiny.

________________________________________________________________

Direct Fuel Injection Market Analysis

Growth Drivers

Strict global regulatory frameworks on tailpipe emissions drive direct and non-negotiable demand for DFI technology. Regulations targeting carbon dioxide and PM necessitate high-pressure injection systems, which optimize the fuel-air mixture, leading to more complete combustion and a reduction in both fuel consumption and GHG emissions. This regulatory imperative translates directly into higher OEM procurement volume for DFI components. Simultaneously, consumer demand for enhanced vehicle performance and better fuel economy acts as a complementary catalyst. DFI facilitates engine downsizing without power loss—often paired with turbocharging—creating a dual-benefit scenario that directly compels manufacturers to integrate the technology into their core product lines to remain competitive.

Challenges and Opportunities

A significant challenge arises from the complexity and high initial cost of DFI systems relative to traditional port fuel injection, which can constrain adoption in highly cost-sensitive automotive segments, thereby restricting market volume. Furthermore, the high-pressure environment of DFI components, which demands specialized, durable materials like carburizing steel, introduces vulnerability to fuel-system fouling from certain blends, potentially hindering component longevity and aftermarket confidence. Conversely, a major opportunity exists in the development of next-generation DFI systems tailored for alternative fuels, such as high-pressure injection systems for hydrogen and Compressed Natural Gas (CNG). The shift towards cleaner alternative fuels in fleet and commercial vehicles opens a new high-growth revenue channel beyond traditional gasoline and diesel applications, directly expanding the total addressable market.

Raw Material and Pricing Analysis

The DFI system is an assembly of highly stressed precision mechanical components, making its pricing highly dependent on specialized metallic alloys. Key components like the injector needle, nozzle body, and high-pressure pump necessitate the use of premium materials, including maraging or carburizing steel, often requiring surface treatments such as nitriding to withstand the extreme heat and pressure cycles of the combustion environment. Fluctuations in the global price and supply stability of essential non-ferrous and high-grade ferrous metals directly impact the production cost of DFI system suppliers. This reliance creates a structural cost constraint, pressuring OEM margins and influencing the final price points of DFI-equipped vehicles.

Supply Chain Analysis

The global DFI supply chain is concentrated within a few highly specialized tier-one automotive suppliers, notably those with deep, proprietary knowledge in high-precision fuel management. Production hubs are strategically located across Germany, Japan, and key Asia-Pacific manufacturing nations like China and South Korea, reflecting the locations of major automotive assembly plants. The complexity lies in the strict tolerance requirements for components like fuel injectors, which must operate reliably at pressures exceeding 2,000 bar. This dependency on highly precise manufacturing processes and specialized materials creates logistical constraints, as any disruption to a single high-precision manufacturing node, or the raw material flow (e.g., hardened steel) into that node, can generate significant lead time extensions for global OEMs.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | Euro 6d Emissions Standard | Mandates extremely low limits on PM (Particulate Matter) and NOx. This regulation compels OEMs to use DFI, often in conjunction with high-pressure systems and particulate filters, directly increasing the penetration rate of advanced DFI systems across all new vehicle platforms. |

| Canada | Light-Duty Vehicle GHG Emission Regulations | Establishes progressively stringent GHG emission targets for light-duty vehicles. This policy makes DFI an essential technology, as it delivers the 1% to 3% fuel economy improvements necessary for manufacturers to meet the compliance benchmarks, directly driving demand for DFI unit volumes. |

| India | Bharat Stage (BS) VI Norms | Implemented to align vehicle emissions with global standards. The shift from BS IV to BS VI, particularly in the diesel and GDI segments, necessitated a mass transition to highly efficient fuel injection, including common rail (direct injection) systems for diesel, thereby creating a surge in demand for component suppliers. |

________________________________________________________________

In-Depth Segment Analysis

By Engine Type: Gasoline Direct Injection Engine

The Gasoline Direct Injection (GDI) segment represents the current core growth driver of the DFI market, directly fueled by the regulatory mandate for engine efficiency and performance. GDI systems offer superior thermodynamic benefits over traditional port fuel injection by enabling higher compression ratios and more precise control over the air-fuel mixture, a necessity for modern downsized, turbocharged engines. This system’s capacity to reduce fuel consumption and maintain high power output for smaller engine displacements directly propels OEM demand, particularly in North America and Europe, where consumers value both fuel economy and dynamic driving characteristics. However, GDI systems face scrutiny regarding their potential for increased PM emissions, which has stimulated demand for high-pressure systems (over 200 bar) and advanced injector tip designs that improve fuel atomization, shifting the market focus toward higher-specification, and thus higher-value, DFI components.

By End-User: Automotive

The automotive sector functions as the foundational and largest end-user for DFI systems, driven primarily by the need to achieve a critical balance among emissions compliance, power output, and manufacturing cost targets. This segment is fundamentally inelastic to mild economic shifts because DFI is a non-negotiable enabling technology for meeting mandatory emissions standards like the EU's Euro 6d or India’s BS VI. While the long-term trend favors Battery Electric Vehicles (BEVs), the automotive end-user demand for DFI remains robust for the immediate to mid-term due to the persistent dominance of hybrid electric vehicles (HEVs) and the continuous optimization of ICE platforms. These platforms utilize DFI to maximize efficiency, allowing them to qualify for green incentives or simply comply with sales mandates, thereby ensuring a sustained, high-volume market for system suppliers. The demand is further bifurcated by the OEM's need for both Gasoline Direct Injection (GDI) and high-pressure Common Rail Direct Injection (CRDI) systems for diesel applications.

________________________________________________________________

Geographical Analysis

US Market Analysis (North America)

The US market for DFI is defined by the twin pressures of Corporate Average Fuel Economy (CAFE) standards and strong consumer preference for larger vehicle segments like SUVs and light trucks. DFI is a critical enabler for meeting CAFE targets without sacrificing the performance demanded in these vehicle types. The technology permits the use of downsized, turbocharged engines that deliver comparable V6 power with I4 fuel economy. This dynamic has resulted in a high adoption rate of GDI systems across nearly all new light-duty vehicle platforms. The aftermarket segment in the US is also significant, driven by the requirement for replacement injectors and pumps in a large, aging fleet of DFI-equipped vehicles.

Brazilian Market Analysis (South America)

Brazil's DFI market is uniquely shaped by its high utilization of ethanol-gasoline blends, specifically E100 for some applications and various blends for conventional use. This mandates that DFI components must be engineered with specialized materials to resist the corrosive properties of ethanol, ensuring system durability and performance longevity. The regulatory environment, focused on promoting bio-fuel use and vehicle efficiency, creates a specific demand for DFI systems capable of reliably handling these alternative fuel chemistries. This engineering requirement differentiates the Brazilian market, creating a competitive moat for suppliers with local expertise in bio-fuel-compatible injection technology.

German Market Analysis (Europe)

Germany, as a leading center for automotive engineering and production, showcases a demand profile heavily skewed toward high-performance and sophisticated DFI systems. The stringent Euro 6d norms for both gasoline and diesel engines have created an imperative for ultra-high-pressure injection systems (over 250 bar) to minimize PM and NOx emissions. Furthermore, the high-end vehicle manufacturers based in Germany require DFI systems that integrate seamlessly with complex engine architectures, such as variable valve timing and hybridization, requiring high-precision electronic control units and injectors. This focus drives premium pricing and technological leadership within the European segment.

South African Market Analysis (Middle East & Africa)

The DFI market in South Africa is characterized by a high proportion of older vehicle imports and a sensitivity to fuel quality. The demand is primarily generated by OEMs seeking to introduce newer, more fuel-efficient models that comply with local emission regulations, which, while less stringent than those in Europe, still necessitate modern fuel management. The challenge of inconsistent fuel quality across the region creates a demand for DFI components engineered for robustness and tolerance to fuel impurities, shifting the focus from maximizing performance to maximizing durability and reliability under challenging operational conditions.

Chinese Market Analysis (Asia-Pacific)

The Chinese market is the single largest production and sales hub, making its demand a global volume driver. The adoption of emissions standards (China 6) equivalent to or exceeding Euro 6 requires immediate and widespread deployment of DFI technology across the rapidly expanding domestic passenger vehicle fleet. Government policy, which strongly supports both high-efficiency ICEs and New Energy Vehicles (NEVs), ensures a continuous, high-volume demand for DFI components in both conventional and HEV powertrains. The competitive landscape is intensely focused on price, localized sourcing, and rapid scaling of production capacity to support the massive domestic automotive manufacturing base.

________________________________________________________________

Competitive Environment and Analysis

The Direct Fuel Injection market operates as a mature oligopoly dominated by a few global Tier-1 automotive suppliers. Competition centers on technological sophistication, component miniaturization, and the ability to integrate fuel management systems with complex electronic control units (ECUs) to meet increasingly restrictive emissions mandates. Companies leverage extensive Intellectual Property (IP) and long-standing relationships with global OEMs, making market entry extremely challenging for new competitors. Strategic positioning is now less about engine power and more about efficiency, particulate control, and dual-fuel system compatibility, particularly as the automotive industry transitions towards various forms of electrification.

Robert Bosch GmbH

Robert Bosch GmbH maintains a dominant position by offering a comprehensive, integrated portfolio that spans both Gasoline Direct Injection (GDI) and Common Rail (diesel) systems. The company's strategic positioning focuses on high-precision, high-pressure systems, such as their GDI solutions that enable high-efficiency engine downsizing. Their core strength is the deep integration of mechanical and electronic components; for example, their Electronic Control Unit (ECU) technology is central to controlling injection timing and pressure, crucial for meeting Euro 6d and other global standards. Bosch’s strategy is to remain the system provider of choice for manufacturers maximizing the potential of the internal combustion engine.

Denso Corporation

Denso Corporation, a major Japanese supplier, focuses its competitive efforts on developing high-reliability and technologically advanced DFI components, particularly for the Asian and North American markets. Denso's strategic advantage lies in its injector and pump designs that prioritize durability and ultra-precise fuel atomization. The company is actively positioning itself by providing solutions that reduce the specific DFI challenges of high-pressure operation, such as managing soot and particulate formation, thereby supporting OEMs in meeting next-generation emissions targets without the need for excessive exhaust after-treatment, a key selling point for cost-conscious manufacturers.

Vitesco Technologies GmbH

Vitesco Technologies GmbH, originating from Continental AG's powertrain division, specializes in intelligent and electrified powertrain technologies, positioning its DFI solutions as part of a broader "clean" mobility portfolio. The company's strategic focus is on integrating its DFI systems with its own power electronics and sensor technology, specifically targeting hybrid applications. This approach leverages the need for the DFI system to perform optimally and intermittently within a hybrid cycle, requiring ultra-fast response and precise metering. Their product line emphasizes advanced sensors and actuators to optimize combustion across various operating modes.

________________________________________________________________

Recent Market Developments

- January 2024: LanzaJet celebrated the grand opening of its Freedom Pines Fuels Plant, the world's first ethanol-to-Sustainable Aviation Fuel (SAF) production facility. This event is highly relevant as the direct fuel injection market extends into marine and aerospace. The availability of commercial-scale SAF production creates a new demand source for specialized, robust DFI systems engineered to handle the unique properties of these advanced, non-petroleum-based fuels in aviation engine applications.

- September 2023: Stanadyne, a fuel and air management systems supplier, launched a new design platform for hydrogen injectors. This platform includes both a high-pressure direct injector suitable for applications from 25 to 200 kW per cylinder, and a high-flow port injector for high gaseous fuel flow rates. This product launch strategically expands the company's addressable market beyond traditional fossil fuels into the rapidly emerging hydrogen engine sector for light, medium, and heavy-duty vehicles, directly responding to the market need for alternative-fuel combustion technology.

________________________________________________________________

Direct Fuel Injection Market Segmentation

- BY ENGINE TYPE

- Gasoline Direct Injection Engine

- Diesel Direct Injection Engine

- BY SALES CHANNEL

- OEM (Original Equipment Manufacturer)

- Aftermarket

- BY END-USER

- Automotive

- Aerospace

- Marine

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Thailand

- Others

- North America