Report Overview

Digital Printing Packaging Market Highlights

Digital Printing Packaging Market Size:

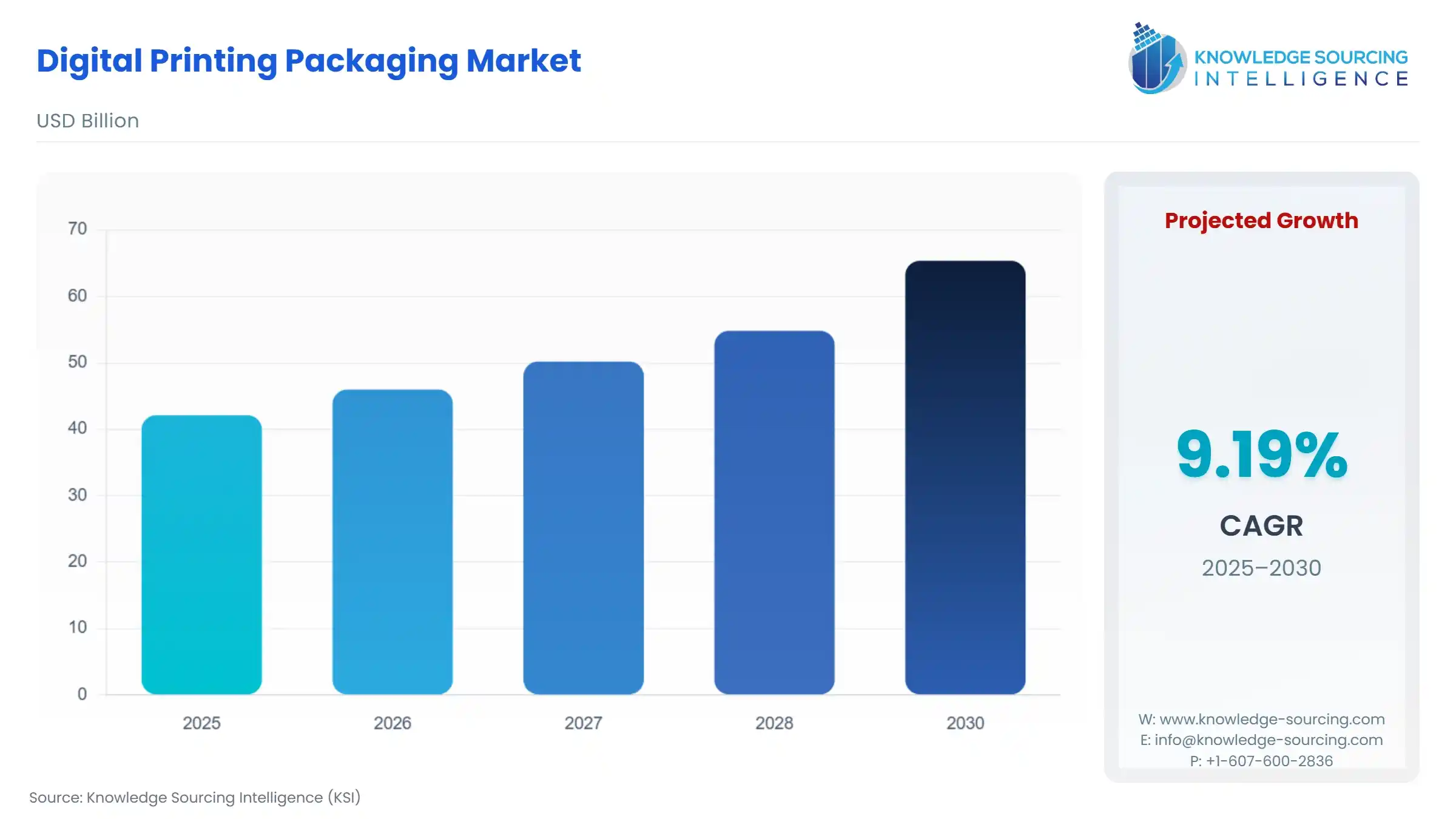

Digital Printing Packaging Market, with a 8.91% CAGR, is projected to increase from USD 42.111 billion in 2025 to USD 70.292 billion in 2031.

Digital Printing Packaging Market Trends:

The digital printing packaging market refers to the industry that uses digital technology to print packaging materials such as labels, cartons, and flexible packaging. It involves the use of specialized printers and software to create high-quality, customized packaging designs. Digital printing offers benefits like faster production, reduced costs, and the ability to accommodate shorter print runs and personalized designs, making it a popular choice for many businesses in the packaging industry.

Digital Printing Packaging Market Growth Drivers:

The digital printing packaging market is driven by several key factors. One of the main drivers is the growing demand for customization and personalized packaging solutions in various industries. With digital printing, businesses can easily create one-of-a-kind designs that match individual customer preferences, while also efficiently handling smaller print quantities. Additionally, digital printing offers faster production times, cost-effectiveness, and flexibility, making it an appealing choice for businesses looking to enhance their packaging appeal and brand differentiation.

Increasing Demand for Customized and Personalized Packaging Solutions:

The increasing demand for customized and personalized packaging solutions is a major growth factor. Digital printing technology enables businesses to create unique designs, tailor packaging to individual customer preferences, and incorporate variable data. This customization capability helps companies to stand out in a competitive market, enhance their recognition, and create stronger emotional connections with customers. Customized packaging also improves shelf appeal and differentiates products, ultimately driving growth and increasing customer loyalty.

Shorter Print Runs and Cost-Effectiveness:

Digital printing offers cost-effective production for shorter print runs in the packaging industry. Unlike traditional printing methods, it eliminates the need for expensive printing plates and reduces setup time, making it more feasible for small to medium-sized businesses and limited edition runs. This cost efficiency allows businesses to reduce production costs and achieve faster time to market. Additionally, digital printing provides flexibility for design changes and versioning, enabling businesses to adapt quickly to market demands. Overall, digital printing enhances affordability and production efficiency for shorter print runs in packaging.

Faster Production Times:

Digital printing offers a significant speed advantage over conventional printing methods, making it ideal for businesses with time-sensitive requirements or quick turnaround times. This rapid printing capability enables businesses to meet tight deadlines, seize market opportunities, and efficiently respond to changing demands. By facilitating quick production and delivery of packaging materials, digital printing helps businesses optimize their supply chain, minimize delays, and enhance customer satisfaction.

Improved Print Quality and Color Accuracy:

Advancements in digital printing technology have greatly improved print quality and color accuracy in packaging designs. Digital printers now offer high-resolution outputs, sharp details, and vibrant colors resulting in visually appealing and professional packaging. This enhanced print quality helps create a positive impression, attract consumer attention, and reinforce the firm’s image. The ability to accurately reproduce intricate designs and communicate important product information further enhances consumer engagement and demand.

Sustainability and Environmental Considerations also act as market drivers:

The increasing focus on sustainability has driven the adoption of digital printing in the packaging industry. Digital printing minimizes waste through on-demand production and eliminates pre-press setup materials, reducing environmental impact. The use of eco-friendly inks and the support for recycled and bio-based packaging materials further align with sustainable practices. Overall, digital printing enables greener and more sustainable packaging production, meeting the demand for eco-friendly solutions.

Digital Printing Packaging Market Segmentation Analysis:

The expansion of e-commerce is driving the market growth:

The rapid growth of e-commerce has fueled the demand for customized packaging and shorter print runs. Digital printing offers the flexibility and speed required to meet the packaging needs of e-commerce businesses. It enables personalized packaging for individual orders and seasonal promotions, allowing businesses to create a unique and memorable customer experience. The on-demand nature of digital printing reduces storage costs and eliminates the risk of obsolete packaging. Additionally, digital printing facilitates seamless integration of branding elements, reinforcing brand recognition and loyalty. Overall, digital printing empowers e-commerce businesses to meet the evolving demands of online retail and deliver compelling packaging solutions.

The rise of Direct-to-Consumer (D2C) Brands is boosting market growth:

The emergence of direct-to-consumer brands has driven the need for exceptional packaging that differentiates products and creates memorable customer experiences. Digital printing enables direct-to-consumer brands to achieve highly customized and visually appealing packaging that aligns with their identity. It offers unparalleled customization capabilities, facilitates personalization, allows for experimentation and iteration, and helps create a lasting impression. By leveraging digital printing, D2C brands can effectively engage consumers; stand out in the market, and build strong brand loyalty.

Flexible Packaging and Variable Data Printing:

The growth of flexible packaging, including pouches and sachets, benefits from the versatility and variable data printing capabilities of digital printing. Businesses can customize and print variable information, such as barcodes, QR codes, or individualized product details, effectively and efficiently. The cost-effectiveness and speed of digital printing support shorter print runs and faster time to market. By leveraging digital printing technology, businesses can efficiently meet the unique demands of flexible packaging, enhance product visibility, engage consumers, and drive sales.

Digital Printing Packaging Market Geographical Outlook:

Asia Pacific region is expected to dominate the market:

The Asia Pacific region is expected to dominate the digital printing packaging market because of its large consumer base, cost advantages, technological advancements, and changing consumer preferences. Moreover, the presence of prominent manufacturing hubs like China and India offers cost advantages and easy access to diverse packaging materials. Furthermore, the Asia Pacific region has witnessed substantial technological advancements in the digital printing market, boosting market growth. Lastly, the rise in disposable incomes and evolving consumer preferences favouring customized and visually captivating packaging further propel the adoption of digital printing in this region. Therefore, with a growing population, manufacturing hubs, and investments in digital printing infrastructure, the region is well-positioned for substantial market growth.

List of Top Digital Printing Packaging Companies:

Traco Packaging

Eastman Kodak Company

HP Development Company, L.P.

Xerox Corporation

Elanders Germany

Market Segmentation:

BY TYPE

Corrugated Packaging

Folding Cartons

Flexible Packaging

Labels

BY PRINTING TECHNOLOGY

Inkjet Printing

Electro photography Printing

BY END-USER

Food & Beverages

Pharmaceuticals

Electronics

Personal Care & Cosmetics

Others

BY GEOGRAPHY

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others