Report Overview

Digital Imaging Market Report, Highlights

Digital Imaging Market Size:

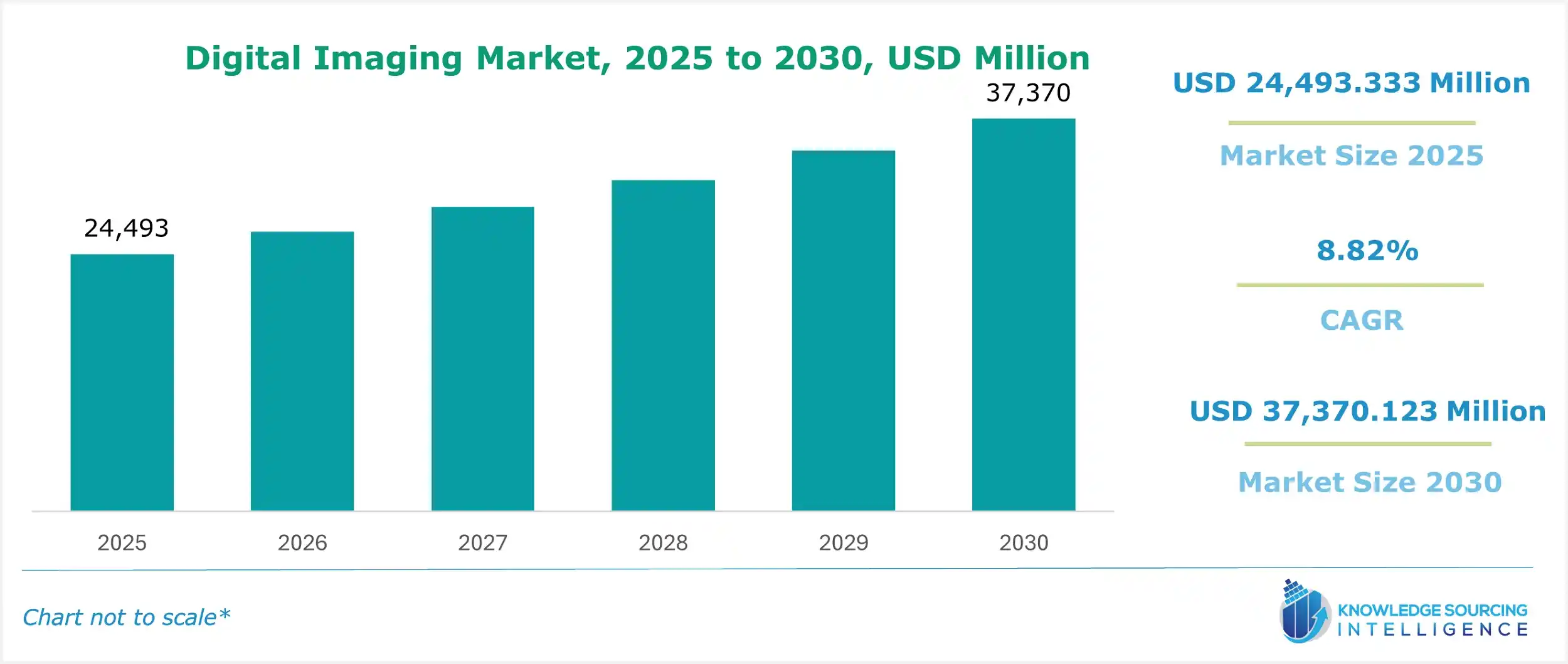

The digital imaging market is evaluated at US$24,493.333 million in 2025, growing at a CAGR of 8.82% and reaching a market size of US$37,370.123 million by 2030.

The growth in demand for security and surveillance systems is pushing digital imaging. Residential and commercial use is increasing as investments in high-tech surveillance tools grow, along with expanding global concerns about security and safety. Since digital imaging provides clear, high-resolution monitoring and recording for enhancing security processes, it becomes a necessity in these systems. The development of smart cities further enhances this, with greater crime prevention awareness and the integration of digital imaging with next-generation analytics and AI. Since security systems require sharper, clearer, and real-time imaging to efficiently observe and safeguard different environments, this demand is fueling constant evolution in imaging technologies.

Digital Imaging Market Drivers:

- Increasing Need for Security and Surveillance Systems

Developing automated, high-throughput analyzers with improved sensitivity and accuracy has transformed digital imaging in several industries, particularly in the semiconductor sector, where exact control over silica concentrations in ultrapure water is essential. Remote silica level monitoring and analysis is made possible by combining wireless connectivity and cloud-based data management systems. Proactive water quality management is made possible by this technological breakthrough, increasing efficiency and data accessibility.

- Growing use of digital cameras is estimated to increase market expansion.

Due to their growing use in personal and professional settings, high-resolution digital cameras are becoming increasingly in demand. The digital image market is dramatically expanding as companies require high-resolution imaging for uses such as marketing, product design, and quality inspection, and customers demand improved image quality for photography and video recording. Better visual documentation, enhanced user experience, and the growing importance of high-definition media in several industries are driving this trend.

- Developments in Software for Image Processing

The digital imaging market’s growth depends on advancements in image processing software. Recent software developments have improved the ability to edit, analyze, and manage digital images. These developments improve imaging systems' usability and functionality, increasing their appeal to expert and novice users. By giving consumers access to more potent and adaptable imaging solutions, improved software features like sophisticated filters, automated adjustments, and advanced analytical tools are propelling market expansion.

Digital Imaging Market Restraints:

- Data Security and Privacy Concerns

The digital imaging market is challenged with data security and privacy issues, particularly in sensitive areas such as healthcare. The confidence of the users and market adoption can be affected by the potential for data breaches and unauthorized access to digital images. It is important to ensure robust data security measures and compliance with privacy regulations to eliminate these concerns and facilitate market growth.

Digital Imaging Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period.

Due to advancements in economic growth, infrastructure development, and power plant construction, the Asia-Pacific market is expected to grow at the highest CAGR during the forecast period. They are anticipated to further drive the digital imaging market expansion. The significant development and modernization of manufacturing infrastructure in countries like China and India are key factors driving stronger demand. Asian-Pacific countries are involved in the manufacture of defence aircraft, which is expected to grow the employment of digital imaging across aerospace and defence industries.

Digital Imaging Market Key Launches:

- In November 2024, the Aquilion ONE/INSIGHT Edition CT scanner from Canon Medical Systems was named the 2024 Best New Radiology Device at the annual Minnies Awards. This event honors radiology's innovation and excellence. Unveiled at RSNA 2023, this flagship CT scanner exemplifies Canon's dedication to developing radiology through innovative technology and improved clinical workflows.

- In November 2024, Detection Technology, a world leader in X-ray detector solutions, advances medical imaging at the RSNA 2024 show by showcasing a wide range of flat panel X-ray detectors. This distinctive line of medical flat panels consists of 20 solutions that offer a broad dynamic range, high frame rates, and outstanding image quality at low dosages. The recently improved portfolio is tailored for various medical uses, such as dental imaging, oncology, fluoroscopy, wireless radiography, and image-guided surgery.

Digital Imaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Digital Imaging Market Size in 2025 | US$24,493.333 million |

| Digital Imaging Market Size in 2030 | US$37,370.123 million |

| Growth Rate | CAGR of 8.82% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Digital Imaging Market |

|

| Customization Scope | Free report customization with purchase |

Digital Imaging Market Segmentation:

- By Technology

-

- Metrology

- Radiography

- Machine Vision

- LiDAR

- By Industry Vertical

-

- Aerospace

- Automotive

- Consumer Electronics

- Semiconductor

- Pharmaceutical

- Oil & Gas

- Public Infrastructure

- Energy & Power

- By Geography

-

- North America

-

-

- United States

- Canada

- Mexico

-

-

- South America

-

-

- Brazil

- Argentina

- Others

-

-

- Europe

-

-

- Germany

- France

- Spain

- United Kingdom

- Others

-

-

- Middle East and Africa

-

-

- UAE

- Saudi Arabia

- Others

-

-

- Asia Pacific

-

-

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Taiwan

- Others

-