Report Overview

Desktop 3D Printing Market Highlights

Desktop 3D Printing Market Size:

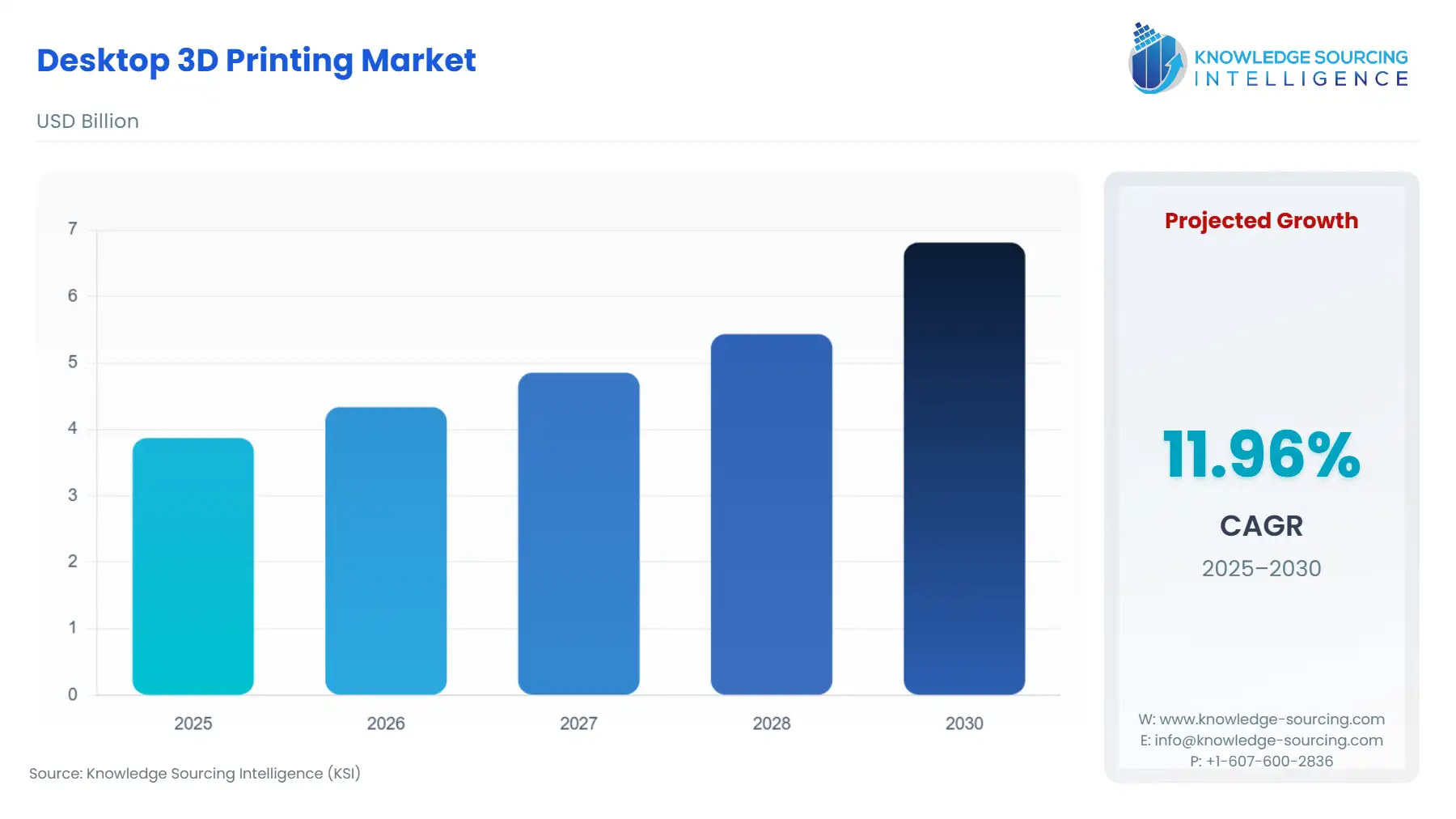

The Desktop 3D Printing Market is expected to grow from US$3.873 billion in 2025 to US$6.813 billion in 2030, at a CAGR of 11.96%.

Desktop 3D Printing Market Trends:

The global adoption of desktop 3D printers is being fueled by the growing use of additive manufacturing as well as the rising demand for rapid prototyping and sophisticated manufacturing across several industries. Rapid prototyping has become more popular, which has helped businesses create effective systems and products. During the anticipated period, these elements are anticipated to work together to drive the market.

- Diversified Application

The diverse technology of 3D printing is being used to produce everything from desk accessories to decorations and functional elements. When designing machinery and systems, the accuracy and accurate sizing of these functional elements are crucial. Iterations with shorter lead times and 3D printing of functional parts enable users to quickly create the prototype without relying on machine shop capabilities, lowering fabrication costs and speeding up the desktop 3D printing market. According to the report by the Government of the United Kingdom published on October 2022, $14 million has been granted for projects using digital technology to increase energy efficiency, productivity, and growth across major manufacturing industries. Projects include large-scale sustainable 3D printing including Desktop 3D printing and utilizing AI to increase the effectiveness of steel production.

- Rising Share of Desktop Printing

The rising share of Desktop Printing is expected to propel the 3D desktop printing market. According to The Additive Manufacturing Landscape 2020 report by UK-based additive manufacturing software company AMFG, the share of desktop machines in the global 3D printing hardware was a major 15.4%, as compared to electronics and composite machines with 3.8% and 6.9% of the share. This makes desktop machines hold the 3rd position globally after metal and polymer machines. The high share of desktop machines or printers in the hardware category of the 3D printing business is directly projected to boost the market demand for 3D desktops thereby enhancing it over the forecast period.

- Increasing Market Competiton

The major companies are focusing on various strategies such as new product development, expansions, mergers and acquisitions, and investments. For instance, 3D Systems and Enhatch, a provider of AI software applications for surgical procedures, collaborated in March 2022. Through this collaboration, AI will be included in 3D System's patient-specific solutions, which include services like cutting-edge software, unique implant and instrument design, skilled treatment planning, and manufacturing procedures. The implementation of additive manufacturing technologies on a broad scale and rising technological developments are the main drivers for growth. Favourable government policies raised R&D expenditure, and technology standardization is anticipated to accelerate market expansion.

- Technological Innovations

Technological innovations are propelling market expansion. For instance, in June 2023, HeyGears, a major supplier of 3D printing technology and solutions, announced the beginning of pre-sales for the UltraCraft Reflex, its first desktop 3D printing product for end users. The UltraCraft Reflex is an all-in-one production platform that enables users to more quickly and effectively realize their ideas. This cutting-edge resin 3D printing solution is positioned to enhance the making process by intelligently simplifying each step leading to the printed product due to its superior features and capabilities. The XiP desktop printer, which was introduced in December 2022, has established itself as the go-to option for business users wishing to upgrade their desktop SLA and resin-based printers to greater build volumes and better print speeds. XiP desktop 3D printer is servicing a wide range of technical and dentistry applications, including orthodontic models, splints, and surgical guides, with hundreds of units sold globally in just a few months.

- Increasing Adoption of stereolithography (SLA)

SLA is an additive manufacturing technology that helps in creating various 3D shapes. To make these shapes laser energy is used and that helps in hardening the resins in the reservoir. Things such as concept models, intricate geometrics, cosmetics prototypes, and various other things can be made from SLA technology. Companies see the SLA technology 3D printing grow in the coming years and are heavily invested in this technology. For instance, in November 2021, SHINING 3D launched a new SLA 3D Printer & 3D Scanner at Formnext 2021. As per the company, the newest additions to the product portfolio would empower fast, efficient, high-performing, and accessible 3D printing with high-resolution 3D scanning for various industrial purposes.

- North America is Expected to Grow Considerably

The innovative technological developments to suit various industry needs will propel the market growth in desktop 3D printing solutions in the region. The rising expenditure by developed economies such as the US related to advanced manufacturing technologies will propel market growth. Favorable government policies to increase the share of funding for R&D in 3D desktop printing technologies will impact market growth. For Instance- The National Aeronautics and Space Administration (NASA) recently identified crucial R&D investment that can bring advancement for 3D printing components for space applications. According to estimates from Sculpteo, the top listed priority was given to the strength of material near to 75%, followed by low cost & ease of usage respectively. Over 68% of companies preferred the use of 3D printing solutions for pre-series manufacturing & prototyping.

Desktop 3D Printing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Desktop 3D Printing Market Size in 2025 | US$3.873 billion |

| Desktop 3D Printing Market Size in 2030 | US$6.813 billion |

| Growth Rate | CAGR of 11.96% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Desktop 3D Printing Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Technology

- Fused Deposition Modeling (FDM)

- Fused Filament Fabrication (FFF)

- Stereolithography (SLA)

- Others

- By Filament Used

- PLA

- PETG

- ABS

- Others

- By Component

- Hardware

- Software

- Services

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America