Report Overview

Cyber Warfare Market - Highlights

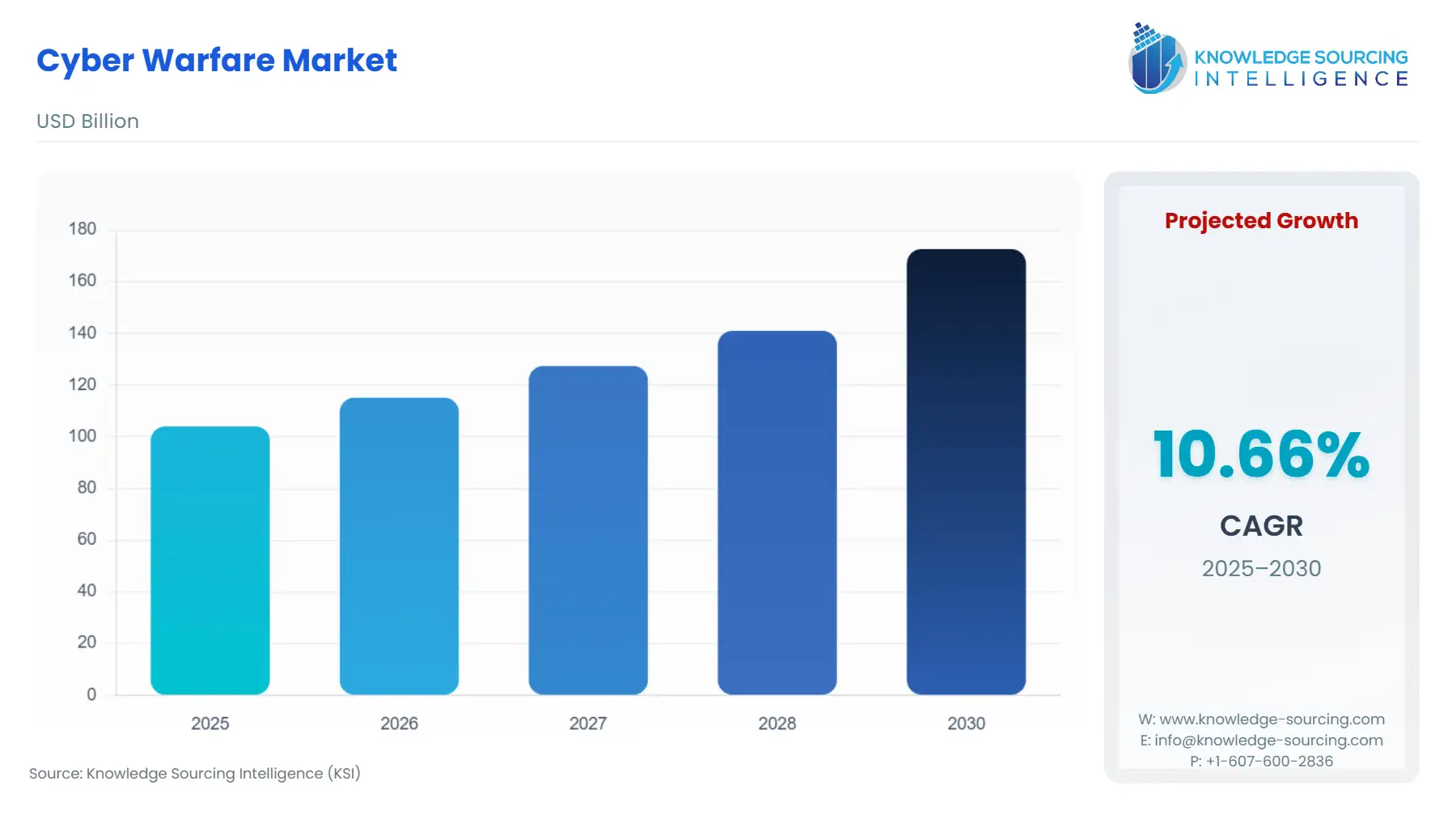

Cyber Warfare Market Size:

The cyber warfare market is expected to achieve a 10.66% CAGR, growing from USD 104.058 billion in 2025 to USD 172.701 billion by 2030.

Cyberwarfare is the act of computerized and virtual attack initiated by an organization or a nation with the intention to target and cause substantial damage and harm to another nation or its military, or its government. These attacks have the potential to wreak havoc on the critical functioning of the country to the extent that they may cause infrastructure loss or loss of life. One of the earliest cyberwarfare incidents that helped the world understand and perceive the potential of cyberwarfare was the Stuxnet Worm attack in 2010. It was a highly developed malware attack on the Iranian nuclear program targeting the data control systems.

With advancements in technology and the evolution of computer software, the intensity and impact of cyberwarfare attacks have seen growth over the last decade. As it is expected that over the next few decades, technology will continue to expand its horizon, it is inevitable that its application in cyber warfare activities will be colossal. Even during the COVID-19 lockdown, there have been instances of cyberwarfare activities. This demonstrates that the war ideology of the human world is shifting towards biological and cyberwarfare. Therefore, the cyberwarfare market is expected to experience impressive advancement in the upcoming years.

The rise in cyberattacks is fueling growth in the market for Cyberwarfare market. For instance, in January 2023, the Malaysian Government discovered a bunch of cyberattacks at their initial stages and prevented them from being successful. These attacks were believed to be the action of an unidentified hacker community trying to extract confidential information from the national defence network of Malaysia. Additionally, throughout the initial months of 2022, amidst the war situation between both countries, Russia and Ukraine launched a series of cyberattacks against each other frequently. Various departments of the target country, such as the electricity, justice, and cabinet, were attacked. These attacks were stopped by both countries in the latter half of 2022.

Cyber Warfare Market Drivers:

- The investments and developments in cybersecurity forces act as a detriment to the growth of the cyber warfare market.

With the increasing threat of cyberwarfare attacks in different forms, such as malware, hacking and theft, viruses, etc, various nations across the world have simultaneously started investing in strengthening their cybersecurity and defense. Many companies, such as IBM, Imperva, and Palo Alto Networks, offer cybersecurity solutions to organizations and nations all over the world. With efficient and effective research and investment into the cybersecurity field, countries and organizations can come up with concrete and impenetrable cybersecurity solutions to battle against cyberwarfare attacks and make them ineffective. This could hinder the expansion of the cyber warfare market if the attacking organization or nation is not able to come up with new developments to break through the cybersecurity measures.

Cyber Warfare Market Recent Developments:

- In December 2022, BAE Systems announced that it would be collaborating with Rolls-Royce Company to develop an engine for a new fighter jet, which is expected to have advanced cyber warfare and AI capabilities. This project will be funded by the UK and its allies, Italy and Japan.

- In February 2023, Ions Trading Technologies, a financial data management company, fell victim to a cyberattack. This affected the functioning of the derivatives market, and some of the company’s clients were forced to finish their data processes manually.

Cyber Warfare Market Geographical Outlook:

- Asia Pacific region contains a significant opportunity for expansion of the Cyberwarfare market, with China taking the lead in this region.

According to the World Data Bank, countries in the Asia-Pacific region, like China, North Korea, India, and Vietnam, are among the top 15 countries with the largest number of hackers. Given that governments across the world have started investing in improving and increasing their cyber power and cybersecurity, the presence of a hacker community in the country acts as a catalyst in reaching their cyber goals faster. In many classifications of cyber power, China holds the top rank and is continuing to invest in and develop its cyber army. China and North Korea are known for cyberwarfare attacks, causing damage to the target nation. Keeping these factors in mind, it can be said that the Asia Pacific region has a great potential to hold a large market share of the cyberwarfare world in the upcoming years.

Cyber Warfare Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 104.058 billion |

| Total Market Size in 2031 | USD 172.701 billion |

| Growth Rate | 10.66% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Industry Vertical, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cyber Warfare Market Segmentation:

- CYBER WARFARE MARKET BY TYPE

- Viruses

- Malware

- Hacking

- Data theft

- Ransomware

- Others

- CYBER WARFARE MARKET BY INDUSTRY VERTICAL

- Government and Defense

- Aerospace

- BFSI

- Corporate

- Others

- CYBER WARFARE MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America