Report Overview

Cosmetics Ingredients Market - Highlights

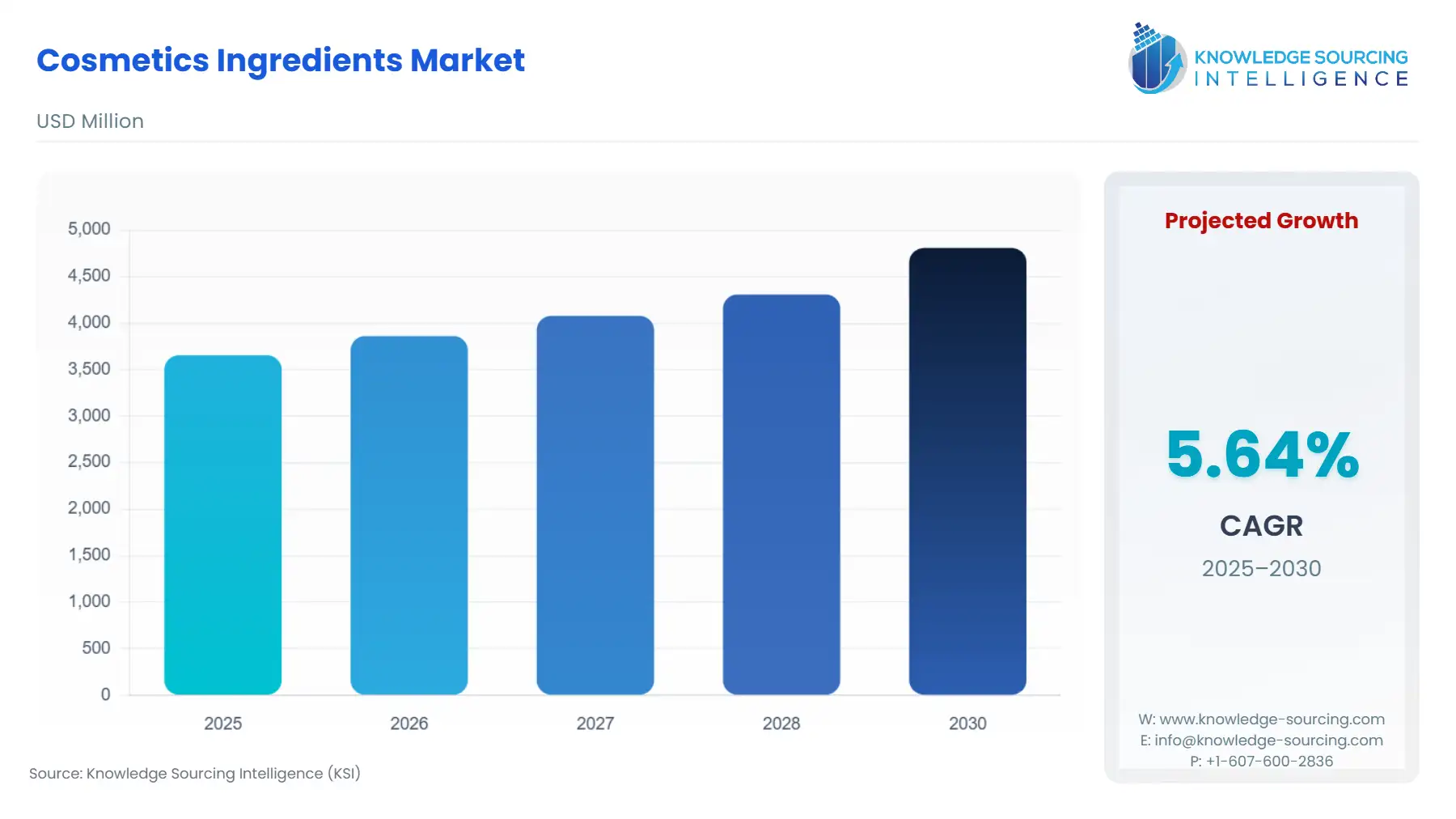

Cosmetics Ingredients Market Size:

The cosmetics ingredients market is expected to grow from USD 3.655 billion in 2025 to USD 4.808 billion in 2030, at a CAGR of 5.64%.

Cosmetic components are the same substances that are employed in the manufacture and composition of cosmetics. Cosmetic additives are also utilized as washing, moisturizer, and coloring agent. Cosmetic ingredients are the raw materials utilized in the production of personal care products all over the world. Furthermore, the cosmetic ingredients market is rising due to the increasing use by consumers and the availability of several products that are organic and clean label. In addition, companies have also been enhancing their e-commerce segment which has been beneficial for the market’s profitability. Similarly, rising demand for specialized skincare products is predicted to propel the market expansion of cosmetic ingredients over the projected timeframe.

Cosmetics Ingredients Market Driver:

- The increasing awareness of chemical-free and organic products will positively influence the market

Growing consumer awareness of clean-label cosmetic goods has resulted in the creation of environmentally friendly green cosmetics. Cosmetic ingredient producers develop new products or ingredients, as well as conduct intensive research and development, to fulfill customer demands. The growing emphasis on improving and modifying the textual properties of various ingredients used in the personal care and cosmetics industries, as well as rising consumer awareness about the benefits and drawbacks of using products made with specific ingredients, are expected to fuel demand in the global cosmetic ingredients market in the coming years. Several companies have launched products to enhance their beauty range by providing clean products to their customers. For instance, Olay launched three new body-washing products with the vitamin B3 complex in April 2020. Such product releases have encouraged the effective use of natural cosmetic components in the cosmetics and personal sector for the development of diverse product lines in skincare and body care, consequently driving the growth of the cosmetic ingredients industry throughout the forecast period. Additionally, in November 2022, Juicy Chemistry, a beauty business located in Coimbatore, introduced Color Chemistry, an organic color cosmetics brand that uses "pigment and skin-loving" ingredients. According to the company, its goods are organic, responsibly packaged, sustainably sourced, and devoid of synthetic perfumes and talc.

- The collaboration and market competitiveness of companies in the industry has been beneficial for the growth of the segment

Due to the prevalence of advanced and upgraded cosmetics products by various beauty brands, the market is grown significantly competitive to provide expansion. Therefore, companies have collaborated with brands to enhance their operational and marketing strategies which have led to the market gaining substantial momentum for the upcoming years. For instance, Sharon Laboratories Ltd. inked an agreement in April 2022 to purchase the cosmetic ingredients unit of Gorla Minore of B&C S.p.A, and this acquisition gives Sharon Laboratories the chance to expand its cosmetic ingredients product line. Moreover, Evonik purchased Botanica in October 2021 as part of an effort to expand Evonik Care Solutions' footprint in the personal care and productive Cosmetic Ingredients Market.

Cosmetics Ingredients Market Geographical Outlook:

- Asia Pacific accounts for a major share during the forecasted period

Due to the increase in the e-commerce industry in the region in addition to market competitiveness, companies have significantly generated their revenue in the past 5 years. Moreover, ASEAN held its third ASEAN Online Sale Day (AOSD) in 2022. It was a three-day online shopping event that took place on August 8 to 10, 2022. More than 200 ASEAN e-commerce enterprises participated in AOSD in 2020, offering a wide range of goods and services at promotional or reduced pricing via their e-commerce platforms. In 2021, the event grew even further, with over 350 firms from throughout ASEAN taking part. According to the Association of Southeast Asian Nations, in 2022, it is projected that corporate and consumer interest in AOSD will remain high. ASEAN's e-commerce sector is predicted to quadruple in size from US$100 billion to US$300 billion by 2025, as per the same source.

Furthermore, according to Shiseido's Quarterly Report, sales of the company's cosmetics products for men and women increased by 9% in Asia-Pacific in the first half of 2022 compared to the first half of sales volume in 2021. Similarly, according to a L'Oréal statement, the company's sales of active cosmetic products in China increased by 13.4% in Q1 2022 compared to Q1 2021. Growing cosmetic product consumption in key Asia-Pacific nations such as China is boosting the demand for cosmetic components such as emulsifiers and preservatives in the area, fueling the expansion of the market.

Cosmetics Ingredients Market Key Developments:

- In May 2022, SUGAR Cosmetics received $50 million in its Series D investment, sponsored by L Catterton's Asia fund. Returning shareholders A91 Partners, Elevation Capital, and India Quotient also participated in the round.

- In November 2022, Alix Avien Paris announced the arrival of its high-end beauty and cosmetic goods in India. Along with a varied assortment of make-up products, the beauty business seeks to produce make-up that gives increased skincare-like nutrition.

- In October 2022, Felisha Cosmetics, a leading beauty firm, increased its product line by launching new products for its brands Color Fx, Urban Veda, and Skin Fx at the recently concluded Cosmoprof show in Mumbai.

Cosmetics Ingredients Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.655 billion |

| Total Market Size in 2031 | USD 4.808 billion |

| Growth Rate | 5.64% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Ingredient Type, Product Type, Function, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cosmetics Ingredients Market Segmentation:

- By Ingredient Type

- Natural

- Synthetic

- By Product Type

- Preservatives

- Thickeners

- Emulsifiers

- Colors & Fragrances

- Others

- By Function

- Cleansing

- Moisturizing

- Aroma

- Bleaching

- Others

- By Application

- Skincare

- Bodycare

- Haircare

- Oralcare

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Australia

- Others

- North America