Report Overview

Cooling Towers Market Size, Highlights

Cooling Towers Market Size:

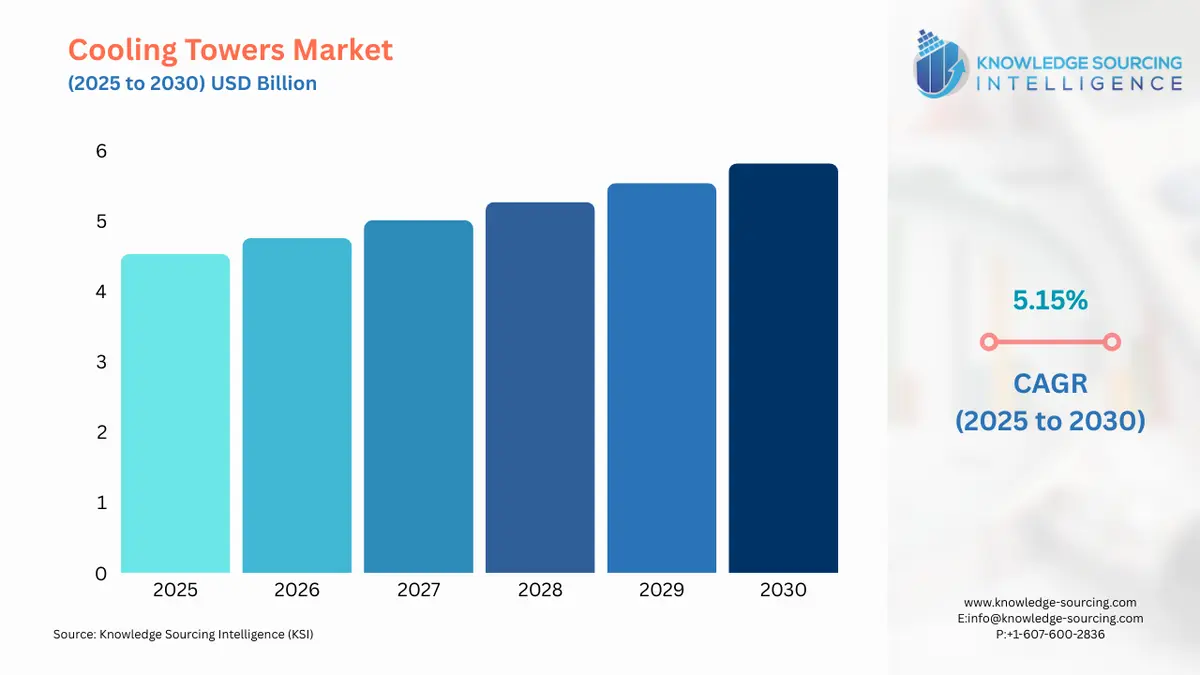

The cooling towers market is anticipated to reach US$5.823 billion in 2030 from US$4.531 billion in 2025 at a CAGR of 5.15%.

Cooling towers are specialized heat exchangers that assist in managing the temperature of industrial buildings, manufacturing plants, and factories. Their ability to expel excessive heat makes them an integral part of various industrial operations where high-temperature activities are performed.

Favorable investment in new oil and gas refineries, followed by the establishment of manufacturing units and new power stations, has propelled the demand for cooling towers to remove excessive heat in such infrastructures, driving the global market.

Likewise, the ongoing technological innovations in cooling towers to bolster the overall performance output are acting as an additional driving force for the market expansion. However, the high cost associated with raw material procurement, labor, technical expertise, and price volatility are expected to hamper the market demand for these structures, hindering the overall market expansion.

Cooling Towers Market Growth Drivers:

- Favorable Investment in oil refineries has propelled the market growth.

Cooling towers circulate the heat generated during operations and by HVAC equipment, which increases the building’s overall temperature and negatively impacts ventilation. Oil refineries carry various functions, such as petroleum and gas processing, extraction, and storage, which generate a lot of heat. Hence, since cooling towers are based on the heat removal principle, they find high applicability in such refineries.

Rapid industrialization, high consumer demand, and bolstering growth in the transportation sector have increased the overall demand for crude oil globally, making major petroleum companies expand their refinery operations to enhance their production capacity. For instance, in September 2024, Bharat Petroleum Corporation Ltd announced an investment of US$8.95 billion over the next five years to expand the company’s refining capacity. Moreover, the company announced two petroleum projects worth US$6.4 billion in 2023.

Additionally, in January 2024, Eni confirmed its decision to build Italy’s third bio-refinery in its Livorno site. This will further address the company’s commitment to reaching full-scale carbon neutrality from 1.65 million tons to 5 million tons by 2050.

- Growing technological innovations have accelerated the market growth.

The current industrial boom in major economies has increased the scale of operations, especially in chemical, oil and gas, food and beverage, and power energy, all of which are the major heat producers. The cooling towers, by bringing water and air together, dissipate the excessive heat, which further minimizes the structural damage by maintaining the temperature flow within.

Over the past couple of years, technological innovations have gained traction for various commercial and industrial applications. With the current ongoing emission issue, the demand for machines and equipment that can easily dissipate heat is high. Hence, various market players have invested in expanding their cooling tower product offerings. For instance, in January 2024, Tower Tech USA received the FM approval certification for the company’s fully-factory assembled FRP (Fiber-Reinforced Polymers) cooling towers. This demonstrates Tower Tech’s commitment to providing high-quality cooling towers matching global standards and safety norms to increase their shelf-life.

Cooling Towers Market Segment Analysis:

- The natural draft cooling tower is expected to constitute a considerable market share.

By type, the cooling towers market is divided into natural draft and mechanical draft. The latter is projected to hold a significant market share due to its cost-effective nature, easy operability, low maintenance, and power-saving capacity, making it ideal for petroleum plants, refineries, power stations, and manufacturing units. The growing number of end-user applications is positively impacting the overall segment growth.

- The chemical plants are expected to grow constantly during the given time frame.

Application-wise, the cooling towers are analyzed into chemical plants, oil & gas refineries, power stations, food processing plants, and others. The chemical plants are poised for a positive expansion fueled by the booming industrial chemical demand in major economies which has led to investments in new manufacturing establishments.

Likewise, power stations will account for a considerable market share, which is attributable to government-backed initiatives and projects to bolster renewable energy usage in power and electricity generation. Additionally, oil and refineries are estimated to grow steadily owing to ongoing offshore and onshore exploration projects, followed by investment in establishing new units in the Middle East region.

Cooling Towers Market Geographical Outlooks:

- North America is anticipated to account for a considerable market share.

Based on geography, the cooling towers market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The North American region is anticipated to account for a considerable market share fueled by the favorable investments in new power stations to address the growing energy demand in major regional nations, namely the United States. For instance, in June 2024, Bechtel initiated the ground-breaking ceremony of the “Natrium Demonstration Project” in Wyoming, which involved the construction of a nuclear power plant that would generate enough energy to power 400,000 homes. The project forms part of the US Department of Energy’s “Advanced Reactor Demonstration Program”.

Additionally, bolstering growth in other major sectors such as chemicals, food, and beverage, followed by strategic maneuvers to bolster the United States' oil production capacity, has further augmented the regional market expansion. According to U.S. Energy Information, as of January 2024, there were 132 operable oil refineries in the US, with the recent addition of Texas International Terminal, which was established in February 2022.

The Asia Pacific region will also constitute a significant market share due to rapid industrialization in major nations, namely China, Japan, India, and South Korea. This will be followed by favorable schemes and public-private partnerships to bolster oil exploration projects, thereby establishing more refineries in the region. Likewise, Europe is estimated to grow at a constant rate, whereas South America will account for a minimal market share.

Cooling Towers Market Key Developments:

- In November 2023, Metso Corporation launched its upgraded “Evaporative Cooling Tower,” which uses a hot electric precipitator and a bag filter for cooling hot furnace off-gases through evaporation. The tower is equipped with automatic control features to streamline cooling during startup and other varying processes.

- In September 2022, Tower Tech launched “StromStrong” cooling towers featuring fiber-reinforced polymer corrosion-resistant technology. This technology makes the towers capable of functioning in extreme weather conditions and withstanding major climatic events such as earthquakes and hurricane-force winds.

Cooling Towers Market Scope:

| Report Metric | Details |

| Cooling Towers Market Size in 2025 | US$4.531 billion |

| Cooling Towers Market Size in 2030 | US$5.823 billion |

| Growth Rate | CAGR of 5.15% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cooling Towers Market | |

| Customization Scope | Free report customization with purchase |

The cooling towers market is segmented and analyzed as follows:

- By Type

- Natural Draft

- Mechanical Draft

- By Component

- Fan

- Spray Nozzles

- Distribution Basin

- Collection Basin

- Others

- By Application

- Chemical Plants

- Oil & Gas Refineries

- Power Stations

- Food Processing Plants

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America