Report Overview

Contraceptives Market - Strategic Highlights

Contraceptives Market Size

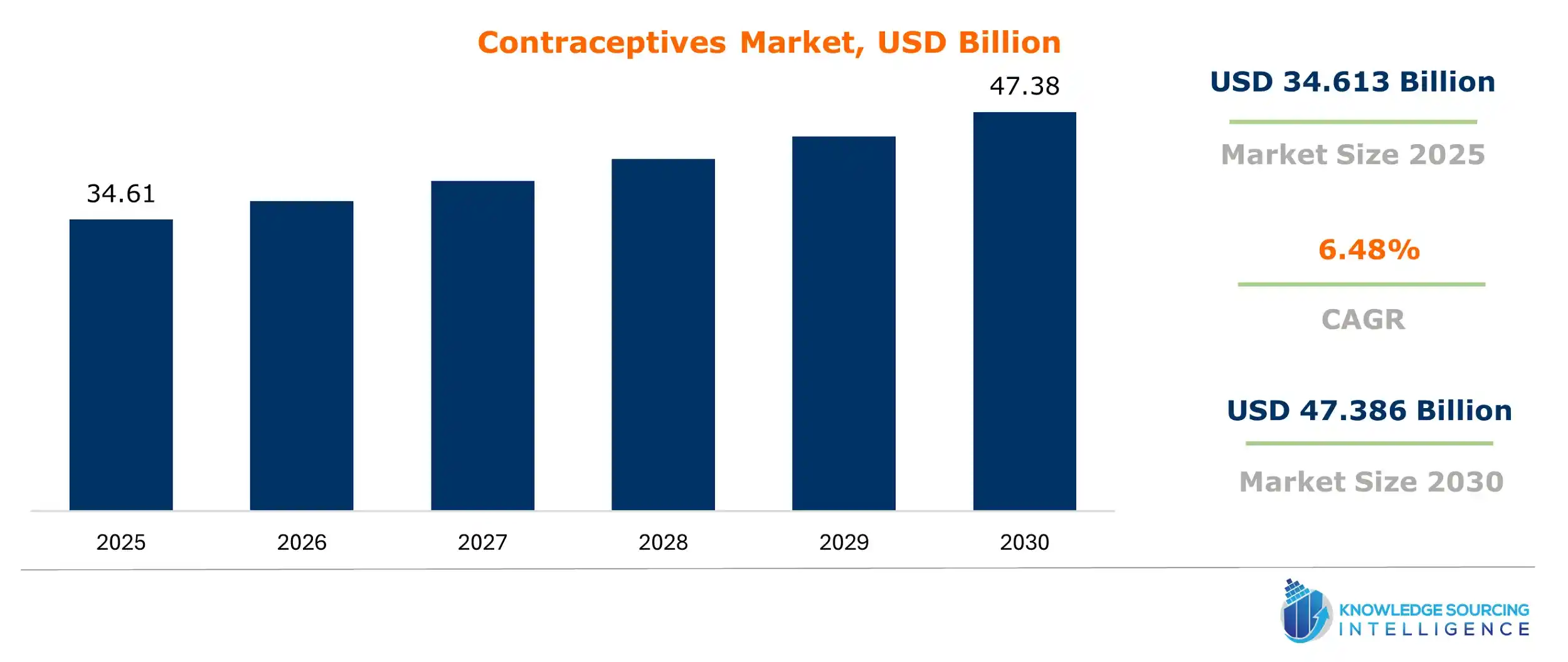

The contraceptive market is expected to grow at a CAGR of 6.48%, reaching a market size of US$47.386 billion in 2030 from US$34.613 billion in 2025.

Contraception is the application that prevents a woman from pregnancy through medications or devices. Other commonly known as fertility control and birth control. The market is expected to continue growing as the incidence of STDs rises. More women are seeking contraceptive medicines and devices, particularly among young women who are beginning to use contraception as they attain higher levels of education.

Furthermore, the health risks posed by teenage pregnancy, increased awareness regarding modern contraceptive methods, and a growing preference for oral contraceptives as the principal method to avoid unintended pregnancy are expected to drive market growth over the next few years.

Contraceptive Market Growth Drivers:

- The growing need for population control is contributing to the contraceptive market growth

Government measures to control population growth in various countries have increased awareness of family planning and contraception among women in both rural and urban areas. Additionally, rising incidences of unintended pregnancies have led to increased utilization of oral contraceptives, especially in developed markets. Particularly in Asian countries, the population is expanding at an incredible rate, impacting the microeconomic balance. The public and private sectors are working together to control this growing population, which should benefit sex education and the use of contraceptives in the years to come. This is expected to drive the market revenue for oral contraceptives during the forecast period.

- High demand for pregnancy wearable technology is anticipated to boost the contraceptive market.

Wearable technology for tracking unborn child movements is gaining traction in the presence of increasing awareness and lifestyle changes among women. Pregnancy devices are useful throughout pregnancy, from conception until childbirth. Some home ultrasounds and baby health monitors provide essential information to parents about their unborn child. It is becoming a reality that wearables are used in terms of functionality in frugal and portable small sizes for hospitals and home health services. It helps in monitoring fetal development.

The market for wearable technology is propelled by the 800 deaths yearly due to pregnancy-related diseases, per estimates by WHO. Common pregnancy problems have increased and are affecting both the mother and child. In conjunction with telehealth and IoT, emerging new care models can make wearable pregnancy devices more commonplace as they enhance healthcare systems and prolong maternity leaves. These are growing the market for contraceptives.

- Growing demand for hormonal contraceptives is anticipated to boost the contraceptive market.

As the population grows and birth control technology advances, hormonal contraception is changing and becoming more widely used. By thickening cervical mucus, thinning the uterine lining, and preventing egg release, hormonal pills that contain progesterone and estrogen prevent pregnancy. Development in public awareness for an increase in consumption for rapid or easy incapacity from the side of the children. Progestin and estrogen are combined hormones that thicken cervical mucus and prevent ovulation at the combination phase. Moreover, only two classes of the available marketed drugs have achieved patient compliance. Additionally, awareness, changes in lifestyle as well as programs from the government have made hormonal contraception a common means of avoiding conception.

Contraceptive Market Restraints:

- Lack of awareness is anticipated to hamper the market growth

One major factor impeding the market expansion for contraceptives is a lack of awareness, especially in rural and underdeveloped areas. Most individuals are not even made aware of the various types of availability, much less how to appropriately use these methods. This ignorance frequently results from insufficient sexual health impartation and fewer outreach programs from organizations or healthcare providers.

Cultural taboos around reproductive health conversations often hamper frank communication and dissemination of apt information, thus making this issue worse. In addition, inaccurate, exaggerated concerns about long-term health risks or side effects further discourage the use of contraceptives. This situation prevents many individuals from making wise decisions, ultimately leading to reduced adoption rates and, subsequently, higher incidences of unwanted pregnancies.

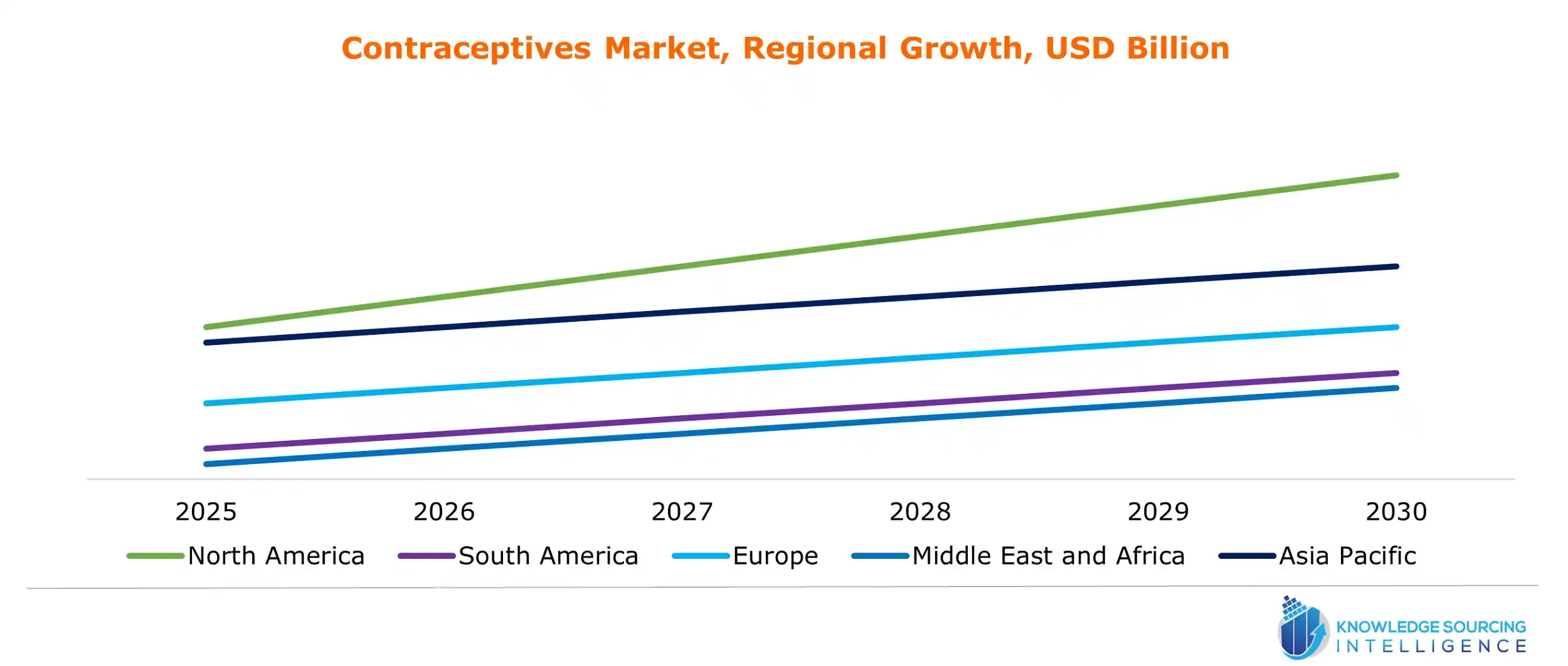

Contraceptive Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

The market growth in North America includes the inclination of young people toward sexual activities and the high awareness of reproductive health and contraception among them regarding the matters. Teenagers in the regions need contraceptives more due to the introduction and spread of cheap generic products and devices. The expansion of publicly funded family planning services and the rise in social organization efforts in the US to increase access to contraception. Most importantly, the two government-aided initiatives where insurance covers contraceptive methods- the Affordable Care Act and Title X- have made these products accessible and affordable.

Contraceptive Market Key Launches:

- In March 2024, Perrigo Company plc, a prominent supplier of consumer self-care products, shipped Opill® to pharmacies and major retailers and will be available online and on store shelves nationwide. In July 2023, the FDA approved Opill®, the first over-the-counter (OTC) birth control pill available in the United States without a prescription, for use by people of all ages.

- In February 2024, the U.S. biotech firm Daré Bioscience and Bayer partnered to create a hormone-free monthly contraceptive to broaden the use of existing methods of birth control. The contraceptive device, which is a ring that is placed into the vagina, works for three weeks without the user having to do anything during sexual activity.

List of Top Contraceptives Companies:

- Allergan plc (AbbVie)

- ANSELL LTD.

- Bayer AG

- CooperSurgical Inc.

- Merck & Co., Inc.

Contraceptives Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Contraceptives Market Size in 2025 | US$34.613 billion |

| Contraceptives Market Size in 2030 | US$47.386 billion |

| Growth Rate | CAGR of 6.48% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Contraceptives Market |

|

| Customization Scope | Free report customization with purchase |

The contraceptive market is segmented and analyzed as follows:

- By Product

- Drugs

- Contraceptive Pills

- Injectable Contraceptives

- Topical Contraceptives

- Devices

- Condoms

- Intrauterine Devices (IUDs)

- Diaphragms

- Rings

- Others

- Drugs

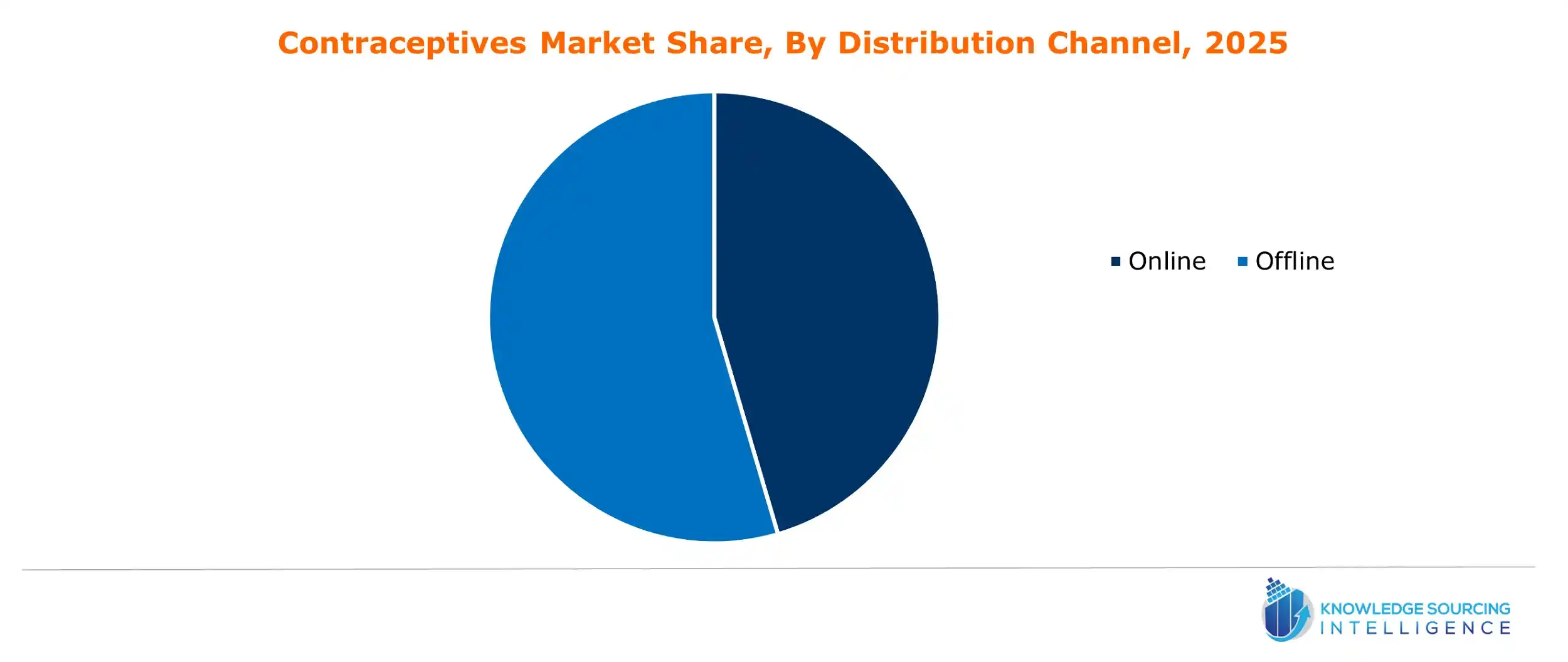

- By Distribution Channel

- Online

- Offline

- By Age Group

- 15–24 years

- 25–34 years

- 35–44 years

- Above 44 years

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America

Our Best-Performing Industry Reports:

- Chemical Warehousing Market

- Artificial Intelligence (AI) Text Generator Market

- 3D Motion Capture System Market

Navigation

- Contraceptives Market Size

- Contraceptives Market Key Highlights:

- Contraceptive Market Growth Drivers:

- Contraceptive Market Restraints:

- Contraceptive Market Geographical Outlook:

- Contraceptive Market Key Launches:

- List of Top Contraceptives Companies:

- Contraceptives Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 12, 2025