Report Overview

Contact Lenses Market Size, Highlights

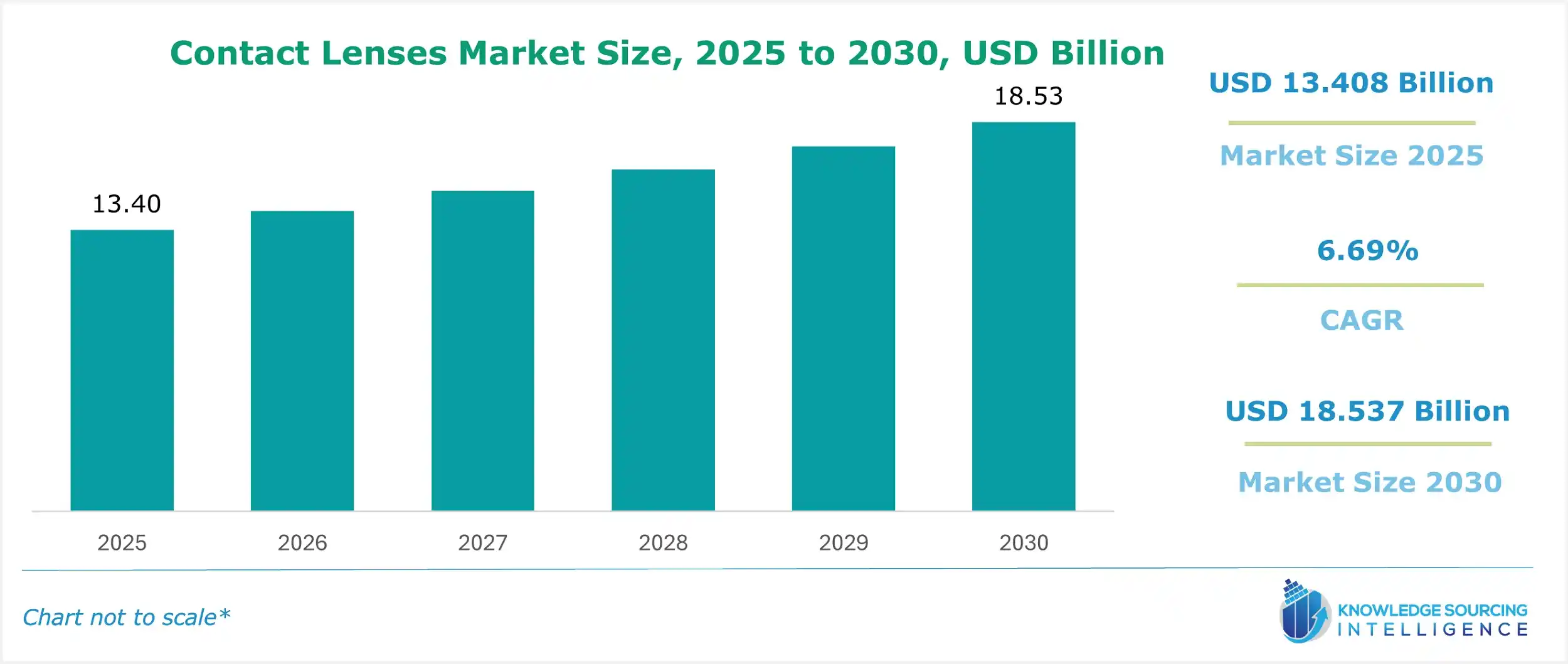

Contact Lenses Market Size

The contact lenses market is expected to grow at a CAGR of 6.69%, reaching a market size of US$18.537 billion in 2030 from US$13.408 billion in 2025.

The primary reason for the rising global demand for contact lenses is the increased incidence of refractive errors, which include myopia, hyperopia, presbyopia, and astigmatism.

The rising incidence of eye disorders also adds to this demand because most of the aging population has eye disorders. The rapidly growing prospects arising from an increase in demand for cosmetic and colored lenses, which are more often purchased for aesthetic purposes, greatly affect the market growth of contact lenses. In addition, people lead more active lifestyles, so they prefer to wear contact lenses instead of glasses; this applies mainly to athletes and some people who regularly engage in sports activities.

Moreover, contact lenses offer users features, such as broadened usage without the hindrances of frames and added mobility, making them a better option for glasses. Furthermore, active individuals have become increasingly inclined towards using contact lenses as a viable alternative to their lifestyle. This trend is also spurred by constant innovation by the market participants, with the introduction of new products promising to enhance demand in the sector.

Contact Lenses Market Growth Drivers:

- Increasing refractive error prevalence to increase lens penetration is contributing to the global Contact lens market growth

The common ocular disorder refractive error affects people of all ages and is generally recognized as a public health problem. Numerous studies and WHO reports stated that refractive error is the main cause of visual impairment and vision loss. Globally, vision impairment is also on the increase, mainly due to the increasing incidence of myopia and presbyopia, especially in children and adults.

According to an estimate given from WHO data, in 2023, about 2.2 billion people will be nearsighted, while an additional 1 billion will be moderately or severely visually impaired or blind due to an uncorrected refractive error. Moreover, awareness has grown for vision correction globally through national and regional governmental efforts and by industrial participants. The market for contact lenses grew on account of these. For instance, CooperVision has reported that there are around 45.0 million lens users in the US alone. Furthermore, NCBI revealed that 140.0 million people were using lenses globally in 2023.

- Growing requirements for vision correction are anticipated to increase the global market share

People worldwide are having vision issues, such as astigmatism, hyperopia, and myopia, meaning nearsightedness and farsightedness. The increase in the need for corrective riding methods such as contact lenses has been accompanied by an increase in the number and effects of factors such as hereditary ones and increased screen-on time. Contact lenses are another useful and less invasive method for those who want to see well but without the burden of glasses. One of the primary driving forces for market growth is the demand for vision correction. In addition, age-associated vision problems, notably presbyopia, are becoming more common with increasing numbers of older adults. Now, presbyopic treatment contact lenses are in demand in this market.

- Increased technological advancements are anticipated to boost the global Contact lenses market.

Technological developments have majorly influenced the various types of contact lenses that have been brought into the industry. For example, the new silicone hydrogel materials can manufacture contact lenses that can be much safer, more comfortable, and breathable for wear-type use. Another advance has been the availability of daily disposable types of lenses, which have lowered the possibility of infection and made lens maintenance more achievable.

Yet another technological advancement includes smart contact lenses, which are embedded with sensors and microelectronics. These smart contact lenses have the potential to measure health indicators like intraocular pressure in glaucoma and glucose levels in diabetic patients, creating possibilities for future medical and consumer applications. Therefore, these developments could eventually increase market growth by attracting tech-savvy demographics into an arena where contact lenses transcend prescription corrections.

- The increasing elderly population is anticipated to increase the demand

The world's aging population is one of the excellent contributory demographic trends in the contact lens market. As people age, their vision becomes susceptible to cataracts and presbyopia. They have brought contact lenses, such as multifocal and toric contact lenses, into popularity as a remedy for some vision issues caused by aging. Another reason is that older people prefer contact lenses over glasses for cosmetic purposes and for comfier use. People spend most of their later lives maintaining an active lifestyle and looking young. Aging individuals form a significant market for contact lens manufacturers and vision correction specialists, especially in regions like North America and Europe.

Contact Lenses Market Restraints:

- Alternative refractive error treatment options are anticipated to hamper the market growth

Long-term lens wear hazards such as corneal edema, infections, superficial keratitis, red eye, and many more are prompting many patients to seek alternatives other than lenses. There are several introductions in medical research or technological advancements, such as corneal inlays, implantable lenses, or laser eye surgery.

Lasik surgery is primarily one of the most effective procedures used for vision correction. It is a revolutionary technique that is excellent for long-term fixes for disorders like astigmatism, farsightedness, and nearsightedness. Consequently, people are increasingly drawn towards these surgeries instead of using contact lenses to realize longer-term relief from these problems.

Contact Lenses Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

North America is one of the biggest and most developed contact lens markets. With a strong healthcare system and widespread knowledge of vision correction options, the region comprises the United States and Canada.

The demand for contact lenses is still being driven by the prevalence of vision problems like myopia and presbyopia, which are partially caused by increased screen time.

In addition to medical applications, people who want to improve or alter the color of their eyes frequently use cosmetic contact lenses.

Key Launches in the Contact Lenses Market:

- In November 2024, the U.S. launch of PRECISION7 ®, the only one-week replacement contact lens with the ground-breaking 7-day ACTIV-FLO ® System, was announced by Alcon, the world leader in eye care committed to helping people see brilliantly. Over half of new patients are still fitted with reusable lenses because of cost concerns, even though almost 90% of Eye Care Professionals (ECPs) think daily disposable lenses are better for their patients overall. Most optometrists concur that patients would find a one-week contact lens replacement schedule easier to understand than a two-week one. When daily disposables are not an option, PRECISION7 offers a comfortable performance breakthrough and an easy-to-remember replacement schedule.

- In June 2024, the INFUSE for Astigmatism daily disposable contact lenses from Bausch + Lomb was released. The business anticipates that eye care providers will begin receiving the lenses. Osmoprotectants, electrolytes, and moisturizers are combined in silicone hydrogel lenses to maintain stable vision and eye comfort for 16 hours. To achieve that comfort, Kalifilcon A, the material used to make the lenses, combines a low modulus, a high breathability of 107 Dk/t, and an overall moisture content of 55%.

List of Top Contact Lenses Companies:

- Bausch & Lamb Pvt. Ltd

- Zeiss International

- CooperVision

- Essilor International S.A.

- Hoya Corporation

Contact Lenses Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Contact Lenses Market Size in 2025 | US$13.408 billion |

| Contact Lenses Market Size in 2030 | US$18.537 billion |

| Growth Rate | CAGR of 6.69% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Contact Lenses Market |

|

| Customization Scope | Free report customization with purchase |

The contact lenses market is segmented and analyzed as follows:

- By Type

- Soft

- Rigid Gas Permeable

- Hybrid

- Others

- By Design

- Spherical

- Toric

- Multifocal

- Others

- By Life

- Daily disposable

- Monthly

- 6-months

- Yearly

- By Application

- Corrective

- Therapeutic

- Cosmetic

- Others

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America

Our Best-Performing Industry Reports

Navigation

- Contact Lenses Market Size

- Contact Lenses Market Key Highlights:

- Contact Lenses Market Growth Drivers:

- Contact Lenses Market Restraints:

- Contact Lenses Market Geographical Outlook:

- Key Launches in the Contact Lenses Market:

- List of Top Contact Lenses Market Companies:

- Contact Lenses Market Scope:

- Our Best-Performing Industry Reports