Report Overview

Conductive Polymer Coatings Market Highlights

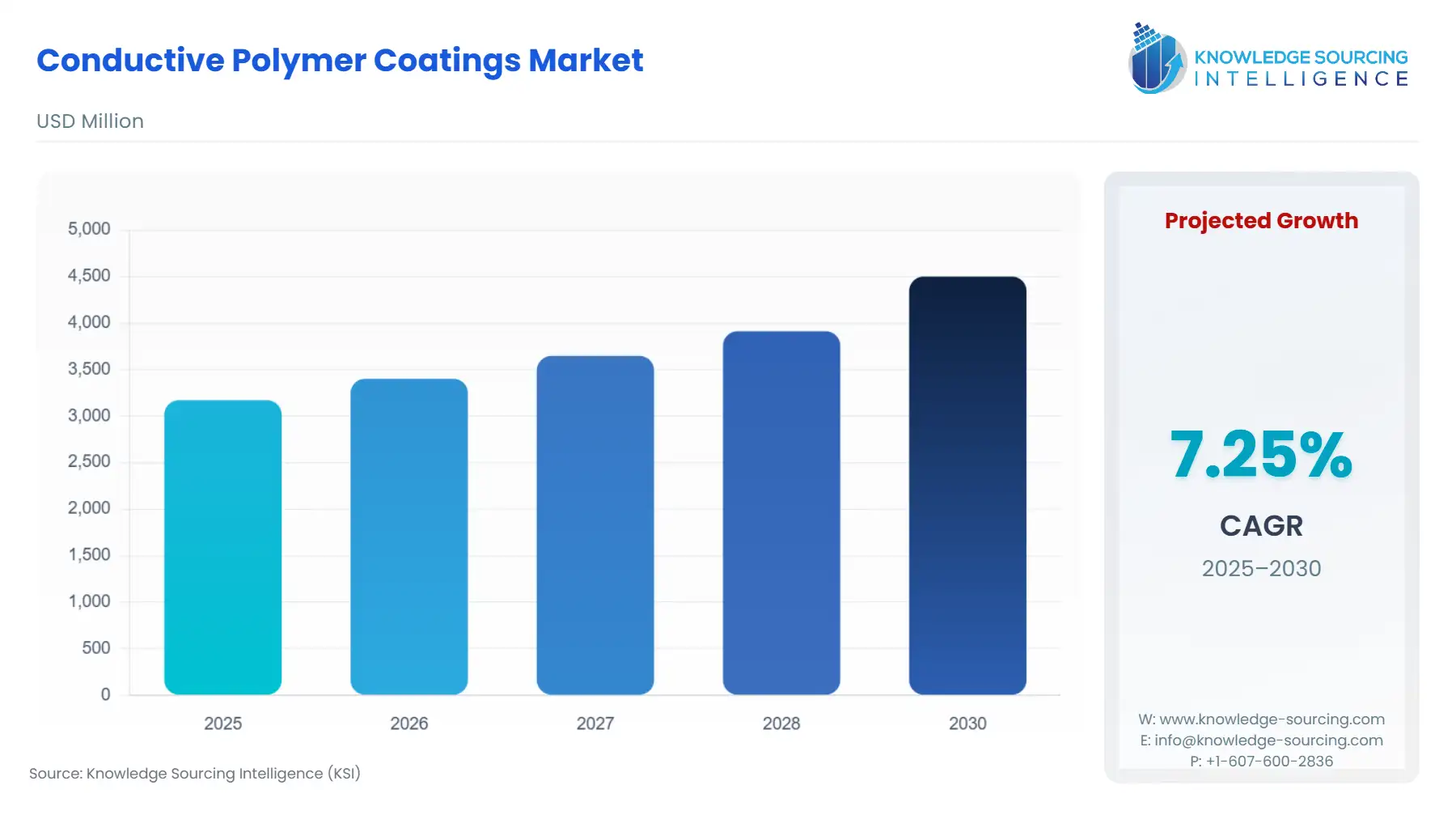

Conductive Polymer Coatings Market Size:

Conductive Polymer Coatings Market is anticipated to grow from US$3.172 billion in 2025 at a CAGR of 7.25% to US$4.501 billion in 2030.

Conductive polymer coatings are organic polymers that have conductivity. They are deposited in thin films on substrates, allowing for applications like anti-static coatings, electromagnetic shielding, smart sensors, corrosion protection, energy storage, and organic electronics. These materials are lightweight, easy to process, and possess unique features, making them promising candidates for future technologies.

Electric and hybrid vehicles (EVs) increase the market for conductive polymer coatings due to improvements in battery efficiency and protection of electronic components. Growing applications of advanced electronics in automotive, consumer devices, and industrial sectors raise the demand for coatings with corrosion and electrostatic discharge (ESD) protection. Sustainability trends and green manufacturing practices support the implementation of conductive polymers. Technological advancements in flexible electronics and government incentives for green technologies further support market growth. In addition, the rising demand for smart devices and connected automotive systems fuels the use of these coatings.

What are the drivers of the conductive polymer coatings market?

- Rising production of automotive industries

The growing production in the automotive industry, mainly with the trend toward electric and hybrid vehicles, is heavily driving the demand for conductive polymer coatings. With more dependence on advanced electronics in vehicles, such as batteries, sensors, and power management systems, the demand for coatings that offer conductivity, corrosion resistance, and ESD protection is rising. As stated by the OICA (International Organization of Motor Vehicle Manufacturers), overall vehicle production rose 10% in 2023 compared to 2022. Further, the total number of vehicles produced is 93,546,599, of which 67,133,570 are cars and 26,413,029 are commercial vehicles. These figures come from the major economies of India, China, Canada, Germany, France, Japan, the United States, etc.

Furthermore, the need for light, fuel-efficient vehicles is the primary driver of conductive polymers, which are lightweight but do not compromise on performance, being as effective as metals. With increased emphasis on smart, connected vehicles and regulatory pressures toward sustainability, automotive manufacturers have started looking at conductive polymer coatings as an eco-friendly, cost-effective solution to meet the changing demands, further boosting market growth.

The rising demand for high durability and performance in the automobile industry is a major contributor to the conductive polymer coatings market growth. As vehicle technology advances, with elements such as battery management systems, sensors, and powertrains, a greater need arises for material that can withstand harsh conditions such as extreme temperatures, moisture, chemicals, and physical wear.

- Growth in Renewable Energy Sector

The renewable energy sector’s growth has significantly boosted the conductive polymer coatings market because of their critical applications in solar panels, wind turbines, and energy storage systems. It increases the conductivity of photovoltaic cells, prevents environmental damage to wind turbine components, and enhances the performance of batteries in energy storage solutions. Moreover, the emphasis on sustainability in this sector aligns with the eco-friendly nature of conductive polymer coatings, propelling the demand for the product.

The percentage of countries committed to peaking their emissions is expected to increase from 36% in 2010 to 60% in 2030 (source: Emission Gap Report 2018, United Nations Environment Programme). Besides, the European Commission has set a target of achieving a 90% reduction in emissions by 2050. These collaborative efforts and initiatives are anticipated to drive the market for renewable-based chemicals in the coming years.

Conductive polymer coatings market geographical outlook:

- The conductive polymer coatings market is segmented into five regions worldwide

By geography, the conductive polymer coatings market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

North American conductive polymer coatings are mainly driven by electric and hybrid vehicles, which are increasing with growing demands for battery systems, power electronics, and electromotor components that should guarantee energy efficiency and be protected against corrosion. Aligning with this, in 2022, Canadian imports of automotive parts and components totaled US$15.4 billion, close to 2020 levels. The United States share in the total Canadian automotive import market remains dominant at approximately 62%.

The demand for conductive polymers used in circuit boards, sensors, and antennas is also driven by technological advancements in electronics, especially in the automotive and consumer electronics industries. The drive for sustainability and eco-friendly manufacturing processes is another significant factor, as these coatings are more environment-friendly than traditional metal coatings. The encouragement for green technology, along with incentives such as favorable policies of the governments, also increases market growth by demanding a higher supply of materials that correspond to severe environmental standards.

Rapid industrialization and a boom in automobile and electronics segments drive the conductive polymer coating market in the Asia Pacific region. Countries like China, Japan, and South Korea are leading EV producers, and therefore, as demand for EVs increases, so does the need for conductive polymers in battery management systems and power electronics. Another reason for the strong demand for these coatings is that a large consumer electronics sector is manufacturing major smartphones, wearable electronic devices, and other smart devices. For instance, fixed-asset investment in China's electronic information manufacturing business increased by 9.3 percent year on year in 2023, reflecting the sector's revival, according to government statistics. The Ministry of Industry and Information Technology announced that the increase was 0.3 percentage points more than that of China's entire industry.

In addition to this, as per the International Energy Agency, in 2022, almost 66,000 electric buses and 60,000 medium- and heavy-duty trucks were sold globally, accounting for around 4.5% of total bus sales and 1.2% of total truck sales. China continues to dominate the manufacture and sales of electric (and fuel cell) trucks and buses. In 2022, 54,000 new electric buses and 52,000 electric medium- and heavy-duty trucks were sold in China, accounting for 18% and 4% of overall sales in China and about 80% and 85% of global sales, respectively. In addition, it is stated that Chinese brands are the major leaders in the bus and truck markets of Latin America, North America, and European countries.

Government initiatives to reduce emissions and support green technology are driving the adoption of these coatings in EV and other sustainable automotive solutions. It is also supported by the cost-efficient manufacturing capabilities and innovations in this region's material science field.

Conductive Polymer Coatings Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Conductive Polymer Coatings Market Size in 2025 | US$3.172 billion |

| Conductive Polymer Coatings Market Size in 2030 | US$4.501 billion |

| Growth Rate | CAGR of 7.25% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Conductive Polymer Coatings Market |

|

| Customization Scope | Free report customization with purchase |

Conductive Polymer Coatings Market Segmentation:

- By Application

- Electronics

- Automotive

- Aerospace

- Packaging

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America