Report Overview

Combined Heat and Power Highlights

Combined Heat and Power (CHP) Market Size:

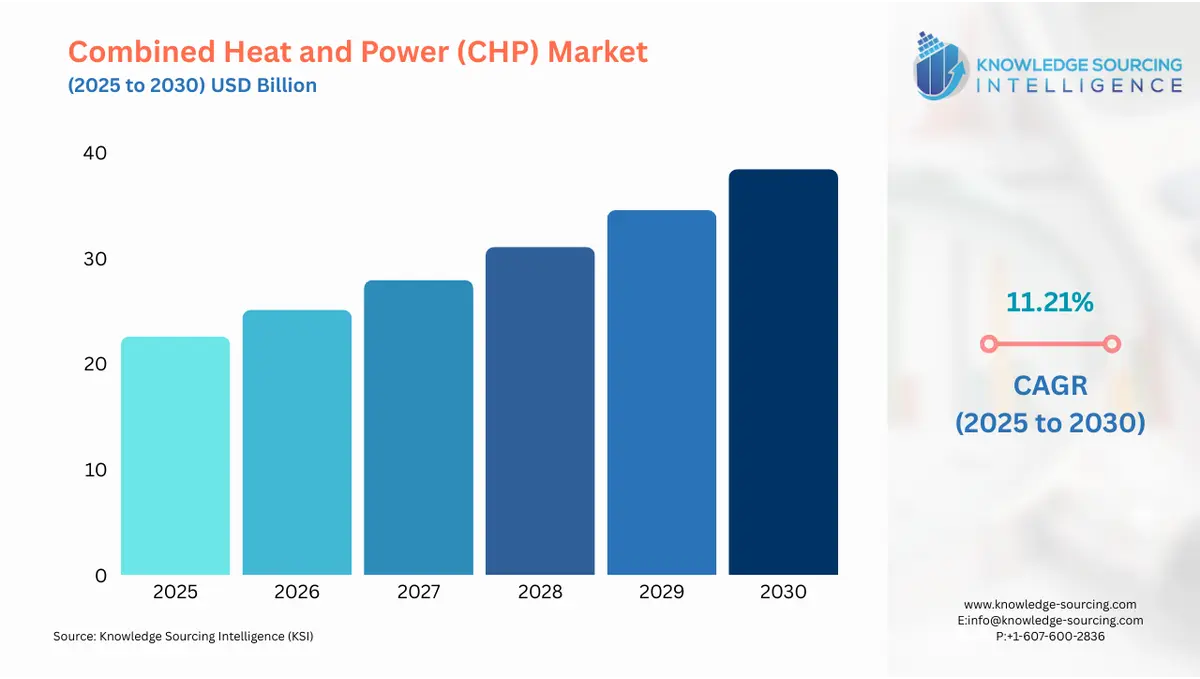

The combined heat and power (CHP) market is evaluated at US$22.590 billion in 2025, growing at a CAGR of 11.21% and reaching a market size of US$38.433 billion by 2030.

Combined heat and power (CHP) refers to an energy-efficient system that generates electricity from several types of fuels and can capture the heat generated and be reused for space heating, domestic hot water, and industrial processes, among others. These systems can be installed in several places, such as buildings, utilities, individual facilities, and others. Combined heat and power systems are often considered useful, especially for facilities with both electricity and heat requirements.

Combined Heat and Power (CHP) Market Trends:

This market is primarily driven by the constantly growing end-user requirements for replacing conventional energy systems due to considerably high operational and maintenance costs and uninterrupted utility supply. Furthermore, the constantly growing usage of natural gas also catalyzes the combined heat and power systems market growth during the forecast period. Additionally, the growing demand for energy efficiency, especially across the industrial sector, has further propelled the adoption of these systems in the coming years, which, in turn, is significantly shaping the market growth during the coming years.

The beneficial features offered by these cogeneration systems, such as enhanced reliability, efficiency, and safety, have also led to an upsurge in their adoption across several countries. Many countries, both developed and developing, are now focusing on reducing greenhouse gas emissions. This shift in priority has resulted in increased investment in renewable energy projects. As a result, manufacturers are expected to see significant business growth opportunities over the next five years.

According to the United States Environmental Protection Agency, approximately two-thirds of the energy that is primarily used by conventional energy systems is often wasted as discharged heat into the atmosphere. During the electricity distribution process, a significant amount of energy is also wasted in the form of heat. Thus, these systems are considered highly beneficial as they can capture the heat and help with distribution losses. These systems can improve efficiency by almost 80%, which is around 30% higher than the conventional technologies used.

Combined Heat and Power (CHP) Market Drivers:

- Government regulations to boost the market expansion

The combined heat and power market is primarily being driven by the growing focus of governments worldwide on reducing carbon footprints with the aim of protecting the environment, as heavy dependence on fossil fuels has led to a degradation of the overall environment. As a result, governments and corporations worldwide are investing in exploiting the potential offered by renewable energy sources, i.e., wind, solar, and hydroelectric energy. Growing investment in the setting up of clean energy power plants, coupled with favorable government policies is poised to create significant business opportunities for combined heat and power systems manufacturers over the coming years.

Combined Heat and Power (CHP) Market Segment Analysis:

- Natural Gas to hold a healthy market share

By fuel type, the natural gas segment is projected to hold a substantial market share throughout the next five years. The primary factor supporting this segment’s share significantly includes natural gas, which is considered one of the cleanest energy sources and is comparatively less costly than other fuel types. Furthermore, the constantly growing usage of natural gas in the energy mix, especially in the world's developing economies, is supporting this segment's growth throughout the forecast period. The coal-based CHP systems are also projected to hold a considerable market share.

However, the growth of this segment is expected to be slow because there is a growing focus on using renewable sources for electricity generation. Its high calorific value and low cost are some of the factors driving this segment’s growth during the next five years. The biomass-fuelled CHP systems are projected to show promising growth during the forecast period.

Combined Heat and Power (CHP) Market Geographical Outlook:

- Europe and North America are expected to show significant growth in the projected period

Geographically, the European region is anticipated to hold a considerable market share because it boasts of being one of the most prominent regions inclined towards reducing carbon emissions. Several countries in the region are taking all the necessary steps to curb carbon emissions. Increased investments in clean energy projects are also a key factor supplementing the market growth in the European region during the next five years. Stringent regulations regarding the promotion of CHP projects in the form of funding and subsidy schemes are also one of the major factors supporting the regional market expansion.

North America is also expected to hold a significant market share since it is one of the most prominent regions in the early adoption of technology. This, along with the presence of cutting-edge infrastructure across the power sector and a growing emphasis on increasing the installation capacity of CHP plants in many parts of the region, will be key factors bolstering the market in the North American region over the next five years. Additionally, the Asia Pacific region is projected to show promising growth during the next five years, primarily due to the growing focus of the governments of many countries to increase the share of clean energy in the energy mix.

Combined Heat and Power (CHP) Market Key Developments:

Owing to the increasing natural gas industry and the implementation of strict environmental regulations by governments, the combined heat and power market has reported substantial advancements in the sector.

- In April 2022, Capstone Green Energy Corporation, a global pioneer in sustainability and on-site resilient green Energy as a Service (EaaS) solutions, that Arctic Energy Inc., its Alaska distributor, received an order for five Capstone 65 kW ICHP dual-mode microturbines. A waste treatment facility owned by the Municipality of Anchorage adopted the system. It will provide heat and electricity to the facility’s vital infrastructure, allowing it to operate even in the harshest winter weather. Overall, the approach will save money for the town by protecting it from increasing utility bills. The inherent efficiency of the CHP system, as well as the high reliability/low maintenance attributes of the microturbines, will help to reduce costs.

- In May 2022, Doosan Group declared that it will invest heavily in energy industries such as small modular reactors (SMRs), gas turbines, hydrogen turbines, and hydrogen fuel cells over the next five years. Doosan Enerbility intends to undertake relevant investments to revitalize the local nuclear power plant ecosystem in the second half of 2023 to begin manufacturing key SMR bodies. Earlier in 2022, Doosan Enerbility and NuScale of the United States agreed to produce major components for SMRs, as noted by NuScale.

- Wärtsilä, a technology company, will work with Capwatt, a Portuguese energy solutions provider and independent power producer, to test green hydrogen and natural gas blend fuel for the Capwatt power plant in Maia. The initiative started in 2023 and will test mixtures, including up to 10% green hydrogen. A Wärtsilä 34SG, a natural gas engine, presently powers the combined heat and power plant that supplies electricity to the Sonae Campus and the national grid. This will be one of the first times that green hydrogen will be utilized to reduce the carbon footprint of a Wärtsilä power plant that operates on gas.

Combined Heat and Power (CHP) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Combined Heat and Power Market Size in 2025 | US$22.590 billion |

| Combined Heat and Power Market Size in 2030 | US$38.433 billion |

| Growth Rate | CAGR of 11.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Combined Heat and Power Market |

|

| Customization Scope | Free report customization with purchase |

Combined Heat and Power (CHP) Market Segmentation:

- By Fuel Type

- Coal

- Natural Gas

- Biomass

- Others

- By Application

- Commercial

- Residential

- Industrial

- By Configuration

- Combustion Turbine

- Steam Boiler

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Italy

- Others

- Middle East and Africa

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America